1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Labels?

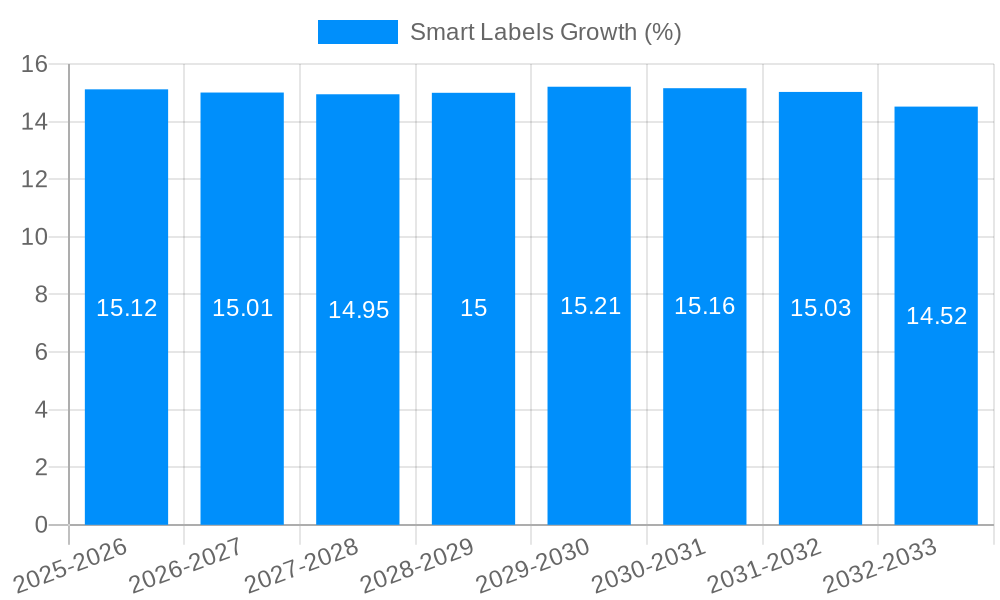

The projected CAGR is approximately 15.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Smart Labels

Smart LabelsSmart Labels by Application (Automotive, Healthcare & Pharmaceutical, Logistic, Retail, Manufacturing, Others), by Type (EAS Labels, RFID Labels, Sensing Labels, Electronic Shelf Labels, NFC Tags), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

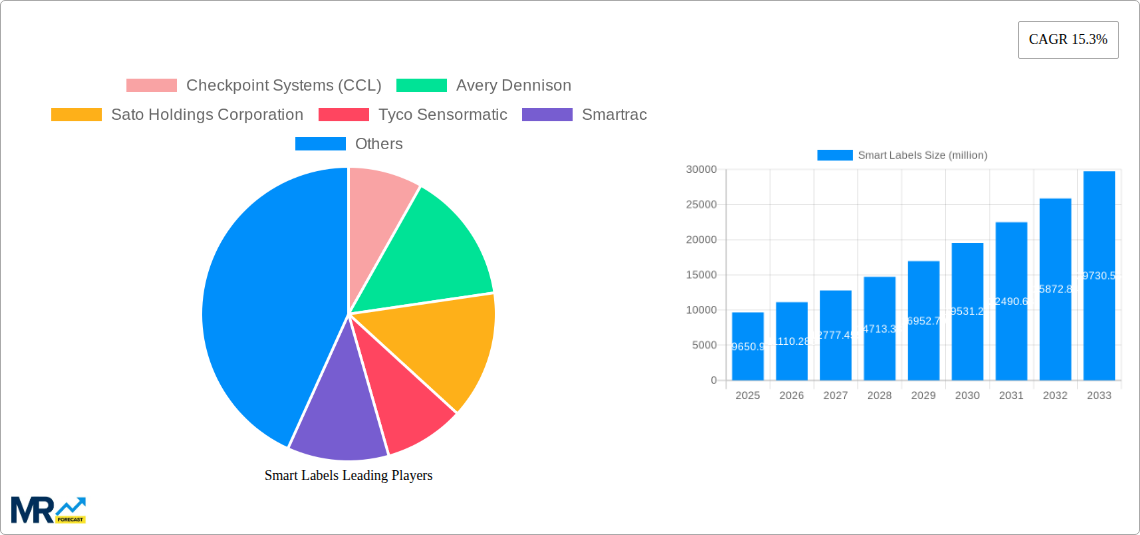

The global Smart Labels market is experiencing robust expansion, projected to reach a significant valuation of approximately $9,650.9 million. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 15.3% anticipated between 2025 and 2033. This upward trajectory is largely propelled by the increasing demand for enhanced inventory management, supply chain visibility, and improved customer experiences across various industries. The automotive sector, in particular, is a significant contributor, leveraging smart labels for component tracking and quality control. Healthcare and pharmaceuticals are adopting these technologies for counterfeit detection, temperature monitoring of sensitive medications, and streamlined dispensing. Furthermore, the retail sector is revolutionizing its operations with electronic shelf labels (ESLs) and RFID tags for dynamic pricing, real-time stock updates, and personalized promotions, significantly boosting operational efficiency and customer engagement. The logistics industry also benefits immensely from enhanced tracking and tracing capabilities, ensuring greater transparency and security throughout the supply chain.

The market's dynamic landscape is characterized by continuous innovation, particularly in the development of advanced sensing labels and NFC tags, which offer more sophisticated data collection and communication capabilities. The proliferation of IoT devices and the increasing digitalization of businesses worldwide are further fueling the adoption of smart labels. Key players are actively investing in research and development to introduce more cost-effective, durable, and feature-rich solutions. While the market exhibits strong growth potential, challenges such as initial implementation costs and the need for standardized integration protocols remain. However, the clear benefits in terms of operational efficiency, loss reduction, and enhanced data accuracy are driving widespread adoption, making the smart labels market a pivotal area of technological advancement and investment. The increasing focus on sustainable supply chains and product lifecycle management will also contribute to the long-term growth and diversification of smart label applications.

This comprehensive report offers an in-depth analysis of the global Smart Labels market, providing critical insights and actionable intelligence for stakeholders. The study encompasses a detailed examination of market dynamics, key trends, growth drivers, challenges, and future projections, with a strong focus on the period from 2019 to 2033. The base year for estimation is 2025, with the forecast period extending from 2025 to 2033, building upon a thorough historical analysis from 2019 to 2024. The report quantifies the market in millions of units, offering a clear understanding of market size and volume.

The global Smart Labels market is poised for unprecedented growth, projected to reach a valuation of USD 7,500 million by 2033, a significant leap from its estimated USD 3,200 million in 2025. This expansion is fueled by an escalating demand for enhanced supply chain visibility, inventory management, and enhanced consumer engagement. The increasing adoption of IoT technologies across various industries is a primary catalyst, enabling real-time tracking and monitoring of assets and products. Electronic Shelf Labels (ESLs) are emerging as a dominant force, particularly within the retail sector, revolutionizing pricing strategies and promotional activities. Their ability to dynamically update prices and display marketing messages directly on shelves offers a significant advantage in a competitive retail landscape. RFID labels continue to hold a strong position, driven by their utility in inventory management, asset tracking, and access control in sectors like logistics and manufacturing. The growing emphasis on product authenticity and recall management, especially in the healthcare and pharmaceutical industries, is also contributing to the adoption of sophisticated smart labeling solutions. Furthermore, the integration of sensing capabilities within labels, allowing for the monitoring of environmental conditions like temperature and humidity, is gaining traction, particularly for sensitive goods in the food and beverage and pharmaceutical segments. The ongoing miniaturization of technology and decreasing production costs are making these advanced labeling solutions more accessible, paving the way for wider adoption across small and medium-sized enterprises. The report identifies a pronounced trend towards interoperability and standardization, enabling seamless integration of smart labels with existing enterprise systems and fostering a more connected ecosystem. The increasing focus on sustainability is also influencing the market, with a growing demand for eco-friendly materials and energy-efficient smart label technologies.

Several key factors are propelling the global Smart Labels market forward. The relentless pursuit of operational efficiency and cost reduction across industries is a primary driver. Businesses are increasingly recognizing the value of real-time data and automation in streamlining processes, from warehouse management to customer interaction. The burgeoning e-commerce sector, with its complex supply chains and demanding delivery timelines, necessitates robust tracking and tracing capabilities, making smart labels indispensable. Furthermore, the growing emphasis on counterfeit prevention and product traceability, particularly in high-value sectors like pharmaceuticals and luxury goods, is creating significant demand for secure and intelligent labeling solutions. Consumer demand for personalized experiences and enhanced product information is also a contributing factor. Smart labels, especially those employing NFC technology, can offer consumers direct access to detailed product information, usage instructions, and even interactive content, fostering brand loyalty and engagement. The increasing awareness and adoption of Internet of Things (IoT) devices across various verticals, from smart homes to industrial automation, are creating a fertile ground for smart labels to become an integral part of the connected ecosystem. This interconnectedness allows for the seamless collection and analysis of data, leading to more informed decision-making and optimized operations. Regulatory mandates in certain industries, aimed at improving product safety and recall procedures, are also indirectly boosting the adoption of smart labeling technologies that facilitate precise tracking and identification.

Despite the promising growth trajectory, the Smart Labels market faces certain challenges and restraints that could impede its full potential. A significant hurdle is the initial cost of implementation, particularly for large-scale deployments. While the cost of individual smart labels is decreasing, the investment in associated infrastructure, such as readers and software, can be substantial, posing a barrier for smaller businesses. Another concern revolves around data security and privacy. As smart labels collect and transmit sensitive information, ensuring the robustness of cybersecurity measures to prevent data breaches and unauthorized access is paramount. The complexity of integration with existing legacy systems can also present a challenge, requiring significant IT resources and expertise to ensure smooth interoperability. Furthermore, the need for standardized protocols and interoperability across different technologies and platforms remains an ongoing concern. A lack of universal standards can lead to fragmentation and hinder widespread adoption. The availability of skilled labor for the installation, maintenance, and management of smart labeling systems can also be a limiting factor in some regions. Lastly, user adoption and the perception of added value by end-users, especially consumers, are crucial. If the benefits of smart labels are not clearly communicated or demonstrably impactful, resistance to adoption could slow down market penetration.

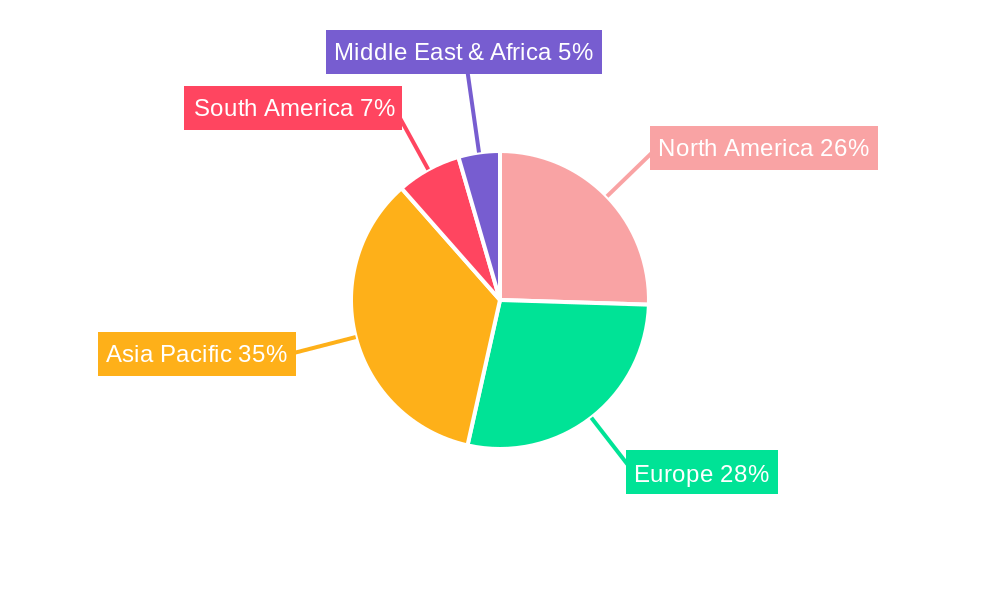

The Retail segment is poised to dominate the global Smart Labels market, with an estimated market share of 35% by 2033, driven by the widespread adoption of Electronic Shelf Labels (ESLs). This dominance is particularly pronounced in North America and Europe, which are expected to collectively account for over 60% of the global market revenue during the forecast period.

Retail Segment Dominance:

Dominant Regions:

The Smart Labels industry is experiencing significant growth catalyzed by several key factors. The escalating adoption of the Internet of Things (IoT) across diverse sectors is creating a demand for interconnected devices, with smart labels serving as crucial data points for real-time monitoring and control. Furthermore, the continuous drive for enhanced supply chain visibility and efficiency is pushing businesses to invest in technologies that offer robust tracking and tracing capabilities. The growing concern over product counterfeiting and the need for enhanced security and authenticity verification are also significant growth drivers, particularly in high-value industries.

This comprehensive report delves into the intricate landscape of the global Smart Labels market, providing a 360-degree view for informed strategic decision-making. The study meticulously analyzes market segmentation, regional dynamics, and technological advancements, offering granular insights into the industry's trajectory from 2019 to 2033. With a base year of 2025, the report projects a robust market valuation of USD 7,500 million by the end of the forecast period, highlighting the significant growth potential driven by burgeoning demand for enhanced supply chain visibility, inventory management, and consumer engagement. The report quantifies market size in millions of units and includes a detailed examination of key industry players, emerging trends, and the critical driving forces and challenges shaping the market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.3%.

Key companies in the market include Checkpoint Systems (CCL), Avery Dennison, Sato Holdings Corporation, Tyco Sensormatic, Smartrac, SES (imagotag), Zebra, Fujitsu, Honeywell, TAG Company, Paragon ID, Century, Pricer, Alien Technology, Invengo Information Technology, Multi-Color Corporation, Samsung, E Ink, Displaydata, .

The market segments include Application, Type.

The market size is estimated to be USD 9650.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Smart Labels," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Smart Labels, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.