1. What is the projected Compound Annual Growth Rate (CAGR) of the Stock Trading Training Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Stock Trading Training Services

Stock Trading Training ServicesStock Trading Training Services by Application (Self-directed Investors, Merchant, Traders, Others), by Type (Beginner Training, Intermediate Training, Advanced Training), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

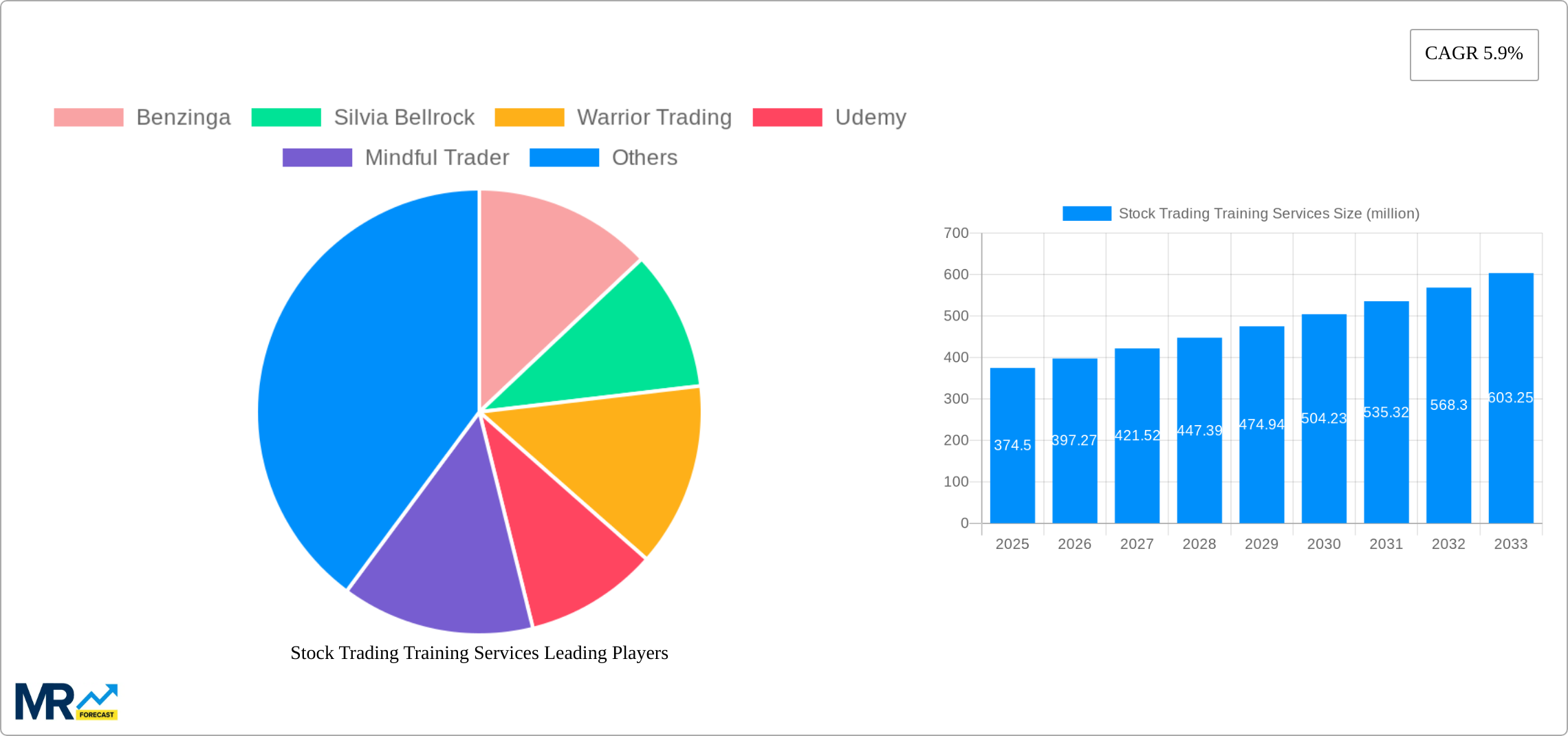

The global stock trading training services market, valued at $560.7 million in 2025, is poised for significant growth. Driven by the increasing popularity of online trading, particularly among self-directed investors and the rise of retail trading platforms, the market exhibits strong potential. The segment encompassing beginner and intermediate training programs constitutes a substantial portion of the market, reflecting a large pool of individuals seeking to acquire basic and intermediate trading skills. Technological advancements facilitating online learning and the proliferation of accessible educational resources further contribute to market expansion. While regulatory scrutiny and the inherent risks associated with stock trading could act as restraints, the continuous influx of new retail investors and the evolving sophistication of trading strategies are expected to counterbalance these factors. Geographic expansion, particularly in regions with emerging markets and growing internet penetration, presents significant opportunities for growth. Key players like Benzinga, Warrior Trading, and Udemy leverage diverse educational formats, including online courses, webinars, and mentorship programs, to cater to diverse learning styles and experience levels. The market is characterized by intense competition, with established players and emerging providers vying for market share through innovative offerings and strategic partnerships. The projected Compound Annual Growth Rate (CAGR) and future market size are influenced by factors such as economic conditions, technological innovation, and regulatory changes.

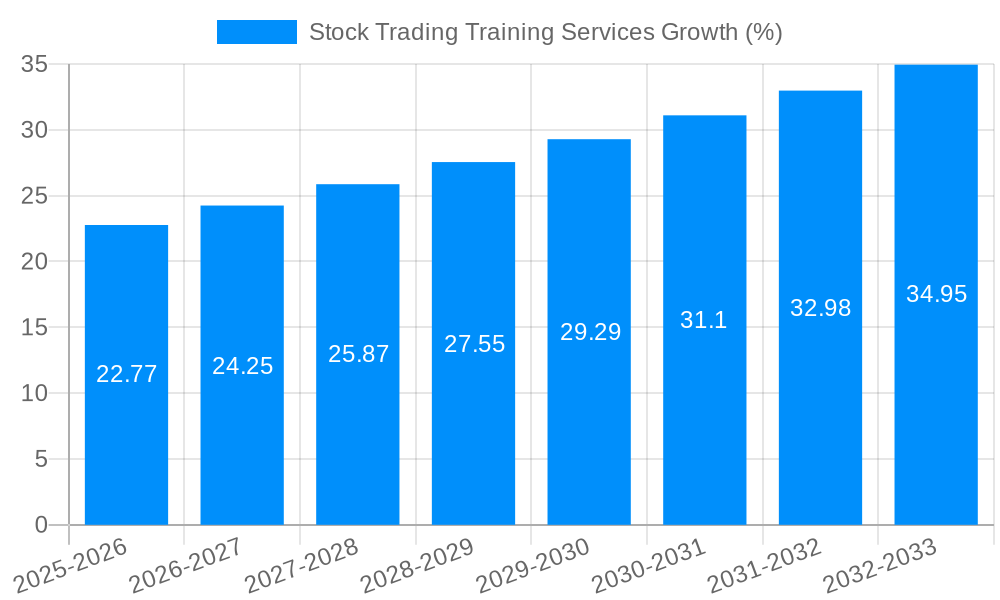

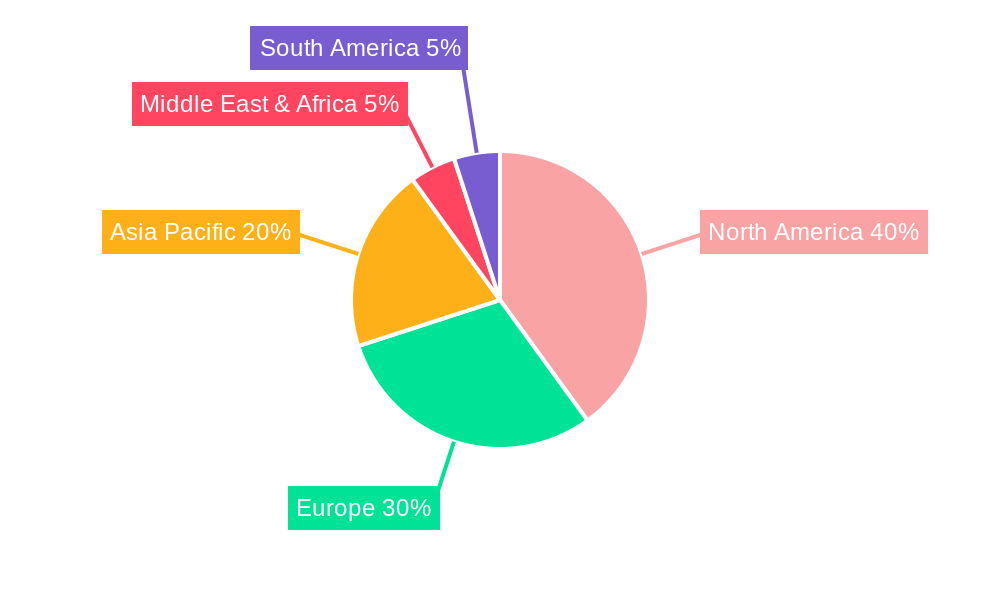

The forecast period (2025-2033) anticipates continued market expansion, driven by an expanding base of retail investors seeking professional development and the ongoing evolution of trading strategies and technologies. The advanced training segment is projected to witness accelerated growth fueled by the increasing complexity of financial markets and the demand for specialized trading expertise. Growth will vary across geographical regions, with North America and Europe maintaining dominant positions, while Asia Pacific is anticipated to demonstrate robust growth driven by rising digital adoption and a burgeoning middle class. The success of individual companies will hinge on their ability to adapt to changing market dynamics, develop high-quality content, and effectively market their services to targeted audiences. Continuous innovation in educational delivery methods, integration of advanced technologies, and focusing on personalized learning experiences are critical success factors for players in this competitive market.

The global stock trading training services market exhibited robust growth throughout the historical period (2019-2024), exceeding $XXX million in 2024. This expansion is primarily fueled by the increasing accessibility of online trading platforms and a growing interest in self-directed investing, particularly among millennials and Gen Z. The market's growth trajectory is expected to continue, with a projected value surpassing $XXX million by the estimated year 2025 and reaching $XXX million by 2033. This signifies a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). The rising popularity of online courses, webinars, and mentorship programs has broadened the reach of training services, making them accessible to a wider audience irrespective of geographical location. Furthermore, the increasing complexity of financial markets and the desire for higher returns are driving individuals to seek professional training to enhance their trading skills and knowledge. The market is witnessing a shift towards specialized training programs catering to specific trading styles, such as day trading, swing trading, and algorithmic trading. The integration of technology, including AI-powered trading tools and simulated trading environments, is further enhancing the effectiveness and appeal of these training programs. Competition among providers is intense, leading to continuous innovation in course content, delivery methods, and pricing strategies to attract and retain customers. This dynamic environment is expected to continue shaping the market's future growth.

Several factors contribute to the remarkable growth of the stock trading training services market. The democratization of finance, with increased access to online brokerage accounts and trading platforms, has lowered the barriers to entry for aspiring traders. This increased accessibility has fueled demand for training to navigate the complexities of the market effectively. Simultaneously, a growing awareness of financial literacy and the potential for wealth creation through investing is driving individuals to seek professional guidance and training. The proliferation of online learning platforms and educational resources, offering flexible and convenient learning options, has further boosted market growth. These platforms cater to diverse learning styles and preferences, making stock trading education more accessible than ever before. Furthermore, the economic uncertainty in recent years has prompted many individuals to explore alternative investment options, increasing the demand for skill enhancement through specialized training. Finally, the continuous evolution of trading strategies and technologies necessitate ongoing professional development for traders to remain competitive. This requirement drives a consistent stream of new learners to training providers.

Despite the positive growth outlook, the stock trading training services market faces several challenges. The market is highly competitive, with numerous providers vying for market share, leading to price wars and the need for continuous innovation to maintain a competitive edge. Maintaining the quality and relevance of training materials in a rapidly evolving market presents a significant hurdle. The industry relies heavily on the credibility and reputation of instructors and training providers, and negative experiences can deter potential learners. The lack of standardized qualifications and certifications within the industry can create uncertainty for consumers regarding the quality and efficacy of training programs. Furthermore, the inherently risky nature of stock trading can lead to negative outcomes for learners, even with training, potentially damaging the reputation of the industry. Effective regulation and oversight are crucial to mitigate these risks and enhance consumer trust. Finally, attracting and retaining experienced instructors who can provide valuable insights and practical knowledge is an ongoing challenge for training providers.

The North American and European regions are currently dominating the stock trading training services market, driven by high levels of financial literacy, robust online infrastructure, and a large population of self-directed investors. However, the Asia-Pacific region is experiencing significant growth, fueled by increasing internet penetration and a rising middle class with a growing interest in investment opportunities. Within the market segments, the Self-directed Investors application segment holds the largest market share, representing a significant portion of the overall demand. This is further categorized by a substantial preference for Beginner Training, reflecting the influx of new entrants into the stock market.

The considerable market share held by beginner training within the self-directed investor segment underscores the significant opportunity for expansion in educating new participants and fostering financial literacy. The market's focus on providing accessible and effective beginner training materials contributes substantially to its growth trajectory.

The stock trading training services market is driven by the increasing accessibility of online trading, the rise in self-directed investing, and the growing demand for financial literacy. Technological advancements are continuously enhancing the effectiveness and reach of training programs, while economic uncertainty encourages individuals to seek higher returns through skilled investing. The market's continuous innovation in content, delivery methods, and pricing strategies further fuels its growth.

This report provides a detailed analysis of the stock trading training services market, covering market size, growth drivers, challenges, key players, and future trends. It offers valuable insights for investors, businesses, and individuals seeking to understand and participate in this dynamic industry. The comprehensive nature of the report, including historical data, current estimates, and future forecasts, provides a solid foundation for informed decision-making. The report also offers segment-specific analysis, enabling a targeted understanding of specific market niches and their growth potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Benzinga, Silvia Bellrock, Warrior Trading, Udemy, Mindful Trader, Eagle Investors, LinkedIn Learning, TD Ameritrade, NSE India, Bear Bull Traders, Bulls On Wall Street, Online Trading Academy, Trading for Beginners, London Academy of Trading, Shaw Academy, NIFM, .

The market segments include Application, Type.

The market size is estimated to be USD 560.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Stock Trading Training Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Stock Trading Training Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.