1. What is the projected Compound Annual Growth Rate (CAGR) of the Music Licensing Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Music Licensing Services

Music Licensing ServicesMusic Licensing Services by Type (/> Print, Public Performance, Others), by Application (/> Individuals & Music Groups, Enterprises & Institutions), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

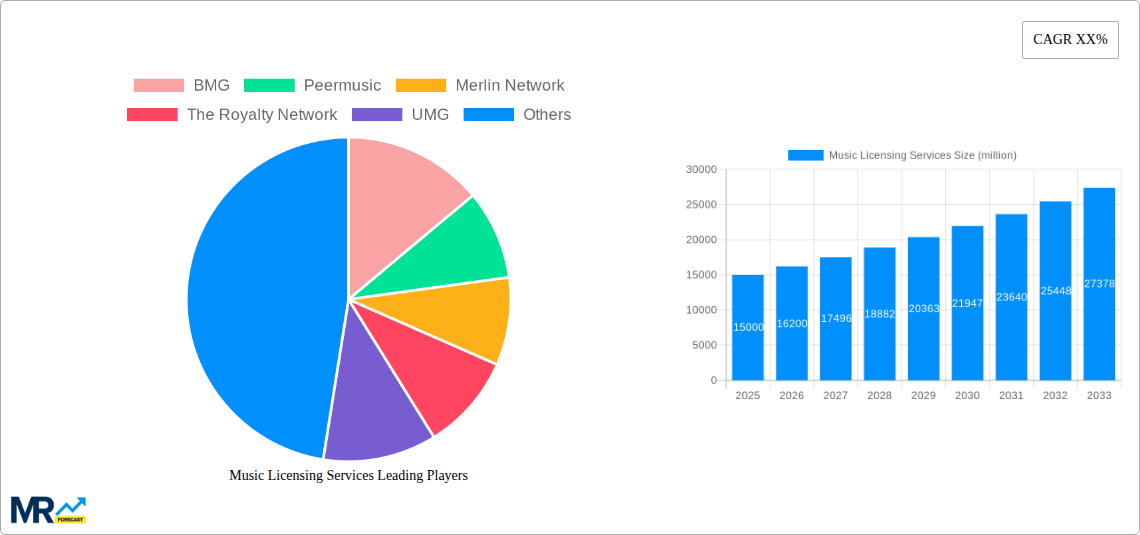

The global music licensing services market is experiencing robust growth, driven by the increasing demand for music across diverse platforms, including streaming services, video games, film, television, and advertising. The market's expansion is fueled by the rising popularity of online music consumption, the proliferation of digital content creation, and the increasing sophistication of music licensing technologies. Major players like UMG, Sony Music, Warner Music, and independent players such as Merlin Network and BMG are actively shaping the market landscape through strategic partnerships, acquisitions, and technological advancements. The growth is further propelled by the ongoing shift from physical media to digital distribution models, making music licensing a critical element for both rights holders and content creators. We estimate the 2025 market size to be around $15 Billion, based on industry reports and considering the significant revenue generated from various licensing segments. A compound annual growth rate (CAGR) of 8% is projected for the forecast period (2025-2033), indicating sustained growth despite potential economic fluctuations.

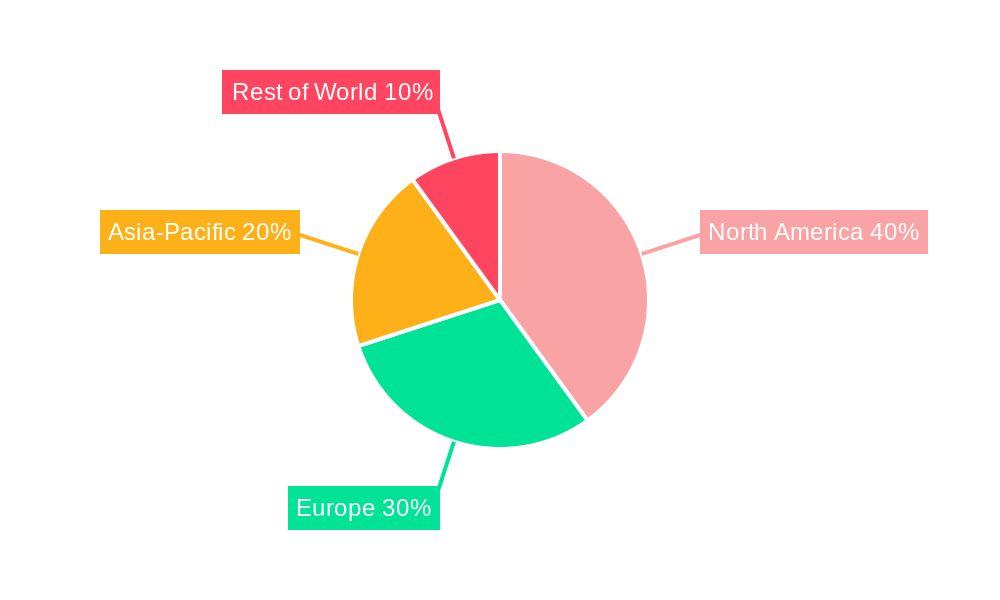

While the market shows strong potential, certain challenges exist. Negotiations between licensing bodies and users can be complex and time-consuming, potentially hindering growth. Furthermore, the rise of user-generated content platforms presents both opportunities and challenges, requiring sophisticated licensing models to balance creator rights and platform usage. The industry also faces the ongoing issue of copyright infringement and piracy, impacting overall revenue generation. Segmentation within the market is significant, with distinctions between types of licenses (e.g., synchronization, mechanical, performance) and geographical regions (North America consistently leads in market share followed by Europe and Asia). Successfully navigating these challenges will require continuous innovation in licensing technologies, improved copyright protection mechanisms, and proactive strategies to address regional variations in licensing regulations. The forecast period is expected to witness ongoing consolidation among industry players, as larger companies acquire smaller firms to expand their market share and licensing capabilities.

The global music licensing services market exhibited robust growth during the historical period (2019-2024), exceeding $XX million in 2024. This expansion is projected to continue throughout the forecast period (2025-2033), with the market anticipated to reach a value exceeding $XXX million by 2033. Several key trends are driving this growth. The increasing digitization of music consumption, fueled by streaming services like Spotify and Apple Music, has significantly expanded the avenues for music licensing and usage. This has led to a surge in demand for efficient and comprehensive licensing solutions from a wide range of businesses, from film and television production companies to advertising agencies and video game developers. Simultaneously, the rise of user-generated content (UGC) platforms, like YouTube and TikTok, presents both challenges and opportunities. While raising concerns about copyright infringement, these platforms also create a vast new market for music licensing, particularly for shorter clips and background music. The market is also witnessing a shift towards more flexible and adaptable licensing models, moving away from traditional, rigid structures towards dynamic pricing and usage-based agreements. This evolution is spurred by the ever-changing landscape of digital media consumption and the need for greater transparency and efficiency in licensing processes. This trend is further enhanced by the increasing adoption of digital rights management (DRM) technologies, ensuring better protection for copyrighted musical works and enabling more effective licensing and revenue collection. The emergence of blockchain technology also holds promise for streamlining licensing transactions, improving transparency and reducing the risk of fraud, and ultimately enhancing efficiency across the board.

The growth of the music licensing services market is propelled by several interconnected factors. The explosive growth of streaming platforms has fundamentally altered music consumption, creating a vastly expanded market for licensing. The ease of accessing millions of songs online has heightened demand for music across various sectors, from advertising and film to video games and social media. Moreover, the rise of user-generated content (UGC) platforms necessitates efficient and robust licensing systems to manage the sheer volume of copyrighted material used daily. This increased demand has spurred innovation in licensing technologies, leading to the development of more user-friendly and efficient platforms. The increasing awareness of copyright protection and the legal implications of unauthorized music usage are also driving market growth. Businesses and individuals are increasingly seeking legitimate licensing solutions to avoid legal complications and safeguard their brands. Finally, advancements in technology, such as blockchain and AI, promise to further streamline licensing processes, reduce administrative burdens, and improve revenue collection for rights holders, further bolstering market expansion.

Despite its promising growth trajectory, the music licensing services market faces several significant challenges. The complexity of copyright laws and licensing agreements can be a major hurdle, particularly for smaller businesses and independent artists. Navigating the intricacies of international copyright regulations adds another layer of complexity. Furthermore, the prevalence of piracy and copyright infringement continues to be a significant threat, undermining revenue streams for rights holders and hindering market growth. The ever-evolving digital landscape requires constant adaptation, with new technologies and platforms emerging regularly. This demands ongoing investment in infrastructure and expertise to stay ahead of the curve. Effectively managing and collecting royalties can also be a complex and resource-intensive process, particularly with the fragmented nature of the music industry. The need for transparency and efficient royalty distribution systems is therefore paramount for the sector's continued success. Finally, the increasing use of AI-generated music raises new copyright and licensing concerns that still need to be effectively addressed.

The North American music licensing services market is projected to maintain its leading position throughout the forecast period due to a high concentration of major music labels, extensive digital music consumption, and a well-established legal framework for copyright protection. However, the Asia-Pacific region, particularly China, is expected to show significant growth, driven by increasing music consumption, the rapid expansion of streaming services, and a burgeoning entertainment industry.

Segments: The synchronization licensing segment (music used in film, TV, and advertising) and the mechanical licensing segment (music reproduction and distribution) are expected to be particularly significant throughout the forecast period. The increasing demand for original music scores in film and television and the proliferation of digital music distribution platforms drive the demand in both these segments. The growth of user-generated content (UGC) platforms also creates new opportunities in micro-licensing and shorter-form music usage.

The convergence of several technological advancements and market trends is accelerating the growth of music licensing services. The increasing sophistication of digital rights management (DRM) technology enhances copyright protection and facilitates smoother licensing processes. The adoption of blockchain technology holds the potential for revolutionizing royalty collection and ensuring greater transparency. These advancements contribute to a more efficient and transparent licensing ecosystem, attracting more businesses and independent artists to participate in the formal music licensing market. Growing demand for high-quality music across various media platforms and the rise of personalized music experiences further fuel the sector’s rapid expansion.

This report provides a comprehensive analysis of the music licensing services market, covering historical data, current market trends, and future projections. It delves into the key drivers and challenges shaping the market, providing in-depth insights into the leading players and their strategies. The report also explores the evolving regulatory landscape and the technological advancements that are transforming the industry. With detailed segmentation by region, country, and licensing type, this report offers valuable information for industry stakeholders seeking to understand and navigate the dynamic music licensing services market. The extensive data and insightful analysis equip businesses with the knowledge they need to make informed decisions and capitalize on market opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BMG, Peermusic, Merlin Network, The Royalty Network, UMG, Cooking Vinyl, Warner Music, Sony, Emperor Entertainment Group, China Record Corporation, KOMCA, SESAC.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Music Licensing Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Music Licensing Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.