1. What is the projected Compound Annual Growth Rate (CAGR) of the Telematics Boxes?

The projected CAGR is approximately 11.5%.

Telematics Boxes

Telematics BoxesTelematics Boxes by Type (Plastic Telematics Boxes, Metal Telematics Boxes, Other), by Application (Passenger Vehicle, Commercial Vehicle, World Telematics Boxes Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

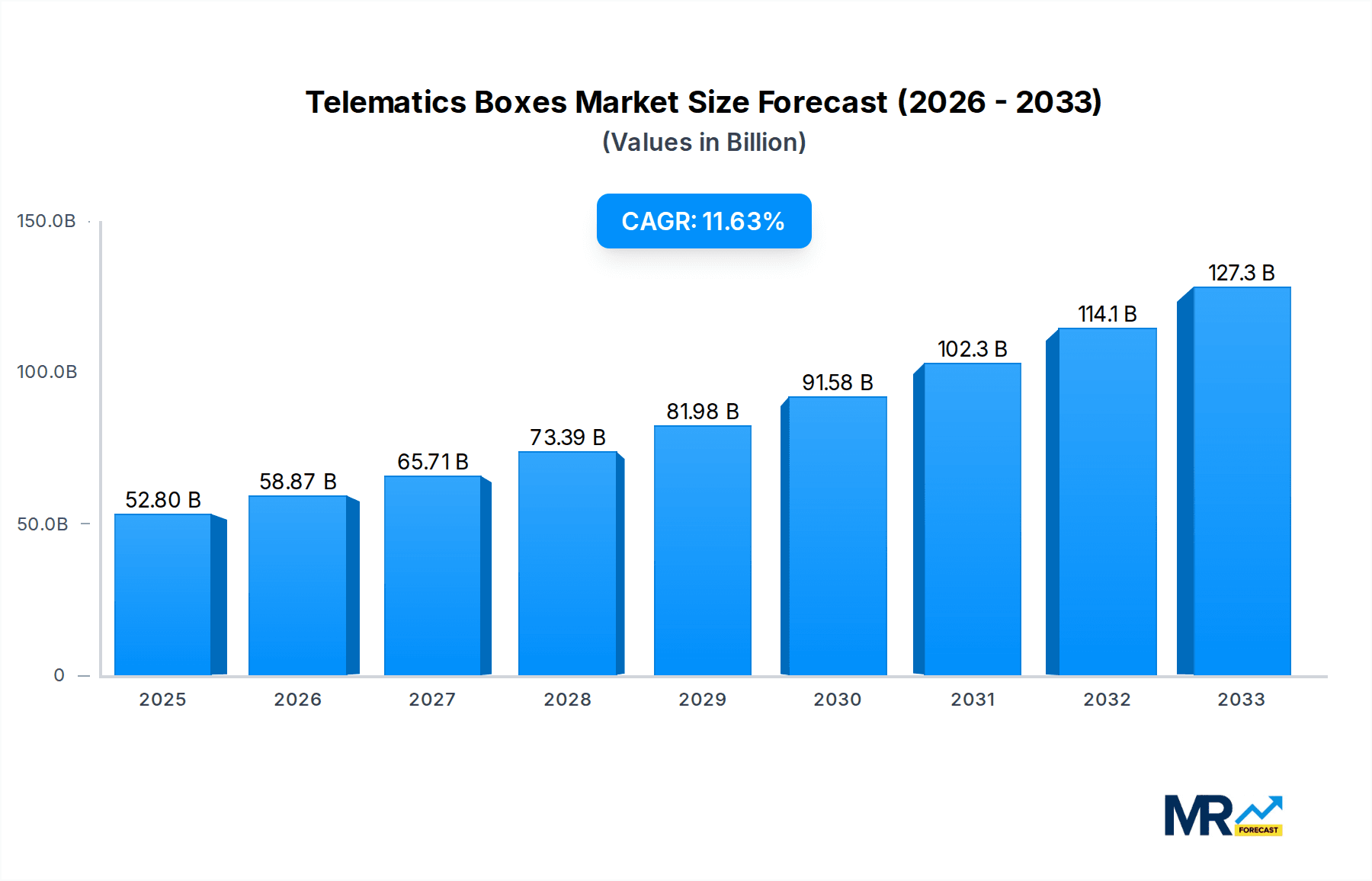

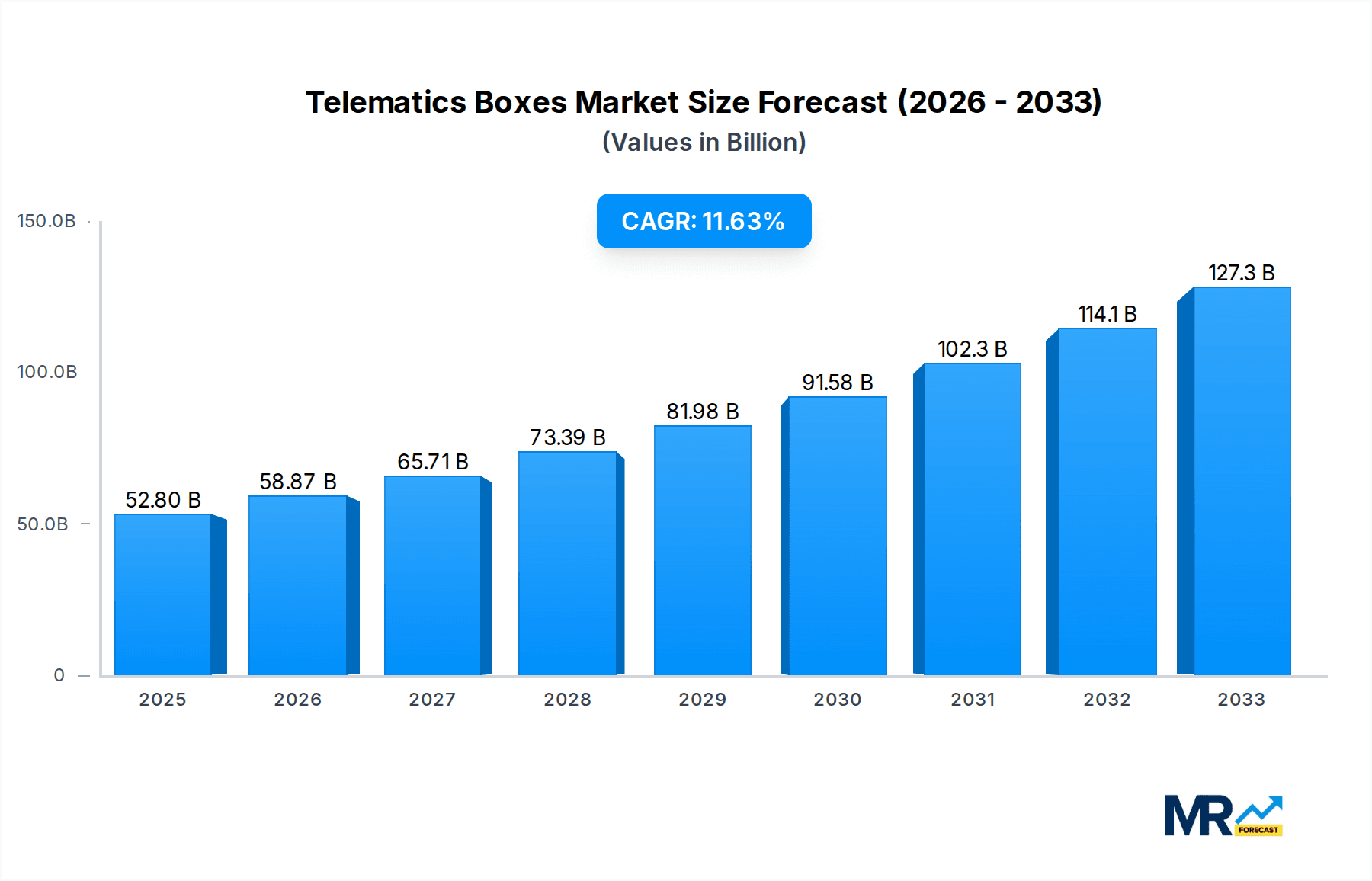

The global telematics boxes market is poised for robust expansion, projected to reach a significant size of USD 52.8 billion. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 11.5% over the forecast period of 2025-2033. The increasing adoption of connected vehicle technology, driven by the demand for enhanced safety, efficiency, and driver behavior monitoring, underpins this upward trajectory. Key market drivers include the escalating penetration of smartphones and the internet of things (IoT) in vehicles, alongside supportive government regulations promoting advanced safety features and emissions control. Furthermore, the growing fleet management industry, seeking to optimize operational costs and improve logistical efficiency through real-time data insights, is a substantial contributor to market growth. The competitive landscape is characterized by key players like Octo, BOX Telematics, and Magneti Marelli, who are actively investing in innovation and expanding their product portfolios to cater to evolving market needs.

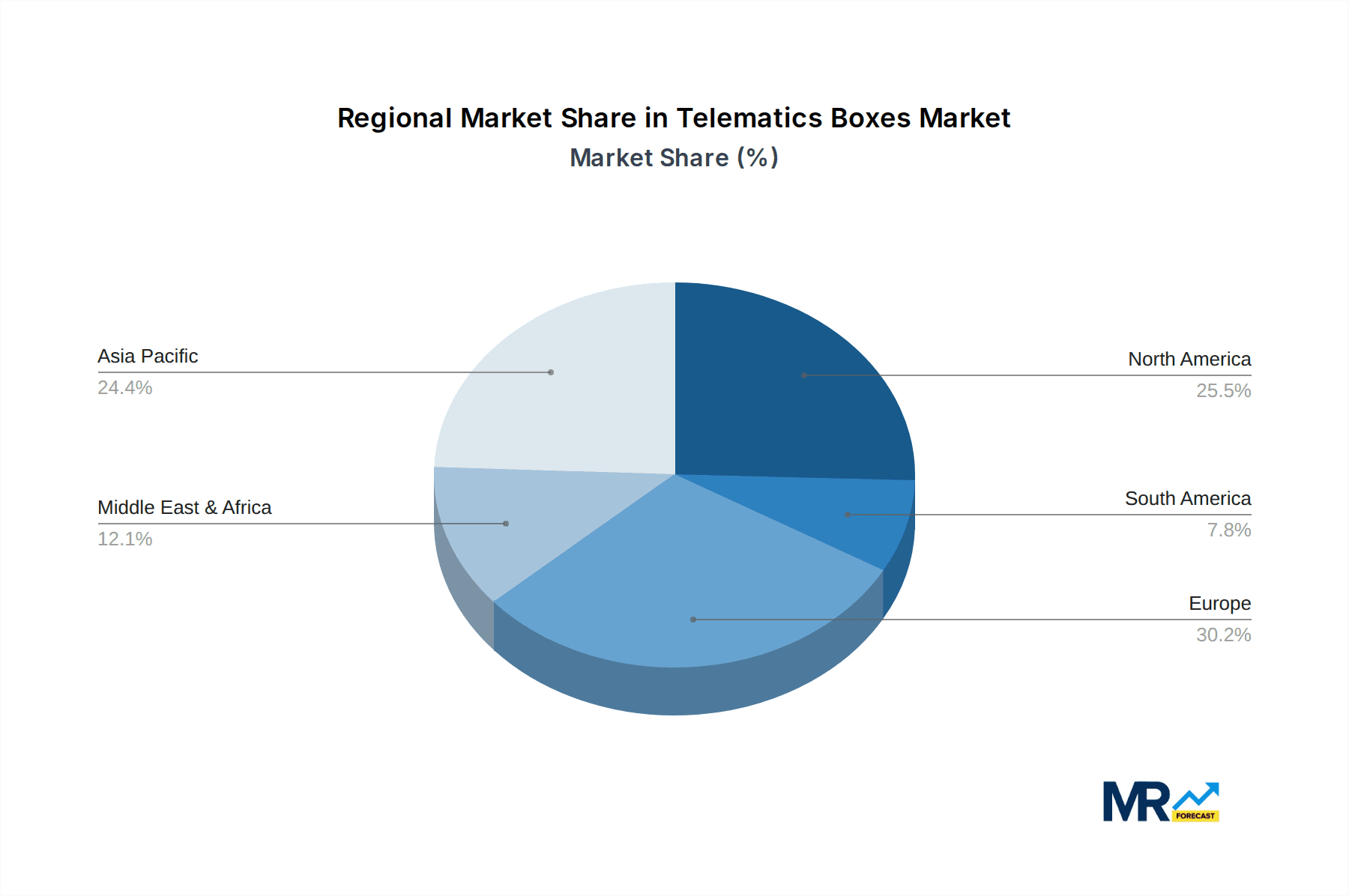

The market segmentation reveals a strong demand for both plastic and metal telematics boxes, catering to diverse application needs within passenger and commercial vehicles. The burgeoning commercial vehicle segment, in particular, is a significant revenue generator due to the critical role telematics plays in fleet management, route optimization, and cargo security. Geographically, the Asia Pacific region, led by China and India, is anticipated to emerge as a dominant force, driven by rapid advancements in automotive manufacturing, increasing disposable incomes, and a growing appetite for smart mobility solutions. North America and Europe also represent mature yet continuously growing markets, propelled by advanced technological infrastructure and a strong focus on vehicle safety and cybersecurity. While the market presents immense opportunities, potential restraints such as data privacy concerns and the high initial cost of implementation in some regions could pose challenges. However, ongoing technological advancements and the development of more affordable solutions are expected to mitigate these concerns, paving the way for sustained market growth.

Here's a unique report description on Telematics Boxes, incorporating the requested information and structure:

The global telematics box market is poised for significant expansion, projected to reach astronomical figures by 2033. During the Study Period of 2019-2033, with a Base Year of 2025, the market's trajectory indicates a robust CAGR. The Estimated Year of 2025 already showcases a burgeoning demand, which is expected to accelerate through the Forecast Period of 2025-2033. This growth is not monolithic; rather, it's characterized by nuanced shifts in technological adoption, evolving application demands, and strategic market plays by key industry participants. The historical period from 2019-2024 laid the groundwork for this expansion, witnessing early adoption in fleet management and insurance telematics. Looking ahead, the market is increasingly influenced by advancements in AI, IoT integration, and the ever-present drive for enhanced vehicle safety and efficiency. The increasing connectivity of vehicles, coupled with the proliferation of smart city initiatives, is creating a fertile ground for telematics solutions. Furthermore, regulatory mandates concerning vehicle data security and emission monitoring are subtly, yet powerfully, driving the adoption of sophisticated telematics hardware. The industry is also seeing a bifurcation in product offerings, with specialized solutions catering to both the high-volume passenger vehicle segment and the demanding commercial vehicle sector. Innovations in miniaturization, power efficiency, and data processing capabilities within the telematics boxes themselves are key trends, enabling more seamless integration and advanced functionality. The growing emphasis on proactive maintenance, driver behavior monitoring, and real-time diagnostics further amplifies the need for these devices. The evolving landscape of connected car services, from infotainment to advanced driver-assistance systems (ADAS), all rely on a robust telematics backbone, solidifying its indispensable role in the automotive ecosystem. The convergence of hardware, software, and data analytics is shaping the future of telematics boxes, moving them from mere data loggers to intelligent decision-making hubs within vehicles.

The telematics boxes market is being propelled by a confluence of powerful drivers that are fundamentally reshaping the automotive and transportation industries. Foremost among these is the escalating demand for enhanced vehicle safety and security. Telematics boxes enable real-time monitoring, crash detection, and emergency assistance, significantly improving response times and potentially saving lives. This is complemented by the burgeoning interest in Usage-Based Insurance (UBI) policies, where telematics data accurately assesses driving behavior, leading to more personalized and cost-effective premiums for consumers. The efficiency gains offered by telematics are also a major catalyst; for commercial fleets, detailed insights into fuel consumption, route optimization, and driver performance translate directly into substantial cost reductions. Furthermore, the growing sophistication of connected car technologies, including over-the-air (OTA) updates, remote diagnostics, and advanced infotainment systems, necessitates a robust telematics infrastructure to facilitate seamless communication and data exchange. The increasing adoption of autonomous driving technologies also relies heavily on accurate and real-time data provided by telematics systems, making them foundational to the future of mobility.

Despite the promising growth trajectory, the telematics boxes market faces several significant challenges and restraints that could temper its expansion. A primary concern revolves around data privacy and security. The vast amounts of sensitive personal and vehicle data collected by telematics boxes raise legitimate concerns among consumers and regulators regarding unauthorized access and misuse. Building and maintaining robust security protocols is paramount, yet also a costly endeavor for manufacturers. Another restraint is the initial cost of hardware and installation, which can be a barrier, particularly for smaller businesses or price-sensitive consumer segments. The complexity of integrating telematics solutions with existing vehicle systems and the need for specialized expertise can also slow down adoption. Furthermore, the rapid pace of technological evolution means that telematics boxes can become obsolete quickly, requiring continuous investment in research and development to stay competitive. The fragmentation of the market, with numerous players and diverse offerings, can also create confusion for potential customers and hinder standardization. Finally, the perceived lack of tangible immediate benefits for some end-users, especially in the passenger vehicle segment beyond insurance incentives, can limit voluntary adoption.

The telematics boxes market is characterized by regional variations in adoption rates and segment dominance. North America stands out as a key region poised to dominate the market, driven by its early and widespread embrace of telematics technology across both passenger and commercial vehicle segments. The region's mature insurance industry has been a significant proponent of Usage-Based Insurance (UBI) programs, directly fueling demand for telematics boxes for accurate driving behavior assessment. The presence of major telematics providers and fleet management companies, coupled with supportive regulatory frameworks and a high disposable income, further solidifies North America's leading position.

Within this dominant region, the Application: Passenger Vehicle segment is projected to experience substantial growth and exert significant influence on the market. The increasing integration of telematics solutions into new passenger vehicles as standard features, driven by manufacturers' efforts to offer connected services and enhance customer experience, is a major contributor. The growing popularity of insurance telematics for younger drivers and the desire for enhanced vehicle safety features, such as remote diagnostics and emergency services, are further bolstering adoption in this segment. The availability of aftermarket telematics devices for older vehicles also plays a crucial role.

Furthermore, the Type: Plastic Telematics Boxes segment is expected to lead in terms of volume and market share. The inherent advantages of plastic telematics boxes, including their lower manufacturing costs, lighter weight, and ease of customization, make them an attractive option for mass production. Advances in polymer science and manufacturing techniques allow for the creation of durable, heat-resistant, and aesthetically pleasing plastic enclosures that meet the stringent requirements of the automotive industry. The scalability of plastic molding processes also enables manufacturers to meet the high demand from the automotive sector efficiently. The cost-effectiveness of plastic materials makes them particularly suitable for the high-volume passenger vehicle segment, where price sensitivity is a critical factor. The ability to integrate various electronic components seamlessly within plastic casings, while ensuring signal integrity and electromagnetic compatibility, further solidifies their dominance.

However, the Application: Commercial Vehicle segment, while potentially smaller in sheer unit volume compared to passenger vehicles, represents a segment with high value and significant revenue generation. The critical need for fleet management, asset tracking, driver performance monitoring, and regulatory compliance (e.g., Hours of Service for trucking) makes telematics boxes indispensable for commercial operations. The return on investment for telematics in commercial vehicles is often more tangible and immediate, leading to higher adoption rates among businesses focused on operational efficiency and cost optimization.

The World Telematics Boxes Production itself is a dynamic landscape. While North America leads in current adoption, Europe is rapidly catching up, driven by stringent emission regulations, a strong focus on sustainability, and the increasing prevalence of connected car services. The rise of e-mobility in Europe also presents unique opportunities for telematics to monitor battery health and charging infrastructure. Asia-Pacific, particularly China, is emerging as a significant growth engine, fueled by its massive automotive market, rapid technological advancements, and government initiatives promoting smart transportation. The production hubs within these regions are increasingly sophisticated, with manufacturers investing heavily in R&D and advanced manufacturing capabilities.

The telematics boxes industry is experiencing robust growth fueled by several key catalysts. The increasing demand for Usage-Based Insurance (UBI) is a primary driver, offering personalized premiums based on driving behavior. Furthermore, the relentless pursuit of operational efficiency and cost reduction in commercial fleets, through optimized routing, fuel management, and predictive maintenance, is pushing widespread adoption. The expanding ecosystem of connected car services, from infotainment to advanced driver-assistance systems (ADAS), necessitates reliable telematics solutions. Finally, increasing regulatory mandates concerning vehicle safety, emissions, and data security are subtly but powerfully encouraging telematics integration.

This comprehensive report delves into the intricate dynamics of the global telematics boxes market, providing an in-depth analysis of its evolution from the Historical Period of 2019-2024 through to the Forecast Period of 2025-2033. It meticulously examines key market trends, growth drivers such as Usage-Based Insurance and fleet efficiency, and critical challenges including data privacy concerns. The report further dissects regional dominance, highlighting the pivotal role of North America, and explores segment-specific growth, with a focus on Passenger Vehicles and Plastic Telematics Boxes. With a detailed look at leading players and significant industry developments, this report offers invaluable insights for stakeholders seeking to navigate and capitalize on this rapidly expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.5%.

Key companies in the market include Octo, BOX Telematics, Ingenie Services, Magneti Marelli, RAC, Black Telematics Box, Mobile Devices, Trakm8, Telefonica, Aplicom OY, Novero.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Telematics Boxes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Telematics Boxes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.