1. What is the projected Compound Annual Growth Rate (CAGR) of the Sleep Supplement?

The projected CAGR is approximately 10.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sleep Supplement

Sleep SupplementSleep Supplement by Type (Gummy, Tablet, Capsule, Others, Offline, E-Commerce), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

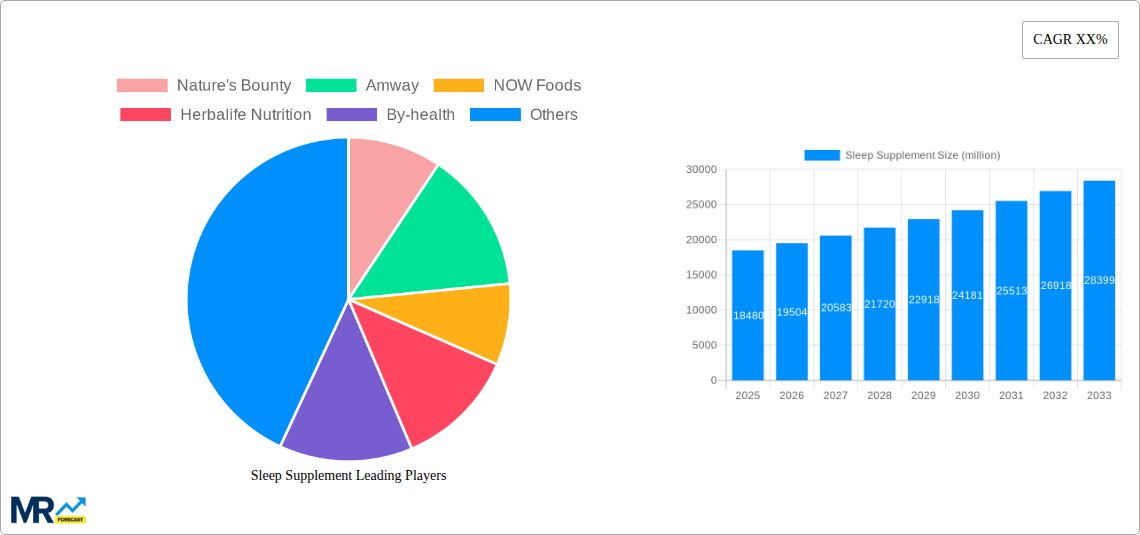

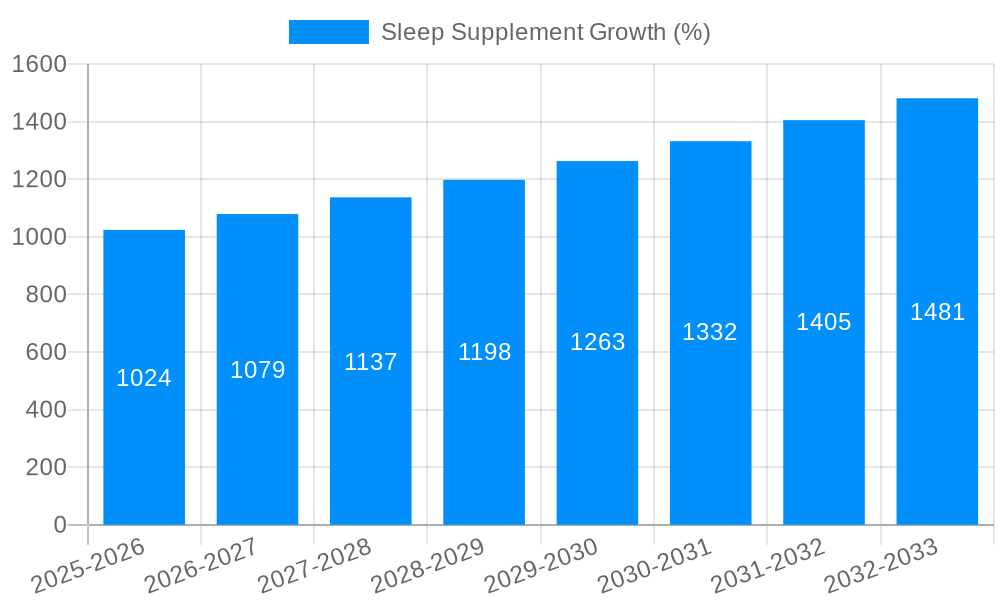

The global sleep supplement market, currently valued at $18.48 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. This expansion is driven by several key factors. Increasing prevalence of sleep disorders like insomnia and sleep apnea, coupled with rising stress levels and irregular lifestyles in modern society, fuels the demand for effective sleep aids. The growing awareness of the importance of sleep for overall health and well-being, alongside increased accessibility through various distribution channels like e-commerce and brick-and-mortar stores, further contributes to market growth. Consumer preference is shifting towards natural and herbal sleep supplements, creating opportunities for brands emphasizing organic ingredients and sustainable practices. The market segmentation reveals a diverse landscape, with gummies, tablets, and capsules holding significant market share, alongside a growing online presence. Competitive rivalry among established players like Nature's Bounty, Amway, and NOW Foods, alongside emerging brands focusing on innovation and specialized formulations, shapes market dynamics. Specific product development, such as targeted formulations for age groups or specific sleep issues, presents promising avenues for future growth.

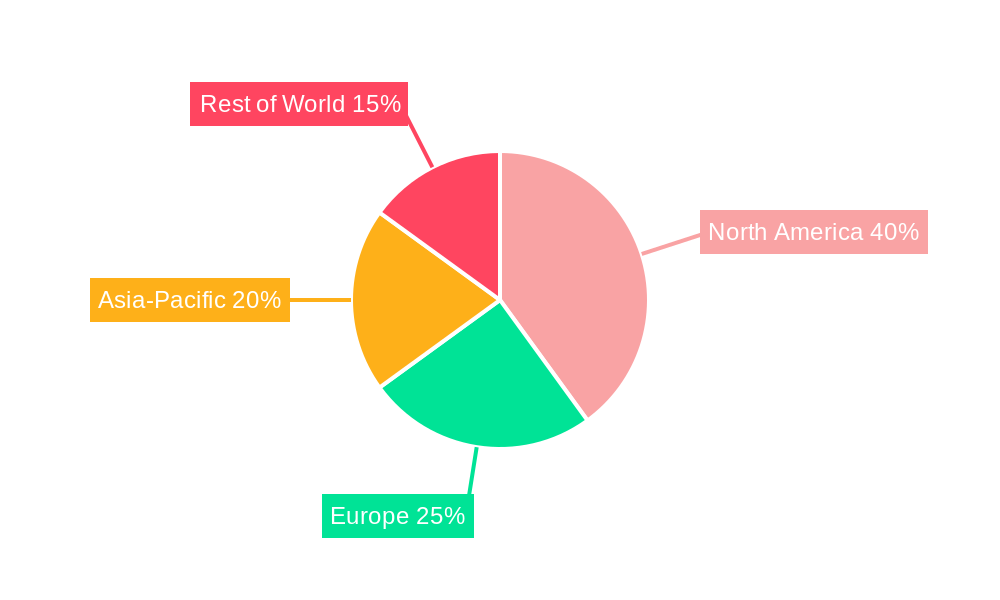

The market's geographic distribution shows a significant presence in North America and Europe, driven by high disposable incomes and increased health consciousness. However, the Asia-Pacific region is expected to witness substantial growth in the coming years due to rapid economic development and rising awareness of sleep health in developing economies like India and China. Regulatory landscape and safety concerns regarding certain ingredients remain a challenge, but manufacturers are addressing these concerns through stringent quality control and transparent labeling practices. The market is also experiencing innovation in delivery methods and formulations, with advancements in targeted drug delivery and personalized sleep solutions. This ongoing innovation ensures the market's dynamic nature, attracting both established and new entrants. The forecast period promises exciting opportunities for companies that successfully adapt to evolving consumer preferences and navigate the regulatory environment.

The global sleep supplement market, valued at XXX million units in 2025, is experiencing robust growth, projected to reach XXX million units by 2033. This surge is driven by a confluence of factors, including rising awareness of sleep disorders, increasing stress levels in modern lifestyles, and a growing preference for natural and over-the-counter solutions for sleep improvement. The market demonstrates a strong preference for convenient formats like gummies and capsules, fueled by the increasing demand for user-friendly and easily ingestible supplements. E-commerce channels are proving to be significant growth drivers, offering convenient access and wider product selection to consumers. However, the market also faces challenges, including regulatory scrutiny regarding ingredient efficacy and safety claims, along with concerns about potential side effects and interactions with other medications. Key players are navigating these challenges through rigorous quality control, transparent labeling, and strategic investments in research and development to enhance product efficacy and safety profiles. The market is also witnessing innovation in supplement formulations, with the emergence of targeted blends combining multiple sleep-promoting ingredients like melatonin, valerian root, and chamomile. This trend reflects the growing sophistication of consumer demand for more holistic and effective sleep solutions, beyond single-ingredient supplements. Furthermore, increasing consumer interest in personalized wellness and preventative healthcare is bolstering demand for sleep supplements tailored to specific needs and age groups. The market segmentation, including product type (gummies, tablets, capsules), distribution channels (offline, e-commerce), and geographic regions, presents a complex landscape with varying growth trajectories and opportunities for different players. The historical period (2019-2024) reveals a steady upward trend, solidifying the market's robust growth trajectory during the forecast period (2025-2033).

Several key factors are propelling the growth of the sleep supplement market. Firstly, the escalating prevalence of sleep disorders globally, including insomnia, sleep apnea, and restless legs syndrome, is a major driver. Modern lifestyles characterized by increased stress, irregular sleep schedules, and excessive screen time contribute significantly to poor sleep quality. This widespread problem fuels the demand for effective solutions, with sleep supplements emerging as a readily accessible and convenient option for many. Secondly, the growing awareness of the crucial role of sleep in overall health and well-being is a significant factor. Consumers are increasingly recognizing the link between quality sleep and improved physical and mental health, driving them to seek out supplements that can improve their sleep patterns. The rising popularity of holistic and natural wellness approaches further fuels this trend, with consumers actively searching for natural remedies to address sleep issues. Finally, the increasing accessibility and convenience of purchasing sleep supplements through both online and offline channels also play a pivotal role. The e-commerce boom provides easy access to a wider range of products and brands, enhancing consumer choice and convenience.

Despite its significant growth, the sleep supplement market faces several challenges. One major concern is the lack of stringent regulation and standardization in the industry. This can lead to inconsistent product quality, inaccurate labeling, and unsubstantiated efficacy claims. Consumers may be misled by marketing materials that overpromise the benefits of particular supplements. Furthermore, the potential for adverse side effects and interactions with other medications poses a significant risk. Some ingredients commonly found in sleep supplements, such as melatonin, can have unintended consequences when taken in excessive doses or in combination with other drugs. The inherent variability in individual responses to supplements also complicates the issue, making it challenging to predict how a particular product will affect a specific consumer. Finally, the competitive landscape within the market, with numerous brands vying for market share, creates a challenge for individual companies to stand out and establish a strong brand presence. Overcoming these challenges requires a commitment to ethical business practices, rigorous quality control, transparent labeling, and investments in scientific research to validate product efficacy and safety.

The e-commerce segment is poised to dominate the sleep supplement market during the forecast period (2025-2033).

E-commerce Convenience: Online platforms offer unparalleled convenience, allowing consumers to browse and purchase sleep supplements from the comfort of their homes at any time. This factor is especially appealing to busy individuals and those with limited mobility.

Wider Product Selection: E-commerce channels typically offer a much broader selection of sleep supplements compared to traditional brick-and-mortar stores. Consumers can easily compare products from various brands and choose the option that best meets their individual needs and preferences.

Targeted Advertising and Personalization: E-commerce platforms leverage data analytics to deliver targeted advertising and personalized recommendations, increasing the likelihood of conversion and repeat purchases.

Competitive Pricing: Online retailers often offer more competitive pricing compared to traditional retailers, further enhancing the attractiveness of this segment.

Global Reach: E-commerce platforms transcend geographical boundaries, allowing businesses to reach consumers worldwide, regardless of their location. This expansion significantly increases the overall market potential for sleep supplements.

The growth of this segment is further fueled by increasing internet penetration rates, particularly in developing economies, and the rising adoption of mobile commerce. This makes it easier for people to access health and wellness products online. Furthermore, the growing popularity of online reviews and ratings provides consumers with valuable insights before making their purchases, fostering trust and confidence in online transactions. This builds consumer confidence in this rapidly growing segment. Several major players in the sleep supplement industry are already heavily invested in expanding their online presence and enhancing their e-commerce capabilities, recognizing its significant growth potential. This intense competition further accelerates innovation and expansion within the online space, leading to a significant increase in sales of sleep supplements through e-commerce channels.

The sleep supplement industry's growth is catalyzed by rising consumer awareness of the importance of sleep, increased stress levels in modern life, and the burgeoning popularity of convenient and easily accessible wellness solutions. This convergence drives the demand for effective and natural sleep aids, providing a fertile ground for market expansion.

The comprehensive sleep supplement report offers a detailed analysis of market trends, driving forces, challenges, key players, and significant developments. The report provides valuable insights for stakeholders, including manufacturers, distributors, and investors, seeking to understand the dynamics of this rapidly growing market and capitalize on emerging opportunities. The in-depth analysis enables informed decision-making, strategic planning, and effective resource allocation within the sleep supplement sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.0%.

Key companies in the market include Nature's Bounty, Amway, NOW Foods, Herbalife Nutrition, By-health, SWISSE, GNC, Nestlé, Moon Juice, Otsuka Pharmaceutical Co., Ltd., Unipharm, Pure Healthland, Hum Nutrition, Jarrow Formulas, Tylenol, Ion Labs, Biotics Research.

The market segments include Type.

The market size is estimated to be USD 18480 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Sleep Supplement," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sleep Supplement, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.