1. What is the projected Compound Annual Growth Rate (CAGR) of the Targeted Genome Analysis Kits?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Targeted Genome Analysis Kits

Targeted Genome Analysis KitsTargeted Genome Analysis Kits by Type (PCR-based Targeted Kits, NGS (Next Generation Sequencing)-based Targeted Kits, Other), by Application (Hospital, Laboratory, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

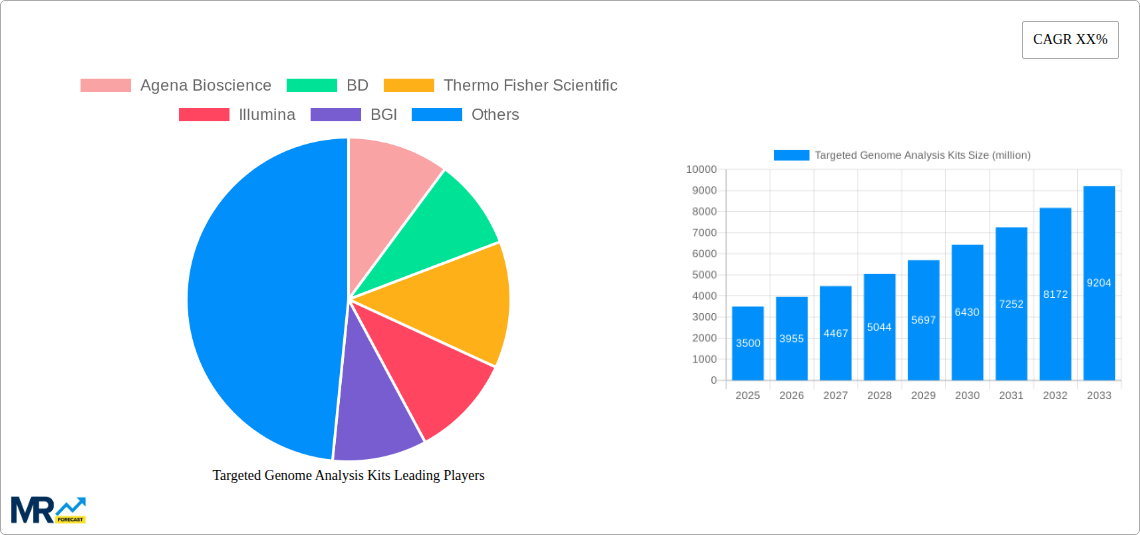

The global Targeted Genome Analysis Kits market is poised for significant expansion, projected to reach an estimated USD 3,500 million in 2025. Driven by an impressive Compound Annual Growth Rate (CAGR) of approximately 15%, the market is expected to surge to over USD 7,000 million by 2033. This robust growth is primarily fueled by the increasing demand for personalized medicine, advancements in diagnostic technologies, and the expanding applications of genomics in research and clinical settings. The rising incidence of genetic disorders, coupled with a greater understanding of the human genome's role in disease development, is further propelling the adoption of targeted genome analysis techniques. Key industry players are heavily investing in research and development to enhance kit efficiency, accuracy, and cost-effectiveness, leading to innovative product launches that cater to diverse analytical needs. The expanding research infrastructure and growing awareness about the benefits of genetic testing in early disease detection and treatment selection are also significant contributors to this upward market trajectory.

The market landscape for Targeted Genome Analysis Kits is characterized by a dynamic interplay of technological innovation and evolving market demands. The PCR-based Targeted Kits segment, while established, continues to offer reliable solutions for specific genetic analyses. However, the Next-Generation Sequencing (NGS)-based Targeted Kits segment is experiencing accelerated growth due to its superior throughput, comprehensive coverage, and ability to analyze complex genomic regions. Hospitals and specialized laboratories represent the dominant application segments, leveraging these kits for a wide range of purposes including cancer diagnostics, rare disease identification, and pharmacogenomics. Restraints such as high initial investment costs for advanced sequencing technologies and the need for skilled personnel to interpret complex genomic data are present, but are being progressively overcome by technological miniaturization and the development of user-friendly platforms. Emerging trends include the integration of artificial intelligence and machine learning for data analysis, and the increasing focus on liquid biopsy applications, all of which are set to shape the future of this critical market.

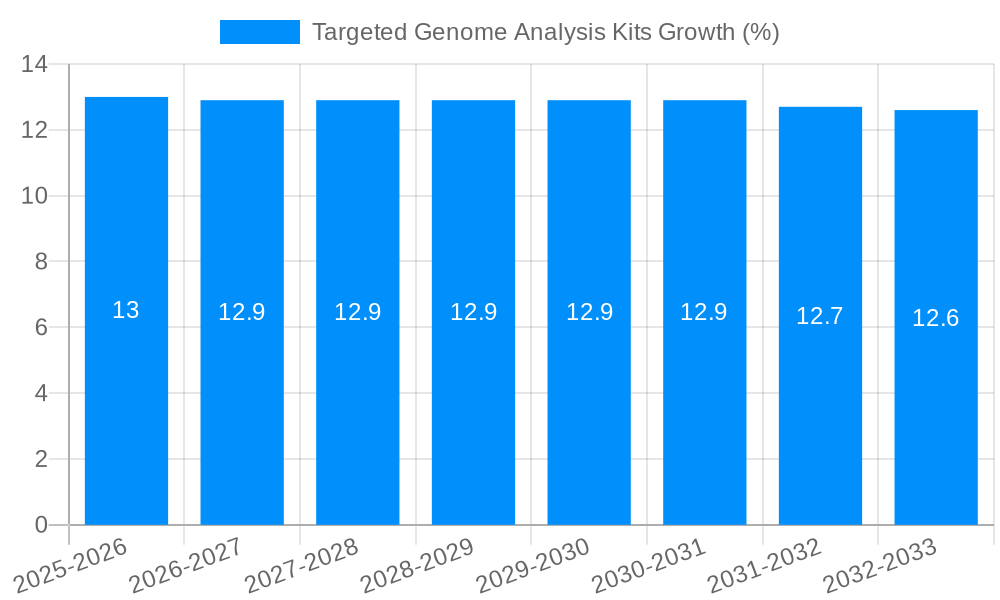

XXX, a leading market intelligence firm, projects a robust expansion within the global Targeted Genome Analysis Kits market, driven by increasing adoption across healthcare and research sectors. The market, valued at USD 1,500 million in the base year 2025, is anticipated to witness a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025-2033. This significant growth trajectory is underpinned by advancements in genomic technologies, a burgeoning understanding of genetic diseases, and the escalating demand for personalized medicine. During the historical period of 2019-2024, the market demonstrated a steady upward trend, fueled by early adoption of NGS technologies and increased research funding. The study period, encompassing 2019-2033, highlights a transformative phase for targeted genome analysis, moving from niche research applications to mainstream clinical diagnostics and therapeutic development.

The market landscape is characterized by a dynamic interplay of technological innovation and evolving application needs. The shift towards more sophisticated and precise analytical tools is evident, with a particular surge in demand for kits enabling high-throughput analysis of specific genetic variants. This precision is crucial for identifying actionable biomarkers in oncology, rare disease diagnostics, and infectious disease monitoring. Furthermore, the increasing regulatory landscape and the push for greater data standardization are indirectly fostering market growth by encouraging the development of reliable and validated analysis kits. The growing emphasis on preventative healthcare and early disease detection further amplifies the need for accurate and efficient genetic analysis solutions. The estimated market size for 2025 is projected to reach USD 1,700 million, reflecting sustained positive momentum.

The increasing integration of Artificial Intelligence (AI) and machine learning in data analysis is also poised to revolutionize the targeted genome analysis space. These technologies will enable more efficient interpretation of complex genomic data, accelerating the discovery of novel genetic associations and therapeutic targets. As the cost of sequencing continues to decline and the accuracy of targeted analysis kits improves, their accessibility for a wider range of research institutions and clinical laboratories will expand. The market is also witnessing a growing interest in non-invasive genetic testing methods, which will further drive the demand for specialized kits capable of analyzing circulating cell-free DNA (cfDNA) or RNA. The projected market value for the estimated year 2025 aligns with these optimistic forecasts.

The targeted genome analysis kits market is experiencing a powerful surge, propelled by a confluence of factors that are reshaping the landscape of molecular diagnostics and research. At the forefront is the accelerating pace of discoveries in genomics, particularly in understanding the genetic underpinnings of complex diseases like cancer, neurodegenerative disorders, and inherited conditions. This deepening knowledge directly translates into a demand for kits that can precisely and efficiently interrogate specific genomic regions associated with these diseases, enabling earlier and more accurate diagnoses. The exponential growth in genetic data generated by next-generation sequencing (NGS) technologies, coupled with the need to make this data clinically relevant, has created a strong imperative for targeted analysis solutions that can pinpoint actionable variants without the need for full genome sequencing, thereby reducing cost and turnaround time.

Furthermore, the burgeoning field of personalized medicine is a significant propellant. As healthcare shifts towards tailoring treatments based on an individual's unique genetic makeup, the demand for targeted genome analysis kits that can identify patient-specific genetic profiles for drug response, disease susceptibility, and treatment efficacy has become paramount. This is particularly evident in oncology, where companion diagnostics rely heavily on targeted panels to select the most effective therapies for patients. The increasing prevalence of rare genetic diseases, which often require precise molecular diagnosis for effective management, also contributes significantly to market growth. Moreover, a supportive regulatory environment in many regions, coupled with a growing recognition of the economic and societal benefits of precision medicine, is encouraging investment and innovation in this sector.

Despite the promising growth trajectory, the targeted genome analysis kits market is not without its hurdles. A primary challenge lies in the complexity and cost associated with advanced genomic analysis. While the overall cost of sequencing has decreased, the development, validation, and ongoing maintenance of highly specific and accurate targeted kits, particularly those for complex multiplex analyses, can still be substantial. This can limit accessibility for smaller laboratories or institutions with budget constraints, especially in resource-limited settings. The rapid evolution of technology also presents a challenge, as kits may become obsolete quickly if not continuously updated to incorporate new scientific discoveries and technological advancements, requiring significant R&D investment and agility from manufacturers.

Another significant restraint is the need for robust bioinformatics and data interpretation infrastructure. Analyzing the vast amounts of data generated by targeted genome analysis kits requires sophisticated bioinformatics pipelines, skilled personnel, and substantial computational resources. The lack of readily available expertise and infrastructure in many healthcare settings can hinder the full utilization of these kits, creating a bottleneck between data generation and actionable clinical insights. Furthermore, regulatory hurdles and standardization issues can impede market entry and widespread adoption. Ensuring that targeted genome analysis kits meet stringent quality and performance standards for clinical use, and harmonizing these standards across different regions, is a complex and time-consuming process. Finally, ethical considerations and data privacy concerns associated with genetic information can create societal apprehension and influence the pace of adoption, requiring careful navigation and transparent communication.

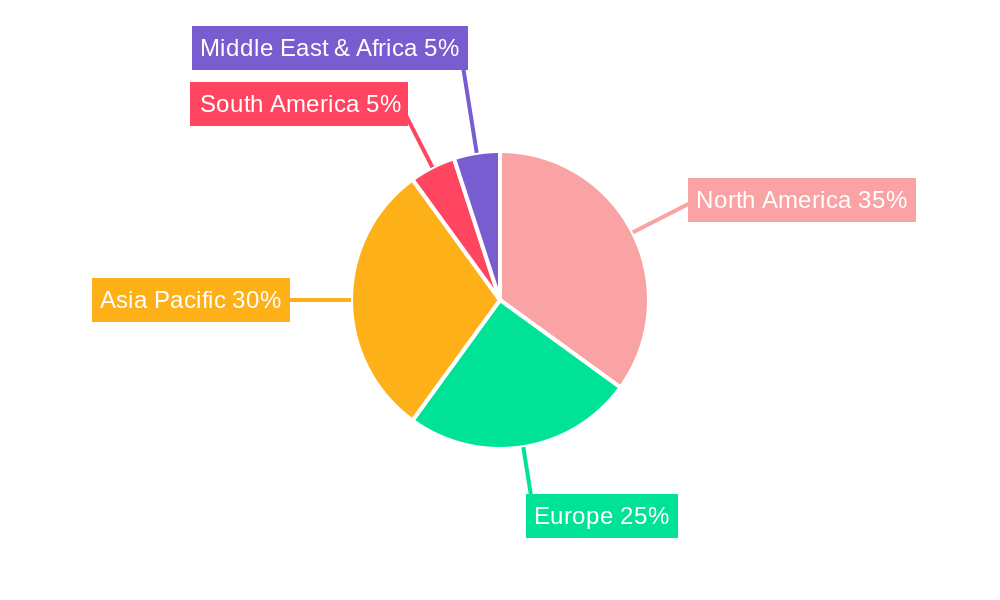

The global Targeted Genome Analysis Kits market is poised for significant regional and segmental dominance, with North America and Europe emerging as key players, driven by a confluence of factors that favor advanced healthcare infrastructure, robust research funding, and a high prevalence of genetic research and clinical applications.

Dominant Regions/Countries:

North America: This region, particularly the United States, is expected to continue its leadership due to several compelling reasons.

Europe: The European market, led by countries such as Germany, the United Kingdom, and France, is another significant contributor to market dominance.

Dominant Segments:

Type: NGS (Next Generation Sequencing)-based Targeted Kits: This segment is set to dominate the market and is expected to be the primary driver of growth throughout the study period.

Application: Hospital: The hospital segment is anticipated to be a major end-user driving the demand for targeted genome analysis kits.

The targeted genome analysis kits industry is experiencing significant growth catalysts, primarily driven by the ever-expanding utility of genetic information. The increasing prevalence of chronic diseases, especially cancer, fuels demand for kits that can identify specific mutations for targeted therapies. Advances in personalized medicine are making kits crucial for predicting drug efficacy and minimizing adverse reactions. Furthermore, the growing understanding of rare genetic disorders and the subsequent need for precise diagnosis is a major growth driver. The declining cost of sequencing technologies and the development of more user-friendly kits are also expanding accessibility to laboratories and hospitals worldwide.

This report offers an exhaustive examination of the Targeted Genome Analysis Kits market, providing in-depth insights into its present state and future trajectory. It meticulously analyzes market dynamics, including driving forces, challenges, and opportunities, and forecasts market growth across key segments and regions. The report delves into technological trends, competitive landscapes, and the impact of regulatory frameworks. With a robust analytical framework, it aims to equip stakeholders with actionable intelligence for strategic decision-making, highlighting the significant potential and evolving landscape of targeted genome analysis.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Agena Bioscience, BD, Thermo Fisher Scientific, Illumina, BGI, Agilent, Daicel Arbor Biosciences, Singleron, Mole Bioscience.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Targeted Genome Analysis Kits," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Targeted Genome Analysis Kits, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.