1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart RFID Tool Box?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Smart RFID Tool Box

Smart RFID Tool BoxSmart RFID Tool Box by Type (Glass Door, Alloy Door, World Smart RFID Tool Box Production ), by Application (Aerospace, Electricity, Rail, Fire Department, Mechanical, World Smart RFID Tool Box Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

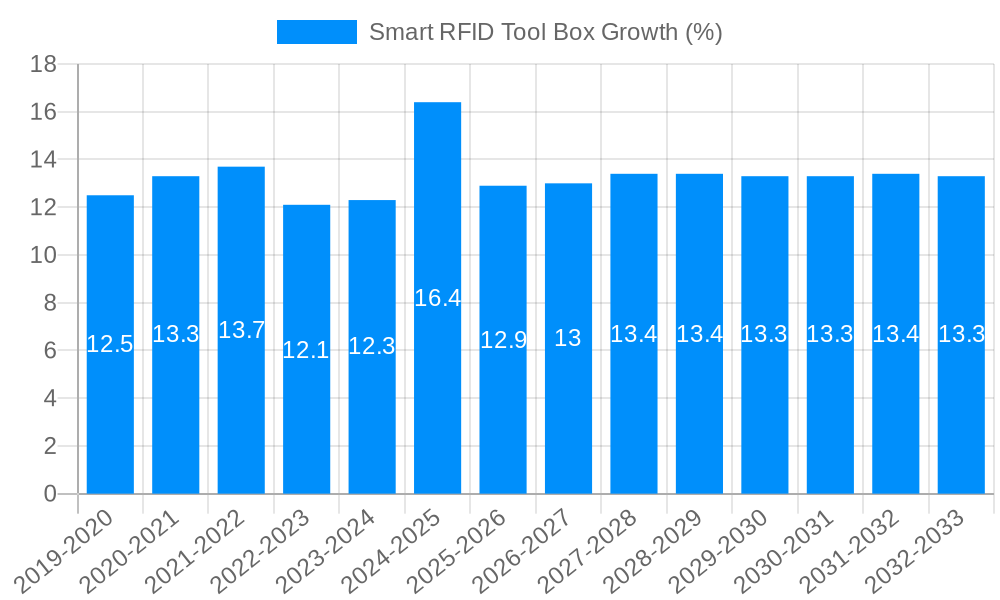

The global Smart RFID Tool Box market is poised for significant expansion, projected to reach an estimated USD 850 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.5% through 2033. This impressive growth is primarily fueled by the escalating demand for enhanced asset tracking, inventory management, and security across various industrial sectors. The increasing adoption of the Internet of Things (IoT) and radio-frequency identification (RFID) technology is revolutionizing tool management, offering real-time visibility and preventing tool loss, theft, or misplacement. Industries such as aerospace, electricity, rail, fire departments, and mechanical engineering are actively investing in these intelligent solutions to optimize operational efficiency, reduce downtime, and ensure compliance with stringent safety regulations. The market is witnessing a surge in innovations, with manufacturers focusing on developing durable, user-friendly, and cost-effective smart toolboxes.

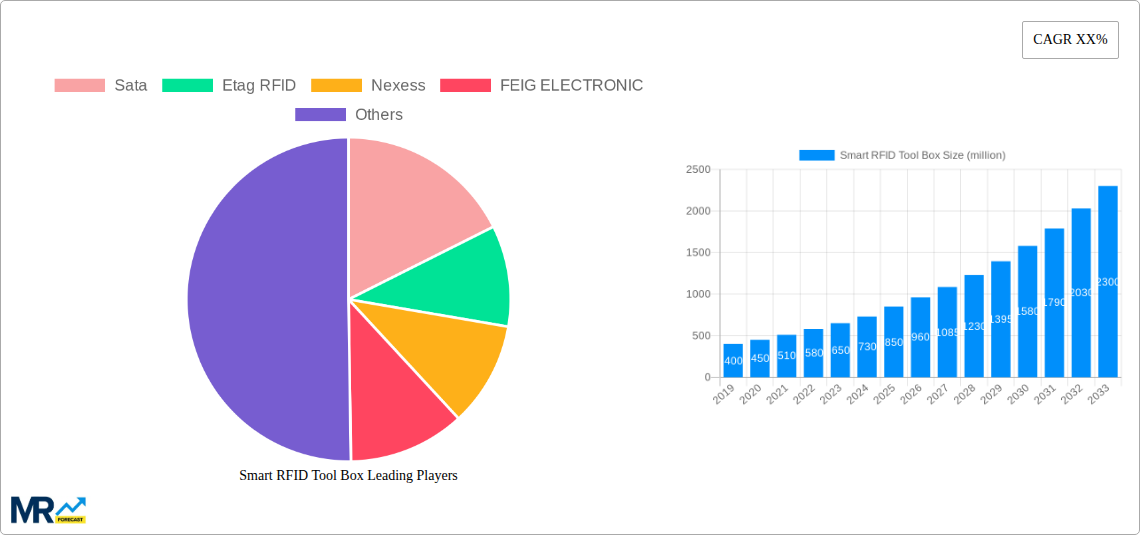

The market landscape is characterized by several key drivers, including the growing need for streamlined inventory control in complex operational environments and the imperative to improve worker productivity by ensuring immediate access to the right tools. The rising adoption of smart manufacturing and Industry 4.0 principles further propels the demand for connected and automated systems, with smart RFID toolboxes being a crucial component. Key trends include the integration of advanced RFID tags, cloud-based management platforms, and mobile accessibility for remote monitoring and control. Challenges, such as the initial investment cost and the need for standardized protocols for interoperability, are being addressed through ongoing technological advancements and increasing industry-wide collaboration. The market is segmented into types like Glass Doors and Alloy Doors, with widespread application across critical industries. Leading companies like Sata, DEWALT, and Etag RFID are at the forefront of innovation, driving market growth and shaping the future of tool management.

This comprehensive report delves into the dynamic global market for Smart RFID Tool Boxes, meticulously analyzing trends, drivers, challenges, and opportunities. Spanning a detailed study period from 2019 to 2033, with a base year of 2025 and an extended forecast period from 2025 to 2033, this research offers an in-depth understanding of market evolution. The historical period of 2019-2024 provides crucial context for understanding the trajectory of this burgeoning sector.

The Smart RFID Tool Box market is experiencing a significant inflection point, transitioning from niche adoption to mainstream integration across various industrial and professional sectors. The core trend revolves around the escalating demand for enhanced asset tracking, inventory management, and operational efficiency. The integration of RFID technology within toolboxes is not merely a technological upgrade but a strategic imperative for industries striving to minimize tool loss, prevent unauthorized access, and streamline maintenance workflows. We project the global market to reach an estimated value of over $750 million by the end of the forecast period. This growth is fueled by an increasing recognition of the quantifiable benefits, such as reduced downtime, improved safety compliance, and optimized resource allocation. The evolution of RFID technology itself, marked by smaller form factors, improved read ranges, and enhanced data security protocols, is a constant trend that directly influences the capabilities and attractiveness of these toolboxes. Furthermore, the increasing adoption of Industry 4.0 principles and the broader digitalization of industrial operations are creating a fertile ground for Smart RFID Tool Boxes to become an integral component of connected ecosystems. The market is also witnessing a trend towards specialized solutions tailored to specific industry needs. For instance, toolboxes designed for harsh environments in the Aerospace or Rail sectors will incorporate more robust RFID tags and durable casing, while those for the Fire Department might prioritize immediate access and tamper-evident features. The shift towards cloud-based data management and analytics further solidifies this trend, allowing for real-time monitoring and predictive maintenance insights derived from tool usage patterns. The development of user-friendly interfaces and intuitive software platforms is another critical trend, ensuring that the advanced technology translates into practical benefits for end-users without requiring extensive technical expertise. The market is also seeing a gradual, yet significant, shift from basic RFID tagging to more sophisticated solutions that incorporate IoT capabilities, enabling bidirectional communication and remote diagnostics. This continuous innovation and adaptation to evolving industry demands are defining the current and future landscape of the Smart RFID Tool Box market. The increasing focus on cybersecurity within industrial settings also presents a trend of incorporating more secure RFID solutions, ensuring data integrity and preventing unauthorized manipulation of tool inventory. The demand for customizability and integration with existing enterprise resource planning (ERP) systems is another noteworthy trend, indicating a move towards holistic operational management.

Several potent forces are driving the accelerated adoption and expansion of the Smart RFID Tool Box market. Paramount among these is the ever-present need for enhanced operational efficiency and cost reduction across industries. The ability of RFID-enabled toolboxes to provide real-time visibility into tool location and status directly translates into significant savings by minimizing time spent searching for tools, preventing theft or loss, and enabling more accurate inventory management. Furthermore, the increasing emphasis on safety and compliance in hazardous or regulated environments is a major catalyst. For sectors like Aerospace, Rail, and the Fire Department, where tool integrity and accessibility are critical for safety protocols, Smart RFID Tool Boxes offer an indispensable solution for ensuring that the right tools are available at the right time, and are in proper working condition. The continuous advancements in RFID technology, including miniaturization, enhanced durability, and increased read ranges, are making these solutions more accessible, reliable, and cost-effective. This technological evolution removes previous barriers to adoption. The broader digitalization of industries, often referred to as Industry 4.0, is also a significant propellant. As companies invest in connected systems and data-driven decision-making, Smart RFID Tool Boxes naturally fit into this ecosystem, providing valuable data on tool usage, maintenance needs, and overall asset lifecycle. This integration fosters a more intelligent and responsive operational environment. The growing awareness of the benefits of automated inventory management, which Smart RFID Tool Boxes facilitate, is another key driver. The reduction in manual labor and the elimination of human error associated with traditional inventory methods are compelling reasons for businesses to invest. Finally, the increasing regulatory pressure for improved asset control and traceability in critical sectors acts as a constant push factor, encouraging companies to adopt robust tracking solutions.

Despite the promising growth trajectory, the Smart RFID Tool Box market faces certain challenges and restraints that could temper its expansion. A primary obstacle remains the initial cost of implementation. While the long-term ROI is evident, the upfront investment in RFID tags, readers, software, and potentially new toolbox infrastructure can be a significant barrier for smaller enterprises or those with budget constraints. The perceived complexity of integrating RFID systems with existing IT infrastructure can also be a deterrent. Companies may lack the in-house expertise to seamlessly integrate these new technologies, leading to hesitations. Furthermore, the reliability and performance of RFID technology can be influenced by environmental factors. Interference from metal objects, liquids, or other radio frequencies can impact read accuracy and range, necessitating careful system design and deployment, which adds to the cost and complexity. Security concerns related to data privacy and potential unauthorized access to inventory data are also a consideration. While RFID technology offers enhanced security, robust encryption and access control mechanisms are crucial to mitigate these risks, and any perceived vulnerability can lead to market apprehension. The standardization of RFID protocols and data formats across different manufacturers and industries is still an ongoing process. A lack of universal standards can lead to interoperability issues, making it difficult to integrate solutions from various vendors. Finally, the need for ongoing training and workforce adaptation to new technologies can present a human capital challenge, as employees need to be trained on how to use and maintain the Smart RFID Tool Boxes effectively.

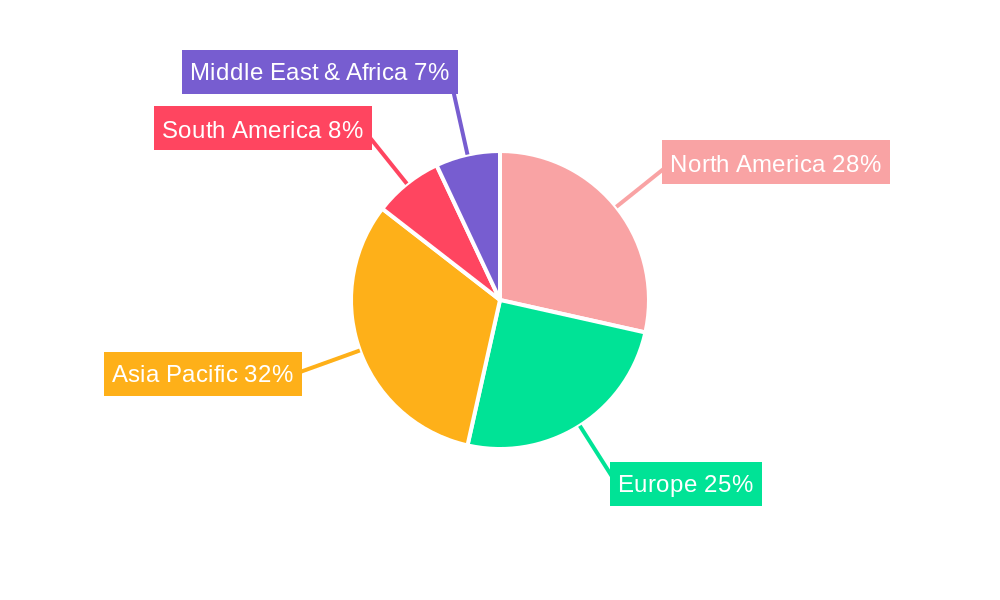

The global Smart RFID Tool Box market is poised for significant dominance by specific regions and industry segments, driven by unique economic, technological, and regulatory factors.

Key Dominant Segments:

Application: Aerospace: This sector is a prime candidate for market dominance due to the stringent safety regulations, the high value of specialized tools, and the critical need for precise asset tracking. In the Aerospace industry, the loss or misplacement of a single specialized tool can lead to extensive delays, significant financial repercussions, and even compromise flight safety. Smart RFID Tool Boxes offer an unparalleled solution for managing an extensive inventory of tools, ensuring that each tool is accounted for, calibrated, and readily available for maintenance and assembly processes. The complex supply chains and the need for verifiable audit trails further amplify the demand for such advanced tracking solutions. The robust nature of RFID technology, capable of withstanding the harsh environmental conditions often found in aerospace manufacturing and maintenance facilities, also contributes to its suitability. We estimate the Aerospace application to account for over $150 million in market value by 2025.

Application: Rail: Similar to Aerospace, the Rail industry relies heavily on efficient maintenance and the precise management of a vast array of specialized tools. The safety-critical nature of rail operations necessitates that all equipment, including tools, is meticulously tracked and accounted for. Smart RFID Tool Boxes can significantly improve maintenance efficiency by reducing tool search times, preventing the use of uncalibrated or incorrect tools, and ensuring compliance with rigorous safety standards. The vastness of rail networks and the decentralized nature of maintenance depots make real-time inventory visibility crucial for operational effectiveness. The cost savings associated with reduced tool loss and improved maintenance scheduling are substantial drivers in this segment. The Rail segment is projected to contribute over $120 million to the global market by 2025.

Type: Alloy Door Tool Boxes: While not exclusively tied to a specific application, the trend towards more durable and secure toolboxes is evident. Alloy Door toolboxes, offering superior protection against environmental elements and potential theft, are expected to see increased demand when integrated with RFID technology. This type of toolbox is particularly relevant for industries that require robust storage solutions for valuable or sensitive tools, often found in the aforementioned Aerospace and Rail sectors, as well as in heavy manufacturing and construction environments. The combination of enhanced physical security with intelligent tracking capabilities provides a comprehensive asset management solution.

Key Dominant Regions:

North America: This region, particularly the United States, is expected to lead the market. Its advanced industrial infrastructure, high adoption rate of new technologies, significant investments in sectors like aerospace and defense, and a strong emphasis on operational efficiency and safety compliance make it a fertile ground for Smart RFID Tool Boxes. The presence of leading technology providers and a mature market for automation solutions further bolster its dominance.

Europe: European countries, with their well-established manufacturing base, stringent safety regulations (especially in industries like rail and automotive), and a growing focus on Industry 4.0 initiatives, are also anticipated to be major contributors to market growth. Countries like Germany, the United Kingdom, and France are expected to show strong adoption rates.

The synergy between advanced technological adoption, stringent regulatory frameworks, and the inherent need for enhanced operational control within these key segments and regions will solidify their dominance in the global Smart RFID Tool Box market, contributing significantly to the projected market value of over $750 million.

The Smart RFID Tool Box industry is experiencing a surge in growth driven by several key catalysts. The increasing global push towards industrial automation and the adoption of Industry 4.0 principles is a primary driver, as businesses seek to create more connected and intelligent operational environments. The tangible benefits of enhanced asset visibility, reduced tool loss, and improved inventory accuracy are compelling arguments for adoption, directly impacting operational efficiency and cost savings. Furthermore, evolving safety regulations across various sectors, particularly in Aerospace and Rail, necessitate more robust tracking and management of critical tools, making Smart RFID Tool Boxes an indispensable solution. The continuous innovation in RFID technology, leading to more affordable, durable, and capable tags and readers, is further lowering adoption barriers. The growing demand for data-driven decision-making and the desire to optimize maintenance schedules and workflows are also fueling growth, as these toolboxes provide valuable real-time data on tool usage and condition.

This report provides an exhaustive examination of the global Smart RFID Tool Box market, offering a 360-degree view for stakeholders. Beyond market sizing and forecasts, it meticulously analyzes the intricate web of trends, including the growing demand for automation, the evolution of RFID technology, and the increasing emphasis on asset traceability. The report also dissects the critical driving forces, such as the pursuit of operational efficiency, cost reduction, and the stringent safety regulations shaping industry adoption. Crucially, it addresses the prevalent challenges and restraints, including implementation costs, integration complexities, and environmental interference, offering insights into mitigation strategies. The in-depth regional analysis pinpoints key growth areas and the dominant market segments like Aerospace and Rail, highlighting their specific needs and adoption patterns. Furthermore, the report identifies pivotal growth catalysts and profiles the leading industry players, providing a competitive landscape. Significant developments are chronicled with projected timelines, offering a glimpse into the future trajectory of the market. This comprehensive coverage empowers businesses with the strategic insights needed to navigate this evolving and promising market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sata, Etag RFID, Nexess, FEIG ELECTRONIC, Etag RFID, Rovonj, D.O RIFD Group, DEWALT, Shanghai Quanray Electronics, Shandong Yulian Intelligence, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Smart RFID Tool Box," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Smart RFID Tool Box, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.