1. What is the projected Compound Annual Growth Rate (CAGR) of the Roller Conveyor?

The projected CAGR is approximately 4.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Roller Conveyor

Roller ConveyorRoller Conveyor by Type (Chain-Driven Roller Conveyors, Belt-Driven Live Roller Conveyors, Gravity Roller Conveyors, Powered Roller Conveyor, Accumulating Roller Conveyor, Flexible Roller Conveyor, Pallet Handling Roller Conveyor, Others), by Application (Agricultural, Electronic, Food Processing, Pharmaceutical, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

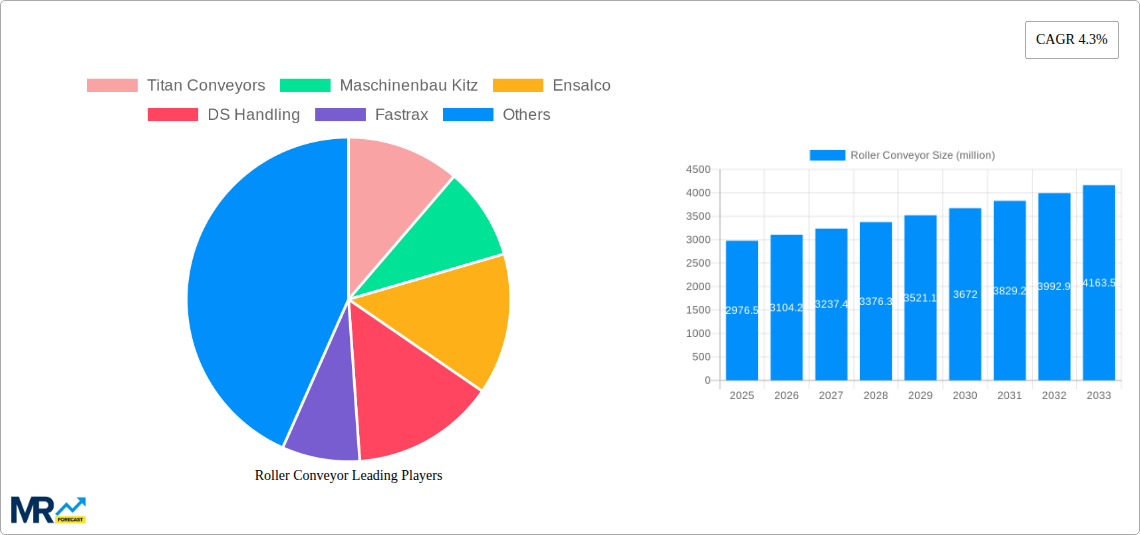

The global roller conveyor market is poised for significant expansion, projected to reach $2976.5 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.3% anticipated from 2025 to 2033. This steady growth is primarily propelled by the increasing demand for automation across diverse industries seeking to enhance operational efficiency, reduce labor costs, and improve throughput. Key drivers include the burgeoning e-commerce sector, which necessitates efficient material handling for warehousing and fulfillment operations, and the growing adoption of smart manufacturing principles, where roller conveyors play a crucial role in integrated production lines. Furthermore, advancements in conveyor technology, such as the development of more durable materials, improved sensor integration for enhanced control and monitoring, and the introduction of specialized designs for specific applications like pharmaceutical or food processing, are contributing to market dynamism. The market is also witnessing a trend towards modular and flexible conveyor systems that can be easily reconfigured to adapt to evolving production needs.

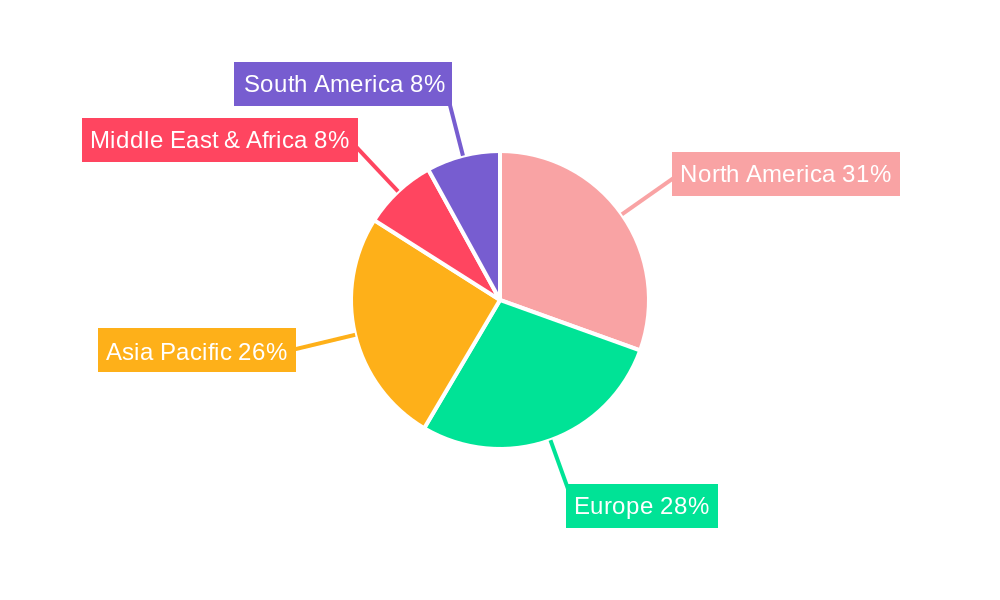

While the market presents substantial opportunities, certain restraints may influence its trajectory. These include the initial capital investment required for advanced roller conveyor systems, particularly for small and medium-sized enterprises (SMEs), and the potential for disruption from alternative material handling solutions. However, the long-term benefits of increased productivity and reduced operational expenses are expected to outweigh these initial concerns. Segmentation analysis reveals strong demand across various types, including chain-driven, belt-driven, and powered roller conveyors, catering to a wide spectrum of industrial applications. The agricultural, electronic, food processing, and pharmaceutical sectors are identified as major application areas, each presenting unique requirements and growth potential. Geographically, North America and Europe are expected to remain dominant markets, driven by advanced industrial infrastructure and a high adoption rate of automation. However, the Asia Pacific region is projected to exhibit the fastest growth, fueled by rapid industrialization, expanding manufacturing capabilities, and government initiatives promoting automation.

The global roller conveyor market is poised for robust expansion, projected to reach an impressive value in the millions of USD by the end of the Estimated Year: 2025, with sustained growth anticipated through the Forecast Period: 2025-2033. This upward trajectory is underpinned by a confluence of factors, including the escalating demand for automation across diverse industrial sectors, the inherent efficiency and versatility of roller conveyor systems, and a burgeoning focus on optimizing supply chain logistics. During the Study Period: 2019-2033, the market has witnessed significant evolution, driven by technological advancements and the increasing adoption of smart manufacturing principles. The Base Year: 2025 serves as a pivotal point for understanding current market dynamics and projecting future trends. Key market insights reveal a pronounced shift towards sophisticated, intelligent roller conveyor solutions that integrate seamlessly with broader warehouse management and enterprise resource planning systems. The emphasis is increasingly on customized solutions tailored to specific application needs, moving beyond generic product offerings. Furthermore, there's a growing appetite for lightweight, durable, and energy-efficient roller conveyor designs, reflecting a broader industry commitment to sustainability and operational cost reduction. The Historical Period: 2019-2024 laid the groundwork for this expansion, characterized by initial adoption phases in established industries and a gradual exploration of newer applications. The market has matured from basic material handling to incorporating features like sensor integration for real-time monitoring, predictive maintenance capabilities, and enhanced safety protocols. The rise of e-commerce has also been a significant catalyst, necessitating faster throughput and more efficient sorting and distribution processes, areas where roller conveyors excel. The increasing need for precision in handling delicate or specialized products, such as those in the pharmaceutical and food processing sectors, is also driving innovation in roller conveyor technology, leading to the development of specialized variants with enhanced control and gentler handling mechanisms. The overarching trend is one of continuous innovation, driven by the pursuit of increased productivity, reduced operational costs, and improved safety and ergonomics within industrial environments.

The roller conveyor market's impressive growth is propelled by a multifaceted set of drivers that are fundamentally reshaping industrial operations. A primary catalyst is the relentless pursuit of enhanced operational efficiency and productivity. In today's competitive landscape, businesses are under immense pressure to optimize their workflows, reduce bottlenecks, and accelerate the movement of goods. Roller conveyors, with their ability to facilitate smooth, continuous, and often automated material flow, directly address these needs. The burgeoning e-commerce sector, with its exponential growth and demand for rapid order fulfillment, has become a significant propellant. The need for efficient sorting, picking, and packing operations in distribution centers and warehouses directly translates to a higher demand for adaptable and high-throughput roller conveyor systems. Furthermore, the increasing adoption of Industry 4.0 principles and smart manufacturing technologies is a pivotal driver. Roller conveyors are becoming increasingly integrated with sensors, IoT devices, and advanced control systems, enabling real-time monitoring, data analytics, and predictive maintenance. This level of integration allows for greater operational visibility, proactive issue resolution, and ultimately, reduced downtime. The inherent versatility of roller conveyors, suitable for handling a wide array of products, from heavy industrial components to fragile consumer goods, also contributes to their widespread adoption across various industries. Finally, the ongoing global push towards automation across manufacturing, logistics, and warehousing operations, aimed at reducing labor costs, improving safety, and increasing output, is a fundamental and sustained driver for the roller conveyor market.

Despite the robust growth trajectory, the roller conveyor market is not without its challenges and restraints. A significant hurdle is the initial capital investment required for sophisticated roller conveyor systems, particularly those with advanced automation features. While the long-term return on investment can be substantial, the upfront cost can be a barrier for small and medium-sized enterprises (SMEs) or businesses in cost-sensitive industries. Integration complexity with existing infrastructure and legacy systems can also pose a challenge. Seamlessly incorporating new roller conveyor solutions into established operational frameworks requires careful planning, technical expertise, and potentially significant modifications, which can lead to increased project timelines and costs. Furthermore, maintenance and repair costs, although often offset by increased efficiency, can be a concern for some operators. The need for specialized technicians and the potential for downtime during repairs can impact operational continuity and profitability. The rapid pace of technological advancement presents another double-edged sword. While it drives innovation, it can also lead to rapid obsolescence of older systems, necessitating continuous upgrades and investments to remain competitive. Finally, safety regulations and compliance requirements, while essential for worker well-being, can also add to the cost and complexity of system design and implementation. Ensuring that roller conveyors meet all relevant safety standards, especially in environments with human interaction, requires meticulous attention to detail and adherence to stringent guidelines.

The roller conveyor market's dominance is poised to be shared by several key regions and segments, each contributing unique strengths to the overall landscape.

Key Dominating Regions/Countries:

North America (particularly the United States): This region is a powerhouse in terms of market share due to its advanced industrial infrastructure, a high concentration of large-scale manufacturing facilities, and a leading role in e-commerce adoption. The widespread implementation of automation in warehousing and logistics, driven by companies like Titan Conveyors and Hytrol, solidifies its dominance. The significant presence of industries such as Food Processing and Pharmaceutical, which heavily rely on efficient material handling, further bolsters its position. The ongoing investments in upgrading existing facilities and building new, highly automated distribution centers are a testament to its market leadership.

Europe (specifically Germany and the UK): Europe boasts a strong manufacturing base, particularly in Germany, with a deep-rooted commitment to engineering excellence and automation. Countries like Germany, through companies such as Maschinenbau Kitz and Axmann, are at the forefront of developing and implementing sophisticated roller conveyor solutions. The stringent quality standards and the drive for operational efficiency across European industries, including Agricultural and Electronic sectors, contribute significantly to market demand. The UK's burgeoning e-commerce sector and its focus on supply chain optimization are also key drivers.

Asia-Pacific (particularly China and India): This region is experiencing the most rapid growth. China, with its vast manufacturing capabilities and a rapidly expanding e-commerce market, is a colossal consumer of roller conveyor systems. The sheer scale of industrial activity and the ongoing drive to modernize its manufacturing and logistics sectors, with companies like Jolinpack emerging, positions it as a critical market. India's burgeoning economy, increasing industrialization, and a growing focus on automation in sectors like Food Processing and Pharmaceutical are also propelling its market share upwards. The development of more cost-effective and efficient solutions tailored to the needs of developing economies further enhances the region's importance.

Key Dominating Segments:

Type: Powered Roller Conveyor: This segment is a significant market driver due to its versatility and ability to handle a wide range of loads and operational requirements. Powered roller conveyors offer controlled movement, making them indispensable for applications requiring precise positioning, speed control, and the ability to convey materials uphill or through complex layouts. Their integration with automated systems and their ability to be easily configured for various tasks, from simple transport to complex sorting, makes them a preferred choice across industries. Companies like LEWCO and Alvey are prominent in this segment.

Application: Food Processing: The Food Processing industry is a substantial contributor to the roller conveyor market's growth. The stringent hygiene requirements, the need for gentle product handling, and the demand for efficient, high-volume throughput make roller conveyors an ideal solution. From raw ingredient handling to the packaging and palletizing of finished goods, roller conveyors play a crucial role. Developments in stainless steel designs, easy-to-clean surfaces, and specialized guides ensure compliance with food safety regulations. Companies like Wyma often cater to this sector with specialized solutions.

Application: Electronic: The Electronic industry demands high precision, speed, and reliability in material handling. Roller conveyors are extensively used for moving components, sub-assemblies, and finished electronic products through manufacturing lines and distribution centers. The need for anti-static properties, vibration control, and the ability to handle delicate items drives innovation in this segment. Companies like DS Handling often provide solutions for intricate electronic assembly lines.

The interplay between these dominant regions and segments creates a dynamic and expanding market, driven by innovation, increasing automation, and the continuous demand for efficient material handling solutions.

The roller conveyor industry is experiencing several potent growth catalysts that are fueling its expansion. The most significant is the accelerating trend towards automation and Industry 4.0 adoption across manufacturing and logistics. This drive for increased efficiency, reduced labor costs, and enhanced precision directly translates to a higher demand for sophisticated roller conveyor systems. The booming e-commerce sector is another powerful catalyst, necessitating faster throughput, more efficient sorting, and robust material handling solutions in distribution centers and warehouses. Furthermore, the increasing need for supply chain optimization and the pursuit of streamlined operations across all industries are pushing businesses to invest in reliable and versatile conveying technologies. Finally, the development of more advanced, intelligent, and energy-efficient roller conveyor designs, incorporating features like IoT connectivity and predictive maintenance, is opening up new application possibilities and driving market growth.

This report offers a comprehensive analysis of the roller conveyor market, providing invaluable insights for stakeholders. It delves deep into market trends, meticulously dissecting the forces driving growth and the challenges that may impede it. With a detailed breakdown of key regions and dominating segments, the report empowers businesses to identify strategic opportunities and tailor their approaches. The inclusion of leading players and their significant developments offers a competitive landscape overview, while an examination of growth catalysts highlights avenues for future expansion. This in-depth coverage, spanning the Study Period: 2019-2033 with a sharp focus on the Base Year: 2025 and the Forecast Period: 2025-2033, provides a robust foundation for informed decision-making, strategic planning, and navigating the evolving dynamics of the roller conveyor industry. The report's granular approach ensures that businesses can leverage this data to optimize their investments, enhance their operational efficiencies, and solidify their market positions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.3%.

Key companies in the market include Titan Conveyors, Maschinenbau Kitz, Ensalco, DS Handling, Fastrax, Wheelabrator, Hytrol, Jolinpack, Wyma, Axmann, Rack & Roll, EQM, LEWCO, Marceau, Alvey, .

The market segments include Type, Application.

The market size is estimated to be USD 2976.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Roller Conveyor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Roller Conveyor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.