1. What is the projected Compound Annual Growth Rate (CAGR) of the Single Phase Built-In Overload Protector?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Single Phase Built-In Overload Protector

Single Phase Built-In Overload ProtectorSingle Phase Built-In Overload Protector by Application (Refrigerator, Freezer, Air Conditioner, Others, World Single Phase Built-In Overload Protector Production ), by Type (Thermal, Electromagnetic, Others, World Single Phase Built-In Overload Protector Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

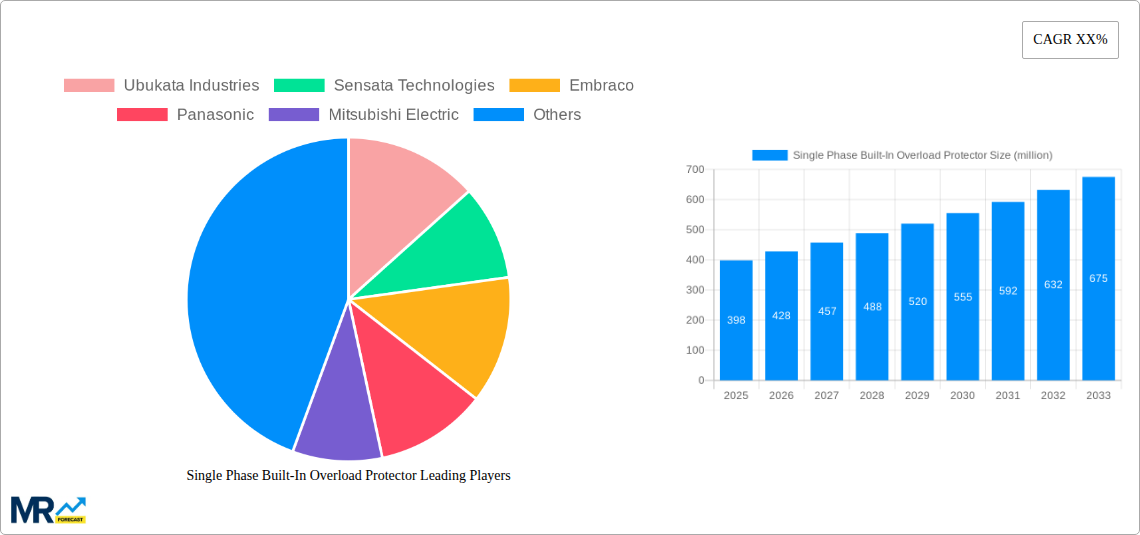

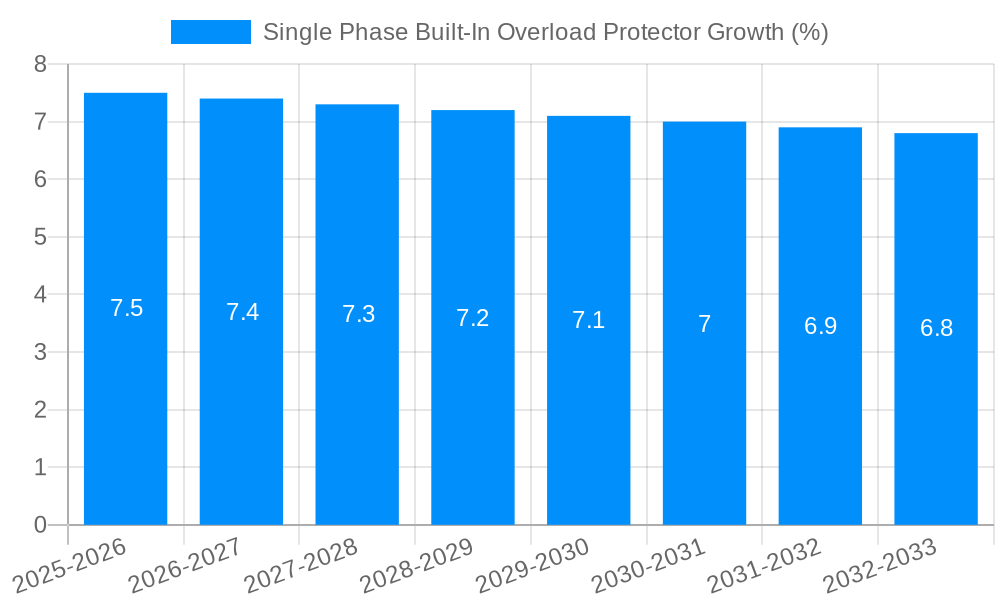

The global market for Single Phase Built-In Overload Protectors is poised for significant expansion, estimated at a robust 398 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% throughout the forecast period of 2025-2033. This growth is primarily fueled by the increasing demand for energy-efficient and reliable appliances, where these protectors play a critical role in safeguarding electrical components from overcurrents and overheating. The burgeoning consumer electronics sector, coupled with the continuous innovation in home appliances like refrigerators and freezers, is a major catalyst. Furthermore, the growing adoption of air conditioning systems, especially in developing economies, significantly contributes to market expansion. The market is characterized by a strong emphasis on technological advancements, leading to the development of more sophisticated and compact overload protectors.

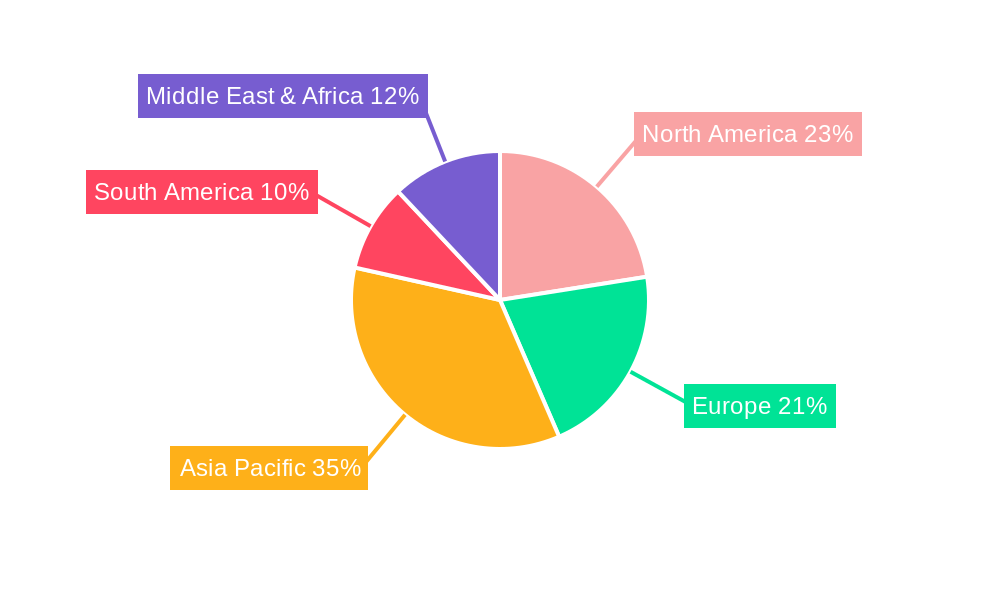

The market segmentation reveals a diverse application landscape, with refrigerators and freezers representing the largest segments due to their widespread use in both residential and commercial settings. Air conditioners also present a substantial growth opportunity. On the type front, thermal overload protectors are expected to dominate, owing to their cost-effectiveness and widespread applicability. However, electromagnetic and other advanced types are also gaining traction as manufacturers seek enhanced performance and specialized protection solutions. Geographically, Asia Pacific is anticipated to lead the market, driven by rapid industrialization, urbanization, and a burgeoning middle class with increasing disposable income to spend on modern appliances. North America and Europe remain significant markets due to the established appliance industry and stringent safety regulations, while emerging economies in South America and the Middle East & Africa offer considerable untapped potential for future growth. Key industry players are actively involved in strategic collaborations and product development to capture market share and address evolving consumer needs.

This comprehensive report delves into the intricacies of the global Single Phase Built-In Overload Protector market, offering detailed analysis and future projections from the historical period of 2019-2024 through to the forecast period of 2025-2033, with 2025 serving as both the base and estimated year. The study provides a granular examination of market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments. The report quantifies market dynamics with millions of units, offering a clear perspective on market size and growth trajectories across various applications and technologies.

The global Single Phase Built-In Overload Protector market is exhibiting robust and consistent growth, driven by an escalating demand for enhanced electrical safety and energy efficiency across a myriad of applications. During the study period from 2019 to 2033, the market is projected to witness a significant upward trajectory, with the base year of 2025 setting the benchmark for projected figures in the millions of units. A key insight is the increasing integration of these protectors in smaller, more sophisticated appliances, moving beyond traditional heavy-duty machinery. For instance, while refrigerators and air conditioners have historically been significant consumers, the "Others" category, encompassing smart home devices, portable electronics, and specialized industrial equipment, is emerging as a potent growth engine. The increasing sophistication of these devices, often operating with sensitive electronic components, necessitates highly reliable and precise overload protection to prevent damage and ensure longevity. Furthermore, the heightened awareness regarding electrical fire hazards and the stringent regulatory landscape in developed and developing nations are compelling manufacturers and end-users to adopt advanced protection solutions. This trend is further amplified by the continuous innovation in protector technologies, with advancements in thermal and electromagnetic designs offering improved response times, reduced power consumption, and enhanced durability. The market is also experiencing a shift towards miniaturization and cost-effectiveness without compromising on performance, making these protectors accessible for a broader range of applications. The overarching trend indicates a market poised for sustained expansion, fueled by both technological advancements and an unwavering focus on electrical safety. The global production in millions of units is expected to reflect this dynamic growth throughout the forecast period.

The global Single Phase Built-In Overload Protector market is experiencing a powerful surge, propelled by several interconnected driving forces that underscore the increasing criticality of these safety devices. A primary driver is the escalating global demand for home appliances and consumer electronics. As populations grow and living standards improve, the adoption of refrigerators, freezers, and air conditioners, particularly in emerging economies, continues to rise exponentially. Each of these units relies on robust overload protection to prevent motor burnout and ensure operational longevity. Coupled with this is the overarching trend of increased automation and the proliferation of smart devices. These modern systems, often incorporating sensitive electronics, require precise and rapid overload protection to safeguard their complex circuitry from unexpected power fluctuations or component failures. Furthermore, a heightened global emphasis on electrical safety standards and regulations is a significant catalyst. Governments and regulatory bodies worldwide are enacting and enforcing stricter safety protocols for electrical equipment, mandating the inclusion of reliable overload protection mechanisms. This regulatory pressure directly translates into increased demand for these protectors. The continuous innovation and technological advancements in the development of overload protectors also play a crucial role. Manufacturers are investing heavily in research and development to create more efficient, compact, and cost-effective solutions, including advancements in thermal and electromagnetic technologies, which further broaden their applicability and market appeal.

Despite the promising growth trajectory, the Single Phase Built-In Overload Protector market is not without its challenges and restraints. One of the significant hurdles is the price sensitivity of certain market segments, particularly in developing economies where cost-effectiveness is a paramount consideration for consumers and manufacturers alike. The need to balance superior protection capabilities with affordable pricing can sometimes limit the adoption of premium, technologically advanced overload protectors. Furthermore, the competitive landscape, characterized by a multitude of players offering a wide spectrum of products, can lead to intense price wars, potentially impacting profit margins for manufacturers. Another considerable challenge is the complexity and cost associated with the integration of these protectors into certain compact or highly specialized appliances. For manufacturers of miniaturized electronics or niche equipment, the space constraints and the need for custom-designed protection solutions can present significant engineering and economic challenges. The evolving nature of electrical standards and the need for continuous compliance can also be a restraint, requiring manufacturers to constantly adapt their product offerings and testing procedures, which incurs additional research and development costs. Moreover, the emergence of alternative protection technologies or integrated solutions within larger control systems could potentially fragment the market and present competition to standalone overload protectors. Lastly, fluctuations in raw material costs and supply chain disruptions can also pose a significant challenge, impacting production costs and the overall availability of components.

The global Single Phase Built-In Overload Protector market is poised for significant regional and segmental dominance, with Asia-Pacific emerging as a powerhouse for both production and consumption. This dominance is underpinned by a confluence of factors, including rapid industrialization, burgeoning consumer electronics markets, and a substantial manufacturing base. Within the Application segment, Air Conditioners and Refrigerators are expected to continue their reign as major market drivers. The escalating demand for cooling solutions in both residential and commercial sectors across the Asia-Pacific region, particularly in countries like China, India, and Southeast Asian nations, fuels the need for millions of reliable overload protectors annually. These appliances, integral to modern living, rely heavily on these devices for efficient and safe operation. The Others segment, encompassing a vast array of devices from industrial machinery to smart home devices, is also witnessing exponential growth in this region, further solidifying Asia-Pacific's leading position.

From a Type perspective, Thermal overload protectors are anticipated to maintain a significant market share due to their cost-effectiveness and widespread applicability, especially in motor protection for appliances like refrigerators and air conditioners. However, the growing emphasis on precision and faster response times in more sophisticated electronic applications is also driving the adoption of Electromagnetic overload protectors. The region’s robust manufacturing ecosystem, capable of producing these protectors at scale, contributes significantly to global production figures in the millions of units. The "World Single Phase Built-In Overload Protector Production" metric, therefore, is heavily influenced by the output originating from Asia-Pacific. Countries like China are not only major consumers but also leading exporters of these components, supplying global markets. The presence of key manufacturers within this region further accentuates its dominance.

Beyond Asia-Pacific, North America and Europe also represent significant markets, driven by stringent safety regulations, a mature consumer electronics sector, and a strong emphasis on energy efficiency. However, the sheer volume of production and consumption, coupled with rapid economic development, positions Asia-Pacific at the forefront of market dominance throughout the study period (2019-2033). The "World Single Phase Built-In Overload Protector Production" is inextricably linked to the manufacturing prowess and consumption patterns observed within this dynamic region.

Several potent growth catalysts are accelerating the expansion of the Single Phase Built-In Overload Protector industry. The increasing adoption of energy-efficient appliances, mandated by governmental regulations and consumer demand, necessitates robust protection mechanisms to ensure optimal performance and longevity. Furthermore, the burgeoning smart home ecosystem, with its interconnected devices, demands sophisticated overload protection to safeguard sensitive electronics from power anomalies. The continuous technological advancements, leading to more compact, precise, and cost-effective protector designs, are expanding their applicability across a wider range of products.

This report offers an exhaustive exploration of the Single Phase Built-In Overload Protector market, providing unparalleled insights for stakeholders. It meticulously analyzes market size and growth forecasts in millions of units from 2019 to 2033, with a detailed focus on the base and estimated year of 2025. The report dissects key market trends, identifies the primary driving forces, and scrutinizes the challenges and restraints impacting the industry. It highlights dominant regions and segments, offering a comprehensive understanding of market dynamics. Furthermore, it pinpoints crucial growth catalysts and profiles the leading players, alongside a chronological overview of significant industry developments. This comprehensive coverage ensures a deep and actionable understanding of the global Single Phase Built-In Overload Protector landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ubukata Industries, Sensata Technologies, Embraco, Panasonic, Mitsubishi Electric, Emerson, Yamada Electric, Honeywell, Thermtrol Corporation, Star Shuaier Electric Appliance, Changrong Electric, Haichuan Electronic.

The market segments include Application, Type.

The market size is estimated to be USD 398 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Single Phase Built-In Overload Protector," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Single Phase Built-In Overload Protector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.