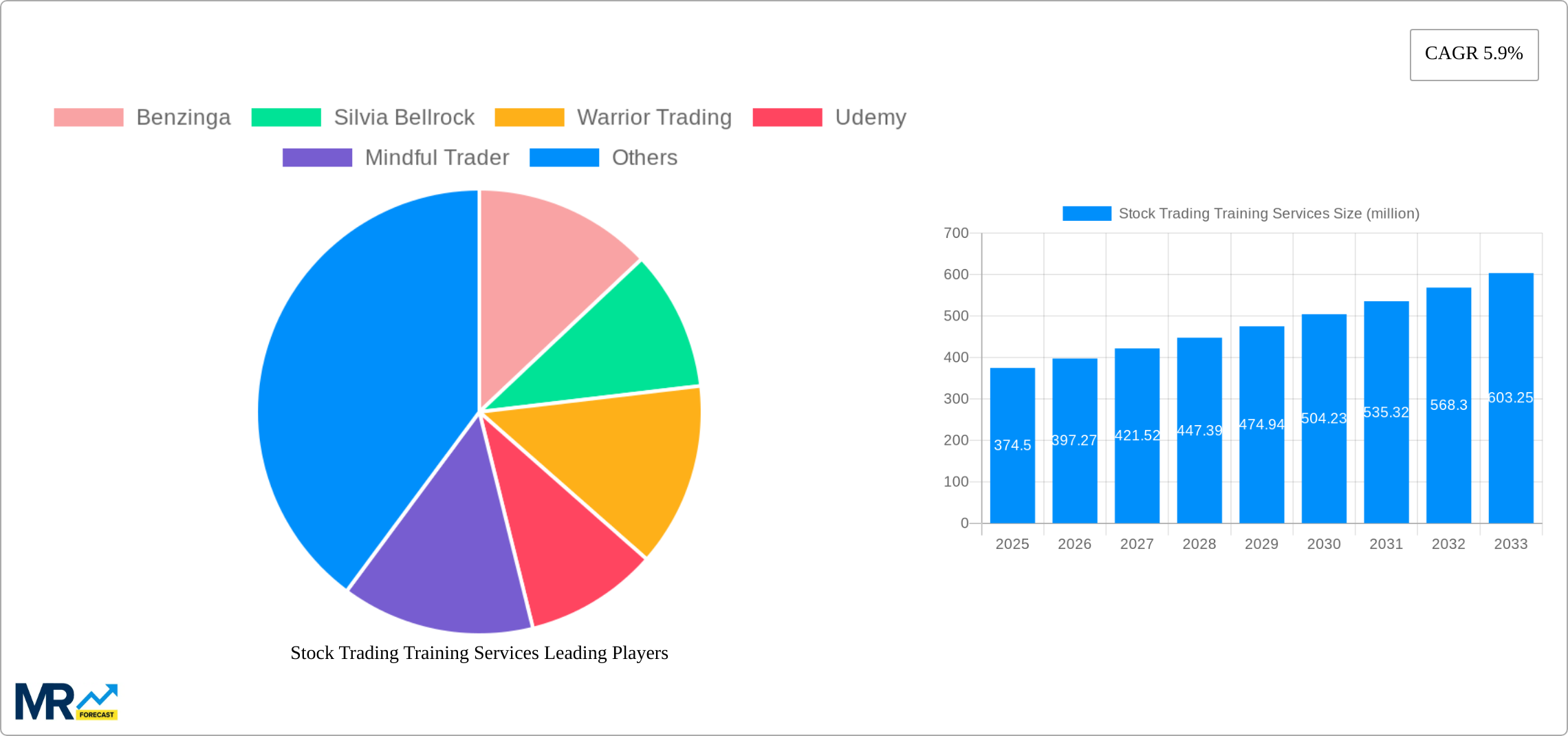

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stock Trading Training Services?

The projected CAGR is approximately 5.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Stock Trading Training Services

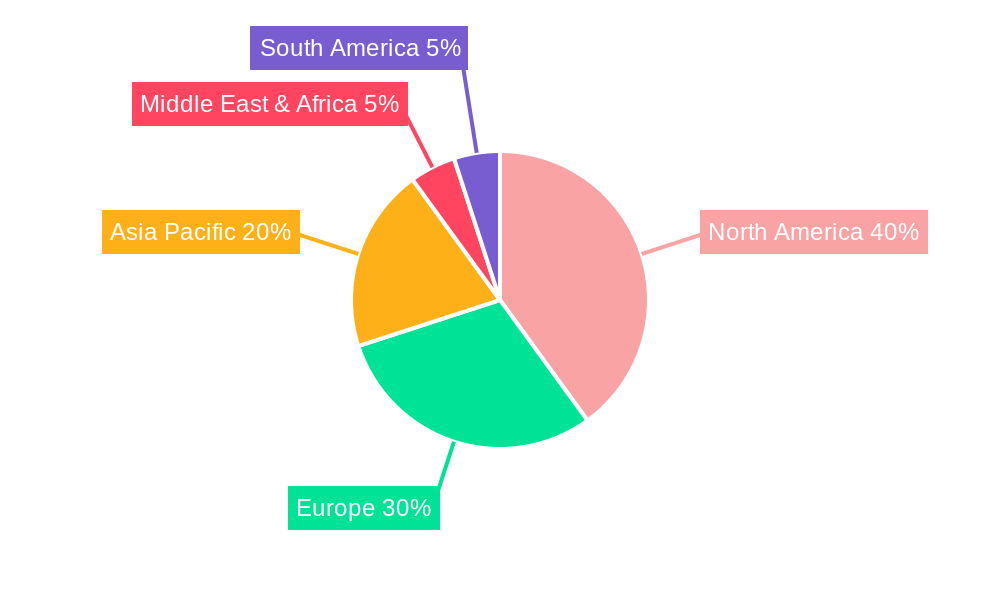

Stock Trading Training ServicesStock Trading Training Services by Type (Beginner Training, Intermediate Training, Advanced Training), by Application (Self-directed Investors, Merchant, Traders, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

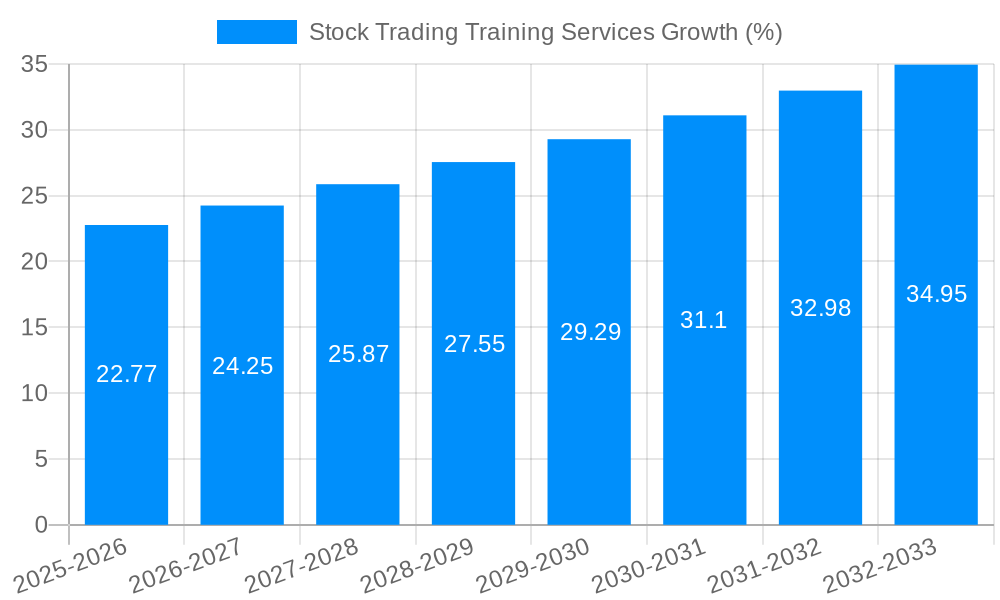

The global stock trading training services market, currently valued at $374.5 million (2025), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.9% from 2025 to 2033. This growth is fueled by several key factors. The increasing popularity of online trading, driven by accessibility and technological advancements, is a major driver. More individuals, particularly self-directed investors and beginner traders, are seeking educational resources to navigate the complexities of the market and improve their trading strategies. The rise of fintech and the availability of sophisticated trading platforms further contribute to this demand. Furthermore, the market is segmented by training level (beginner, intermediate, advanced) and target audience (self-directed investors, merchants, traders, others), catering to diverse learning needs and experience levels. The competitive landscape includes established players like Benzinga, Udemy, and TD Ameritrade, alongside specialized providers focusing on niche segments. Geographic expansion, particularly in rapidly developing economies in Asia-Pacific, represents a significant opportunity for growth in the coming years.

The market's growth trajectory, however, is not without its challenges. Regulatory changes and increased scrutiny of online trading platforms could impact market growth. The inherent risks associated with stock trading, and the potential for financial loss, can act as a restraint. Furthermore, the proliferation of free and low-cost educational resources available online may create pressure on premium training service providers. To maintain a competitive edge, providers need to continuously innovate their offerings, incorporating cutting-edge technologies and adapting to the evolving needs of traders. The focus should be on delivering high-quality, personalized learning experiences that demonstrably improve trading outcomes. This could include incorporating AI-powered learning tools, personalized feedback mechanisms, and simulated trading environments.

The global stock trading training services market experienced substantial growth during the historical period (2019-2024), exceeding $XXX million in 2024. This surge is primarily attributed to the increasing accessibility of online trading platforms and a growing interest in financial markets among millennials and Gen Z. The democratization of finance, fueled by readily available information and lower barriers to entry, has created a massive demand for educational resources to navigate the complexities of stock trading. The market witnessed a shift towards online and blended learning models, offering flexibility and convenience to a broader audience. Furthermore, the rise of social media trading influencers and communities significantly impacted market growth, creating a ripple effect of increased participation and, consequently, a need for structured training. However, the market also grappled with challenges such as the prevalence of misleading information, scams targeting novice traders, and the inherent risks associated with trading itself. The forecast period (2025-2033) projects continued growth, potentially reaching $XXX million by 2033, driven by ongoing technological advancements, evolving regulatory landscapes, and a continuously expanding investor base. This expansion will likely be characterized by a greater emphasis on personalized learning experiences, sophisticated trading strategies, and risk management education. The estimated market value for 2025 is projected to be $XXX million, reflecting a steady upward trajectory. The market is expected to witness dynamic shifts based on technological innovations, evolving investor demographics and the fluctuating global economic climate.

Several factors are driving the expansion of the stock trading training services market. The increasing accessibility of online brokerage accounts and the proliferation of mobile trading apps have significantly lowered the barrier to entry for individual investors. This accessibility, combined with the growing popularity of self-directed investing, fuels demand for educational resources that can equip beginners with the necessary knowledge and skills. The financialization of everyday life, characterized by greater awareness and participation in financial markets, also contributes to the growth. Furthermore, the increasing volatility of traditional investment options, such as bonds and real estate, has led many individuals to explore stock trading as a means of potentially higher returns, even though it involves a higher level of risk. This has spurred a significant demand for training programs that can equip traders with effective risk management strategies. Lastly, the continuous evolution of trading technologies and strategies, including algorithmic trading and high-frequency trading, requires ongoing education and professional development for traders at all levels.

Despite its growth, the stock trading training services market faces significant challenges. The influx of unregulated providers and the proliferation of misleading or fraudulent courses pose a substantial risk to novice investors. Many individuals fall prey to scams promising unrealistic returns, leading to financial losses and a negative perception of the industry as a whole. Another challenge is the inherent complexity of the financial markets and the constantly evolving regulatory landscape, requiring training providers to consistently update their curricula and materials. Ensuring the quality and relevance of training programs, while maintaining accessibility and affordability, is an ongoing struggle. Furthermore, the high level of risk involved in stock trading itself means that even with training, losses are possible. This inherent risk can create barriers to participation for some individuals, and requires providers to emphasize risk management education as a crucial component of their offerings. Lastly, the saturation of the market with providers can lead to price competition and make it difficult for smaller providers to compete effectively.

The United States is projected to hold a significant share of the global stock trading training services market throughout the forecast period (2025-2033), driven by the high level of financial literacy and a culture of self-directed investing. Other developed markets in Europe (particularly the UK and Germany) and Asia-Pacific (particularly Japan, Australia and Singapore) are also expected to demonstrate strong growth. However, emerging markets in Asia, South America and Africa are expected to exhibit substantial expansion potential in the long term, as greater financial inclusion and access to technology drives increased participation in trading markets.

Within market segments, the Beginner Training segment is expected to dominate the market due to the large number of new entrants into stock trading. The ease of access to online platforms and the desire for financial independence drive demand. This segment will likely remain a major growth driver throughout the forecast period. Within applications, Self-directed Investors represent the largest segment, a trend expected to continue, due to the aforementioned increasing democratization of financial markets and decreasing barriers to entry. Although the Traders segment might have a slightly smaller volume in terms of raw numbers, the value of training for professional traders, particularly those engaging in advanced strategies, is significantly higher, leading to this segment having a substantial contribution to the market's overall value.

The growth in the beginner segment is partly fueled by the increasing accessibility of online resources and educational platforms. While seasoned traders benefit from advanced courses focused on niche strategies, the sheer volume of new entrants to the market ensures consistent demand for beginner-level training. The self-directed investor segment will also continue to dominate due to the ongoing trend of individuals managing their own portfolios and the relative ease of opening online trading accounts.

Several factors will significantly contribute to the growth of the stock trading training services industry. Technological advancements in online learning platforms, offering interactive simulations, personalized learning paths, and advanced analytics, will make learning more effective and engaging. Increased regulatory scrutiny and educational initiatives to combat fraudulent practices will enhance consumer trust and support market growth. Furthermore, the increasing integration of artificial intelligence (AI) and machine learning (ML) in trading strategies will create demand for training courses focusing on these advanced techniques.

This report offers a comprehensive overview of the stock trading training services market, encompassing market size estimations, segment analysis, key players, and growth catalysts. It provides insights into market trends, driving forces, and challenges, offering a valuable resource for industry stakeholders, investors, and aspiring traders seeking a deeper understanding of this dynamic market segment. The report’s forecasts, based on robust methodology and extensive data analysis, enable informed decision-making and strategic planning within the stock trading training services sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.9%.

Key companies in the market include Benzinga, Silvia Bellrock, Warrior Trading, Udemy, Mindful Trader, Eagle Investors, LinkedIn Learning, TD Ameritrade, NSE India, Bear Bull Traders, Bulls On Wall Street, Online Trading Academy, Trading for Beginners, London Academy of Trading, Shaw Academy, NIFM, .

The market segments include Type, Application.

The market size is estimated to be USD 374.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Stock Trading Training Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Stock Trading Training Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.