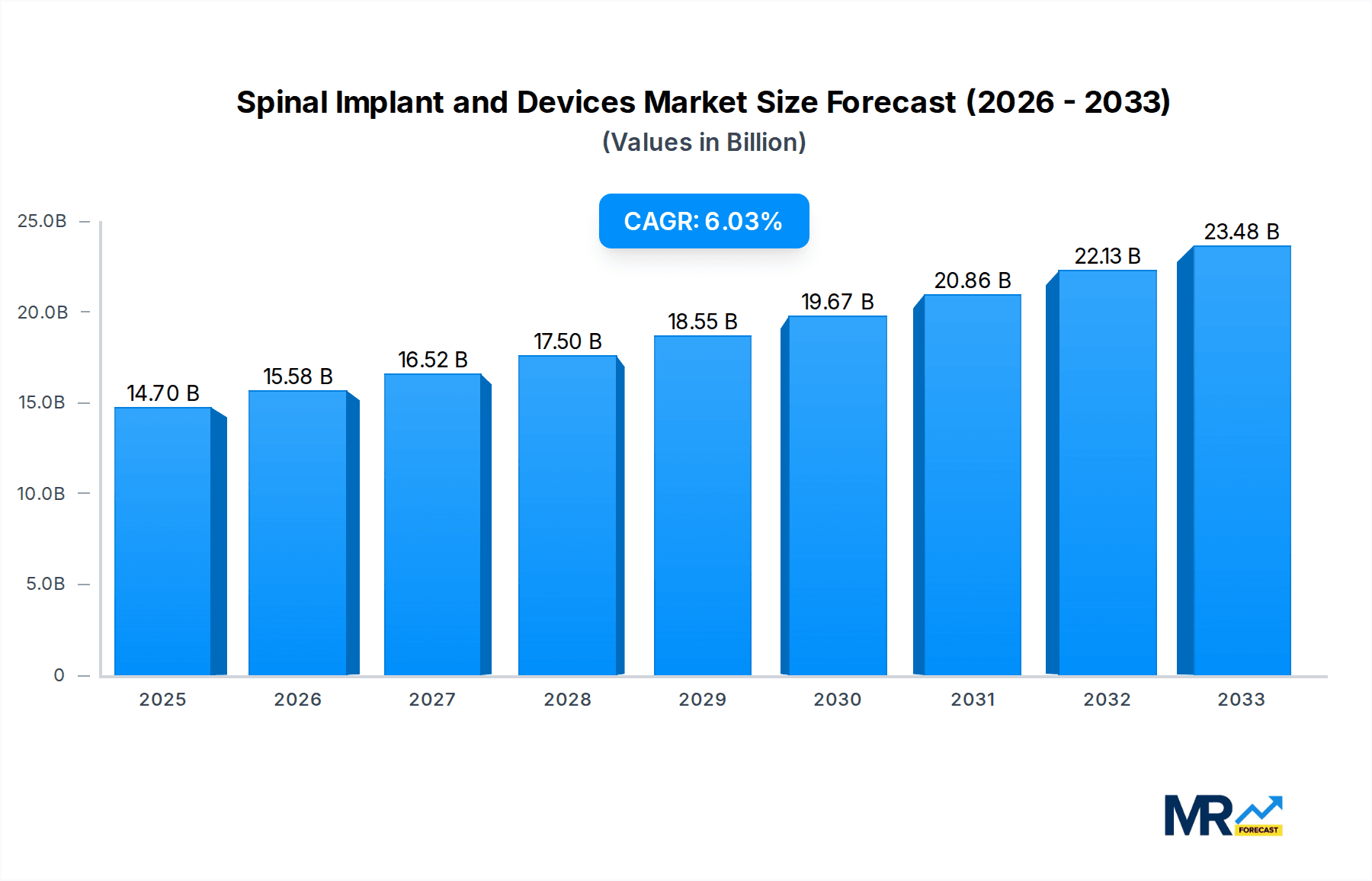

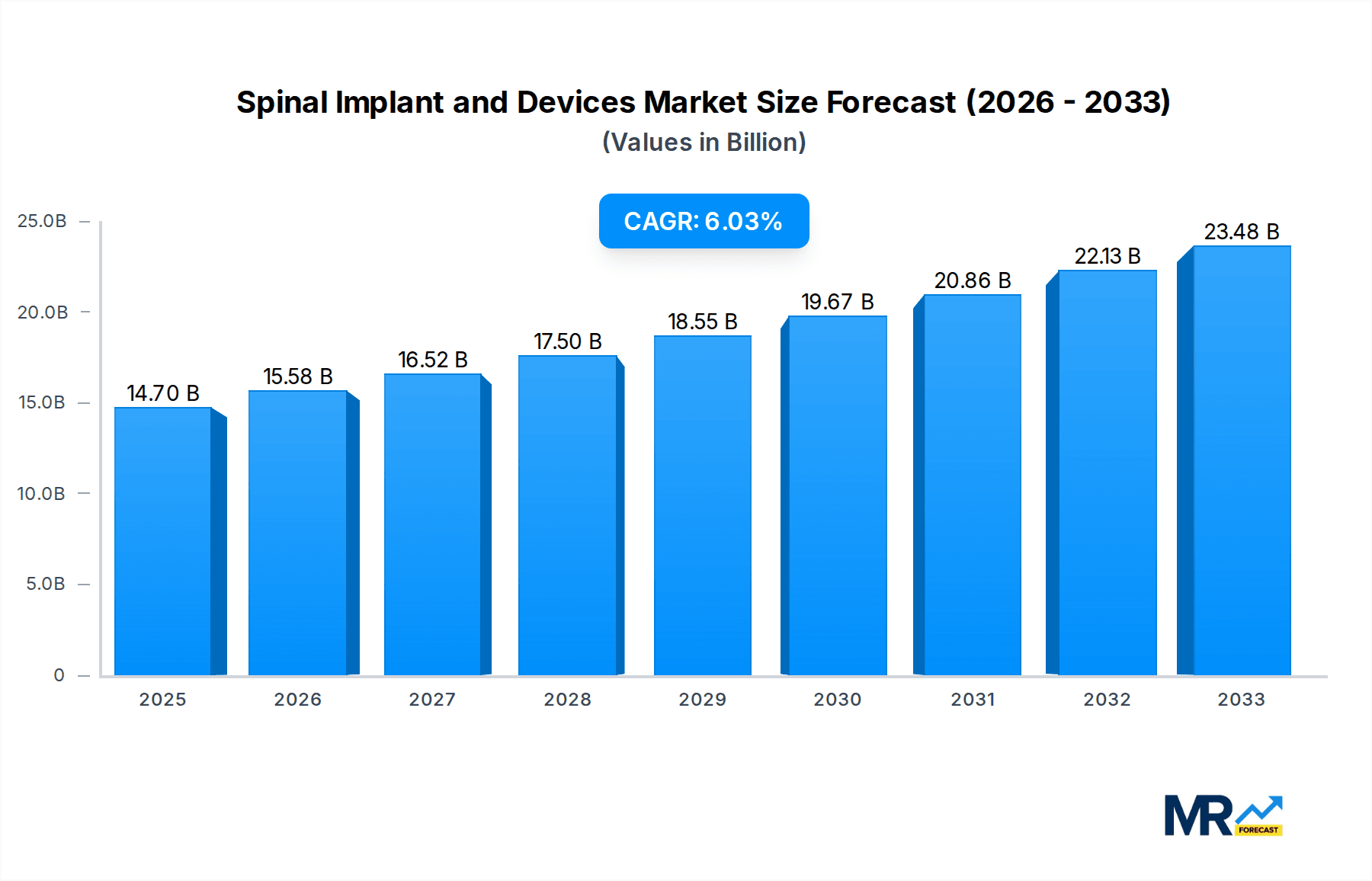

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spinal lmplant and Devices?

The projected CAGR is approximately 6%.

Spinal lmplant and Devices

Spinal lmplant and DevicesSpinal lmplant and Devices by Type (Spinal Fusion Implants, Sports Protection Device, Spine Bone Stimulator, Others, World Spinal lmplant and Devices Production ), by Application (Hospital, Ambulatory Surgery Center, Others, World Spinal lmplant and Devices Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global Spinal Implant and Devices market is poised for significant expansion, projected to reach an estimated $14.7 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6% through 2033. This growth trajectory is fueled by an increasing prevalence of spinal disorders, driven by an aging global population and the rising incidence of degenerative conditions like herniated discs, spinal stenosis, and scoliosis. Advancements in surgical techniques, including minimally invasive procedures, are also contributing to market expansion by improving patient outcomes and reducing recovery times. Furthermore, the growing adoption of innovative spinal technologies, such as biologics and advanced fusion devices, is enhancing treatment efficacy and broadening the scope of surgical interventions, thereby stimulating demand. The market's expansion is further supported by a growing awareness and access to advanced healthcare infrastructure, particularly in emerging economies.

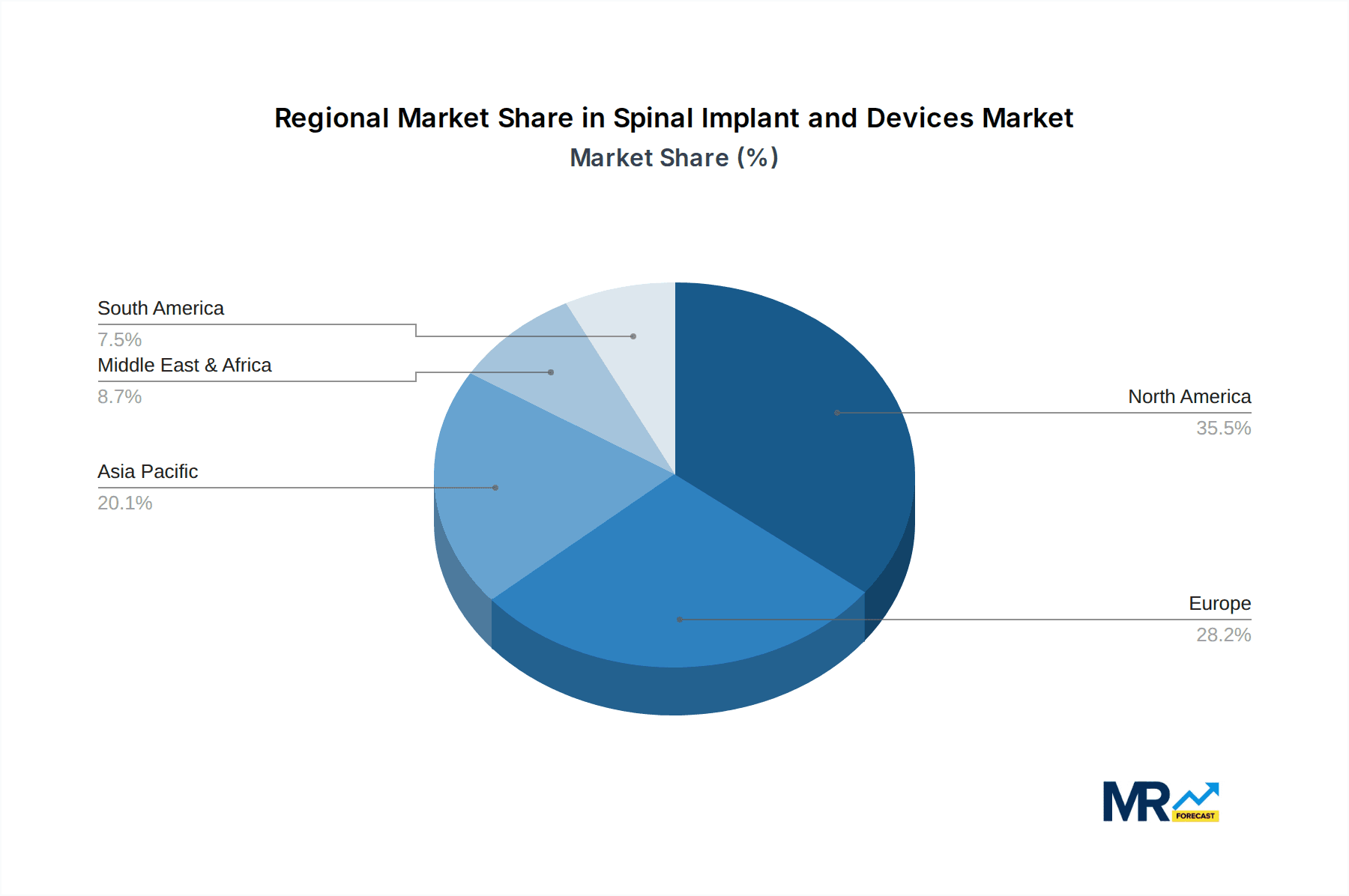

The Spinal Implant and Devices market is segmented into Spinal Fusion Implants, Sports Protection Devices, Spine Bone Stimulators, and Others, with Spinal Fusion Implants holding a substantial market share due to the high demand for surgical correction of spinal deformities and degenerative conditions. Applications are primarily concentrated in hospitals and ambulatory surgery centers, reflecting the specialized nature of spinal surgeries. Geographically, North America leads the market due to its advanced healthcare systems, high patient expenditure, and early adoption of new technologies. However, the Asia Pacific region is expected to witness the fastest growth, driven by a burgeoning patient pool, increasing healthcare investments, and improving accessibility to advanced medical treatments. Key market players like Medtronic, Johnson & Johnson, and Stryker are actively investing in research and development to introduce next-generation spinal solutions, further shaping the competitive landscape and driving innovation within the industry.

Here's a unique report description for Spinal Implants and Devices, incorporating your provided data and structure:

The global Spinal Implants and Devices market, valued at an impressive XXX billion dollars in the estimated year of 2025, is experiencing robust and sustained growth. This dynamic sector is poised for continued expansion, projecting a market size that will reach an estimated XXX billion dollars by the end of the forecast period in 2033. The study period, spanning from 2019 to 2033, encompasses significant historical data from 2019-2024 and a forward-looking projection from 2025-2033. At its core, the market is driven by an increasing prevalence of spinal disorders, including degenerative disc disease, scoliosis, and spinal stenosis, fueled by aging global populations and sedentary lifestyles. Technological advancements are revolutionizing treatment options, with a shift towards minimally invasive procedures and the development of innovative materials like biocompatible polymers and advanced alloys. The base year of 2025 serves as a critical benchmark for understanding current market trajectories and future potential. The increasing adoption of robotic-assisted spinal surgery and the growing demand for personalized implant solutions are further shaping the market landscape. Furthermore, heightened awareness among patients regarding treatment alternatives and improved healthcare infrastructure in emerging economies are contributing to the market's upward momentum. The intricate interplay between technological innovation, demographic shifts, and evolving healthcare practices creates a fertile ground for substantial market development in the coming years. The production of spinal implants and devices is a significant undertaking, with a global output that reflects the escalating need for effective spinal treatments. This comprehensive report delves into the nuanced trends that define this vital segment of the healthcare industry.

Several powerful forces are propelling the global Spinal Implants and Devices market forward. Foremost among these is the burgeoning aging global population. As individuals live longer, the incidence of age-related degenerative spinal conditions escalates, directly translating into a greater demand for corrective surgical interventions and the implants that facilitate them. Simultaneously, the increasing prevalence of obesity and sedentary lifestyles, particularly in developed and developing economies, contributes to a higher burden of spinal pathologies. These lifestyle factors often exacerbate existing conditions or lead to new ones, necessitating surgical solutions. Moreover, remarkable advancements in medical technology are continuously enhancing the efficacy and safety of spinal procedures. Innovations in biomaterials are leading to the development of implants with improved biocompatibility and longevity. The widespread adoption of minimally invasive surgical techniques, facilitated by sophisticated instrumentation and imaging technologies, is also a significant driver. These procedures offer patients reduced recovery times, less pain, and smaller scars, making surgical intervention a more attractive option. The growing investment in research and development by leading manufacturers further fuels innovation, leading to the introduction of novel implant designs and surgical approaches that address unmet clinical needs and expand the therapeutic landscape for spinal conditions.

Despite the robust growth trajectory, the Spinal Implants and Devices market faces several significant challenges and restraints that could temper its expansion. A primary concern revolves around the high cost associated with spinal surgeries and the implants themselves. Reimbursement policies, particularly in certain healthcare systems, can be restrictive, limiting patient access and manufacturer profitability. The intricate regulatory landscape, with stringent approval processes for new devices and technologies, can also lead to extended development timelines and increased R&D expenses for companies. Furthermore, the risk of implant-related complications, such as infection, loosening, or non-union, while diminishing with technological advancements, remains a clinical concern. These adverse events can necessitate revision surgeries, leading to increased healthcare costs and patient dissatisfaction. The scarcity of skilled spine surgeons, especially in emerging markets, can also act as a bottleneck, limiting the number of procedures that can be performed. Public perception and patient hesitancy towards invasive surgical procedures, coupled with the availability of non-surgical alternatives for milder conditions, can also influence market penetration. Addressing these challenges will be crucial for unlocking the full potential of the Spinal Implants and Devices market.

The Spinal Fusion Implants segment, within the Hospital application, is poised to dominate the global Spinal Implants and Devices market. This dominance will be particularly pronounced in the North America region.

Dominance of Spinal Fusion Implants: Spinal fusion implants represent the cornerstone of treatment for a vast array of spinal deformities and degenerative conditions. Their application is critical in addressing issues such as degenerative disc disease, scoliosis, spinal stenosis, and spondylolisthesis. The rising incidence of these conditions, driven by an aging global population and increasing rates of obesity and poor posture, directly fuels the demand for spinal fusion devices. These implants, ranging from pedicle screws, rods, and interbody devices, are indispensable for stabilizing the spine and promoting the fusion of adjacent vertebrae, thereby alleviating pain and restoring structural integrity. The continuous innovation in biomaterials and implant design, leading to more robust, biocompatible, and minimally invasive fusion options, further solidifies their market position. The development of advanced technologies like 3D-printed implants and absorbable bone graft substitutes are also enhancing fusion success rates and patient outcomes, making them a preferred choice for surgeons and patients alike. The comprehensive nature of spinal fusion in treating complex spinal pathologies ensures its enduring significance.

Dominance of Hospital Application: Hospitals are the primary settings for spinal surgeries, especially those involving complex procedures requiring specialized equipment, highly trained medical staff, and intensive post-operative care. The majority of spinal fusion surgeries, trauma-related spinal interventions, and procedures for severe degenerative conditions are performed within inpatient hospital settings. The availability of advanced imaging technologies (MRI, CT scans), surgical robotics, and intensive care units within hospitals makes them the ideal environment for managing these intricate cases. While Ambulatory Surgery Centers (ASCs) are gaining traction for less complex spine procedures, the intricate nature and potential complications associated with many spinal surgeries necessitate the comprehensive infrastructure and immediate accessibility to specialized medical support that hospitals provide. The increasing number of spinal surgeries being performed globally, coupled with the evolving surgical techniques that are often integrated into hospital protocols, ensures the sustained dominance of the hospital segment.

Dominance of North America: North America, particularly the United States, stands as the leading market for Spinal Implants and Devices. This leadership is attributed to several interconnected factors. Firstly, the region boasts a high prevalence of spinal disorders, exacerbated by an aging population and lifestyle-related health issues. Secondly, North America has a highly developed healthcare infrastructure, characterized by widespread access to advanced medical technologies and a robust network of specialized spine surgeons. The region also exhibits a high patient awareness of treatment options and a strong willingness to undergo surgical interventions for pain relief and improved quality of life. Furthermore, significant investments in research and development by leading medical device manufacturers, many of which are headquartered in or have a strong presence in North America, drive innovation and the adoption of cutting-edge spinal technologies. Favorable reimbursement policies, though subject to ongoing evaluation, generally support the use of advanced spinal implants. The concentration of leading healthcare institutions and the strong emphasis on patient outcomes contribute to the sustained dominance of North America in this market.

The Spinal Implants and Devices industry is experiencing significant growth fueled by several key catalysts. The increasing prevalence of spinal disorders, driven by an aging global population and sedentary lifestyles, is a primary driver. Advancements in minimally invasive surgical techniques, enabling faster recovery and reduced patient trauma, are encouraging more individuals to opt for surgical interventions. Technological innovations, including the development of advanced biomaterials, robotic-assisted surgery, and personalized implant designs, are continuously improving treatment outcomes and expanding the therapeutic options available. Furthermore, a growing emphasis on improving patient quality of life and managing chronic back pain is boosting the demand for effective spinal solutions.

This comprehensive report on Spinal Implants and Devices offers an in-depth analysis of the market's current state and future projections. It meticulously details the market size in billions of dollars for the estimated year of 2025 and forecasts its growth through 2033, providing crucial insights for stakeholders. The report examines the intricate interplay of driving forces, such as demographic shifts and technological advancements, alongside the challenges and restraints, including regulatory hurdles and cost factors. It identifies key market segments like Spinal Fusion Implants and Application areas like Hospitals as dominant forces, further highlighting the geographical leadership of regions like North America. This report is an indispensable resource for understanding the dynamics, opportunities, and strategic landscape of the global Spinal Implants and Devices industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6%.

Key companies in the market include Alphatec Holdings, Inc., B. Braun Melsungen AG, Exactech, Inc., Johnson & Johnson (DePuy Synthes), Globus Medical, Inc., Medtronic plc, Nuvasive, Inc., Orthofix International NV, Stryker Corporation, Zimmer Biomet, Surgalign Spine Technologies, Inc..

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Spinal lmplant and Devices," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Spinal lmplant and Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.