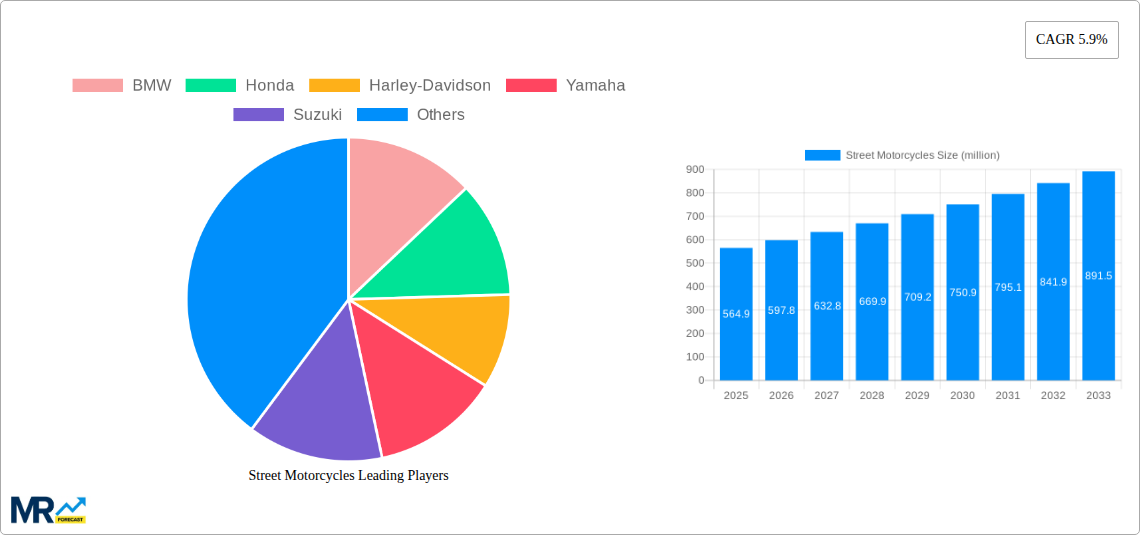

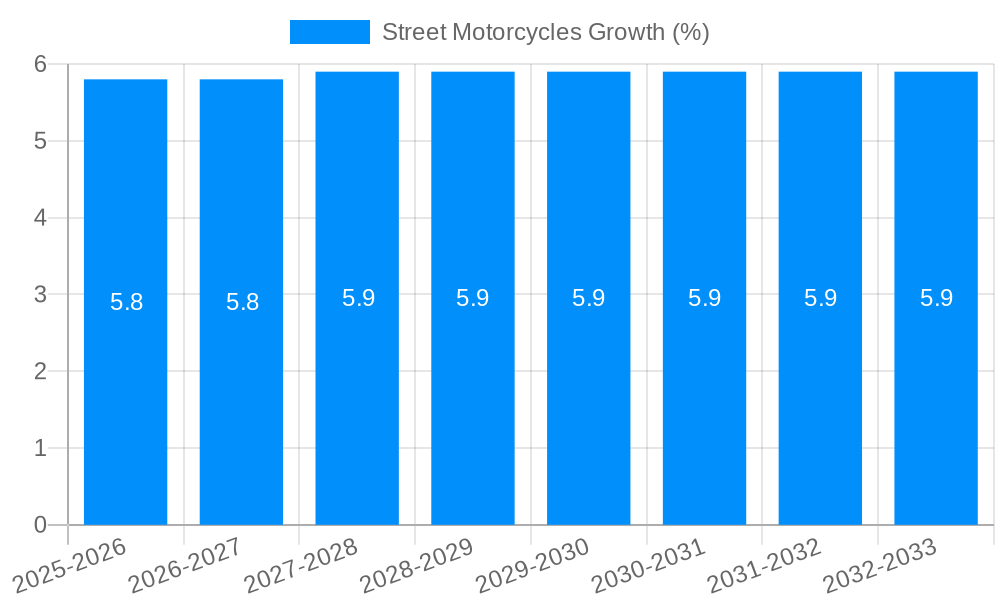

1. What is the projected Compound Annual Growth Rate (CAGR) of the Street Motorcycles?

The projected CAGR is approximately 5.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Street Motorcycles

Street MotorcyclesStreet Motorcycles by Type (Up to 150hp, 151-200hp, 201-250hp, 251hp and Above), by Application (Professional, Amateur), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global street motorcycle market is poised for robust growth, projected to reach approximately USD 564.9 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.9% from 2019 to 2033. This expansion is fueled by a confluence of factors, including increasing disposable incomes in emerging economies, a growing trend towards personal mobility solutions, and the enduring appeal of street motorcycles for both daily commuting and recreational riding. The market is experiencing a significant surge in demand for higher-horsepower models, particularly in the "251hp and Above" segment, reflecting a consumer preference for enhanced performance and sophisticated engineering. This trend is directly supported by advancements in engine technology and a burgeoning culture of motorcycle enthusiasts seeking premium riding experiences. The professional segment, encompassing riders who rely on motorcycles for work or sport, is a key driver, while the amateur segment continues to grow as more individuals embrace motorcycling as a hobby.

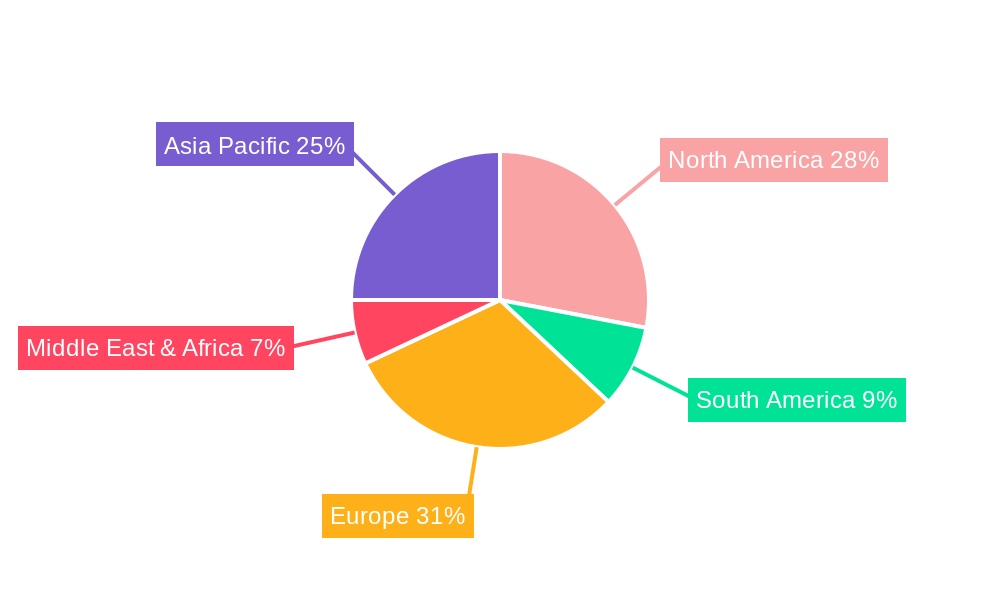

The competitive landscape is characterized by the presence of established global players such as BMW, Honda, Harley-Davidson, Yamaha, Suzuki, KTM, Ducati, and Kawasaki, alongside emerging electric motorcycle manufacturers like Zero. These companies are actively investing in research and development to introduce innovative models, with a particular focus on improving fuel efficiency, safety features, and the integration of advanced technologies. Europe and North America currently represent dominant markets, driven by a mature motorcycle culture and supportive regulatory frameworks. However, the Asia Pacific region, particularly China and India, is emerging as a significant growth engine, attributed to rapid urbanization, improving infrastructure, and a younger demographic embracing motorized two-wheelers. Restraints such as increasing fuel prices and stringent emission regulations are being addressed through technological innovation, particularly in the development of electric and more fuel-efficient internal combustion engine motorcycles, ensuring sustained market vitality.

This comprehensive report delves into the dynamic world of street motorcycles, analyzing market trends, identifying key growth drivers, and forecasting future developments. The study encompasses a broad spectrum of manufacturers, including industry giants like BMW, Honda, Harley-Davidson, Yamaha, Suzuki, Kawasaki, and KTM, alongside performance-oriented brands such as Ducati and Triumph, and emerging electric players like Zero. We will examine the market across various power segments, from "Up to 150hp" to the formidable "251hp and Above," and analyze their adoption within "Professional" and "Amateur" applications. The report's core focus will be on the period between 2019 and 2033, with a detailed base year analysis in 2025 and an extensive forecast period from 2025 to 2033, built upon historical data from 2019-2024.

XXX The street motorcycle market is poised for a significant evolutionary shift driven by a confluence of technological advancements, evolving consumer preferences, and a growing emphasis on sustainability. Over the historical period (2019-2024), we observed a steady increase in the adoption of more sophisticated technology, including advanced rider-aid systems and improved engine efficiency. Looking ahead, the base year of 2025 marks a critical juncture, with a projected global sales volume in the tens of millions of units, indicating robust demand. The forecast period (2025-2033) is expected to witness a substantial CAGR, further cementing the street motorcycle's position as a significant segment of the personal mobility and recreational vehicle market. A key trend emerging is the increasing demand for versatile motorcycles that cater to both commuting and leisure riding. This is fueling innovation in the "Up to 150hp" segment, offering accessible and economical options for a wider demographic. Simultaneously, the "151-200hp" and "201-250hp" segments are experiencing strong growth, driven by enthusiasts seeking a balance of performance and manageable power for spirited riding on both urban streets and open highways. The "251hp and Above" segment, though niche, continues to attract a dedicated following, with manufacturers pushing the boundaries of power and cutting-edge technology for ultimate performance. Electric motorcycles, spearheaded by brands like Zero, are rapidly gaining traction, not only in urban environments but also in performance-oriented applications, signaling a significant shift towards eco-friendly alternatives. This trend is amplified by government initiatives promoting electric vehicle adoption and increasing environmental consciousness among consumers. The integration of smart technologies, such as connected dashboards, GPS navigation, and smartphone integration, is becoming standard, enhancing the rider experience and safety. Furthermore, the rise of adventure touring and retro-styled models reflects a growing desire for escapism and a connection with the heritage of motorcycling. The market is also seeing a bifurcation in application, with a continued demand for professional-grade machines for police and emergency services, while the amateur segment diversifies with a wider range of styles and functionalities to suit varied riding styles and preferences. The impact of economic factors, such as disposable income and fuel prices, will continue to play a crucial role in shaping purchasing decisions, with a projected sustained upward trajectory in sales volumes, reaching well over 20 million units by the end of the forecast period in 2033.

The street motorcycle market's robust growth is primarily propelled by a dynamic interplay of factors that enhance both utility and desirability. A fundamental driver is the increasing global urbanization, which often leads to traffic congestion and parking challenges. In this context, nimble and efficient street motorcycles offer a compelling solution for urban commuting, enabling riders to navigate through traffic with ease and find parking more readily. This practicality, coupled with relatively lower fuel consumption compared to cars, makes them an attractive and economical choice for daily transportation. Furthermore, the enduring appeal of motorcycling as a recreational activity continues to fuel demand. The sense of freedom, adventure, and connection with the environment that riding a motorcycle provides is a powerful draw for a significant segment of the population. This psychological aspect, often associated with a lifestyle rather than just transportation, contributes significantly to sustained sales, especially in performance-oriented segments like 151-200hp and 201-250hp, where enthusiasts seek exhilarating riding experiences. Technological advancements also play a pivotal role. The continuous innovation in engine technology, leading to more powerful yet fuel-efficient engines, alongside the integration of advanced safety features such as Anti-lock Braking Systems (ABS), Traction Control Systems (TCS), and sophisticated rider-aid electronics, are making motorcycles safer and more approachable for a broader audience. The burgeoning electric motorcycle segment, driven by environmental concerns and government incentives, is also emerging as a significant growth propeller, offering a cleaner and quieter alternative for urban mobility and even performance riding. The rise of social media and online communities dedicated to motorcycling has also fostered a sense of community and shared passion, further encouraging new riders to enter the market and existing riders to upgrade their machines.

Despite the generally optimistic outlook, the street motorcycle market is not without its significant challenges and restraints that can temper growth. Foremost among these is the perception of safety and the inherent risks associated with motorcycling. Accidents involving motorcycles can often result in severe injuries or fatalities, leading to regulatory scrutiny and public apprehension, which can deter potential buyers, particularly in the amateur segment. Stricter regulations regarding licensing, helmet use, and noise pollution in many regions, while aimed at improving safety and reducing nuisance, can also add barriers to entry and increase operational costs for riders. Economic downturns and economic uncertainty can significantly impact discretionary spending, and the purchase of a motorcycle, especially higher-performance models, is often considered a luxury item. Fluctuations in fuel prices, while sometimes benefiting motorcycle sales, can also be a double-edged sword if they become excessively volatile, leading to unpredictable running costs. The rapidly evolving automotive landscape, with increasing competition from other personal mobility solutions like electric scooters, e-bikes, and compact cars, also presents a challenge. As these alternatives become more sophisticated and convenient, they can divert potential customers away from motorcycles. The cost of ownership, including insurance premiums which can be higher for motorcycles, maintenance, and the initial purchase price of premium models, can also be a significant deterrent for many consumers. Furthermore, the limited carrying capacity and lack of weather protection offered by motorcycles can make them impractical for certain use cases and commuting needs, especially in regions with extreme weather conditions. The ongoing development and adoption of autonomous driving technologies in cars might also, in the long term, shift consumer perception of personal transportation, potentially impacting the appeal of manually operated vehicles like motorcycles.

The street motorcycle market is characterized by regional variations in dominance, influenced by economic conditions, infrastructure, cultural preferences, and regulatory landscapes. Currently, and projected to maintain its lead through the forecast period up to 2033, Asia-Pacific stands out as the dominant region, driven by a confluence of factors that favor motorcycle adoption.

Beyond the dominant Asia-Pacific region and its focus on lower-displacement motorcycles, other regions and segments are also poised for significant growth and hold influence in specific niches.

North America: While not matching Asia-Pacific in sheer volume, North America is a key market for higher-performance and premium street motorcycles, with a strong emphasis on recreational riding and lifestyle.

Europe: Europe presents a more diversified market, with a significant presence of both commuting and performance-oriented motorcycles.

Emerging Markets (South America, Africa): These regions are expected to witness significant growth in the "Up to 150hp" segment as economic development leads to increased disposable income and a greater need for affordable personal transportation. The market is still in its nascent stages compared to Asia-Pacific but holds substantial future potential.

The Amateur application generally drives the majority of sales volumes across all segments and regions, reflecting the primary use of street motorcycles for personal mobility and recreation. However, the Professional application, particularly in law enforcement and emergency services, represents a stable and technologically advanced niche that requires specialized and high-durability motorcycles, contributing to the sales of specific models within various horsepower categories.

The street motorcycle industry is propelled by several key growth catalysts that are shaping its future trajectory. The continuous evolution of powertrain technology, including advancements in internal combustion engines for greater efficiency and the rapid development of electric vehicle technology, is making motorcycles more appealing across diverse applications. Increasing environmental consciousness among consumers and supportive government policies promoting greener transportation solutions are significantly boosting the adoption of electric motorcycles. Furthermore, the burgeoning trend of adventure touring and the desire for experiential travel are driving demand for versatile motorcycles capable of handling various terrains. The integration of smart technologies and connectivity features enhances rider experience, safety, and convenience, attracting a new generation of tech-savvy riders.

This report provides an in-depth analysis of the street motorcycles market, covering its historical performance from 2019-2024 and projecting its trajectory through 2033, with a crucial base year analysis in 2025. It meticulously examines market trends, including the growing preference for versatile motorcycles and the rising popularity of electric variants. The report identifies key drivers such as urbanization, the recreational appeal of motorcycling, and technological advancements, while also addressing challenges like safety perceptions and economic volatility. It offers a detailed regional analysis, highlighting Asia-Pacific's dominance, particularly in the "Up to 150hp" segment, and the significance of North America and Europe for higher-performance motorcycles and specific applications. Furthermore, the report profiles leading manufacturers, details significant industry developments, and provides a comprehensive understanding of the market's future outlook.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.9%.

Key companies in the market include BMW, Honda, Harley-Davidson, Yamaha, Suzuki, KTM, Ducati, Kawasaki, Triumph, Zero, .

The market segments include Type, Application.

The market size is estimated to be USD 564.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Street Motorcycles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Street Motorcycles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.