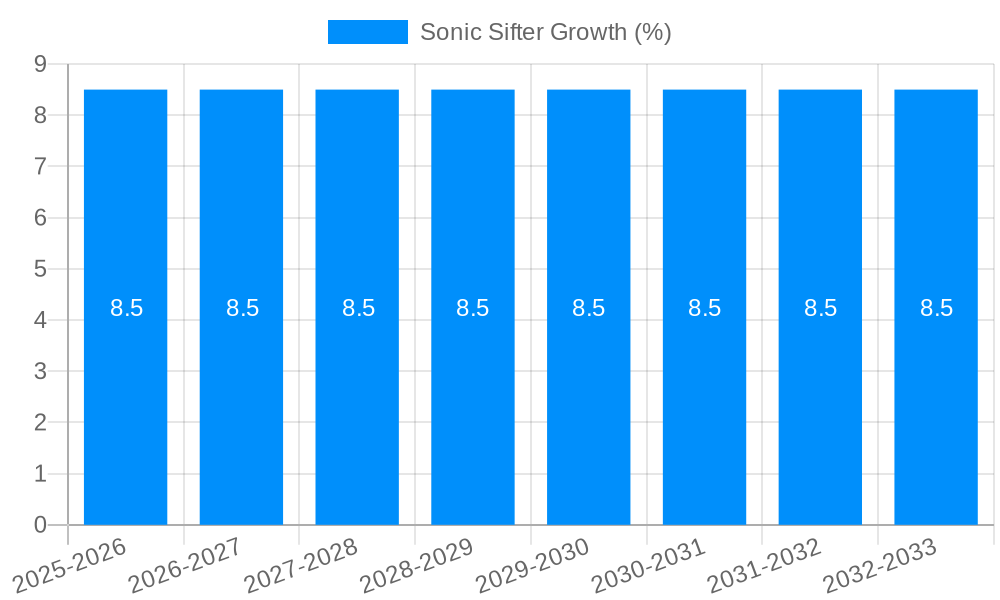

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sonic Sifter?

The projected CAGR is approximately 8.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sonic Sifter

Sonic SifterSonic Sifter by Type (3in, 8in, 12in, Others, World Sonic Sifter Production ), by Application (Food and Beverage, Pharmaceutical, Chemical, Metal, Others, World Sonic Sifter Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

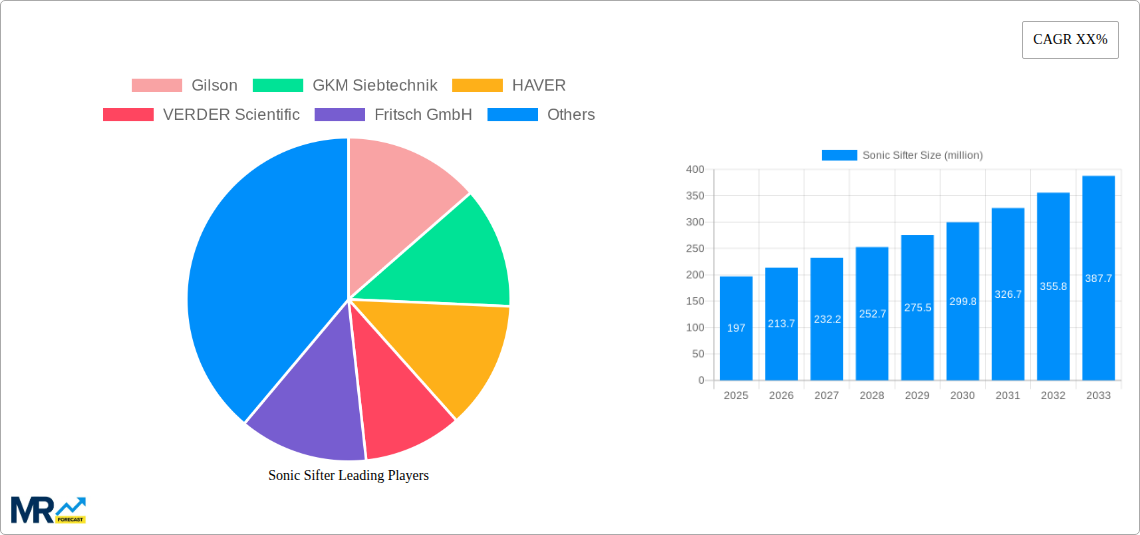

The global Sonic Sifter market is poised for significant expansion, projected to reach an estimated USD 197 million in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This upward trajectory is primarily fueled by the escalating demand for precise particle size analysis across critical industries such as pharmaceuticals and food and beverage. The pharmaceutical sector, with its stringent regulatory requirements for drug formulation and quality control, is a key driver, necessitating advanced sieving technologies for accurate ingredient separation and product consistency. Similarly, the food and beverage industry relies heavily on sonic sifters for ensuring uniform texture, optimizing ingredient mixing, and meeting food safety standards. The inherent advantages of sonic sifters, including their ability to handle fine powders, prevent mesh blinding, and provide highly reproducible results, further bolster their adoption.

Emerging applications in the chemical and metal industries, coupled with advancements in sonic sifter technology such as enhanced digital controls and material handling capabilities, are expected to contribute to sustained market growth. The increasing focus on automation and process optimization within manufacturing environments also plays a crucial role, as sonic sifters integrate seamlessly into automated production lines, reducing manual intervention and improving efficiency. While the market is driven by these strong factors, potential restraints may include the initial capital investment required for advanced sonic sifting equipment and the availability of alternative particle analysis methods. However, the superior performance and reliability offered by sonic sifters are likely to outweigh these concerns, paving the way for their continued dominance in specialized particle separation applications.

This comprehensive report delves into the global Sonic Sifter market, providing an in-depth analysis of its trends, driving forces, challenges, and future outlook. Spanning the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period from 2025-2033, this study offers invaluable insights for stakeholders navigating this dynamic sector. With an estimated market value expected to reach into the tens of millions of dollars by the end of the forecast period, the Sonic Sifter market presents significant opportunities for growth and innovation.

The global Sonic Sifter market is experiencing a period of sustained growth, driven by increasing demand across a multitude of industries that rely on precise particle size analysis and separation. Throughout the study period, from 2019 to the estimated year of 2025, a consistent upward trajectory has been observed, with projections indicating continued expansion well into the forecast period of 2025-2033. A key trend is the growing adoption of advanced sonic sifting technologies that offer enhanced efficiency, accuracy, and automation compared to traditional methods. This evolution is particularly evident in sectors like pharmaceuticals and food and beverage, where stringent quality control and the need for consistent particle distribution are paramount. The increasing complexity of materials being processed, including novel chemical compounds and specialized metal powders, also necessitates the precision and versatility that sonic sifters provide. Furthermore, the global push towards stricter regulatory compliance in various industries is directly fueling the demand for reliable and reproducible particle characterization techniques, making sonic sifters an indispensable tool. The market is also witnessing a rise in the development of smaller, more compact sonic sifter units, catering to laboratories with limited space and specific application needs, as well as the continued dominance of larger, industrial-scale units for high-throughput processing. The interplay between technological advancements and evolving industry standards is creating a fertile ground for innovation, with manufacturers actively investing in research and development to introduce next-generation sonic sifting solutions. The market's resilience, even through periods of economic fluctuation in the historical period, underscores the fundamental importance of particle separation and analysis in modern industrial processes. As we move towards the forecast period, the integration of digital technologies, such as data analytics and connectivity, into sonic sifter operations is expected to become a significant differentiator, offering users greater control, traceability, and predictive maintenance capabilities, further solidifying its market position. The world sonic sifter production is anticipated to mirror this growth, with increased manufacturing capacities and optimized supply chains to meet global demand. The market's overall health is robust, indicating a positive outlook for sonic sifter manufacturers and users alike, with a collective market value projected to ascend into the hundreds of millions of dollars by 2033.

The ascent of the Sonic Sifter market is primarily propelled by a confluence of critical factors, each contributing to its expanding reach and influence across diverse industrial landscapes. A paramount driver is the unwavering demand for stringent quality control and product consistency. In sectors like pharmaceuticals, where even minor variations in particle size can impact drug efficacy and safety, sonic sifters are indispensable for ensuring adherence to precise specifications. Similarly, the food and beverage industry relies heavily on these devices to achieve desired textures, flowability, and shelf-life for a wide array of products, from flour and spices to powdered infant formula. The growing complexity of advanced materials and the emergence of novel manufacturing processes also play a significant role. As industries develop more sophisticated chemical compounds, specialized metal alloys, and engineered nanomaterials, the need for precise particle size analysis and separation becomes more pronounced. Sonic sifters, with their ability to handle a wide range of particle sizes and material types, are at the forefront of this innovation. Furthermore, increasing regulatory scrutiny and evolving industry standards worldwide are compelling businesses to adopt more sophisticated analytical tools. Compliance with these regulations necessitates accurate and reproducible particle characterization, directly boosting the demand for sonic sifting equipment. The continuous technological advancements in sonic sifter design, leading to improved efficiency, speed, and accuracy, also act as a significant impetus. These advancements not only enhance performance but also make the technology more accessible and cost-effective for a broader range of applications, contributing to its sustained growth into the tens of millions of dollars range.

Despite the robust growth trajectory, the Sonic Sifter market is not without its hurdles, which can temper its expansion and necessitate strategic navigation by industry participants. A significant challenge lies in the initial capital investment required for sophisticated sonic sifting equipment. While the long-term benefits of accuracy and efficiency are undeniable, the upfront cost can be a barrier for smaller enterprises or laboratories with limited budgets, potentially restricting market penetration in certain segments. Furthermore, the need for specialized training and technical expertise to operate and maintain these advanced instruments can pose another restraint. Improper operation or calibration can lead to inaccurate results, undermining the very purpose of the sifter and potentially leading to costly errors. The availability of alternative particle analysis techniques also presents a competitive challenge. While sonic sifters excel in specific applications, other methods like laser diffraction or dynamic light scattering might be preferred for certain particle size ranges or material properties, leading to market fragmentation. Moreover, variations in material properties and potential for clogging or fouling can impact the efficiency and lifespan of sonic sifters. Certain materials, particularly those that are sticky, cohesive, or prone to electrostatic charging, may require specialized handling or pre-treatment, adding complexity to the sifting process and potentially increasing operational costs. Finally, economic downturns and global supply chain disruptions, as observed during the historical period, can temporarily impede manufacturing and distribution, affecting market growth and leading to fluctuations in the projected tens of millions of dollars market value.

The global Sonic Sifter market exhibits distinct regional dominance and segment leadership, driven by industrial concentration, technological adoption, and regulatory frameworks. Within the Type segment, the 8-inch sonic sifter is poised to lead the market, accounting for a substantial portion of global production and sales. This size offers an optimal balance between sample capacity and bench space, making it highly versatile for a wide range of laboratory and pilot-scale applications. It caters effectively to the needs of both the pharmaceutical and food and beverage industries, where batch sizes are often moderate and precise separation is critical. The 3-inch sonic sifter will also command a significant share, particularly in academic research and specialized R&D environments requiring high-throughput screening of small sample volumes. The 12-inch sonic sifter will cater to larger industrial operations and high-volume production environments.

In terms of Application, the Pharmaceutical segment is expected to be the dominant force, projected to contribute the largest share to the global Sonic Sifter market value. This dominance is fueled by the stringent quality control requirements inherent in drug manufacturing, including the precise particle size distribution of active pharmaceutical ingredients (APIs) and excipients. The need for consistent drug dissolution rates, bioavailability, and formulation stability directly translates into a high demand for accurate and reproducible particle separation technologies. The Food and Beverage segment is expected to follow closely, driven by similar quality control imperatives related to product texture, shelf-life, and consistency. The Chemical segment, encompassing a broad spectrum of applications from fine chemicals to bulk materials, will also represent a substantial market share.

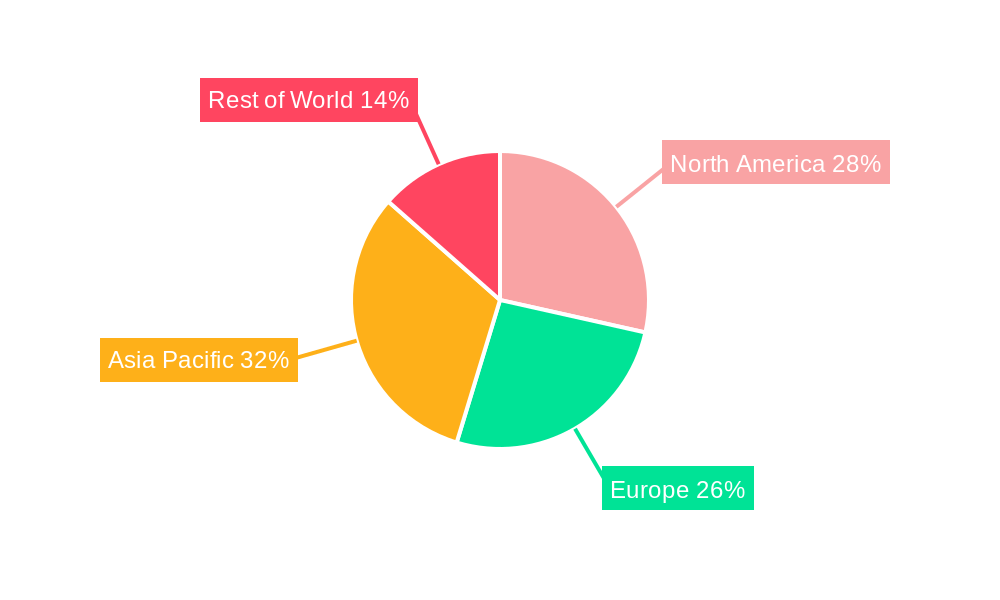

Geographically, North America, particularly the United States, is anticipated to be a key region for market dominance, driven by its advanced pharmaceutical and biotechnology industries, robust chemical manufacturing sector, and high adoption rate of cutting-edge analytical technologies. The presence of leading pharmaceutical companies, extensive research institutions, and stringent regulatory bodies like the FDA underpins this leadership. Europe, with its strong pharmaceutical and chemical manufacturing base in countries like Germany and Switzerland, will also represent a significant market. The region's emphasis on quality standards and innovation further bolsters demand for sonic sifters. Asia-Pacific, with its rapidly expanding pharmaceutical and chemical industries in countries like China and India, is projected to exhibit the highest growth rate in the forecast period, driven by increasing investments in R&D and manufacturing capabilities, as well as growing domestic demand for high-quality products. The combined market value of these leading regions and segments is expected to collectively reach into the hundreds of millions of dollars by 2033.

Several key catalysts are propelling the growth of the Sonic Sifter industry. The incessant demand for enhanced product quality and consistency across industries like pharmaceuticals and food & beverage is a primary driver. As manufacturers strive for greater precision in their formulations and production processes, the need for accurate particle size analysis and separation becomes paramount. Furthermore, the emergence of advanced materials and novel manufacturing techniques necessitates sophisticated tools for material characterization, creating new avenues for sonic sifter applications. The increasing stringency of regulatory standards worldwide also compels businesses to invest in reliable analytical equipment for compliance, further fueling market expansion.

This report offers a comprehensive analysis of the Sonic Sifter market, encompassing historical data from 2019-2024 and projecting trends up to 2033. It provides in-depth insights into market dynamics, including the key drivers propelling growth such as the demand for stringent quality control and the advancement of new materials. The report also addresses the challenges, such as initial investment costs and the need for specialized expertise. Detailed segmentation by type (3in, 8in, 12in, Others) and application (Food and Beverage, Pharmaceutical, Chemical, Metal, Others) allows for a granular understanding of market sub-sectors. The analysis also highlights significant industry developments and identifies the leading players in the global Sonic Sifter arena. With a projected market value reaching into the tens of millions of dollars, this study provides essential intelligence for strategic decision-making and investment planning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.5%.

Key companies in the market include Gilson, GKM Siebtechnik, HAVER, VERDER Scientific, Fritsch GmbH, Glenammer, Hielscher, Orto Alresa, Lavallab, CSC Scientific, DAHAN Vibration Machinery, QAQC LAB EQUIPMENT, MRC Lab, Certified MTP, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Sonic Sifter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sonic Sifter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.