1. What is the projected Compound Annual Growth Rate (CAGR) of the Scrap Tire Shredding Equipment?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Scrap Tire Shredding Equipment

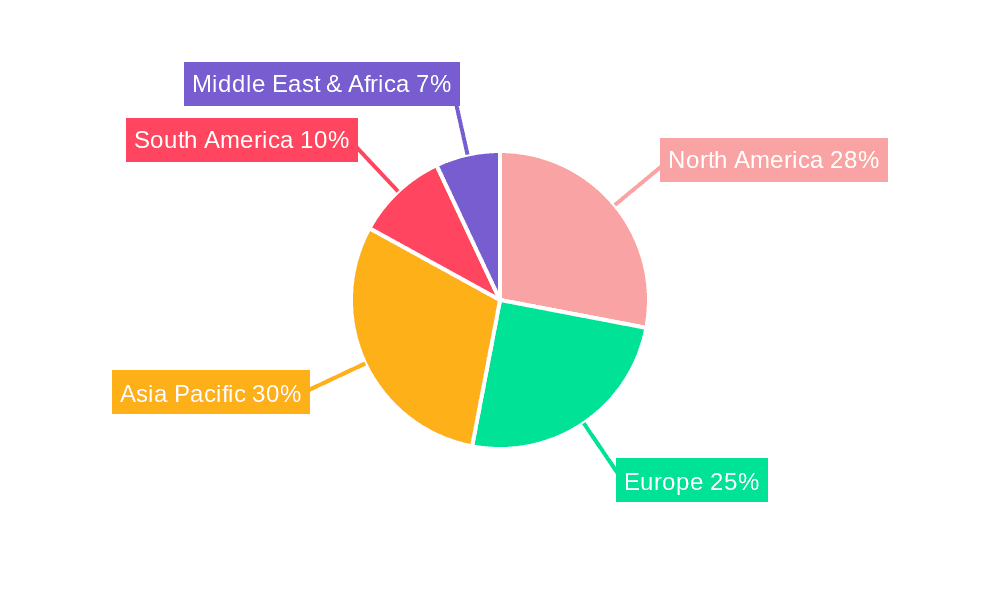

Scrap Tire Shredding EquipmentScrap Tire Shredding Equipment by Type (Electrical Tire Shredder, Hydraulic Tire Shredder), by Application (Shredding of Rubber Tires, Shredding of Radial Tires, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

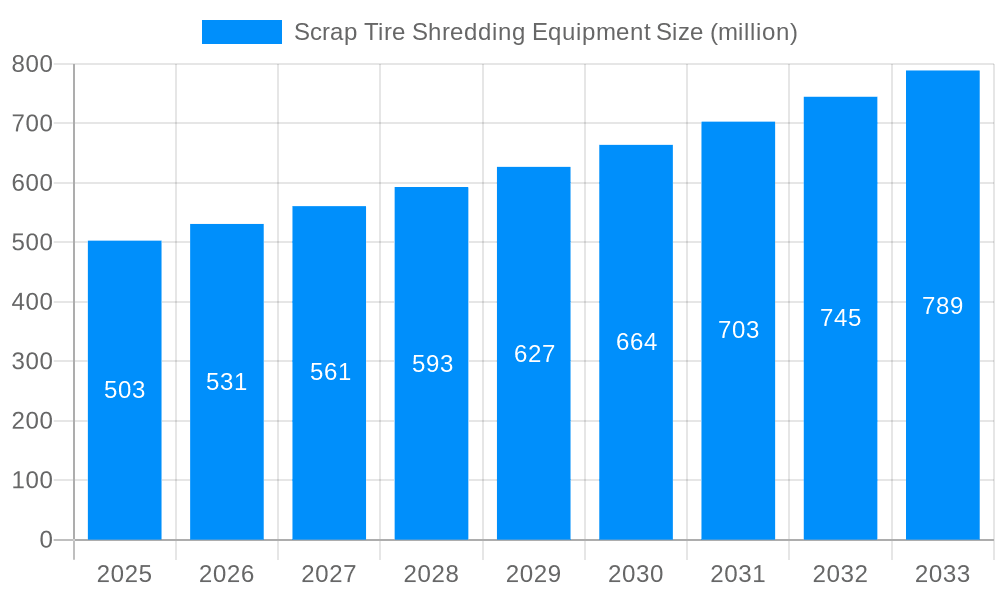

The global market for scrap tire shredding equipment is poised for robust growth, estimated at a value of USD 503 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.6% through 2033. This expansion is primarily fueled by the escalating global volume of end-of-life tires, driven by increased vehicle production and ownership worldwide. The growing environmental consciousness and stringent regulations concerning tire waste management are compelling industries to adopt efficient shredding solutions for recycling and reuse. These shredded tires find applications in various sectors, including the production of crumb rubber for asphalt modification, playground surfaces, and industrial molded products, creating a strong demand for advanced shredding technologies. The market is experiencing a significant shift towards more automated and energy-efficient shredders that can handle diverse tire types and sizes, thereby enhancing operational efficiency and reducing processing costs for end-users.

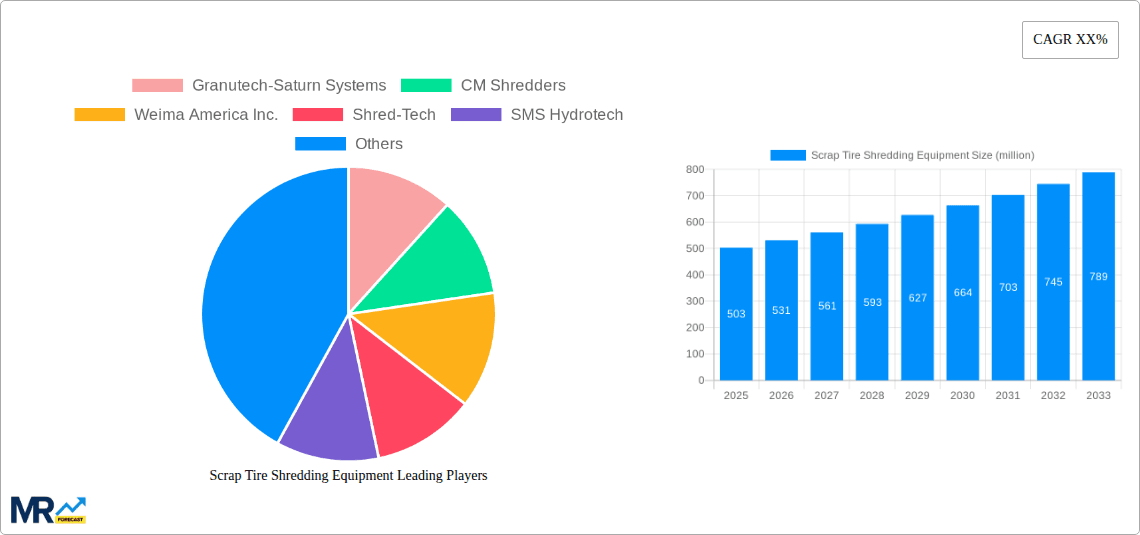

Further analysis reveals that the market is shaped by continuous innovation in shredder design, focusing on improved throughput, reduced maintenance, and enhanced safety features. Key drivers include advancements in shredding technology, the increasing adoption of tire-derived fuel (TDF) in industries like cement manufacturing, and the growing demand for recycled rubber products. However, challenges such as the high initial investment cost of sophisticated shredding machinery and the complexities associated with tire collection and logistics in certain regions might temper growth. Emerging economies, particularly in the Asia Pacific region, are expected to witness substantial market expansion due to rapid industrialization and a burgeoning automotive sector. The competitive landscape is characterized by the presence of several established players and emerging manufacturers, all striving to capture market share through product differentiation, technological prowess, and strategic partnerships.

Here is a unique report description on Scrap Tire Shredding Equipment, incorporating your specified requirements:

XXX (mention key market insights) The global scrap tire shredding equipment market is poised for substantial growth, projected to reach $2,100 million by the end of the forecast period in 2033, a remarkable increase from its valuation in the historical period. This expansion is driven by an escalating global volume of end-of-life tires, a consequence of increased vehicle ownership and a burgeoning automotive sector, particularly in emerging economies. The Base Year of 2025 signifies a critical point where the market is expected to demonstrate a robust trajectory, with the Estimated Year aligning with this optimistic outlook. The Study Period, spanning from 2019 to 2033, encompasses both the nascent recovery from past economic fluctuations and the anticipation of significant technological advancements. Key market insights reveal a growing emphasis on equipment efficiency, energy consumption reduction, and the production of higher-value tire-derived fuel (TDF) and rubber crumb for a variety of industrial applications. The increasing regulatory pressure on proper tire disposal and recycling is also a significant factor influencing market dynamics. Furthermore, the adoption of advanced shredding technologies, including those offering finer particle sizes and greater throughput, is becoming a competitive differentiator. The market is witnessing a shift towards more automated and intelligent shredding systems that can optimize operational parameters in real-time, thereby enhancing productivity and minimizing downtime. The historical period of 2019-2024 laid the groundwork for this current optimism, characterized by steady adoption rates and initial technological refinements. As we move into the Forecast Period (2025-2033), these trends are expected to accelerate, fueled by innovation and an ever-growing need for sustainable tire management solutions. The market is also observing increased investment in research and development by leading manufacturers, aimed at creating more robust, versatile, and environmentally friendly shredding equipment. This proactive approach by industry players is expected to further solidify the market's upward momentum. The integration of smart technologies, such as IoT sensors and predictive maintenance capabilities, is also beginning to shape the competitive landscape, offering new avenues for operational excellence and cost optimization.

The surge in scrap tire generation worldwide acts as the primary propellant for the scrap tire shredding equipment market. An ever-expanding global vehicle fleet, coupled with the typical lifespan of tires, results in millions of end-of-life tires requiring efficient and environmentally sound disposal. This escalating volume necessitates robust shredding solutions to break down tires into manageable materials for recycling and repurposing. Moreover, the growing awareness and stringent government regulations concerning the environmental impact of tire dumps, such as fire hazards and leaching of harmful chemicals, are compelling municipalities and industries to invest in advanced shredding technologies. This regulatory push is creating a sustained demand for equipment that can effectively process these waste streams. The increasing demand for tire-derived products (TDPs), including rubber crumb for playgrounds, sports surfaces, asphalt modification, and the production of TDF for energy generation, further fuels the market. As industries recognize the economic value embedded in scrap tires, the investment in shredding equipment to unlock these resources naturally increases. This circular economy approach, where waste is transformed into valuable commodities, is a significant driving force behind the market's expansion. The pursuit of sustainable practices and the reduction of landfill burden are becoming paramount, making efficient tire shredding an indispensable component of modern waste management strategies.

Despite the promising growth trajectory, the scrap tire shredding equipment market faces several challenges that can temper its expansion. A significant hurdle is the substantial initial capital investment required for high-capacity and advanced shredding machinery. The cost of these industrial-grade systems can be prohibitive for smaller recycling operations, thus limiting widespread adoption in certain regions or segments. Furthermore, the inconsistent quality and composition of scrap tires can present operational challenges. Factors such as varying tire sizes, the presence of steel belts and bead wires, and contamination can affect shredder performance and necessitate frequent maintenance, leading to increased operational costs and downtime. The energy consumption of some shredding processes is also a concern, particularly in regions with high electricity prices. Manufacturers are continuously working to improve energy efficiency, but this remains an ongoing challenge. Public perception and the NIMBY (Not In My Backyard) syndrome associated with recycling facilities can also create regulatory and logistical obstacles for the establishment and expansion of shredding operations. Finally, fluctuating commodity prices for recycled tire materials can impact the economic viability of recycling operations, indirectly affecting the demand for shredding equipment as profitability becomes uncertain.

The Application Segment: Shredding of Rubber Tires, particularly for the purpose of producing rubber crumb and tire-derived fuel (TDF), is expected to be a dominant force in the scrap tire shredding equipment market. This segment's dominance is underpinned by a confluence of factors that drive consistent and high-volume demand for shredded tire material. The increasing global adoption of rubber crumb in diverse applications, such as athletic tracks, playground surfaces, synthetic turf infill, and as an additive in asphalt for road construction, creates a steady stream of demand for finely shredded rubber. The performance benefits of rubber crumb – including shock absorption, durability, and drainage – make it a preferred material in these sectors. Simultaneously, the growing need for alternative and renewable energy sources has propelled the use of TDF in cement kilns, power plants, and industrial boilers. The high calorific value of shredded tires makes them an attractive fuel substitute, contributing to cost savings and a reduced carbon footprint for energy producers. This dual demand from both the materials recycling and energy sectors ensures a robust and consistent market for shredded tire output.

Geographically, North America and Europe are projected to lead the market in terms of revenue and adoption of advanced scrap tire shredding equipment. These regions have well-established regulatory frameworks mandating tire recycling and promoting the use of recycled tire materials. For instance, the United States has a comprehensive system for managing end-of-life tires, with numerous state-level initiatives encouraging recycling. Similarly, the European Union's stringent environmental policies and its commitment to a circular economy foster a strong demand for tire recycling solutions. The presence of advanced manufacturing capabilities, higher disposable incomes, and a mature industrial base in these regions also contribute to their market leadership. Companies in these regions are more inclined to invest in cutting-edge shredding technology that offers greater efficiency, lower operating costs, and the ability to produce high-quality shredded materials that meet specific industry standards. The market in these regions is characterized by a shift towards more sophisticated processing, including multi-stage shredding and granulation to achieve precisely sized rubber particles.

The scrap tire shredding equipment industry is propelled by a potent combination of environmental consciousness and economic opportunity. The escalating global volume of end-of-life tires, driven by increased vehicle ownership, necessitates efficient and sustainable disposal solutions. Stringent government regulations worldwide, aimed at mitigating the environmental hazards posed by tire stockpiles, are compelling investments in shredding infrastructure. Furthermore, the burgeoning demand for tire-derived products, such as rubber crumb for construction and landscaping, and tire-derived fuel (TDF) for energy generation, creates a valuable market for processed tires. This creates a positive feedback loop where environmental imperatives fuel resource recovery, which in turn drives demand for the equipment that makes it possible.

This comprehensive report delves into the multifaceted global scrap tire shredding equipment market, offering in-depth analysis and actionable insights. The study meticulously examines market dynamics, including the projected $2,100 million valuation by 2033, underpinned by extensive data from the 2019-2033 Study Period, with 2025 serving as the pivotal Base and Estimated Year. The report dissects the driving forces, such as escalating tire waste and stringent environmental regulations, alongside critical challenges like high initial investment and operational complexities. It further identifies key regions and segments poised for dominance, with a particular focus on the Shredding of Rubber Tires application and its vital role in producing rubber crumb and TDF, alongside regional leadership in North America and Europe. Leading manufacturers are profiled, and significant industry developments are detailed chronologically. The report provides a holistic view of market trends, technological advancements, and future growth catalysts, offering a definitive resource for stakeholders seeking to understand and capitalize on the evolving landscape of scrap tire shredding equipment.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Granutech-Saturn Systems, CM Shredders, Weima America Inc., Shred-Tech, SMS Hydrotech, SSI Shredding System, ACS Group, Fabtex Engineering Works, Tire Shredder Unlimited, Gongyi Yuanda Machinery Manufacturing Co., Ltd., Henan China Recycling Technology Co., Ltd., Gongyi Hongfu Machinery Manufacturing Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Scrap Tire Shredding Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Scrap Tire Shredding Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.