1. What is the projected Compound Annual Growth Rate (CAGR) of the Tanker Cargo Ship?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tanker Cargo Ship

Tanker Cargo ShipTanker Cargo Ship by Type (Chemical Tanker, Oil Tanker, World Tanker Cargo Ship Production ), by Application (Deep Sea, Offshore, World Tanker Cargo Ship Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

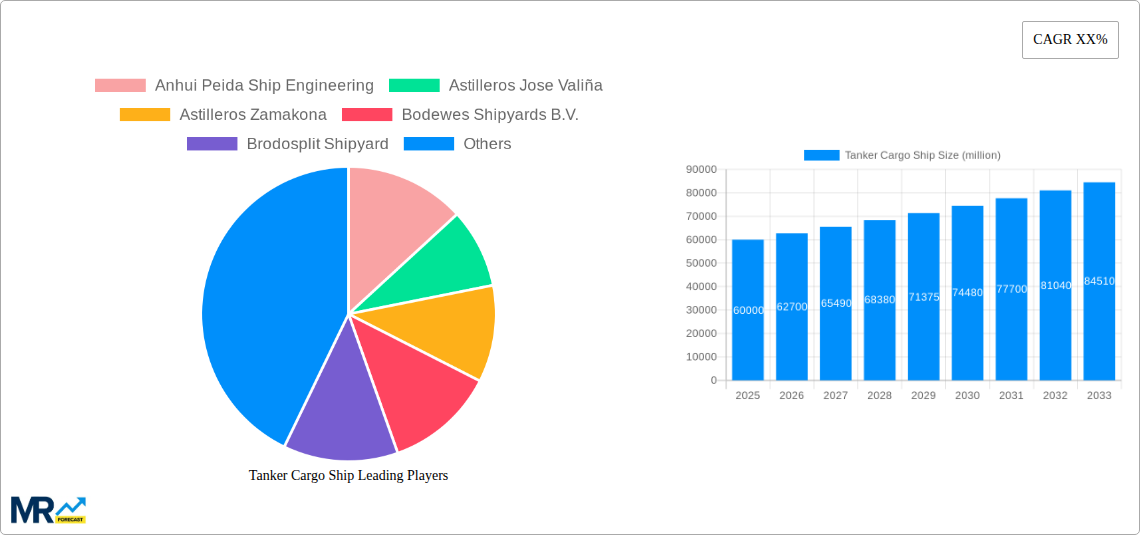

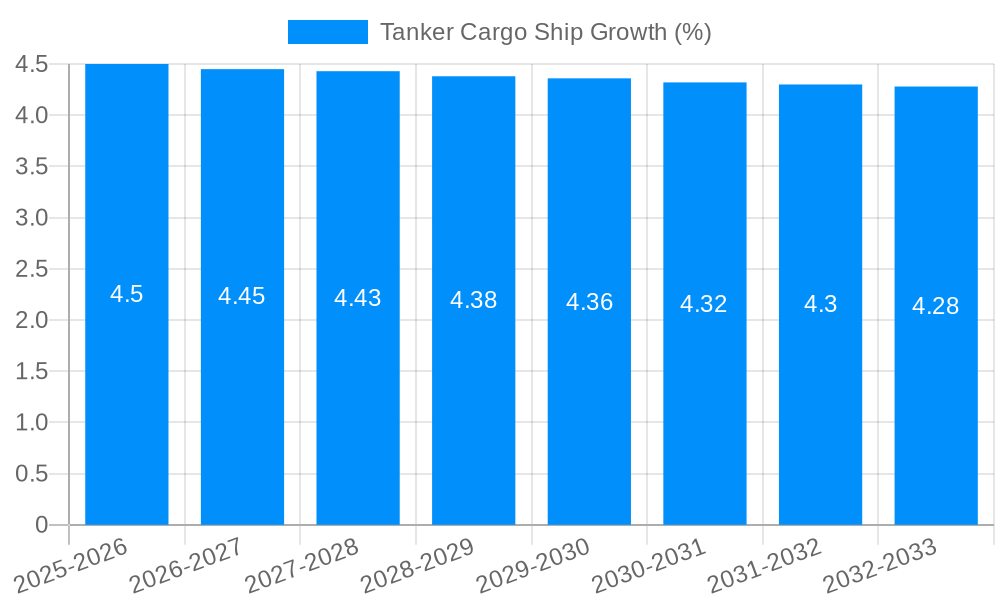

The global Tanker Cargo Ship market is poised for significant expansion, projected to reach a substantial market size by 2033, driven by robust economic activity and increasing demand for the transportation of vital commodities. The market is estimated to be valued at approximately $60,000 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 4.5% throughout the forecast period (2025-2033). This growth is primarily fueled by escalating global trade, the continuous need for oil and chemical transport to meet energy and industrial demands, and the ongoing expansion of maritime infrastructure. Emerging economies, particularly in Asia Pacific, are expected to play a crucial role in this expansion, both as production hubs and consumption centers, necessitating increased shipping capacity for various types of tanker cargo ships, including chemical and oil tankers.

Despite the positive outlook, the market faces certain restraints that could temper growth. Increasingly stringent environmental regulations concerning emissions and ballast water management are compelling shipbuilders and operators to invest in advanced, eco-friendly technologies, leading to higher upfront costs. Geopolitical instability and fluctuations in crude oil prices can also impact shipping volumes and charter rates, creating periods of uncertainty. However, the persistent demand for energy resources and manufactured goods, coupled with technological advancements in shipbuilding and navigation, will continue to propel the market forward. Key application segments such as Deep Sea and Offshore operations will witness sustained demand, supported by technological innovations and the exploration of new energy sources. The world tanker cargo ship production will be influenced by the interplay of these drivers and restraints, creating a dynamic market landscape.

This report offers an in-depth examination of the global tanker cargo ship market, meticulously analyzing trends, drivers, challenges, regional dominance, and future growth catalysts. Covering the historical period of 2019-2024, the base year of 2025, and projecting through the forecast period of 2025-2033, this analysis provides critical insights for stakeholders. The study period extends from 2019 to 2033, with an estimated year of 2025, ensuring a robust understanding of past performance, current status, and future trajectories. The report synthesizes data across various segments, including Chemical Tankers and Oil Tankers, and applications such as Deep Sea and Offshore operations.

The global tanker cargo ship market is experiencing a complex interplay of factors shaping its present and future landscape. XXX has identified key market insights indicating a steady, albeit measured, growth trajectory for the tanker cargo ship sector. A significant trend is the ongoing evolution of fleet composition, driven by both regulatory pressures and the demand for specialized cargo handling. Oil tankers, traditionally the dominant segment, continue to be vital for global energy transportation, with a growing emphasis on larger vessel capacities, such as Very Large Crude Carriers (VLCCs) and Ultra Large Crude Carriers (ULCCs), to capitalize on economies of scale. This trend is further amplified by the ever-present need for efficient and cost-effective crude oil distribution worldwide. The demand for these vessels is intrinsically linked to global energy consumption patterns, geopolitical stability affecting supply routes, and the discovery of new oil reserves. Simultaneously, the chemical tanker segment is witnessing a surge in demand, fueled by the expanding petrochemical industry and the increasing global trade in specialized chemicals. This segment requires vessels with sophisticated cargo containment systems and stringent safety protocols to handle a diverse range of liquid chemicals, from basic petrochemicals to high-value specialty chemicals. The market is also observing a gradual shift towards more environmentally friendly vessel designs. This includes the adoption of cleaner fuel technologies, such as Liquefied Natural Gas (LNG) as a primary fuel, and the implementation of advanced ballast water treatment systems to mitigate the spread of invasive species. The increasing awareness and stringent regulations surrounding maritime emissions are compelling shipbuilders and owners to invest in greener solutions. Furthermore, the "World Tanker Cargo Ship Production" segment, encompassing the overall output and capacity of tanker construction, reflects a cautious optimism. While the historical period might have seen fluctuations due to global economic conditions and trade disputes, the forecast period anticipates a rebalancing of supply and demand. The aging nature of a significant portion of the existing global tanker fleet necessitates new builds and replacements, thereby providing a consistent, though not explosive, demand for new constructions. Innovations in shipbuilding technology, including advancements in hull design for improved fuel efficiency and the integration of digital technologies for enhanced operational management and predictive maintenance, are also shaping the market's evolution.

Several potent forces are driving the growth and evolution of the tanker cargo ship market. The foundational driver remains the insatiable global demand for energy, primarily crude oil and refined petroleum products. As developing economies continue to industrialize and their populations grow, their energy needs escalate, necessitating robust and expansive maritime transportation networks. This perpetual demand for fossil fuels ensures a consistent requirement for oil tankers, particularly for long-haul voyages connecting major production hubs to consumption centers. Furthermore, the burgeoning petrochemical industry is a significant propellant for the chemical tanker segment. The increasing production and global trade of a wide array of chemicals, from industrial feedstocks to specialized additives, necessitate the operation of a diverse fleet of chemical tankers equipped to handle various cargo types safely and efficiently. Technological advancements in shipbuilding and propulsion systems also play a crucial role. Innovations leading to more fuel-efficient designs, the adoption of cleaner fuels like LNG, and enhanced safety features are not merely incremental improvements but are becoming essential for market competitiveness and regulatory compliance. These advancements reduce operational costs for shipping companies and align with the growing global imperative to reduce the environmental impact of maritime transportation. Geopolitical shifts and evolving trade patterns also exert a considerable influence. Changes in oil production capacities, the opening of new trade routes, and international agreements can significantly alter the demand for specific types of tankers and influence their deployment across various shipping lanes. The cyclical nature of the shipping industry, influenced by global economic cycles, also contributes, with periods of high demand for new builds often following periods of fleet renewal or increased trade activity.

Despite the underlying drivers, the tanker cargo ship market grapples with a significant set of challenges and restraints that can temper growth. One of the most prominent is the inherent volatility of global commodity prices, particularly crude oil. Fluctuations in oil prices directly impact demand for tanker services and the profitability of shipping operations, leading to uncertainty and potentially delaying new investment decisions. Stringent and evolving environmental regulations pose another substantial challenge. The International Maritime Organization (IMO) and regional bodies are continuously implementing stricter rules regarding emissions, fuel types, and ballast water management. Compliance often requires significant capital investment in retrofitting existing vessels or constructing new ones with advanced technologies, which can be a considerable financial burden for shipowners. The geopolitical landscape presents another complex layer of restraint. Trade wars, regional conflicts, and sanctions can disrupt established trade routes, alter cargo flows, and lead to periods of oversupply or undersupply of tonnage, creating market instability. The aging global tanker fleet, while creating a demand for new builds, also presents a maintenance and operational challenge. Older vessels may be less fuel-efficient and pose greater environmental risks, requiring careful management and eventual replacement. Furthermore, the cyclical nature of the shipbuilding industry itself can lead to periods of overcapacity, driving down charter rates and new build prices, thereby impacting the profitability of shipyards and the return on investment for owners. Access to financing can also be a restraint, especially in the current economic climate, as banks and financial institutions may adopt more cautious lending policies for large capital-intensive projects like shipbuilding. The skilled labor shortage in the maritime industry, encompassing both seafarers and shipyard workers, can also pose operational and construction challenges.

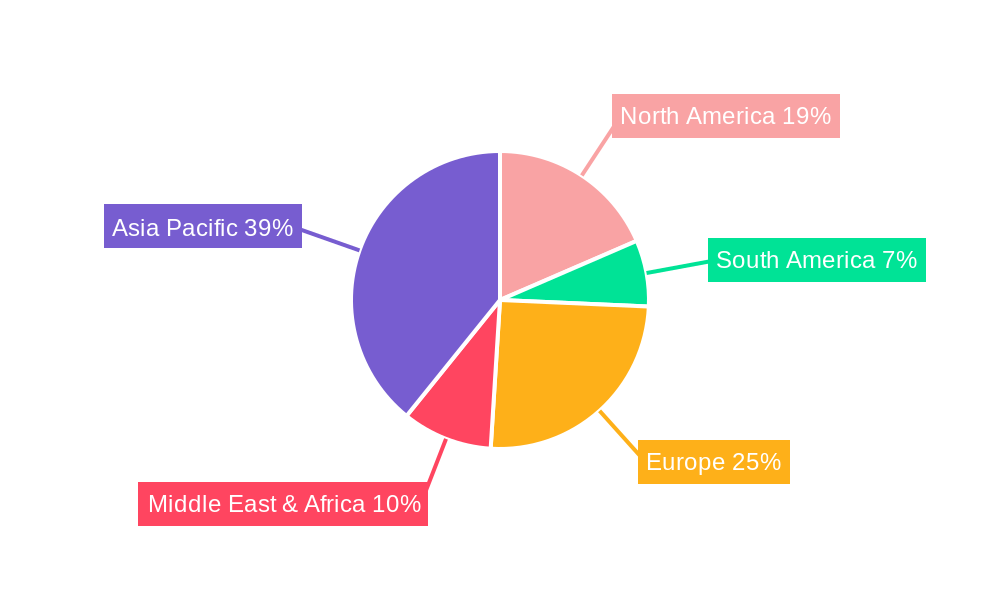

The global tanker cargo ship market is characterized by distinct regional dominance and segment leadership, with Asia-Pacific emerging as a pivotal hub for both production and demand, and Oil Tankers continuing to hold the largest share within the market.

Within the Asia-Pacific region, countries like South Korea, China, and Japan are not only major consumers of energy but also the undisputed leaders in tanker cargo ship construction. This dominance stems from several factors:

In terms of segments, Oil Tankers continue to represent the largest and most significant portion of the global tanker cargo ship market. This dominance is directly attributable to the world's unyielding dependence on crude oil and refined petroleum products for energy and industrial processes.

While Chemical Tankers are a rapidly growing segment, driven by the expansion of the petrochemical industry, and Offshore applications are gaining traction with the development of offshore energy projects, the sheer volume and continuous nature of the global oil trade firmly place Oil Tankers as the dominant segment in the current and foreseeable market landscape. The synergy between the Asia-Pacific's manufacturing might and the enduring global demand for oil makes this region and this segment central to the tanker cargo ship market's dynamics.

Several key factors are poised to act as significant growth catalysts for the tanker cargo ship industry. The ongoing fleet renewal programs, driven by the aging infrastructure of existing vessels and the need to comply with increasingly stringent environmental regulations, will fuel demand for new builds. The growth of emerging economies, particularly in Asia and Africa, will continue to drive up energy consumption, necessitating larger and more efficient tanker fleets for global supply. Furthermore, the advances in cleaner fuel technologies, such as LNG propulsion, and the development of more fuel-efficient vessel designs will not only satisfy regulatory demands but also offer long-term operational cost savings, encouraging investment in modern tonnage.

This report provides a comprehensive overview of the global tanker cargo ship market, delving into its intricate dynamics from 2019 to 2033. It meticulously analyzes the interplay of market trends, driving forces such as global energy demand and technological advancements, and the restraining challenges posed by price volatility and environmental regulations. The analysis highlights the dominance of the Asia-Pacific region in production and the Oil Tanker segment in terms of market share. Furthermore, it identifies crucial growth catalysts, including fleet renewal, the economic expansion of emerging markets, and the adoption of cleaner technologies. A detailed list of leading players and significant market developments further enriches the report's insights, offering stakeholders a robust understanding of the current landscape and future trajectory of this vital global industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Anhui Peida Ship Engineering, Astilleros Jose Valiña, Astilleros Zamakona, Bodewes Shipyards B.V., Brodosplit Shipyard, Construcciones Navales Del Norte, CSBC Corporation, DAEWOO SHIPBUILDING, Damen, General Dynamics NASSCO, Greenbay marine, HANJIN HEAVY INDUSTRIES AND CONSTRUCTION, Hijos de J. Barreras, Hitzler Werft, HYUNDAI HEAVY INDUSTRIES, Imabari Shipbuilding, MITSUBISHI HEAVY INDUSTRIES - Ship & Ocean, Mitsui Engineering & Shipbuilding, Namura Shipbuilding, Nuovi Cantieri Apuania, SAMSUNG HEAVY INDUSTRIES, SembCorp Marine, STX SHIPBUILDING, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tanker Cargo Ship," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tanker Cargo Ship, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.