1. What is the projected Compound Annual Growth Rate (CAGR) of the Sandwich and Wrap Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sandwich and Wrap Packaging

Sandwich and Wrap PackagingSandwich and Wrap Packaging by Type (Plastic, Kraft Paper, Greaseproof Paper, Wax Paper, Foil Paper, Aluminium Foil), by Application (Hotels, Restaurants, Cafes, Fast Food Outlets), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

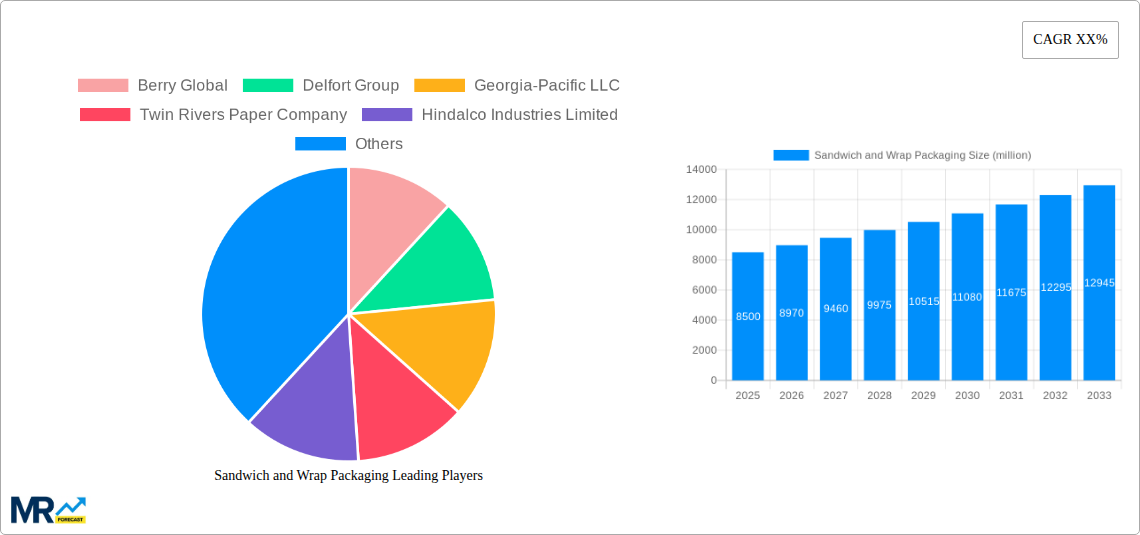

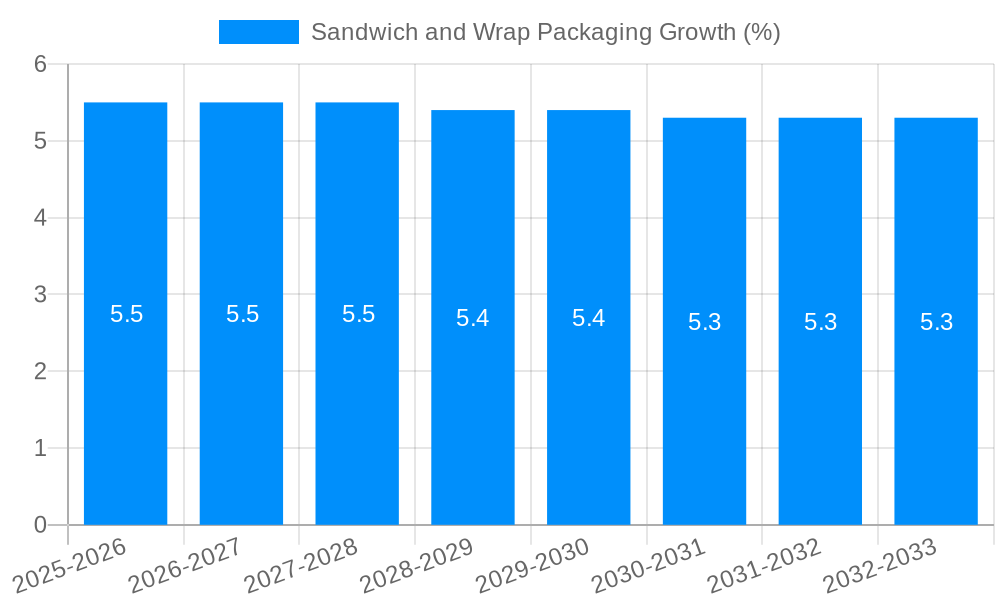

The global sandwich and wrap packaging market is poised for significant expansion, projected to reach approximately $8,500 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of around 5.5% through 2033. This robust growth is primarily propelled by the increasing demand for convenient and on-the-go food options, particularly within the fast-food and quick-service restaurant sectors. Consumers' evolving lifestyles, characterized by busy schedules, are fueling the consumption of pre-packaged sandwiches and wraps, making efficient and attractive packaging a critical component for food businesses. The market is witnessing a strong shift towards sustainable packaging solutions, with Kraft paper and greaseproof paper segments gaining considerable traction as consumers and businesses alike prioritize eco-friendly alternatives over traditional plastic. This trend is not only driven by environmental consciousness but also by increasing regulatory pressures and corporate sustainability initiatives.

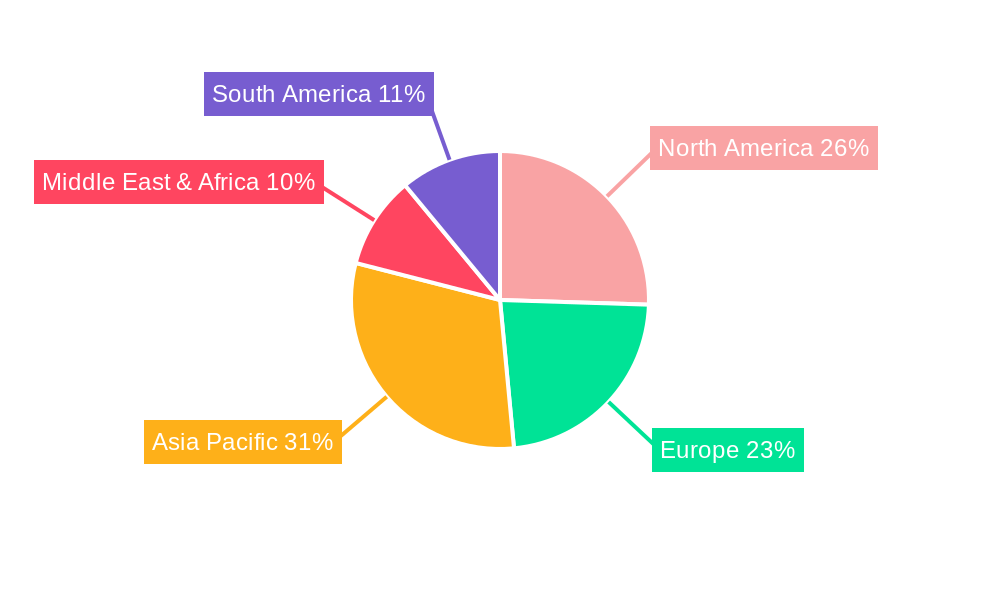

Further analysis reveals that innovation in packaging design, focusing on enhanced product freshness, portability, and visual appeal, will continue to drive market development. The application segment is dominated by hotels, restaurants, and cafes, with fast-food outlets showing the fastest growth potential due to their high volume of sandwich and wrap sales. Geographically, the Asia Pacific region, led by China and India, is emerging as a key growth engine, owing to rapid urbanization, a burgeoning middle class, and the widespread adoption of Western food culture. While the market benefits from strong demand drivers, potential restraints include the fluctuating raw material prices, particularly for plastic and paper, and intense competition among established players and new entrants. The competitive landscape is characterized by strategic partnerships, mergers, and acquisitions aimed at expanding product portfolios and geographical reach. Key players such as Amcor plc, Mondi Group, and Berry Global are actively investing in research and development to introduce advanced packaging solutions that address both consumer needs and sustainability concerns.

The global sandwich and wrap packaging market is poised for significant expansion, driven by evolving consumer preferences and the burgeoning food service industry. Between the study period of 2019 and 2033, with a base year of 2025, the market is expected to witness a substantial increase in demand for innovative and sustainable packaging solutions. The historical period from 2019 to 2024 laid the groundwork for this growth, characterized by increasing urbanization and a greater reliance on convenience foods. The estimated year of 2025 acts as a critical juncture, reflecting current market dynamics and setting the stage for robust growth in the forecast period of 2025-2033. The sheer volume of transactions in the food service sector, encompassing millions of sandwiches and wraps consumed daily, underscores the critical role of effective and appealing packaging. Consumer demand for on-the-go meals, coupled with a growing awareness of environmental impact, is reshaping the packaging landscape. This has led to a diversification of packaging types, moving beyond traditional options to embrace materials that offer enhanced functionality, visual appeal, and eco-friendliness. The emphasis on branding and product differentiation further fuels the need for customizable and aesthetically pleasing packaging, allowing food businesses to stand out in a competitive market. Furthermore, advancements in material science and manufacturing technologies are enabling the creation of packaging that offers superior barrier properties, extending shelf life and maintaining the freshness and integrity of the food product. The convenience factor remains paramount, with consumers seeking packaging that is easy to open, re-sealable, and portable. This trend is particularly evident in the fast-food sector, where rapid service and ease of consumption are essential. As urban populations continue to grow and lifestyles become more hectic, the demand for convenient and portable food options, and by extension, their packaging, is expected to surge. The market is also observing a rise in demand for specialized packaging that caters to specific dietary needs and preferences, such as gluten-free or vegan options, which often require distinct labeling and material considerations to prevent cross-contamination and communicate key information clearly. The integration of smart packaging technologies, although still in its nascent stages for this specific market, also presents future opportunities, with potential for temperature monitoring, authenticity verification, and enhanced consumer engagement.

The sandwich and wrap packaging market is experiencing a powerful surge driven by a confluence of socioeconomic and industry-specific factors. The relentless growth of the global food service sector, encompassing the vast operational scale of hotels, restaurants, cafes, and fast-food outlets, forms the bedrock of this demand. Millions of units of sandwiches and wraps are prepared and served daily, each requiring robust and appropriate packaging. This constant, high-volume consumption directly translates into an insatiable need for reliable packaging solutions. Coupled with this is the undeniable shift in consumer lifestyles towards convenience and on-the-go consumption. As populations urbanize and daily routines become more demanding, individuals increasingly opt for quick, portable meal solutions. Sandwiches and wraps perfectly fit this paradigm, and their packaging is an integral part of their appeal and practicality. The rise of food delivery services has further amplified this trend, creating an even greater reliance on packaging that can withstand transit and maintain food quality. Moreover, there's a significant and growing consumer consciousness around sustainability. This is not just a niche concern but a mainstream expectation, forcing manufacturers and food businesses to prioritize eco-friendly and recyclable packaging materials. Businesses are actively seeking packaging that minimizes environmental impact without compromising on functionality or aesthetic appeal, leading to innovations in biodegradable, compostable, and recycled content materials. Brand differentiation and marketing also play a crucial role; attractive and well-branded packaging can significantly influence purchasing decisions and enhance brand loyalty in a crowded marketplace.

Despite the robust growth trajectory, the sandwich and wrap packaging market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the increasing regulatory scrutiny and pressure regarding single-use plastics. Governments worldwide are implementing stricter legislation and outright bans on certain plastic packaging materials due to environmental concerns. This necessitates a costly and time-consuming transition to alternative materials, which may not always offer the same level of performance or cost-effectiveness. The fluctuating costs of raw materials also pose a significant challenge. Prices of plastics, paper pulp, and aluminum can be volatile, impacting the profitability of packaging manufacturers and subsequently influencing the pricing for food businesses. Furthermore, the development and adoption of truly sustainable and biodegradable packaging solutions are still evolving. While many alternatives exist, some may compromise on barrier properties, leading to shorter shelf life or increased spoilage, which can result in significant food waste – a counterproductive environmental outcome. The infrastructure for collecting, sorting, and recycling certain types of packaging, particularly multi-layer materials, is also not universally developed, hindering the circularity of these products. Consumer perception and willingness to pay a premium for sustainable packaging can also be a restraint. While awareness is high, the actual willingness to bear higher costs for eco-friendly options may vary across different consumer segments and regions. Finally, the operational complexities of transitioning to new packaging formats for established businesses can be a deterrent, requiring investment in new machinery, retraining of staff, and potential disruptions to existing production lines.

The global sandwich and wrap packaging market is characterized by dynamic regional influences and segment dominance, with specific areas and product categories poised to lead the expansion.

Dominant Segments:

Dominant Regions:

Several key factors are acting as potent catalysts for growth within the sandwich and wrap packaging industry. The persistent global trend towards urbanization and busier lifestyles directly fuels the demand for convenient, portable food options, with sandwiches and wraps being prime examples. The expansion of the food service industry, encompassing quick-service restaurants, cafes, and catering services, provides a constant and increasing need for effective packaging. Furthermore, a heightened consumer awareness and demand for sustainable and eco-friendly packaging solutions are driving innovation and market penetration of materials like kraft paper, greaseproof paper, and those with recycled content. The ability of packaging to enhance brand visibility and communicate product information effectively also acts as a significant growth driver, encouraging businesses to invest in aesthetically pleasing and informative packaging.

This comprehensive report delves into the intricate dynamics of the global sandwich and wrap packaging market, spanning the study period from 2019 to 2033, with 2025 serving as the pivotal base and estimated year. It meticulously analyzes historical trends from 2019-2024, forecasts future market trajectories from 2025-2033, and provides in-depth insights into the market's current state and future potential. The report examines key market drivers, including the escalating demand for convenience foods driven by urbanization and evolving consumer lifestyles, and the substantial growth of the food service industry. It also addresses critical challenges such as increasing regulatory pressures on single-use plastics, fluctuating raw material costs, and the ongoing development of truly sustainable packaging alternatives. Furthermore, the report offers a granular overview of dominant market segments by type (Plastic, Kraft Paper, Greaseproof Paper, Wax Paper, Foil Paper, Aluminium Foil) and application (Hotels, Restaurants, Cafes, Fast Food Outlets), identifying regions like North America and Asia Pacific as key growth hubs. It highlights significant developments and strategic initiatives undertaken by leading global players, providing a holistic understanding of this dynamic and evolving industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Berry Global, Delfort Group, Georgia-Pacific LLC, Twin Rivers Paper Company, Hindalco Industries Limited, Huhtamaki Oyj, Mitsubishi HiTec Paper, Amcor plc, Mondi Group, Thong Guan Industries Berhad, The Clorox Company, United Company RUSAL, Hulamin Limited, Anchor Packaging, Harwal Group, Oji Holdings Corporation, S. C. Johnson & Son, Nordic Paper AS, Advanced Coated Products Ltd. (The Food Wrap Co.), Pudumjee Paper Products, KRPA Holding CZ, BPM, Seaman Paper Company, Schweitzer-Mauduit International Inc., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Sandwich and Wrap Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sandwich and Wrap Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.