1. What is the projected Compound Annual Growth Rate (CAGR) of the Safety Cans & Containers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Safety Cans & Containers

Safety Cans & ContainersSafety Cans & Containers by Application (Construction Sector, Pharmaceutical Sector, Manufacturing Sector, Oil and Gas Industry, Mining Industry, Others), by Type (1 Gal, 2 Gal, 2.5 Gal, 5 Gal, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

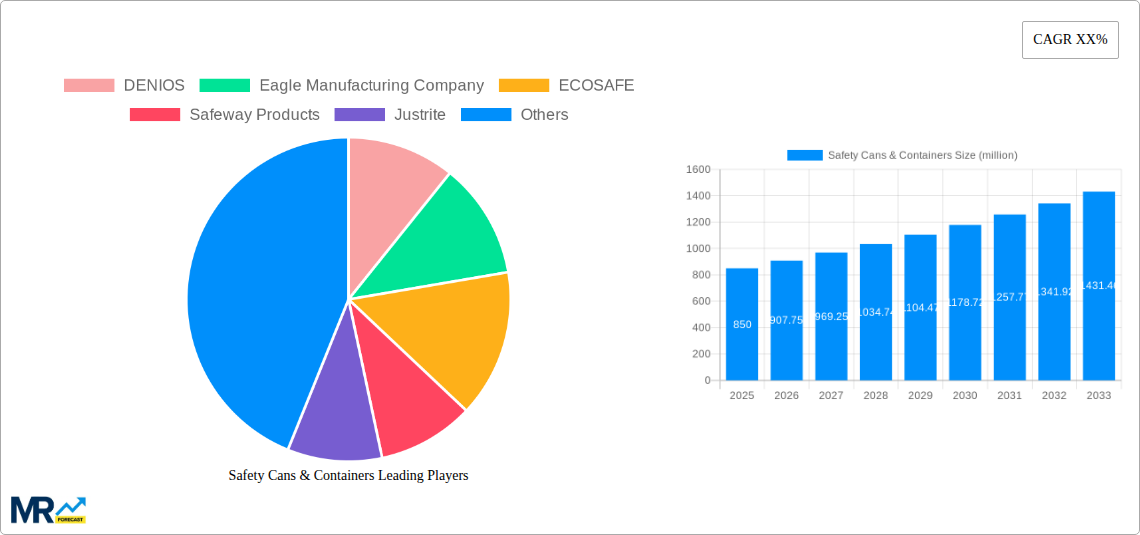

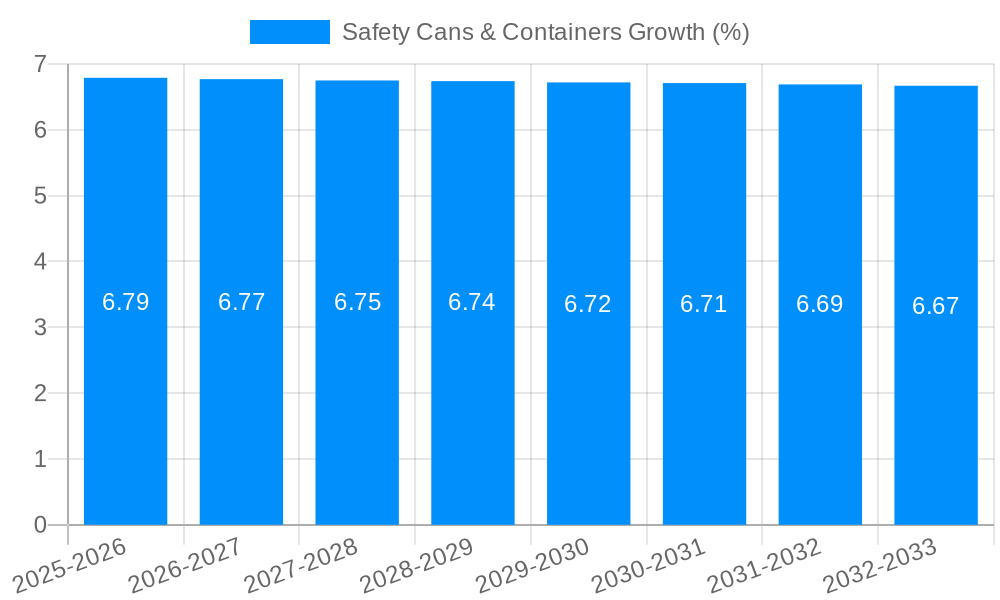

The global Safety Cans & Containers market is poised for significant expansion, projected to reach an estimated $850 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% through 2033. This growth is primarily fueled by escalating safety regulations across diverse industries and a heightened awareness of hazardous material handling protocols. The Construction Sector, a major consumer, is driving demand due to increased infrastructure development and stringent safety standards on construction sites. Similarly, the Pharmaceutical Sector's expansion, coupled with meticulous handling requirements for chemicals and reagents, further propels market expansion. The Manufacturing Sector also contributes significantly, emphasizing operational safety and compliance with environmental protection laws. The Oil and Gas Industry and Mining Industry, inherently dealing with flammable and hazardous substances, are consistent high-volume users, necessitating reliable safety containment solutions. The increasing adoption of these specialized containers across a broader industrial spectrum, driven by a commitment to worker safety and environmental stewardship, underscores the positive trajectory of this market.

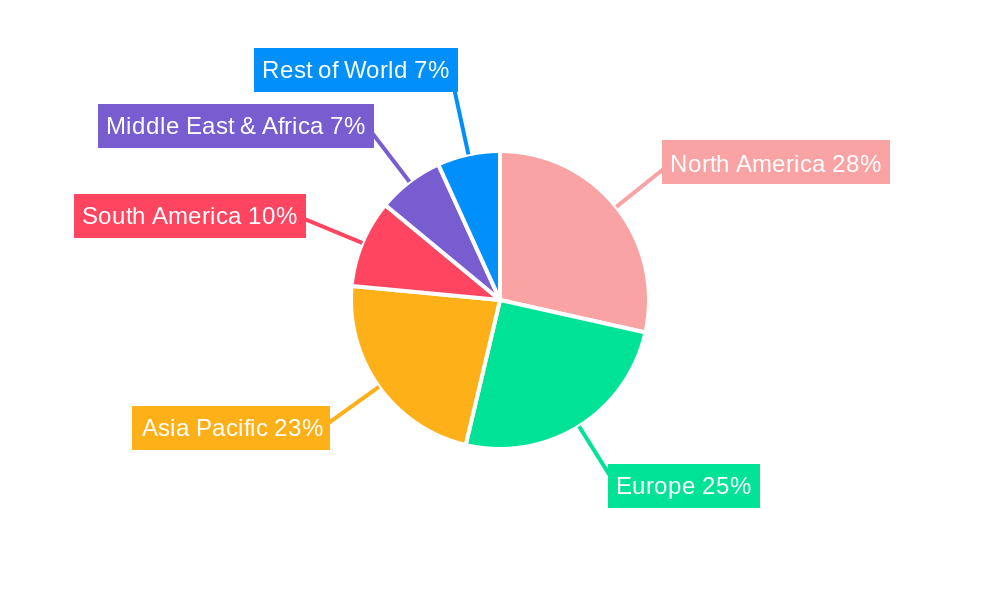

The market's growth is further shaped by several key trends. Innovations in material science are leading to the development of more durable, chemical-resistant, and lightweight safety cans. The increasing availability of various container types, such as 1-gallon, 2-gallon, 2.5-gallon, and 5-gallon options, caters to a wide range of specific application needs. Geographically, Asia Pacific, led by China and India, is emerging as a high-growth region due to rapid industrialization and a burgeoning manufacturing base that prioritizes safety compliance. North America and Europe remain mature yet significant markets, driven by established regulatory frameworks and a continuous focus on workplace safety advancements. While the market is primarily propelled by safety concerns, potential restraints could include the initial capital investment for high-quality safety containers and the availability of alternative, less regulated storage solutions in certain emerging economies. However, the long-term benefits of preventing accidents and ensuring regulatory adherence are expected to outweigh these challenges, solidifying the market's upward momentum.

This comprehensive report delves into the dynamic global market for Safety Cans & Containers, meticulously analyzing trends, drivers, challenges, and future growth trajectories. Spanning a study period from 2019 to 2033, with a base year of 2025, this research provides deep insights into market dynamics, including a detailed forecast from 2025 to 2033, built upon historical data from 2019-2024. The report is designed for industry stakeholders, manufacturers, and investors seeking to understand the evolving landscape of hazardous material containment.

XXX The global Safety Cans & Containers market is experiencing a robust upward trajectory, driven by an increasing emphasis on workplace safety regulations and a growing awareness of the inherent risks associated with flammable and hazardous materials. The market is projected to witness significant growth, with estimated revenues reaching hundreds of millions of dollars by the end of the forecast period. A key trend observed is the increasing demand for specialized containers designed for specific applications, moving beyond generic solutions. This includes a rise in demand for containers offering enhanced fire protection, chemical resistance, and spill containment capabilities. Furthermore, advancements in material science are leading to the development of lighter, more durable, and eco-friendly safety containers, appealing to environmentally conscious industries. The proliferation of e-commerce platforms has also facilitated wider accessibility to a diverse range of safety container products, further stimulating market expansion. The trend towards miniaturization in some industries is also influencing the demand for smaller capacity safety cans, such as the 1 Gal and 2 Gal segments, for precise handling of smaller quantities of volatile substances. Conversely, the larger 5 Gal containers remain critical for bulk storage and transfer operations, particularly in industrial settings. The ongoing evolution of regulatory frameworks across different regions is a continuous catalyst, pushing manufacturers to innovate and adhere to stricter safety standards. This includes advancements in ventilation mechanisms, grounding and bonding features, and ergonomic designs to minimize manual handling risks. The integration of smart technologies, such as RFID tags for inventory management and tracking, is also an emerging trend, although currently in its nascent stages within this market segment. The consistent need for safe storage and transportation of chemicals in sectors like Manufacturing, Pharmaceutical, and Oil and Gas ensures a foundational and stable demand.

The global Safety Cans & Containers market is being significantly propelled by a confluence of factors, with stringent regulatory compliances and a heightened focus on industrial safety emerging as paramount drivers. Governments worldwide are increasingly implementing and enforcing stricter regulations concerning the storage, handling, and transportation of flammable liquids and hazardous chemicals. This legislative push necessitates businesses across all sectors to invest in certified and compliant safety containers, directly fueling market demand. The Oil and Gas Industry, known for its inherently hazardous operations involving highly flammable substances, represents a substantial and consistent market segment, requiring a vast array of safety cans and containers. Similarly, the Manufacturing Sector, with its diverse chemical usage, and the Pharmaceutical Sector, where precise and safe handling of volatile reagents is critical, are significant contributors. Furthermore, a growing corporate responsibility towards employee well-being and environmental protection is fostering a proactive approach to safety. Companies are recognizing that investing in high-quality safety containers is not merely a compliance measure but a critical component of their risk management strategies, aiming to prevent accidents, spills, and potential environmental damage. This proactive stance, coupled with the increasing scale of industrial operations and the global expansion of chemical-intensive industries, ensures a sustained demand for reliable safety containment solutions, contributing to the market's healthy growth trajectory estimated to reach hundreds of millions of dollars in value.

Despite the robust growth potential, the Safety Cans & Containers market is not without its challenges and restraints, which could temper its expansion. One significant restraint is the initial cost of high-quality, certified safety containers. While essential for safety and compliance, the upfront investment can be a barrier for smaller businesses or those operating in price-sensitive markets, potentially leading them to opt for less regulated or lower-quality alternatives, especially in sectors like Construction where cost management is critical. Furthermore, variations in regulatory standards across different countries and regions can create complexity for manufacturers and users alike. Harmonizing these standards and ensuring compliance with diverse requirements can be a resource-intensive undertaking. The evolving nature of hazardous materials and their specific containment needs also presents a challenge. As new chemicals are developed or existing ones are used in novel applications, there is a continuous need for product innovation and adaptation, requiring ongoing research and development investments. The availability of counterfeit or substandard products in the market also poses a threat, potentially undermining the reputation of legitimate manufacturers and compromising safety. Additionally, economic downturns or geopolitical instability can impact industrial output and investment in safety equipment, leading to temporary slowdowns in demand. The sheer volume of products required across sectors like Manufacturing and Oil & Gas means any disruption to these industries can have a ripple effect on the safety container market, potentially impacting revenues estimated to be in the hundreds of millions of dollars.

The global Safety Cans & Containers market exhibits a strong regional and segmental dominance, with specific areas and applications driving significant demand.

Dominant Region/Country:

Dominant Segments:

These dominant regions and segments are projected to continue their leadership due to ongoing industrial activity, regulatory pressures, and technological advancements that necessitate the safe containment of hazardous materials. The combined value generated by these dominant areas is expected to represent a substantial portion of the global market, which is anticipated to reach hundreds of millions of dollars over the forecast period.

Several key factors are acting as powerful catalysts for growth in the Safety Cans & Containers industry. The ever-increasing stringency of global workplace safety regulations is a primary driver, compelling businesses to invest in compliant containment solutions. Furthermore, growing awareness among industries regarding the financial and reputational costs associated with accidents and spills is fostering a proactive approach to safety, leading to increased adoption of high-quality safety containers. The expansion of end-use industries such as manufacturing, pharmaceuticals, and oil and gas, particularly in emerging economies, directly translates to higher demand for these essential products.

This report offers an exhaustive analysis of the Safety Cans & Containers market, encompassing detailed insights into market size, segmentation, competitive landscape, and future projections. The study meticulously examines the impact of key industry developments and trends, providing actionable intelligence for stakeholders. It covers specific applications like the Construction Sector, Pharmaceutical Sector, Manufacturing Sector, Oil and Gas Industry, and Mining Industry, alongside various product types including 1 Gal, 2 Gal, 2.5 Gal, 5 Gal, and Others. The report delves into regional market dynamics and provides a comprehensive outlook for the 2019-2033 study period, with a granular focus on the 2025-2033 forecast period, offering invaluable insights for strategic decision-making within this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DENIOS, Eagle Manufacturing Company, ECOSAFE, Safeway Products, Justrite, Rotzmeier Sicherheitsbehalter, Jamco Products, SciMatCo, Strong Hold Products, Complete Environmental Products, The Durham Manufacturing Company, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Safety Cans & Containers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Safety Cans & Containers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.