1. What is the projected Compound Annual Growth Rate (CAGR) of the Sustainability Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sustainability Packaging

Sustainability PackagingSustainability Packaging by Type (/> Corrugated Packaging, Cellulose Packaging, Cornstarch Packaging, Others), by Application (/> Food, Beverage, Retail and Logistics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

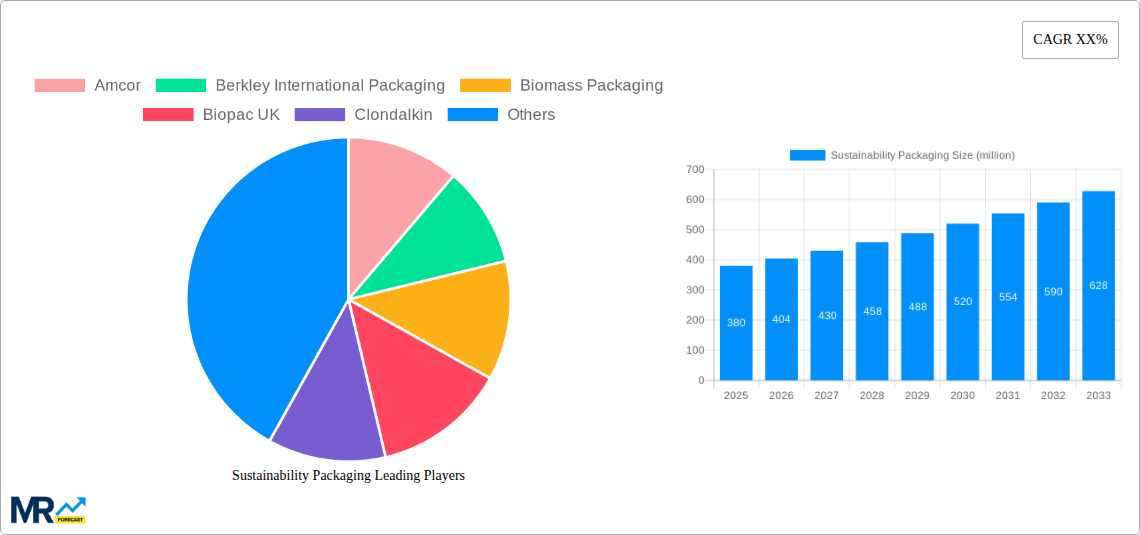

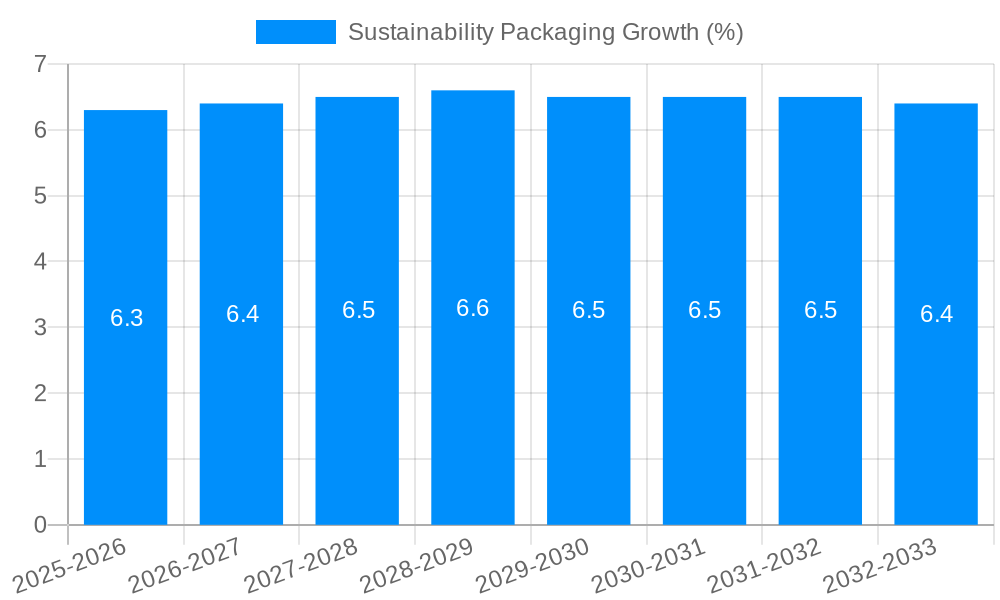

The global sustainable packaging market is poised for significant expansion, driven by a growing consumer and regulatory push for environmentally friendly alternatives to traditional packaging materials. With a projected market size of approximately USD 380 million in 2025, the sector is expected to experience a robust Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This remarkable growth is fueled by increasing awareness of plastic pollution and its detrimental environmental impact, compelling businesses across various sectors to adopt sustainable packaging solutions. Key market drivers include stringent government regulations promoting recycling and waste reduction, coupled with a rising consumer preference for brands demonstrating strong environmental responsibility. Industries like food and beverage, and retail are at the forefront of this transformation, actively seeking innovative packaging that minimizes their ecological footprint.

The sustainable packaging landscape is characterized by a dynamic array of material types and applications. Corrugated packaging and cellulose-based options are leading the charge, offering excellent recyclability and biodegradability. However, emerging materials like cornstarch packaging are also gaining traction, presenting unique bio-based solutions. The sector's growth is further influenced by ongoing research and development in material science, leading to improved performance, cost-effectiveness, and wider applicability of sustainable options. Despite the optimistic outlook, certain restraints, such as higher initial costs for some sustainable materials and the need for robust recycling infrastructure, present challenges. Nevertheless, the overarching trend towards a circular economy and increased corporate sustainability commitments ensures a bright future for the sustainable packaging market, with significant opportunities for innovation and investment. Major global players like Amcor, Mondi, and DS Smith are actively investing in and expanding their sustainable packaging portfolios to cater to this burgeoning demand.

This comprehensive report delves into the dynamic and rapidly evolving landscape of Sustainability Packaging. With a keen focus on the period between 2019 and 2033, including a base year of 2025 and a forecast period spanning 2025-2033, this analysis provides invaluable insights into market trends, driving forces, challenges, and future growth opportunities. The report leverages data from the historical period of 2019-2024 to establish a robust foundation for its projections, offering a holistic view of the industry.

The global sustainability packaging market is experiencing a profound transformation, moving beyond mere compliance to becoming a core strategic imperative for businesses. During the study period of 2019-2033, with a base year of 2025, we observe a clear and accelerating shift towards materials that minimize environmental impact across their entire lifecycle. This includes a significant surge in demand for recyclable, compostable, and biodegradable packaging solutions. Consumers are increasingly informed and vocal about their environmental concerns, exerting considerable pressure on brands to adopt more responsible packaging practices. This consumer-driven demand is a powerful trend, directly influencing product development and procurement strategies within the packaging industry.

Furthermore, the concept of circular economy principles is deeply embedded in the evolving sustainability packaging landscape. This means a move away from the traditional linear "take-make-dispose" model towards one where materials are kept in use for as long as possible, recovering and regenerating products and materials at the end of each service life. This translates to an increased focus on lightweighting, where packaging is designed to use less material without compromising functionality, thereby reducing waste and transportation emissions. The development and adoption of reusable packaging systems are also gaining significant traction, particularly in sectors like e-commerce and food delivery, offering consumers convenient and environmentally friendly alternatives. Technological advancements are playing a pivotal role, with innovations in material science leading to the development of novel bio-based and recycled content alternatives. The integration of smart packaging technologies that can monitor product freshness or provide recycling instructions further enhances the sustainability narrative. Overall, the trend is towards holistic solutions that address waste reduction, resource efficiency, and a reduced carbon footprint, making sustainability packaging an indispensable component of modern business operations. The market is projected to witness substantial growth, driven by these multifaceted trends.

The escalating demand for sustainability packaging is propelled by a confluence of powerful driving forces. Foremost among these is the increasing consumer awareness and demand for eco-friendly products. Consumers, armed with information and driven by a growing sense of environmental responsibility, are actively seeking out brands that demonstrate a commitment to sustainability. This conscious consumerism translates into purchasing decisions, compelling companies to align their packaging strategies with these values. Simultaneously, stringent government regulations and policies worldwide are mandating the use of sustainable packaging materials and promoting waste reduction initiatives. These regulations, often driven by concerns over plastic pollution and climate change, create a compelling business case for companies to invest in and adopt sustainable packaging solutions.

The pursuit of brand differentiation and enhanced corporate social responsibility (CSR) also plays a significant role. In a competitive marketplace, companies are leveraging sustainable packaging as a key differentiator, enhancing their brand image and appealing to a growing segment of environmentally conscious consumers. This also aligns with broader CSR objectives, allowing companies to communicate their commitment to ethical and sustainable practices. Furthermore, economic benefits are increasingly being realized through sustainable packaging. While initial investments may be present, the long-term advantages of reduced material costs, optimized logistics through lightweighting, and potential tax incentives or rebates for adopting green practices are becoming increasingly attractive. The drive for innovation within the packaging industry itself, spurred by the opportunities presented by the sustainability movement, is also a significant driver, leading to the development of new materials and processes.

Despite the burgeoning growth and evident advantages, the sustainability packaging market encounters several significant challenges and restraints. A primary hurdle is the higher cost associated with many sustainable materials and technologies compared to traditional packaging options. The research, development, and scaling of innovative biodegradable or compostable materials often come with a premium, which can be a barrier for businesses, particularly small and medium-sized enterprises (SMEs), aiming to maintain competitive pricing for their products. The lack of standardized infrastructure for collection, sorting, and processing of diverse sustainable packaging materials poses another major challenge. While advancements are being made, many regions still lack the necessary facilities to effectively recycle or compost a wide array of new materials, leading to potential contamination issues and diminished efficacy of sustainability initiatives.

The consumer confusion and lack of clear labeling regarding the proper disposal of different types of sustainable packaging can also hinder progress. Without clear guidance, consumers may inadvertently place compostable items in recycling bins or vice versa, undermining the intended environmental benefits. Performance and functionality concerns can also arise. Some sustainable materials, while eco-friendly, may not always match the barrier properties, durability, or shelf-life preservation capabilities of conventional plastic or metal packaging, especially for sensitive products like certain foods and beverages. Finally, the reliance on global supply chains and the availability of raw materials for sustainable packaging can be subject to volatility, influenced by geopolitical factors, climate change impacts on agricultural yields for bio-based materials, and the fluctuating prices of recycled commodities.

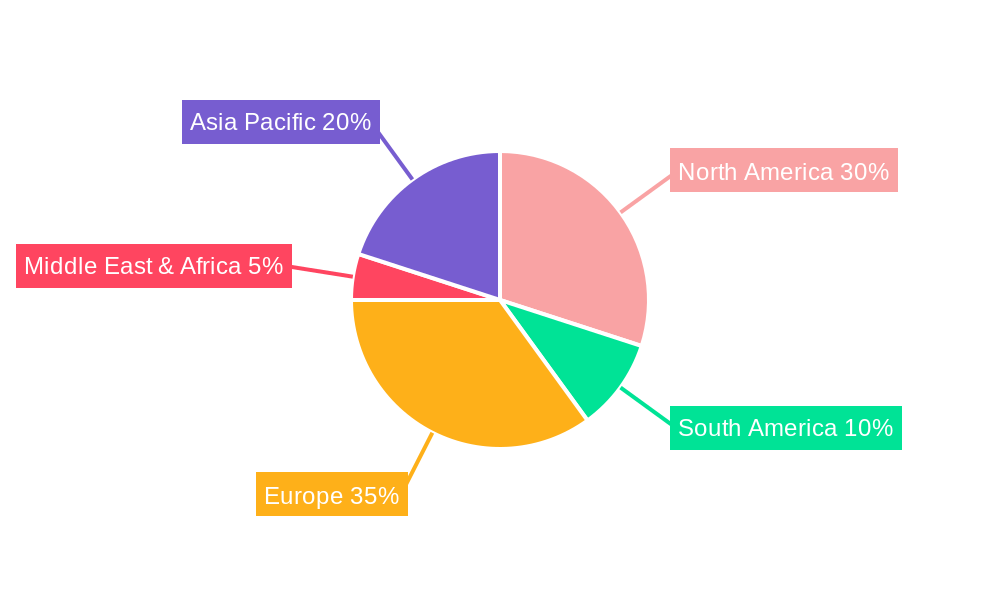

The sustainability packaging market is poised for significant growth across various regions and segments, with certain areas and product types expected to lead the charge. North America and Europe are anticipated to be key regions dominating the market for sustainability packaging. This dominance is driven by a combination of factors including strong government initiatives, stringent environmental regulations, and a highly aware and environmentally conscious consumer base. For instance, in Europe, directives like the Single-Use Plastics Directive have spurred innovation and adoption of sustainable alternatives. Similarly, in North America, increasing corporate sustainability goals and growing consumer demand for eco-friendly products are creating a fertile ground for growth. Countries within these regions are actively investing in research and development for new sustainable materials and improving waste management infrastructure.

Within the Type segment, Corrugated Packaging is expected to continue its strong performance and dominate the market. This is attributed to its inherent recyclability, biodegradability, and widespread availability of recycled content. Its versatility makes it suitable for a vast array of applications, from e-commerce shipping to product protection. The increasing online retail sector further amplifies the demand for sturdy yet sustainable corrugated solutions. The Cellulose Packaging segment is also projected to witness substantial growth, driven by its renewable nature and compostable properties. This includes materials derived from wood pulp, paperboard, and other plant-based fibers, offering a sustainable alternative for various packaging needs.

In terms of Application, the Food and Beverage sector is expected to be a major driver of the sustainability packaging market. This industry faces immense pressure from consumers and regulators to reduce its environmental footprint, particularly concerning single-use plastics. Consequently, there is a significant and growing demand for sustainable packaging solutions for food preservation, product presentation, and transportation. This includes innovative materials for flexible packaging, rigid containers, and beverage cartons that are recyclable or compostable. The Retail and Logistics segment is also a substantial contributor, especially with the rapid expansion of e-commerce, which necessitates robust and sustainable shipping solutions. The emphasis on reducing shipping waste and providing a positive unboxing experience with eco-friendly materials is driving innovation and adoption. The "Others" category, encompassing pharmaceuticals, personal care, and industrial goods, also presents significant opportunities as these sectors increasingly integrate sustainability into their packaging strategies. The overall trend indicates a broad-based adoption of sustainable packaging across multiple industries, with specific segments experiencing accelerated growth due to regulatory pressure, consumer demand, and technological advancements.

Several key factors are acting as potent growth catalysts for the sustainability packaging industry. The intensifying global focus on reducing plastic waste and mitigating climate change is arguably the most significant catalyst, compelling businesses and governments alike to prioritize sustainable alternatives. This environmental imperative is directly translating into increased investment and innovation in the sector. Furthermore, advancements in material science and technology are continuously yielding new, more effective, and cost-competitive sustainable packaging options, making them more accessible and practical for a wider range of applications. The growing consumer preference for brands with a clear commitment to sustainability is another powerful catalyst, as companies recognize the significant impact of eco-conscious purchasing decisions on their brand loyalty and market share.

This comprehensive report provides an in-depth analysis of the global sustainability packaging market, meticulously examining its trajectory from 2019 to 2033. The report offers a granular view of market dynamics, segmented by packaging type (Corrugated Packaging, Cellulose Packaging, Cornstarch Packaging, Others), application (Food, Beverage, Retail and Logistics, Others), and key regional markets. It delves into the intricate interplay of driving forces, such as growing consumer consciousness and stringent regulations, alongside significant challenges like material costs and infrastructure limitations. By dissecting these elements, the report equips stakeholders with the critical intelligence needed to navigate the evolving landscape, identify emerging opportunities, and formulate effective strategies for success in the sustainable packaging arena. The robust methodology, incorporating a detailed study period and forecast period, ensures a reliable and actionable assessment of market potential and future trends.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amcor, Berkley International Packaging, Biomass Packaging, Biopac UK, Clondalkin, DS Smith, EnviroPAK, Evergreen Packaging, Georgia Pacific, Gerresheimer, Huhtamaki, Kruger, Graham, Mondi, Tetra Laval, Ardagh, BeGreen Packaging.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Sustainability Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sustainability Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.