1. What is the projected Compound Annual Growth Rate (CAGR) of the Tamper Evident Closure?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Tamper Evident Closure

Tamper Evident ClosureTamper Evident Closure by Type (PP Closure, PE Closure, Others, World Tamper Evident Closure Production ), by Application (Drink Bottle, Medicine Bottle, Industrial Chemicals, Others, World Tamper Evident Closure Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

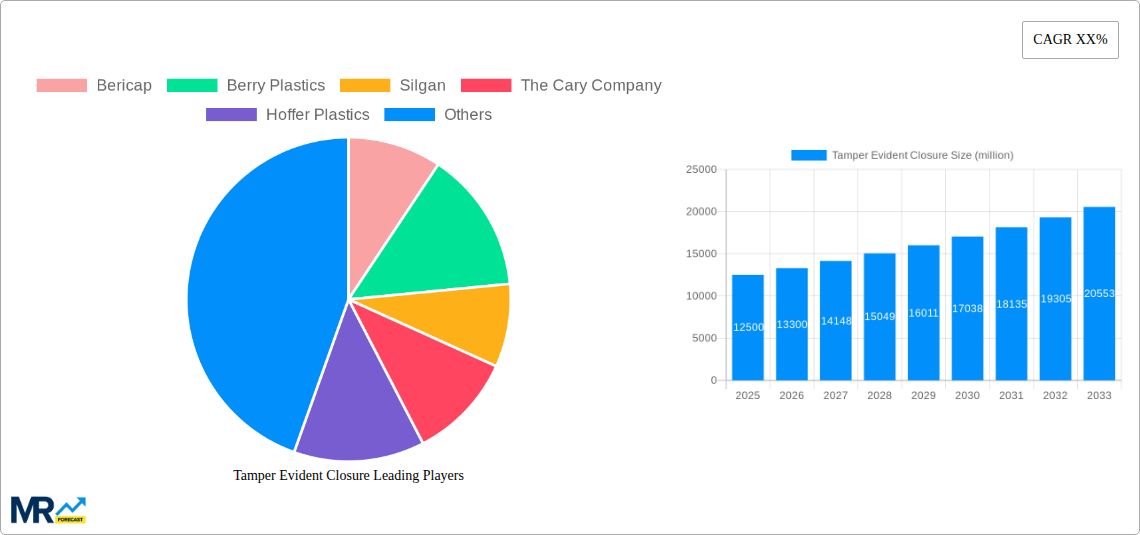

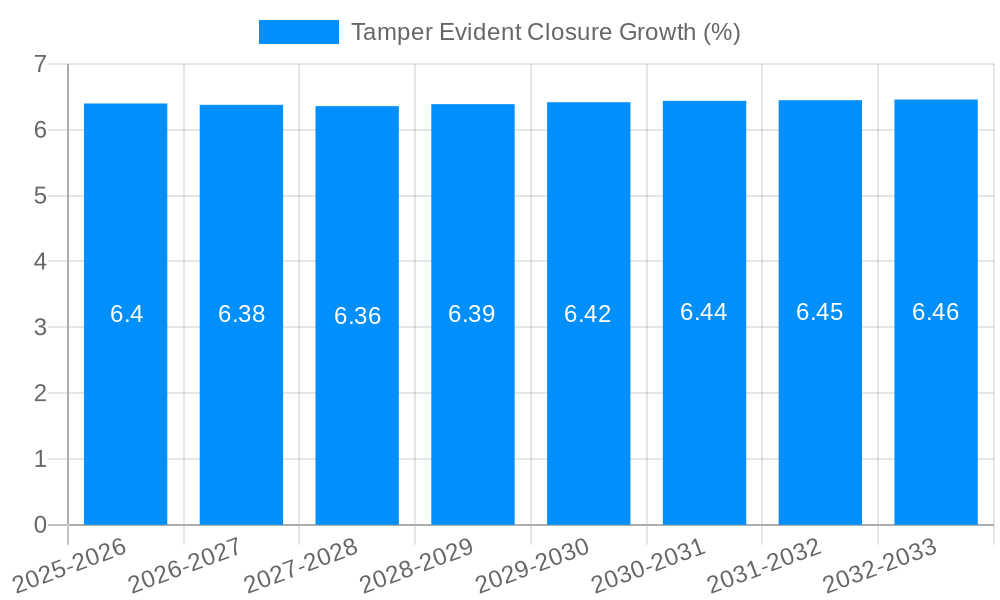

The global Tamper Evident Closure market is projected for significant growth, with an estimated market size of $12,500 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This robust expansion is fueled by an increasing demand for product safety and authenticity across a wide spectrum of industries, including pharmaceuticals, food and beverage, and personal care. Growing consumer awareness regarding product integrity, coupled with stringent regulatory mandates for secure packaging solutions, are primary drivers. Furthermore, advancements in material science and manufacturing technologies are leading to the development of more sophisticated and cost-effective tamper-evident closures, enhancing their adoption rates. The market is witnessing a surge in demand for innovations that offer superior tamper-resistance, ease of use, and sustainability, aligning with evolving consumer preferences and environmental concerns.

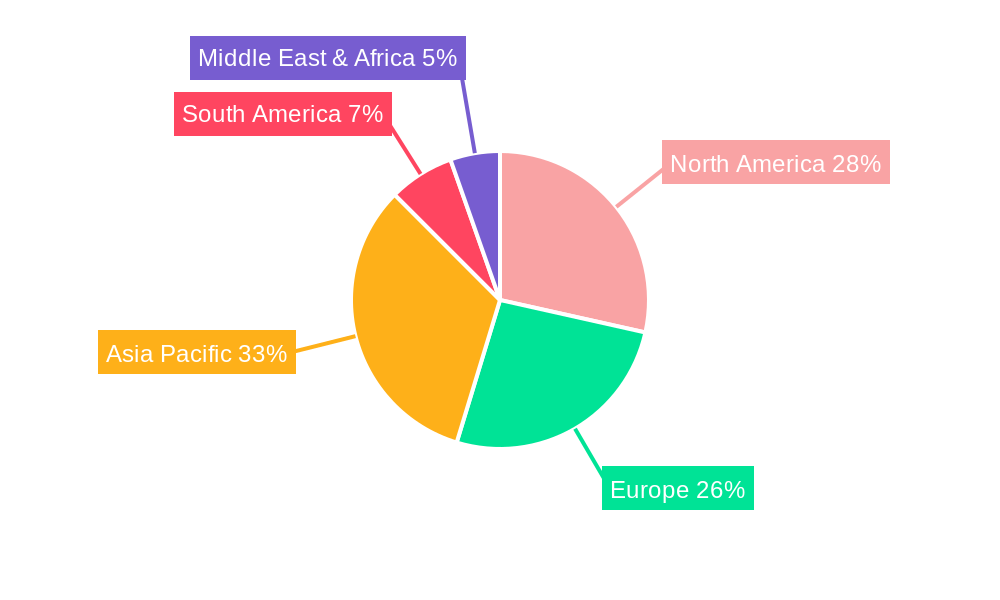

The market segmentation reveals a strong performance across various closure types and applications. Polypropylene (PP) and Polyethylene (PE) closures are expected to dominate the market due to their cost-effectiveness, durability, and versatility. Applications in drink bottles and medicine bottles are particularly prominent, reflecting the critical need for secure packaging in these sectors. Industrial chemicals also represent a substantial segment, emphasizing the importance of preventing unauthorized access and contamination. Geographically, Asia Pacific is poised to emerge as a key growth region, driven by rapid industrialization, a burgeoning middle class, and increasing domestic consumption. North America and Europe remain mature yet significant markets, characterized by high adoption rates of advanced packaging technologies and a strong regulatory framework. Emerging economies in South America and the Middle East & Africa are also expected to contribute to market growth as awareness and regulatory enforcement increase. Despite the positive outlook, factors such as volatile raw material prices and intense competition among manufacturers could present some market restraints, although the overall trend points towards sustained and healthy expansion.

This comprehensive report provides an in-depth analysis of the global Tamper Evident Closure market, offering valuable insights for stakeholders seeking to navigate this dynamic industry. The study spans from 2019 to 2033, with a specific focus on the base year of 2025, and the forecast period of 2025-2033, building upon historical data from 2019-2024. We project a significant market expansion, with global production anticipated to reach over 1200 million units by 2025 and surge towards over 1800 million units by 2033, indicating a robust compound annual growth rate. The report delves into market segmentation by type (PP Closure, PE Closure, Others), application (Drink Bottle, Medicine Bottle, Industrial Chemicals, Others), and examines the critical industry developments shaping the future of tamper evident solutions.

The global Tamper Evident Closure market is experiencing a significant paradigm shift, driven by an escalating demand for enhanced product safety, consumer trust, and regulatory compliance across a multitude of industries. Over the historical period of 2019-2024, we observed a steady upward trajectory, with key drivers including increased awareness of product adulteration and the growing counterfeiting of goods. The base year of 2025 positions the market at a crucial inflection point, with projected global production exceeding 1200 million units, a testament to its growing importance. The forecast period of 2025-2033 is expected to witness sustained and accelerated growth, with the market potentially surpassing 1800 million units by the end of this period. This expansion is fueled by several evolving trends. Firstly, the increasing sophistication of tamper evident technologies, moving beyond simple tear bands to incorporate advanced features like holographic seals, NFC-enabled tags, and unique identification markers, is a key differentiator. These advancements not only enhance security but also offer valuable brand protection and traceability solutions. Secondly, the rising prominence of e-commerce and the associated logistical challenges have amplified the need for secure packaging solutions. Consumers are increasingly demanding assurance that their online purchases have not been compromised during transit, placing a greater emphasis on tamper evident closures for a wider range of products, from pharmaceuticals to premium food items. Furthermore, growing environmental consciousness is subtly influencing trends, with a rising interest in sustainable tamper evident closure materials and designs that minimize waste, aligning with the circular economy principles. The pharmaceutical sector continues to be a dominant force, owing to stringent regulatory requirements and the critical need to safeguard patient safety. However, the food and beverage industry, along with industrial chemical applications, are also witnessing a substantial surge in adoption, reflecting a broader market-wide commitment to security and integrity. The adoption of smart tamper evident solutions, integrating digital technologies for authentication and tracking, is another burgeoning trend that promises to redefine the market landscape in the coming years.

The growth of the Tamper Evident Closure market is propelled by a confluence of powerful factors that underscore the increasing imperative for product integrity and consumer confidence. Foremost among these is the ever-present threat of product counterfeiting and adulteration. As illicit actors become more sophisticated, industries are compelled to adopt robust tamper evident solutions to safeguard their brands and, more importantly, the well-being of their consumers. This is particularly acute in sectors like pharmaceuticals, where the consequences of tampering can be severe, leading to patient harm and significant reputational damage. Furthermore, evolving regulatory landscapes globally are playing a crucial role. Governments and international bodies are increasingly mandating the use of tamper evident features for specific product categories, especially in food and beverage, pharmaceuticals, and chemicals, to ensure consumer safety and prevent the entry of substandard or harmful goods into the market. The surge in e-commerce has also significantly amplified the demand for tamper evident closures. Products shipped directly to consumers are susceptible to tampering during transit, and the visual assurance provided by a secure closure instills confidence and reduces return rates. This trend is expected to continue its upward trajectory as online shopping becomes even more prevalent across diverse product segments. Moreover, growing consumer awareness regarding product safety and authenticity is a potent driver. Consumers are more educated than ever before and actively seek products that offer a clear indication of being untampered with, influencing purchasing decisions and compelling manufacturers to invest in these protective measures.

Despite the robust growth trajectory, the Tamper Evident Closure market is not without its challenges and restraints. A primary hurdle is the cost of implementation. While the benefits of tamper evident closures are undeniable, the initial investment in specialized machinery, materials, and quality control processes can be significant, particularly for smaller manufacturers or those operating with tight profit margins. This cost factor can lead to a slower adoption rate in price-sensitive markets or for lower-value products. Furthermore, the complexity of integration into existing packaging lines can present a technical challenge. Adapting current manufacturing processes to incorporate tamper evident features may require substantial modifications and retraining of personnel, leading to operational disruptions and added expenses. Consumer convenience versus security also represents a delicate balancing act. While tamper evident features are essential for security, overly complex or difficult-to-open closures can lead to frustration and negatively impact the consumer experience. Striking the right balance between robust security and ease of use is an ongoing design challenge for manufacturers. The potential for circumvention by determined counterfeiters also remains a constant threat. As tamper evident technologies advance, so too do the methods employed by those seeking to bypass them. Continuous innovation and the development of more sophisticated, difficult-to-replicate security features are necessary to stay ahead, but this can lead to an arms race between protection and illicit activity. Finally, variations in regulatory enforcement across different regions can create inconsistencies in market demands and compliance requirements, making it challenging for global manufacturers to standardize their tamper evident closure strategies.

Several regions and segments are poised to dominate the Tamper Evident Closure market, driven by a combination of factors including regulatory frameworks, industry concentration, and consumer demand.

Dominant Segments:

PP Closure and PE Closure:

Application: Medicine Bottle and Drink Bottle:

Dominant Regions/Countries:

Several key growth catalysts are fueling the expansion of the Tamper Evident Closure industry. The unrelenting global drive for enhanced product safety and the escalating threat of counterfeiting are paramount, compelling industries to invest in robust protection mechanisms. Furthermore, the tightening of regulatory mandates, particularly within the pharmaceutical and food & beverage sectors, is a significant catalyst, pushing for mandatory adoption of tamper evident features. The burgeoning e-commerce landscape, with its inherent logistical vulnerabilities, is also a major driver, demanding secure packaging for direct-to-consumer shipments. Finally, increasing consumer awareness and demand for product authenticity are influencing purchasing decisions, thereby encouraging manufacturers to incorporate visible tamper evident solutions to build trust.

This report offers an exhaustive examination of the global Tamper Evident Closure market, meticulously covering its intricate dynamics from 2019 to 2033. The analysis includes detailed segmentation by Type (PP Closure, PE Closure, Others) and Application (Drink Bottle, Medicine Bottle, Industrial Chemicals, Others), providing granular insights into the market's structure. We present a comprehensive overview of the World Tamper Evident Closure Production, with projected figures exceeding 1200 million units by 2025 and a forecast to surpass 1800 million units by 2033. The report delves into the driving forces, challenges, key regional dominance, and significant industry developments, offering a strategic roadmap for stakeholders. It also highlights the leading players, providing a crucial understanding of the competitive landscape. This report serves as an indispensable resource for manufacturers, suppliers, investors, and regulatory bodies seeking to understand the present state and future trajectory of the tamper evident closure market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bericap, Berry Plastics, Silgan, The Cary Company, Hoffer Plastics, Marijuana Packaging, Aptar, Oriental Containers, Blackhawk Molding, ALWSCI, Crown Equipment Corporation, Gil Plastic Products, Sailor Plastic Bottles, Heinlein Plastik-Technik, H&K Müller.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Tamper Evident Closure," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Tamper Evident Closure, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.