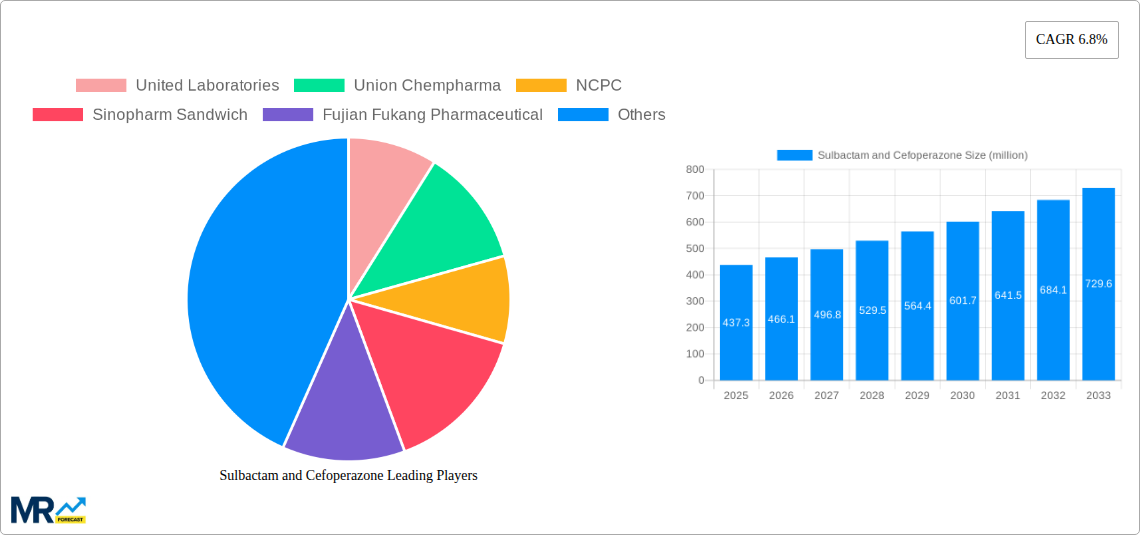

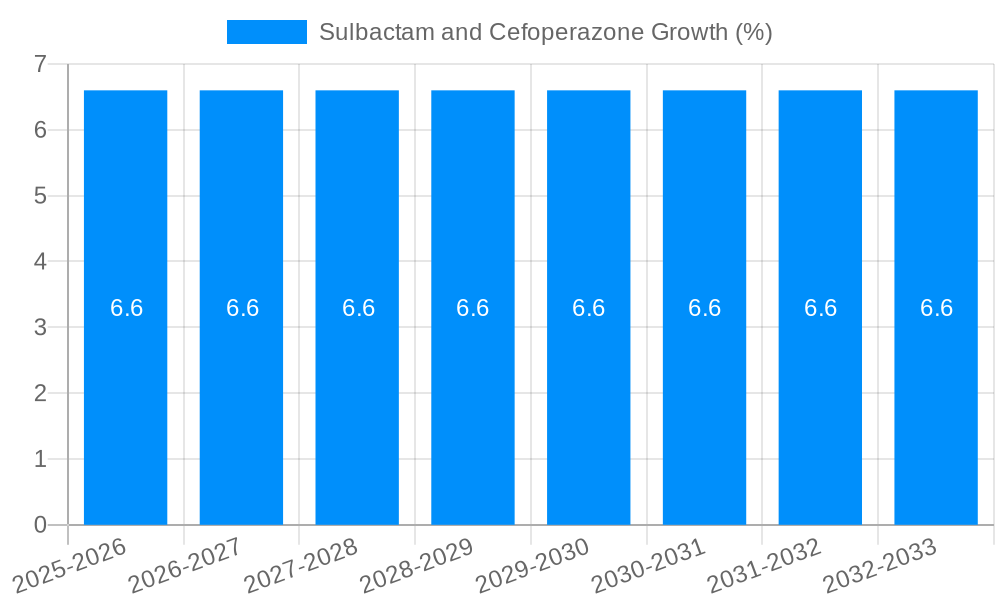

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sulbactam and Cefoperazone?

The projected CAGR is approximately 6.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sulbactam and Cefoperazone

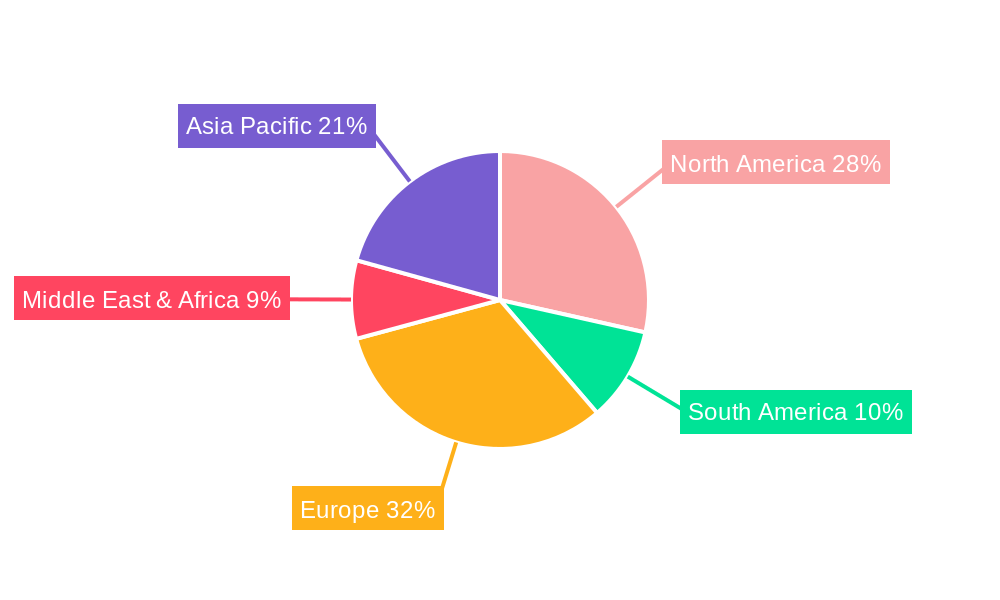

Sulbactam and CefoperazoneSulbactam and Cefoperazone by Type (Powder Injection, Injection), by Application (Respiratory Infections, Urinary Infections, Skin Infections, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Sulbactam and Cefoperazone market is poised for substantial growth, projected to reach USD 437.3 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.8% anticipated throughout the forecast period of 2025-2033. This expansion is primarily driven by the increasing prevalence of bacterial infections, particularly respiratory, urinary, and skin infections, which necessitate effective antibiotic treatments. The combined formulation of Sulbactam and Cefoperazone offers broad-spectrum activity, making it a critical therapeutic option against a range of resistant bacterial strains. Advancements in pharmaceutical research and development, coupled with a growing emphasis on healthcare access in emerging economies, are further bolstering market demand. The Powder Injection segment is expected to lead the market, owing to its versatility and ease of administration in diverse clinical settings.

The market's trajectory is further influenced by a dynamic interplay of drivers, trends, and restraints. Key growth drivers include the rising incidence of hospital-acquired infections (HAIs), the escalating need for combination therapies to combat antimicrobial resistance (AMR), and government initiatives promoting responsible antibiotic use. Emerging trends indicate a focus on developing novel drug delivery systems and exploring new therapeutic applications for Sulbactam and Cefoperazone. However, the market faces certain restraints, such as the increasing threat of antibiotic resistance, stringent regulatory approvals for new drug formulations, and the availability of alternative treatments. Companies like United Laboratories, Union Chempharma, NCPC, Sinopharm Sandwich, Fujian Fukang Pharmaceutical, and Youcare Pharmaceutical are key players actively contributing to market innovation and supply chain resilience. Geographically, the Asia Pacific region, particularly China and India, is expected to witness significant growth due to a large patient pool and expanding healthcare infrastructure, while North America and Europe will remain dominant markets owing to established healthcare systems and high adoption rates of advanced therapeutics.

Here's a unique report description for Sulbactam and Cefoperazone, incorporating the provided information and adhering to the requested structure:

The Sulbactam and Cefoperazone market is poised for significant expansion, driven by a confluence of factors including rising global healthcare expenditures, increasing incidence of bacterial infections, and advancements in pharmaceutical manufacturing. During the Study Period of 2019-2033, the market has exhibited robust growth, with the Base Year of 2025 serving as a pivotal point for understanding current market dynamics and future trajectories. The Estimated Year of 2025 itself will reflect a market value in the hundreds of millions, with projections for the Forecast Period of 2025-2033 indicating a sustained upward trend. The Historical Period of 2019-2024 laid the groundwork for this growth, characterized by increasing adoption of combination therapies for more effective bacterial infection management. Key market insights reveal a growing preference for combination antibiotics like Sulbactam and Cefoperazone due to their broad spectrum of activity and ability to combat beta-lactamase producing bacteria, a significant challenge in contemporary infectious disease treatment. The increasing prevalence of antimicrobial resistance necessitates the use of such potent combinations. Furthermore, the global push for accessible and affordable healthcare solutions, particularly in developing economies, is a significant contributor to the expanding market for injectable antibiotic formulations. The demand for Powder Injection and standard Injection forms of Sulbactam and Cefoperazone is expected to remain strong, catering to diverse clinical settings and patient needs. Innovations in drug delivery systems and formulation technologies are also anticipated to play a crucial role in enhancing efficacy and patient compliance, further bolstering market growth. The market's trajectory is also influenced by regulatory landscapes and the strategic investments made by key industry players in research and development, aiming to introduce improved formulations and expand therapeutic applications. The consistent demand for effective treatments against prevalent infections like Respiratory Infections, Urinary Infections, and Skin Infections underscores the indispensable role of Sulbactam and Cefoperazone in modern pharmacopoeia. The market is not merely about unit sales but also about addressing critical public health needs in combating bacterial pathogens.

The Sulbactam and Cefoperazone market is experiencing a powerful surge primarily fueled by the escalating global burden of bacterial infections. As antimicrobial resistance continues its relentless advance, healthcare professionals are increasingly turning to synergistic antibiotic combinations like Sulbactam and Cefoperazone to effectively manage infections that were once easily treatable. The inherent advantage of this combination lies in sulbactam's role as a beta-lactamase inhibitor, which protects cefoperazone from degradation by bacterial enzymes, thereby widening its spectrum of activity against a broader range of pathogens, including many resistant strains. This enhanced efficacy is a critical driver, especially in hospital-acquired infections where resistance is often more pronounced. Furthermore, the growing global population and an aging demographic contribute to a higher susceptibility to infections, thereby increasing the demand for effective antimicrobial treatments. The continuous rise in healthcare expenditure worldwide, coupled with increased access to healthcare services in emerging economies, also translates into a greater consumption of pharmaceutical products, including essential antibiotics like Sulbactam and Cefoperazone. The widespread application of this combination in treating common yet severe infections such as pneumonia, bronchitis, urinary tract infections, and complex skin and soft tissue infections ensures a sustained and substantial market presence. Pharmaceutical companies are also actively investing in research and development to optimize formulations and explore new therapeutic avenues, which further propels market growth by offering improved patient outcomes and treatment protocols. The market is a testament to the ongoing battle against microbial pathogens and the pharmaceutical industry's commitment to providing effective solutions.

Despite the robust growth prospects, the Sulbactam and Cefoperazone market faces several significant challenges and restraints that could temper its expansion. Paramount among these is the escalating issue of antimicrobial resistance. While Sulbactam and Cefoperazone are designed to combat resistant bacteria, the continuous emergence of new resistance mechanisms poses an ongoing threat to their long-term efficacy. Overuse and misuse of antibiotics, both in human and veterinary medicine, contribute to the accelerated development of resistance, necessitating careful stewardship and promotion of judicious prescribing practices. Another critical restraint is the increasing regulatory scrutiny surrounding antibiotic usage and pricing. Governments and regulatory bodies worldwide are implementing stricter guidelines for antibiotic approval, prescription, and reimbursement, which can impact market access and profitability for manufacturers. The development of novel antibiotics with different mechanisms of action could also present a competitive challenge, offering alternative treatment options that may be perceived as superior or more targeted. Furthermore, the economic burden of infectious diseases, particularly in low- and middle-income countries, can limit the affordability and accessibility of advanced antibiotic therapies, thereby restraining market penetration in these regions. Concerns regarding potential side effects and adverse drug reactions, although manageable with proper administration and patient monitoring, can also influence prescribing patterns and patient adherence. The supply chain complexities and potential for raw material shortages, particularly for active pharmaceutical ingredients (APIs), can also pose a risk to consistent market supply and price stability. The continuous need for clinical validation and post-market surveillance adds to the operational costs and complexities for manufacturers in this segment.

The Sulbactam and Cefoperazone market is poised for significant dominance by the Respiratory Infections segment, particularly within the Asia Pacific region. This dominance is a multifaceted phenomenon driven by a combination of epidemiological factors, healthcare infrastructure development, and market dynamics.

Dominant Segment: Respiratory Infections

Dominant Region/Country: Asia Pacific

In conclusion, the confluence of a high disease burden for respiratory infections and the strong market presence of manufacturers within the Asia Pacific region positions these factors as the primary drivers of dominance in the Sulbactam and Cefoperazone market. The demand for effective treatments against prevalent bacterial pathogens in this region, coupled with the logistical advantages of powder injections, ensures a sustained and substantial market share.

The Sulbactam and Cefoperazone industry is propelled by several key growth catalysts. The persistent rise in the global incidence of bacterial infections, exacerbated by the growing threat of antimicrobial resistance, fuels the demand for potent combination therapies. Increased healthcare spending and improved access to medical facilities, particularly in emerging economies, are further expanding the market reach. The ongoing research and development efforts by leading pharmaceutical companies to optimize formulations, enhance efficacy, and explore novel applications also act as significant growth drivers. Furthermore, the strategic partnerships and collaborations between manufacturers and healthcare providers are crucial in ensuring widespread availability and adoption of these essential antibiotics.

This comprehensive report on Sulbactam and Cefoperazone offers an in-depth analysis of market trends, drivers, challenges, and opportunities from 2019 to 2033, with a focal point on the Base Year of 2025. It delves into the strategic landscape, identifying key players such as United Laboratories, Union Chempharma, NCPC, Sinopharm Sandwich, Fujian Fukang Pharmaceutical, and Youcare Pharmaceutical. The report provides granular insights into market segmentation by Type (Powder Injection, Injection) and Application (Respiratory Infections, Urinary Infections, Skin Infections, Other), highlighting the dominance of Respiratory Infections within the Asia Pacific region. It meticulously details significant industry developments and forecasts the market's trajectory, providing actionable intelligence for stakeholders to navigate this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.8%.

Key companies in the market include United Laboratories, Union Chempharma, NCPC, Sinopharm Sandwich, Fujian Fukang Pharmaceutical, Youcare Pharmaceutical, .

The market segments include Type, Application.

The market size is estimated to be USD 437.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Sulbactam and Cefoperazone," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sulbactam and Cefoperazone, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.