1. What is the projected Compound Annual Growth Rate (CAGR) of the Straight Feeder?

The projected CAGR is approximately 3.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Straight Feeder

Straight FeederStraight Feeder by Type (Fixed, Rubber-Footed, Plate-Spring, World Straight Feeder Production ), by Application (Industrial, Electronic, Medical, Others, World Straight Feeder Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

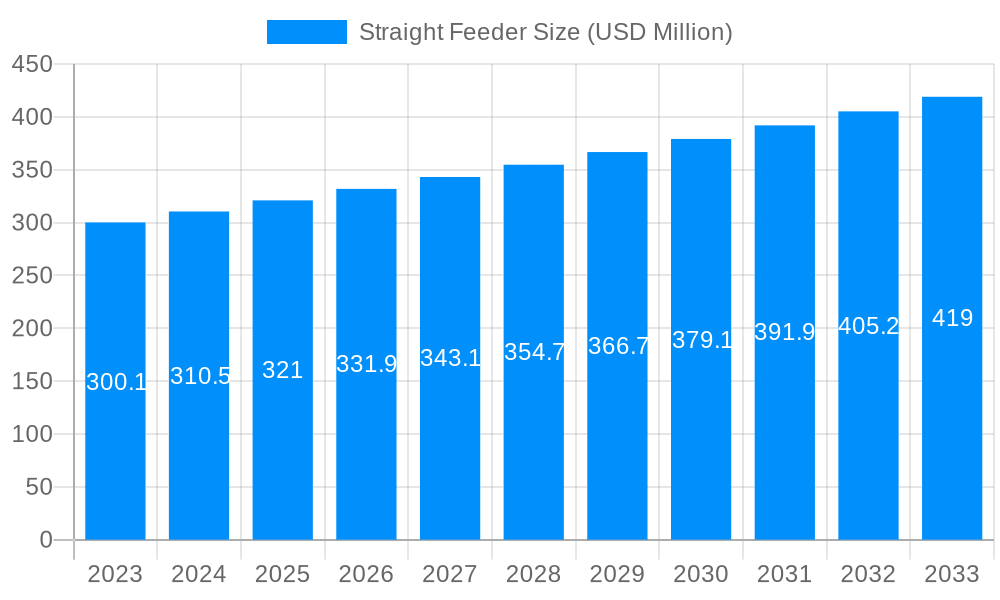

The global Straight Feeder market is poised for steady expansion, projected to reach approximately $370 million by the end of 2025, growing at a Compound Annual Growth Rate (CAGR) of 3.4% through 2033. This growth is underpinned by increasing automation across various industrial sectors, particularly in electronics manufacturing where precise component feeding is critical for high-volume production. The demand for efficient and reliable straight feeders is further amplified by their crucial role in industries like medical device manufacturing, where accuracy and speed are paramount. Advancements in feeder technology, including more sophisticated sorting and orientation capabilities, are also contributing to market dynamism, enabling higher throughput and reduced operational costs for businesses. The market is characterized by a diverse range of feeder types, including fixed, rubber-footed, and plate-spring variations, each catering to specific application needs and component complexities.

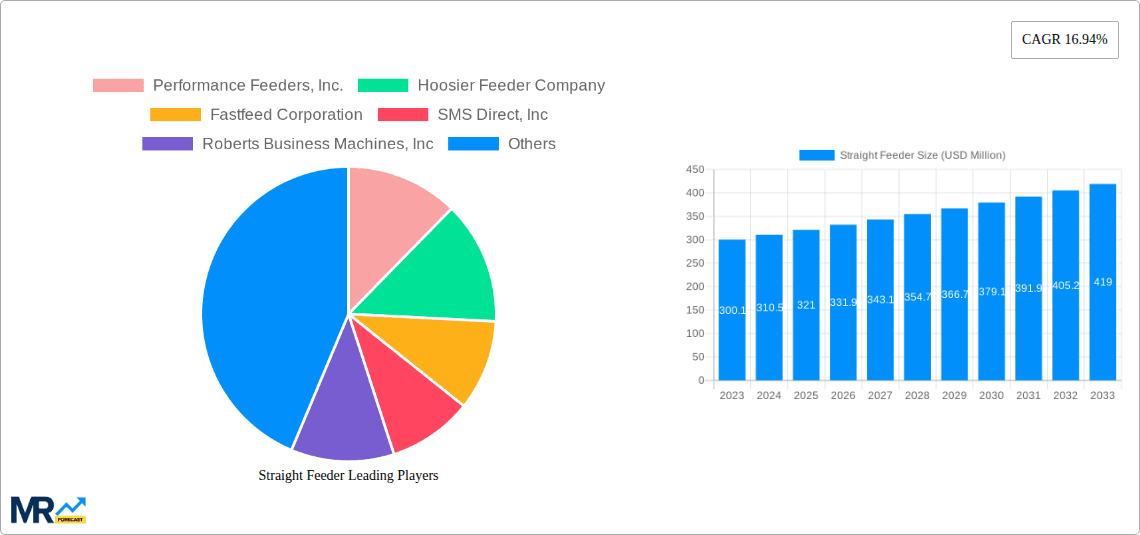

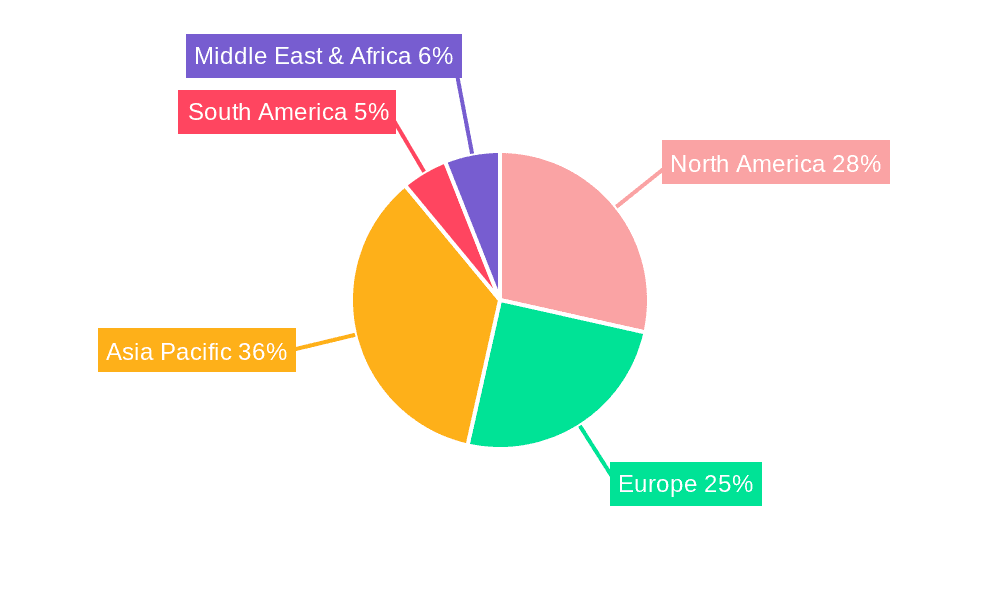

The competitive landscape features a blend of established global players and specialized regional manufacturers, all vying for market share by offering innovative solutions and robust customer support. Key market drivers include the ongoing trend of Industry 4.0 adoption, the need for enhanced manufacturing efficiency, and the increasing complexity of modern electronic components. However, the market also faces certain restraints, such as the initial high cost of advanced feeder systems and the need for specialized technical expertise for operation and maintenance. Despite these challenges, the trajectory for straight feeders remains positive, driven by the persistent global push towards greater automation and precision in manufacturing processes. The Asia Pacific region, with its robust manufacturing base, is expected to be a significant growth engine, followed by North America and Europe.

This in-depth report provides a comprehensive analysis of the global Straight Feeder market, offering critical insights and forecasting future trends for the period 2019-2033, with a base year of 2025 and an estimated year also of 2025. The study delves into the intricate details of market dynamics, including historical performance (2019-2024), current market positioning, and projected growth trajectories. We meticulously examine the various segments and applications of straight feeders, evaluating their impact on overall market evolution. The report aims to equip stakeholders with a thorough understanding of the competitive landscape, technological advancements, and the key factors influencing the market's trajectory, particularly focusing on the World Straight Feeder Production segment and its applications across Industrial, Electronic, and Medical sectors.

The global Straight Feeder market is poised for significant expansion, driven by the increasing demand for automated material handling solutions across diverse industrial sectors. The historical period from 2019 to 2024 witnessed a steady growth in adoption, spurred by advancements in automation and a growing emphasis on manufacturing efficiency. Looking ahead, the forecast period (2025-2033) is expected to see an accelerated pace of market evolution. A key trend is the increasing integration of smart technologies, such as IoT sensors and AI-powered control systems, into straight feeder units. This integration enhances their precision, reliability, and adaptability to various production lines. The World Straight Feeder Production is expected to see a surge in innovation, particularly in catering to highly specialized applications within the Electronic manufacturing domain, where the handling of minute and sensitive components is paramount. Furthermore, the Medical industry's growing reliance on automated processes for the assembly of intricate medical devices and diagnostic tools presents a substantial growth avenue. Fixed feeders, while foundational, are increasingly being complemented by more versatile and adaptable solutions like rubber-footed and plate-spring types, which offer greater flexibility in handling a wider range of materials and component sizes. The market is also observing a trend towards more compact and energy-efficient designs, aligning with broader sustainability initiatives within manufacturing. The sheer volume of World Straight Feeder Production is anticipated to reach a valuation in the millions of dollars, reflecting the indispensable role these components play in modern manufacturing. The continuous push for higher throughput and reduced downtime across all industries will ensure a consistent demand for advanced and reliable straight feeder solutions. Market participants are investing heavily in research and development to create feeders that can handle increasingly complex geometries and materials, further solidifying the market's upward trajectory. The estimated market value for the World Straight Feeder Production is projected to be in the hundreds of millions, highlighting its critical contribution to global manufacturing output. The shift towards Industry 4.0 principles is fundamentally reshaping the straight feeder landscape, emphasizing connectivity, data analytics, and intelligent automation to optimize production processes.

The global Straight Feeder market is experiencing robust growth propelled by several interconnected driving forces. Foremost among these is the escalating global demand for enhanced manufacturing efficiency and productivity. Businesses across industries are increasingly recognizing the critical role of automation in optimizing their production lines, reducing manual labor costs, and minimizing errors. Straight feeders, by providing a consistent and controlled supply of components, are instrumental in achieving these objectives, particularly in high-volume manufacturing environments. The burgeoning Electronic manufacturing sector, with its intricate assembly processes and the need for precise component placement, is a significant driver. As the complexity and miniaturization of electronic devices continue to advance, the requirement for highly accurate and reliable feeding mechanisms becomes paramount. Similarly, the Medical industry's growing adoption of automation for the production of sophisticated medical devices, implants, and diagnostic equipment necessitates specialized and efficient feeding solutions. The continuous innovation in straight feeder technology, leading to more advanced features like intelligent sensing, self-calibration, and enhanced adaptability to different component types, further fuels market growth. Companies are investing in R&D to develop feeders that can handle a wider array of materials, sizes, and shapes, thereby expanding their applicability across a broader spectrum of industries and World Straight Feeder Production initiatives. The increasing emphasis on lean manufacturing principles and the desire to minimize waste and downtime are also contributing factors, as efficient feeding systems play a crucial role in maintaining a smooth and uninterrupted production flow.

Despite the promising growth trajectory, the Straight Feeder market encounters several challenges and restraints that can temper its expansion. One significant hurdle is the high initial investment cost associated with advanced straight feeder systems. For small and medium-sized enterprises (SMEs), the capital expenditure required for sophisticated automated feeders can be a deterrent, particularly in regions with less developed economic landscapes. The complexity of integration with existing manufacturing infrastructure can also pose a challenge. Ensuring seamless compatibility between new straight feeder units and legacy machinery often requires significant engineering effort and time, leading to project delays and increased costs. Furthermore, the need for skilled labor to operate, maintain, and troubleshoot these advanced systems presents a constraint. A shortage of trained technicians and engineers capable of handling the intricacies of modern automation can limit the widespread adoption of straight feeders, especially in developing economies. The variability in component design and material properties across different industries can also necessitate custom-built or highly adaptable feeder solutions, which can be expensive and time-consuming to develop. While the World Straight Feeder Production is growing, the ability to cater to niche and highly specialized requirements without significant R&D investment can be a bottleneck. Finally, concerns regarding the reliability and maintenance requirements of complex automated systems, particularly in harsh industrial environments, can lead to hesitancy among some manufacturers, impacting the overall market penetration.

The global Straight Feeder market is characterized by the dominance of specific regions and segments driven by industrial specialization, technological adoption rates, and manufacturing output. In terms of World Straight Feeder Production, Asia Pacific is emerging as the dominant region. This dominance is largely attributed to the concentration of major manufacturing hubs for electronics, automotive, and general industrial goods within countries like China, South Korea, Japan, and Taiwan. These nations have a strong emphasis on automation and advanced manufacturing technologies to maintain their competitive edge in global markets. The sheer volume of World Straight Feeder Production originating from this region underscores its critical role. Within the Asia Pacific, the Electronic segment is a significant contributor to the demand for straight feeders. The region's prowess in consumer electronics, semiconductors, and telecommunications equipment manufacturing necessitates highly precise and efficient feeding systems for assembling minuscule and sensitive components. The need for high throughput and minimal defect rates in these sectors directly translates to a substantial demand for advanced straight feeder technologies.

In addition to the Electronic segment, the Industrial application segment also plays a pivotal role, encompassing automotive component manufacturing, packaging, and general assembly lines. Countries in the Asia Pacific are leaders in mass production for these sectors, requiring robust and reliable feeding solutions to sustain their output. The World Straight Feeder Production in this context is geared towards high-volume, cost-effective solutions.

Another key region exhibiting strong growth and influence is North America, particularly the United States. Here, the Medical sector is a substantial driver for straight feeder adoption. The region’s advanced healthcare system and leading medical device manufacturers require highly specialized and sterile feeding solutions for the assembly of intricate surgical instruments, diagnostic equipment, and pharmaceutical packaging. The emphasis on precision, traceability, and regulatory compliance in the medical field drives the demand for sophisticated Plate-Spring and Fixed type feeders that can handle delicate and high-value components with utmost care. Furthermore, the reshoring initiatives and the focus on advanced manufacturing within the US are also boosting the demand for automation, including straight feeders, across various industrial applications.

In Europe, countries like Germany, France, and the United Kingdom are significant players, driven by their strong automotive and industrial machinery manufacturing sectors. The demand here often leans towards highly engineered and customized solutions, reflecting a mature industrial base with a focus on quality and precision. The World Straight Feeder Production in Europe often caters to specialized, high-value applications where performance and longevity are prioritized.

Across all these dominant regions, the Type segments also showcase distinct preferences. While Fixed feeders remain foundational for many high-volume, consistent applications, there is a growing adoption of Rubber-Footed feeders for their vibration-dampening capabilities and enhanced stability, and Plate-Spring feeders for their versatility in handling a wide range of component sizes and shapes, especially in dynamic production environments. The World Straight Feeder Production is thus evolving to meet these diverse application-specific needs.

Several growth catalysts are significantly propelling the Straight Feeder industry forward. The relentless pursuit of operational efficiency and cost reduction across global manufacturing sectors is a primary driver, as straight feeders automate a critical, labor-intensive process. The rapid advancements in automation and robotics technology, leading to smarter, more precise, and adaptable feeder designs, are creating new market opportunities. Furthermore, the increasing demand for miniaturized and complex components in industries like electronics and medical devices necessitates specialized feeding solutions, directly fueling innovation and market growth. The global trend towards Industry 4.0 and smart manufacturing is also a substantial catalyst, encouraging the integration of feeders with other automated systems for enhanced data flow and process optimization.

This comprehensive report on the Straight Feeder market provides an exhaustive analysis covering the period from 2019 to 2033, with a base year of 2025. It delves into the intricate market dynamics, exploring growth drivers, challenges, and future projections. The report offers a detailed segmentation of the market, examining the impact of various feeder types like Fixed, Rubber-Footed, and Plate-Spring, alongside an in-depth analysis of applications across Industrial, Electronic, and Medical sectors. A significant focus is placed on the World Straight Feeder Production, evaluating its global output and market share. Stakeholders will gain critical insights into regional market dominance, technological advancements, and the competitive landscape featuring leading industry players. This report serves as an invaluable resource for strategic decision-making and understanding the evolving trajectory of the global straight feeder market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.4%.

Key companies in the market include Performance Feeders, Inc., Hoosier Feeder Company, Fastfeed Corporation, SMS Direct, Inc, Roberts Business Machines, Inc, Straight Shooter Equipment Company, Daishin, Nittoseiko, SINFONIA TECHNOLOGY, Kanto Denshi, AgBrand Products, United Global Packaging LLP, Trimatt Systems Pty Ltd.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Straight Feeder," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Straight Feeder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.