1. What is the projected Compound Annual Growth Rate (CAGR) of the Royalty Free Music Licensing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Royalty Free Music Licensing

Royalty Free Music LicensingRoyalty Free Music Licensing by Type (Custom Music, Stock Music), by Application (Film and Video Production, Podcasts, Advertising, Video Games, Live Performances, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

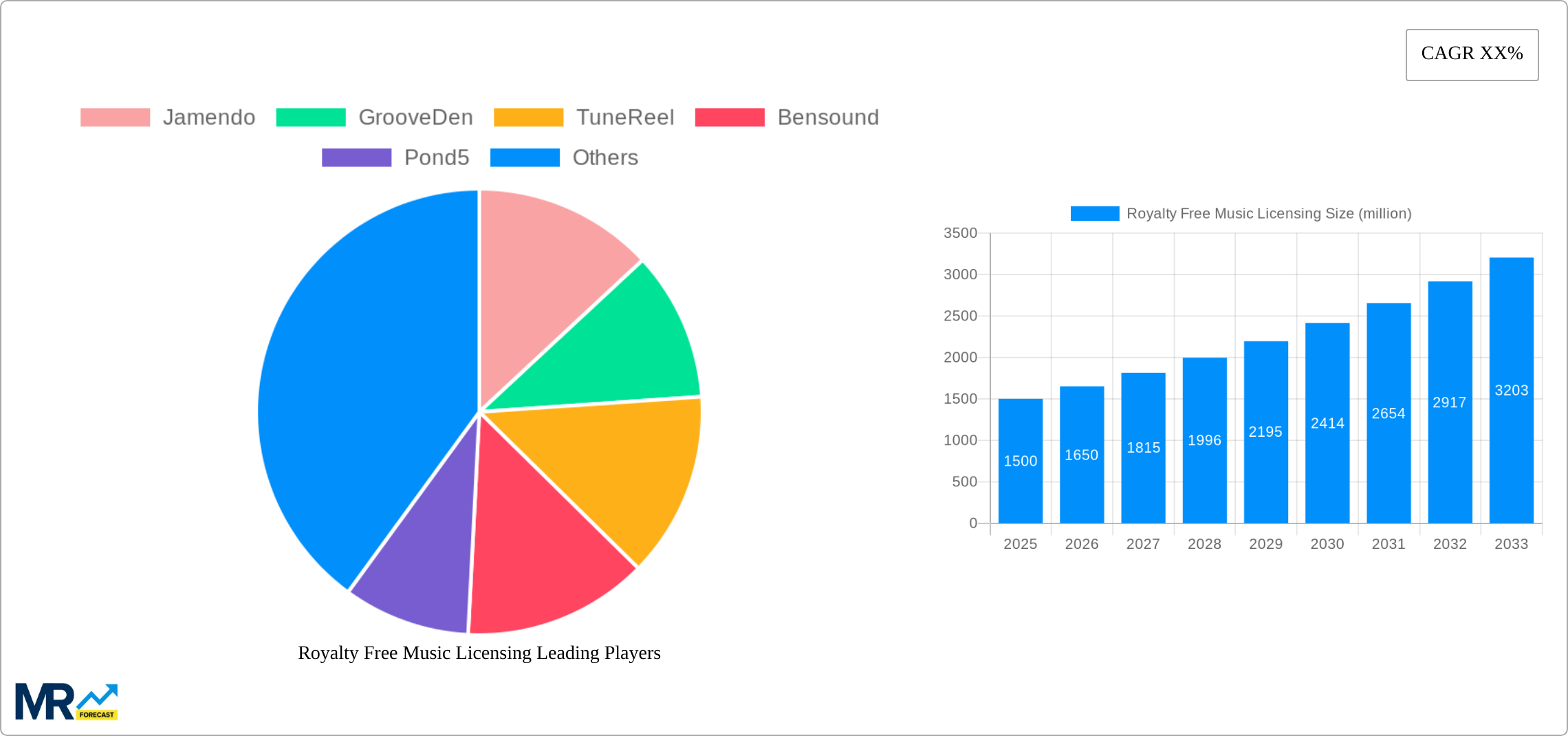

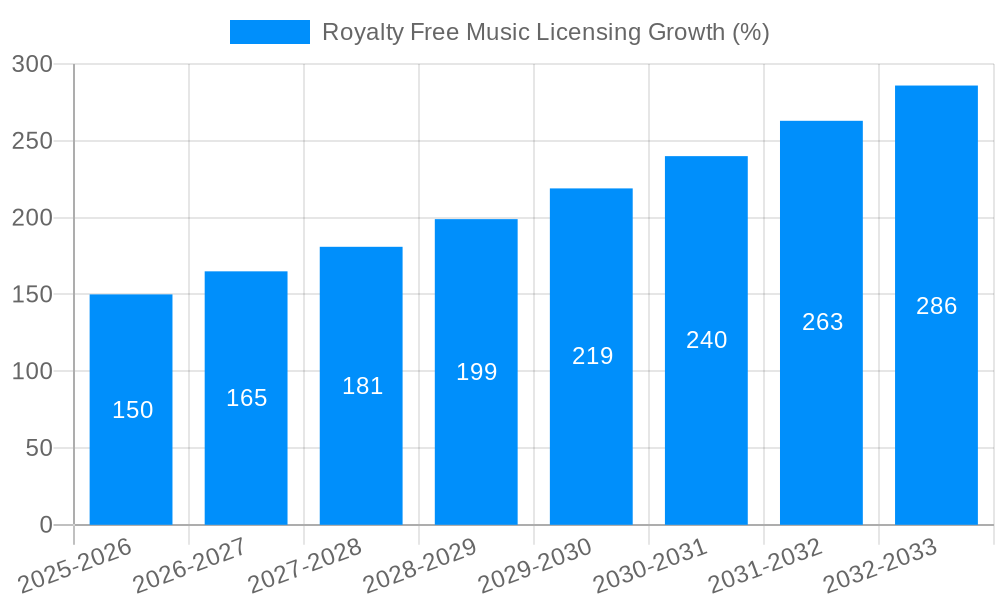

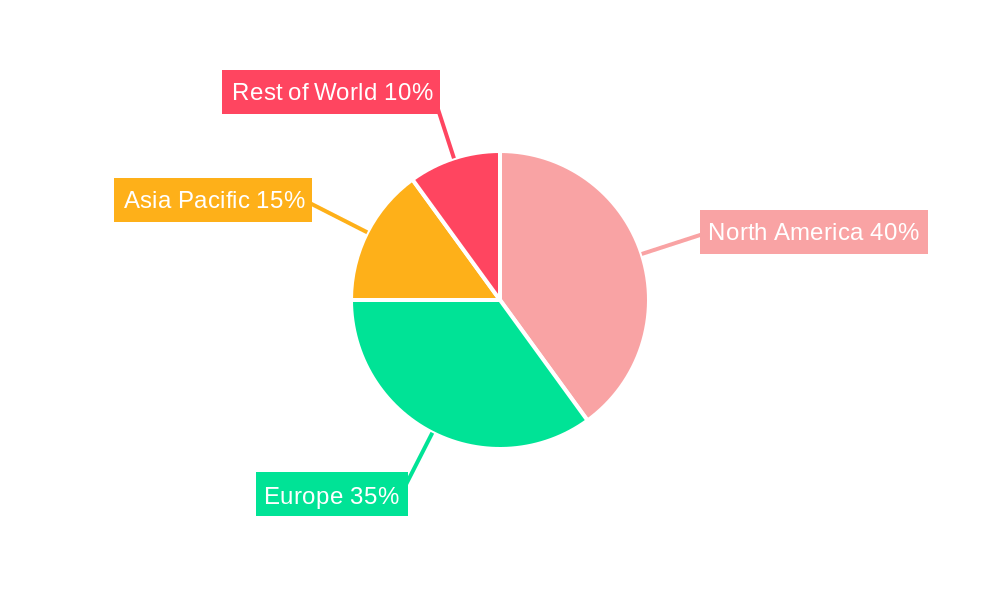

The royalty-free music licensing market is experiencing robust growth, driven by the increasing demand for high-quality audio across diverse digital platforms. The surge in video content creation for platforms like YouTube, TikTok, and streaming services fuels this demand. Podcasts, online advertising, and video games further contribute to the market's expansion. Technological advancements, such as AI-powered music generation tools, are streamlining the creation and licensing processes, while simultaneously creating new avenues for revenue and distribution. The market is segmented by music type (custom vs. stock) and application (film, video, podcasts, etc.), with stock music currently dominating due to its affordability and accessibility. However, the demand for customized music is also rising, especially in niche markets and high-budget productions. This shift reflects a broader trend toward personalized content experiences, which are becoming increasingly important across various media. Major players like Epidemic Sound and Artlist are leading the way, offering subscription models that cater to diverse creator needs. Competition is intense, with numerous smaller players vying for market share. Geographic distribution shows North America and Europe as the dominant regions, although growth in Asia-Pacific and other emerging markets is steadily increasing, presenting significant opportunities for expansion.

Looking ahead, the royalty-free music licensing market is projected to maintain a healthy growth trajectory. The continued rise of digital content consumption, coupled with the evolution of creator economy, will be key drivers. The market faces challenges, including managing copyright issues and navigating evolving licensing agreements. Nonetheless, the increasing ease of access to high-quality royalty-free music and the proliferation of user-friendly platforms will likely support continued market expansion. As the market matures, we can expect further consolidation among major players and an ongoing evolution of licensing models to cater to the ever-changing needs of content creators.

The royalty-free music licensing market is experiencing explosive growth, projected to reach tens of billions of dollars by 2033. Driven by the proliferation of digital content creation and the increasing demand for high-quality audio across diverse platforms, the market witnessed a significant surge in revenue during the historical period (2019-2024). The estimated market value in 2025 sits at several billion dollars, indicating a robust CAGR (Compound Annual Growth Rate) throughout the forecast period (2025-2033). This growth is not uniformly distributed; specific segments like stock music for film and video production are currently experiencing significantly higher demand than others, contributing disproportionately to the overall market valuation. The shift toward online video content creation, podcasting, and digital advertising has created a massive need for affordable, high-quality music, directly fueling the expansion of the royalty-free music licensing market. This trend is further reinforced by the rising popularity of social media platforms, where users constantly require background music for their content. The industry is also witnessing a maturation of business models, with subscription services and curated libraries gaining popularity over individual track purchases, offering users greater value and convenience. This transition has, in turn, spurred the development of more sophisticated search and filtering tools within licensing platforms, improving the user experience. The increasing awareness of copyright issues and the ease of access to royalty-free music compared to traditional licensing have also propelled the market's expansion, making it increasingly attractive for both large corporations and individual content creators. Finally, the continuous development of AI-powered music generation tools is poised to disrupt the market in the years to come, potentially presenting both opportunities and challenges for existing players.

Several key factors are driving the exponential growth of the royalty-free music licensing market. Firstly, the ease and affordability of access are paramount. Unlike traditional licensing, royalty-free music offers a straightforward, cost-effective solution for content creators, regardless of budget size. This makes it an attractive option for independent filmmakers, YouTubers, podcasters, and small businesses that may not have the resources to secure traditional music licenses. Secondly, the sheer diversity of platforms using audio underscores this market expansion. The rise of online video platforms, podcasts, social media, and video games has significantly broadened the market's scope, creating a consistently growing demand for diverse and high-quality audio. Thirdly, the increasing sophistication of the royalty-free music libraries themselves fuels the growth. Platforms are continuously improving their catalogs, incorporating more diverse musical genres and styles, and developing sophisticated search functionalities, making it simpler for users to find the perfect fit for their projects. This, coupled with the convenience of subscription-based models, removes the friction often associated with traditional music licensing. Finally, evolving copyright awareness among creators and an increasing preference for risk mitigation play significant roles. Understanding and avoiding copyright infringement is becoming more important for content creators, leading to a significant shift towards the adoption of royalty-free music options.

Despite the significant growth, the royalty-free music licensing market faces several challenges. One major obstacle is maintaining the quality and originality of the music. The sheer volume of tracks available on many platforms can lead to a perception of homogenous or low-quality music. Maintaining a balance between affordability and providing high-quality, original compositions remains a significant hurdle for many providers. Another challenge is the issue of discoverability. With millions of tracks available, users can find it difficult to locate the perfect music for their projects. Improved search functionality and better curation are crucial for addressing this. Furthermore, the competitive landscape is intense, with numerous players vying for market share. Maintaining a competitive edge requires continuous investment in catalog expansion, technology, and marketing. Finally, the potential for oversaturation and reduced pricing pressure represents a concern. As more players enter the market, price wars can result in decreased profitability for smaller companies and potentially compromise the quality of music offered. The potential for legal disputes, even with royalty-free licenses, necessitates careful monitoring and robust legal frameworks.

The Film and Video Production segment is projected to dominate the royalty-free music licensing market throughout the forecast period (2025-2033). This is fueled by the exponential growth in online video consumption, encompassing platforms like YouTube, streaming services, and social media. This segment generates billions of dollars in revenue annually.

North America and Western Europe are expected to continue leading the market in terms of regional revenue generation. These regions boast mature digital media industries, high internet penetration rates, and a significant number of content creators.

The high demand for audio in video content, including short-form videos, corporate videos, and documentaries, is a primary driver of this segment's dominance.

The ease of licensing and the broad range of musical styles available in royalty-free libraries cater specifically to the diverse needs of film and video production.

The growth of micro-influencers and independent filmmakers, coupled with the rise of low-budget productions, all contribute significantly to the segment's success.

This segment shows a higher willingness to adopt subscription-based models, offering royalty-free music providers a recurring revenue stream.

The technical aspects are also significant; professional video editing software often integrates directly with royalty-free music platforms, streamlining workflow and enhancing accessibility.

The industry's growth is fueled by several catalysts, including the continued rise of digital content creation, the increasing demand for affordable and easily accessible music, and the improvements in technology facilitating easier integration of music into various media formats. The expanding subscription-based model provides predictable revenue streams for providers and streamlined workflows for users, further accelerating growth.

This report provides a comprehensive overview of the royalty-free music licensing market, analyzing its current trends, driving forces, challenges, and future growth prospects. It includes detailed segment analysis, geographical breakdowns, and profiles of key players in the market, offering valuable insights for businesses and individuals involved in or interested in the music licensing industry. The detailed market estimations offer projections that can support strategic planning and investment decisions within the industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Jamendo, GrooveDen, TuneReel, Bensound, Pond5, FiftySounds, Soundstripe, Artlist, PremiumBeat, Epidemic Sound, NeoSounds, Lickd, Shutterstock, Envato Elements, Storyblocks, Stock Music Site, TeknoAXE, Triple Scoop Music, TunePocket, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Royalty Free Music Licensing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Royalty Free Music Licensing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.