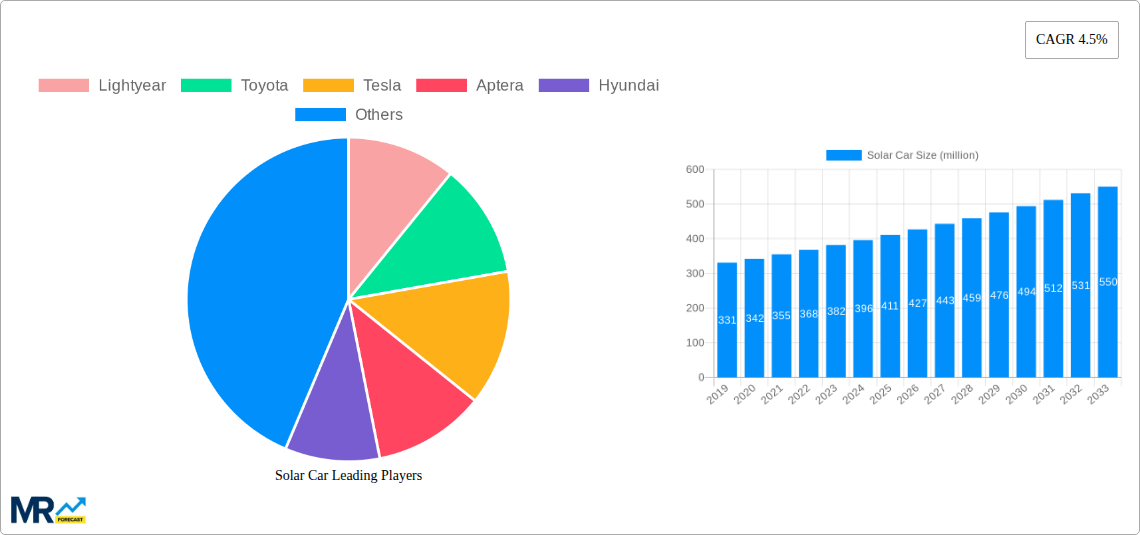

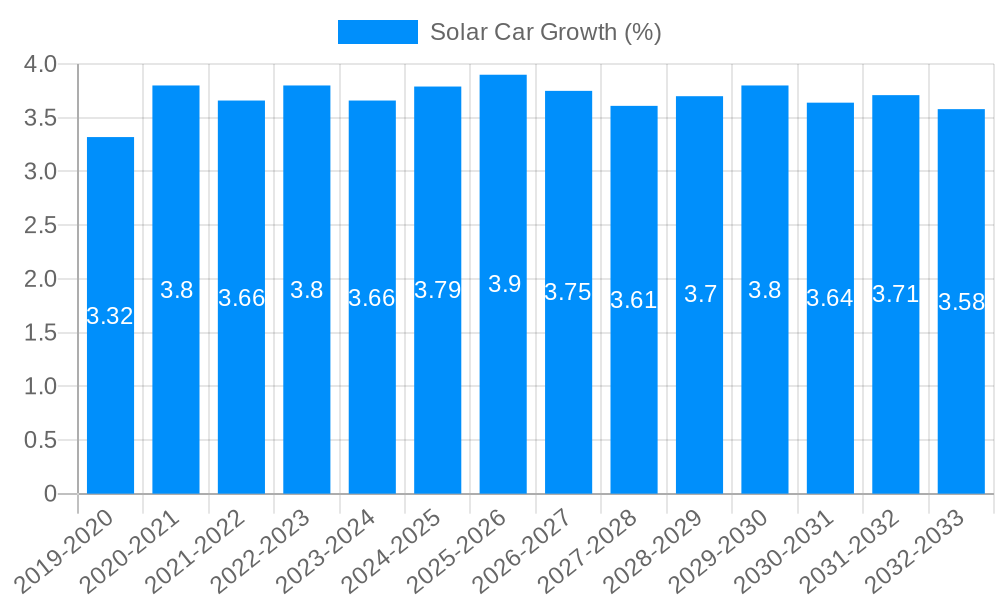

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solar Car?

The projected CAGR is approximately 4.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Solar Car

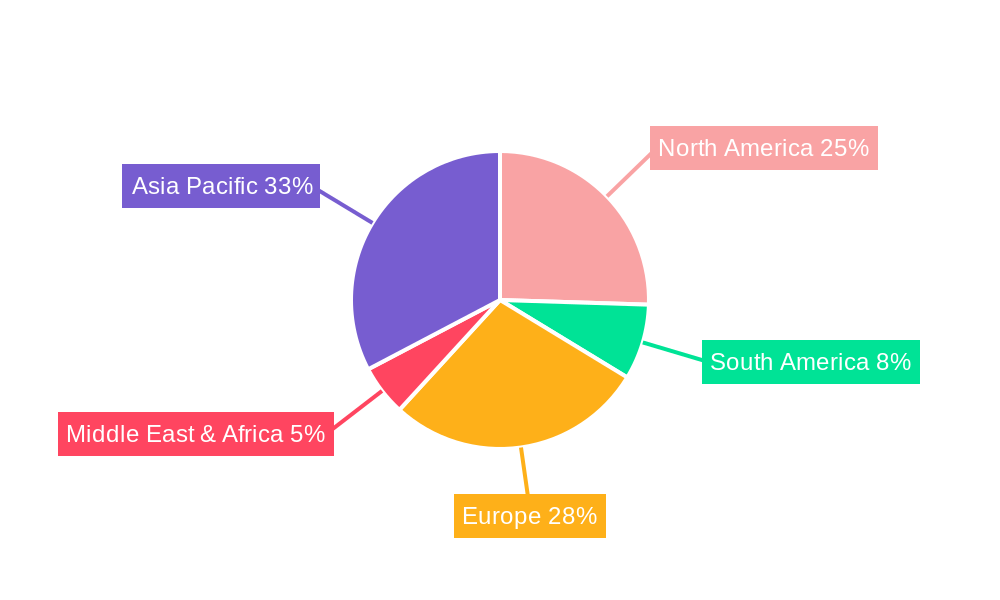

Solar CarSolar Car by Application (Passenger Car, Commercial Vehicle), by Type (Substrate Silicon Cells, Thin Film Solar Cells, Copper Indium Selenium Solar Cells, Dye Sensitized Solar Cells, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Solar Car market is projected to experience robust growth, reaching an estimated market size of approximately \$444 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of 4.5% through 2033. This expansion is fueled by an increasing consumer demand for sustainable transportation solutions and advancements in solar cell technology that enhance efficiency and integration into vehicle designs. Key drivers include government initiatives promoting renewable energy adoption, stricter emission regulations, and the growing awareness of environmental concerns among the populace. The development of lightweight, highly efficient solar panels, particularly substrate silicon cells and thin-film solar cells, is crucial for their successful integration into passenger cars and commercial vehicles, paving the way for a future where vehicles can partially or fully power themselves through sunlight.

The market is witnessing significant innovation across various segments. While passenger cars are expected to dominate in terms of application, commercial vehicles also present substantial growth opportunities as logistics companies seek to reduce operational costs and their carbon footprint. Technological advancements in areas like Copper Indium Selenium Solar Cells and Dye Sensitized Solar Cells, though currently in nascent stages for automotive applications, hold the potential to further revolutionize the market with their unique properties and cost-effectiveness in the long term. Prominent companies like Lightyear, Toyota, Tesla, and Hyundai are actively investing in research and development, showcasing prototypes, and launching solar-integrated electric vehicles, signaling a strong commitment to this burgeoning sector. This competitive landscape is expected to accelerate product development and market penetration, ultimately benefiting consumers with more sustainable and cost-effective transportation alternatives.

Here is a unique report description on Solar Cars, incorporating your specified requirements:

The solar car market is poised for remarkable growth, projected to ascend from an estimated USD 500 million in the base year of 2025 to surpass USD 2,500 million by the end of the forecast period in 2033. This upward trajectory is underpinned by a confluence of technological advancements, increasing environmental consciousness, and supportive government policies. The study period, spanning from 2019 to 2033, with a particular focus on the historical performance from 2019-2024 and the critical base and estimated year of 2025, reveals a market transitioning from niche applications to broader commercial viability. Innovations in photovoltaic (PV) technology are at the forefront, with improvements in the efficiency and durability of solar cells, particularly Substrate Silicon Cells and emerging Thin Film Solar Cells, making them more suitable for integration into automotive designs. Furthermore, the growing demand for sustainable transportation solutions, driven by concerns over climate change and volatile fossil fuel prices, is a significant tailwind. Consumers are increasingly seeking vehicles that offer reduced running costs and a smaller carbon footprint. Early adopters and innovative companies like Lightyear and Aptera are pushing the boundaries, demonstrating the potential for solar-powered vehicles to cover substantial distances and offer a compelling alternative to traditional internal combustion engine vehicles and even some battery electric vehicles. The market's evolution is also characterized by strategic partnerships and investments, as established automotive giants such as Toyota, Tesla, Hyundai, Ford, and Mercedes-Benz's begin to seriously explore and invest in solar integration for their future fleets. This indicates a maturing market where scalability and cost-effectiveness are becoming paramount. The integration of solar technology is moving beyond experimental prototypes to practical applications, with a growing emphasis on optimizing energy capture and storage systems to maximize the range and utility of solar cars. The competitive landscape is intensifying, with a blend of dedicated solar car startups and incumbent automakers vying for market share.

The solar car market is experiencing a powerful surge driven by several interconnected factors. Foremost among these is the escalating global imperative to decarbonize transportation. As governments worldwide set ambitious emissions reduction targets, the demand for zero-emission vehicles intensifies, placing solar cars in a favorable position. The increasing awareness among consumers about environmental sustainability and the desire to reduce their carbon footprint are significant behavioral shifts that directly benefit the adoption of solar-powered mobility. Moreover, the dramatic improvements in solar cell efficiency and cost reduction over the past decade have made solar integration a more feasible and economically attractive proposition for vehicle manufacturers. Companies are investing heavily in research and development to create lighter, more efficient, and aesthetically integrated solar panels for automotive applications. The potential for reduced operational costs for consumers, stemming from the ability to harness free solar energy, is another crucial driver. This is particularly relevant in regions with abundant sunlight, where solar cars could significantly offset charging needs and fuel expenses. The growing charging infrastructure for electric vehicles also indirectly supports solar cars, as they can either supplement their charging or operate independently for shorter durations.

Despite the promising outlook, the solar car market faces several significant hurdles that need to be addressed for widespread adoption. The primary challenge lies in the inherent limitations of solar energy capture. The surface area of a car is finite, and the amount of energy generated by onboard solar panels is often insufficient to power the vehicle entirely, especially in less sunny climates or during periods of low light. This necessitates relying on traditional charging infrastructure, thereby diminishing the 'solar-only' appeal for many users and limiting the practicality for extensive travel. Another major restraint is the cost associated with integrating high-efficiency solar cells and robust battery storage systems. While solar technology is becoming more affordable, the upfront investment for solar cars can still be considerably higher than for conventional vehicles, impacting consumer affordability. The durability and maintenance of solar panels on a vehicle, exposed to various weather conditions and potential damage, also present ongoing concerns. Furthermore, regulatory frameworks and standardization for solar-powered vehicles are still evolving, which can create uncertainty for manufacturers and consumers alike. The weight of solar panels and associated components can also impact vehicle performance and efficiency. Finally, public perception and consumer education are critical; many consumers may still view solar cars as novelties rather than practical transportation solutions, requiring concerted efforts to build trust and demonstrate their capabilities.

The solar car market is expected to witness significant dominance from specific regions and segments, driven by a combination of favorable environmental conditions, supportive government policies, and high consumer adoption rates.

Regions/Countries to Dominate:

Segment to Dominate: Passenger Car

The solar car industry's growth is being significantly catalyzed by rapid advancements in photovoltaic technology, leading to higher solar cell efficiencies and reduced manufacturing costs. Government incentives, including tax credits and subsidies for electric and renewable energy vehicles, are playing a crucial role in making solar cars more economically viable for consumers. Furthermore, a growing global emphasis on sustainability and a desire to reduce carbon emissions are driving consumer preference towards eco-friendly transportation options. Strategic investments and partnerships between established automotive manufacturers and innovative solar technology companies are accelerating product development and market penetration.

This comprehensive report delves into the intricate dynamics of the global solar car market, providing an in-depth analysis of its evolution from the historical period (2019-2024) to a detailed forecast extending to 2033. It meticulously examines market trends, including the projected growth from an estimated USD 500 million in 2025 to over USD 2,500 million by 2033. The report offers a granular understanding of the driving forces, such as environmental mandates and technological advancements, alongside the critical challenges like cost and energy limitations. It identifies key dominating regions and segments, particularly highlighting the passenger car application and the role of Substrate Silicon Cells and Thin Film Solar Cells. Furthermore, it outlines significant growth catalysts and provides a detailed overview of leading industry players and their impactful developments. This report is an indispensable resource for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within the solar car industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.5%.

Key companies in the market include Lightyear, Toyota, Tesla, Aptera, Hyundai, Sono Motor, Ford, Mercedes-Benz’s, General Motor, Hyundai Motor Company, Boeing, Shandong Gaia New Energy Tech. Co., Ltd., .

The market segments include Application, Type.

The market size is estimated to be USD 391 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Solar Car," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Solar Car, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.