1. What is the projected Compound Annual Growth Rate (CAGR) of the Rigid Sleeve Boxes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rigid Sleeve Boxes

Rigid Sleeve BoxesRigid Sleeve Boxes by Type (Corrugated, Cardboard, Kraft, Linen, World Rigid Sleeve Boxes Production ), by Application (Jewelry, Tobacco, Electronics, Personal Care and Cosmetics, Food and Beverages, Others, World Rigid Sleeve Boxes Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

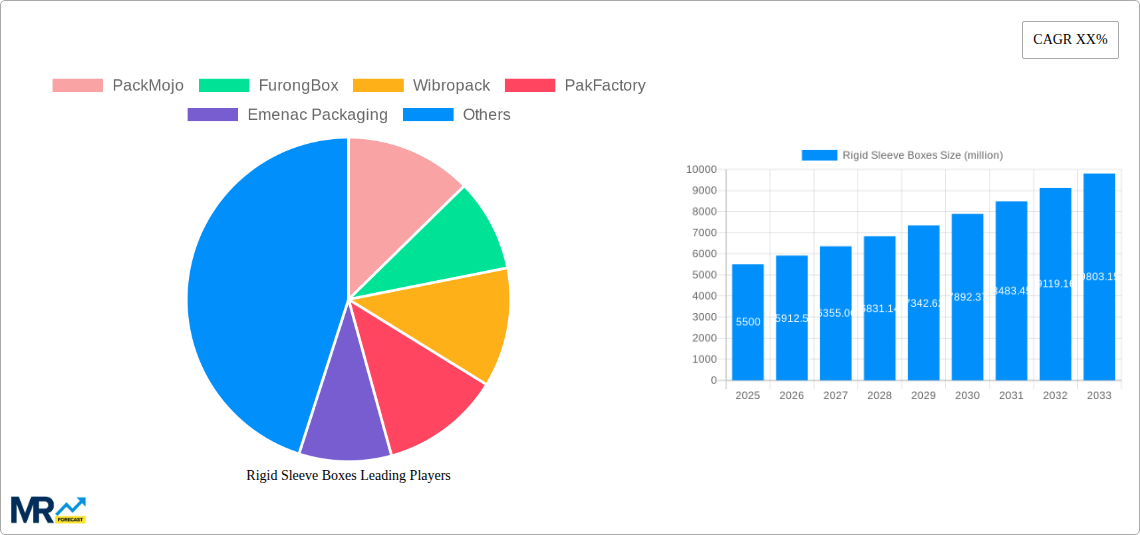

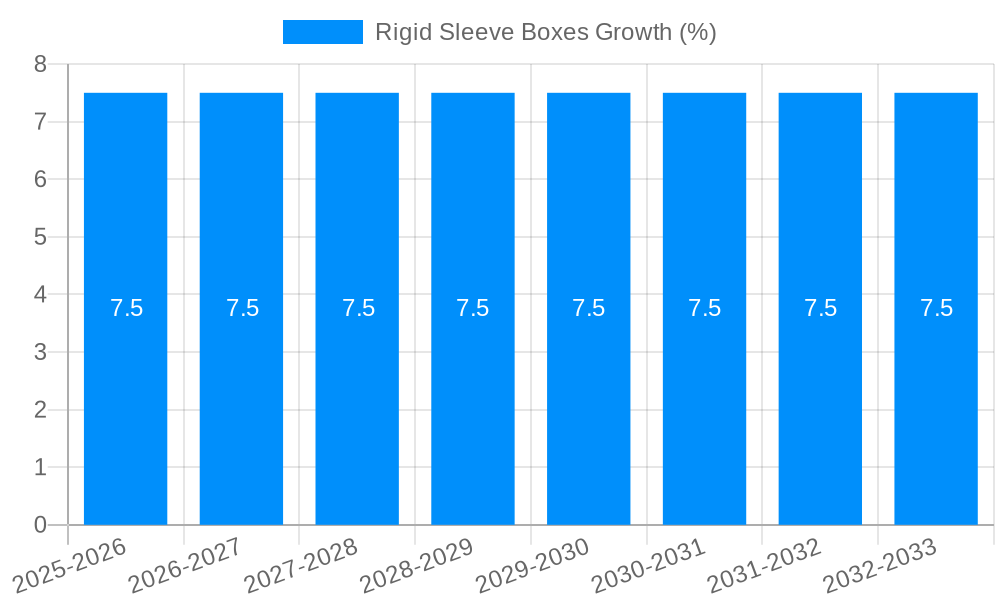

The global Rigid Sleeve Boxes market is poised for substantial growth, driven by increasing consumer demand for premium packaging solutions across diverse industries. Estimated to be valued at approximately $5,500 million, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of around 7.5% between 2025 and 2033. This robust expansion is fueled by the inherent benefits of rigid sleeve boxes, including their superior protection, aesthetic appeal, and reusability, making them ideal for high-value products. The growing emphasis on brand differentiation and enhanced unboxing experiences, particularly within the luxury goods, electronics, and premium food and beverage sectors, acts as a significant catalyst. Key drivers include the rising disposable incomes in emerging economies, the increasing adoption of e-commerce, and the growing preference for sustainable and eco-friendly packaging materials, as many rigid sleeve boxes can be made from recycled or recyclable components. The market's dynamism is further shaped by evolving consumer preferences for visually appealing and durable packaging that elevates the perceived value of a product.

The market segmentation reveals significant opportunities across various applications. The Jewelry and Personal Care & Cosmetics sectors are expected to lead demand, owing to the inherent need for elegant and protective packaging to safeguard delicate and high-value items. The Tobacco and Electronics segments also represent substantial growth areas, where the premium look and feel of rigid sleeve boxes contribute to brand perception and product safety. While the market is largely driven by these applications, the Food & Beverages sector is also witnessing a growing adoption of rigid sleeve boxes for specialty products and gift sets, further diversifying the market landscape. Key market players like International Paper, WestRock, and Smurfit Kappa Group are investing in innovative designs and sustainable manufacturing practices to capture market share. However, potential restraints such as the higher initial cost compared to standard packaging and the availability of alternative premium packaging formats could pose challenges. Nevertheless, the enduring appeal of premium presentation and product integrity is expected to propel the market forward, making it an attractive segment within the broader packaging industry.

This comprehensive report delves into the dynamic World Rigid Sleeve Boxes Production market, meticulously analyzing trends, drivers, challenges, and future prospects from 2019-2033. The base year for this in-depth analysis is 2025, with estimations for the same year provided. The forecast period extends from 2025-2033, building upon the historical data of 2019-2024. The report examines the market across various Types including Corrugated, Cardboard, Kraft, and Linen, and its diverse Applications such as Jewelry, Tobacco, Electronics, Personal Care and Cosmetics, Food and Beverages, and Others. We will also explore the significant Industry Developments shaping this burgeoning sector, with an estimated production reaching millions of units.

The World Rigid Sleeve Boxes Production market is experiencing a profound transformation, driven by a confluence of evolving consumer preferences, burgeoning e-commerce, and an increasing emphasis on premium product presentation. The historical period (2019-2024) witnessed a steady ascent in demand for rigid sleeve boxes, fueled by their ability to elevate brand perception and offer superior product protection. As we move into the estimated year of 2025 and beyond into the forecast period (2025-2033), this trend is poised to accelerate. Consumers are increasingly drawn to products that offer an exceptional unboxing experience, and rigid sleeve boxes, with their sturdy construction and customizable designs, are at the forefront of this movement. This preference is particularly pronounced in high-value sectors like Jewelry and Electronics, where the packaging often mirrors the perceived worth of the contents. Furthermore, the rise of subscription box services across various segments, from Personal Care and Cosmetics to artisanal Food and Beverages, has significantly boosted the demand for durable and aesthetically pleasing packaging solutions. The growing awareness surrounding sustainability is also subtly influencing trends. While traditionally associated with premium, rigid materials, manufacturers are exploring innovative ways to incorporate recycled content and eco-friendly finishes into rigid sleeve box designs without compromising on their structural integrity or visual appeal. This includes advancements in board manufacturing and printing techniques that reduce environmental impact. The shift towards personalized and limited-edition product releases further amplifies the need for bespoke packaging, a niche where rigid sleeve boxes excel due to their adaptability. The integration of smart packaging features, such as NFC tags or QR codes, is also beginning to emerge as a niche trend, offering consumers enhanced product information and brand engagement, further solidifying the premium positioning of rigid sleeve boxes. The projected production figures in the millions of units underscore the substantial market penetration and continued growth trajectory for this packaging format.

Several powerful forces are acting as primary accelerators for the World Rigid Sleeve Boxes Production market. Foremost among these is the relentless expansion of the global e-commerce landscape. As online retail continues its upward trajectory, the need for robust and protective packaging that can withstand the rigors of shipping and handling becomes paramount. Rigid sleeve boxes, with their superior structural integrity compared to many other packaging types, offer an ideal solution, minimizing product damage during transit and reducing return rates for online retailers. This directly translates to cost savings and enhanced customer satisfaction. Secondly, the ever-increasing consumer demand for premium and luxury product experiences plays a pivotal role. Brands across sectors are investing heavily in packaging that not only protects their products but also serves as a powerful marketing tool, communicating quality, exclusivity, and attention to detail. The sophisticated aesthetic and tactile feel of rigid sleeve boxes are perfectly aligned with this objective, significantly contributing to brand loyalty and perceived value. This is particularly evident in the Personal Care and Cosmetics and Jewelry segments, where the unboxing ritual itself has become an integral part of the product experience. Furthermore, the growing trend of gifting and special occasion purchases, especially during festive seasons, drives demand for attractive and gift-ready packaging. Rigid sleeve boxes provide a ready-made solution that enhances the perceived thoughtfulness of a gift. The burgeoning subscription box model, encompassing a wide array of products from Food and Beverages to beauty items, also necessitates packaging that is both visually appealing for display and sturdy enough for regular delivery.

Despite its robust growth, the World Rigid Sleeve Boxes Production market faces certain inherent challenges and restraints that could temper its expansion. A significant hurdle is the cost factor. Compared to more conventional packaging solutions like folding cartons or flexible pouches, rigid sleeve boxes generally incur higher production costs due to the thicker materials, more complex manufacturing processes, and often more intricate finishing options required. This can make them a less viable option for brands operating on extremely tight margins or targeting mass-market segments where price sensitivity is high. The material sourcing and environmental impact also present ongoing considerations. While the market is seeing a move towards more sustainable practices, the production of thick, rigid board can be resource-intensive. Ensuring a consistent supply of high-quality, sustainably sourced raw materials at competitive prices remains a key challenge for manufacturers. Moreover, the logistical complexities and storage requirements associated with rigid sleeve boxes can be a deterrent for some businesses. Their bulkier nature and less collapsible designs can lead to higher shipping costs and necessitate more extensive warehousing space compared to lighter-weight packaging alternatives. The perceived over-packaging by some environmentally conscious consumers, particularly for smaller or less delicate items, can also pose a reputational challenge, even if the packaging is designed for reusability or recyclability. Lastly, the need for specialized machinery and expertise for intricate designs and high-quality printing can create barriers to entry for smaller packaging companies, potentially limiting the overall competitive landscape and innovation within certain sub-segments.

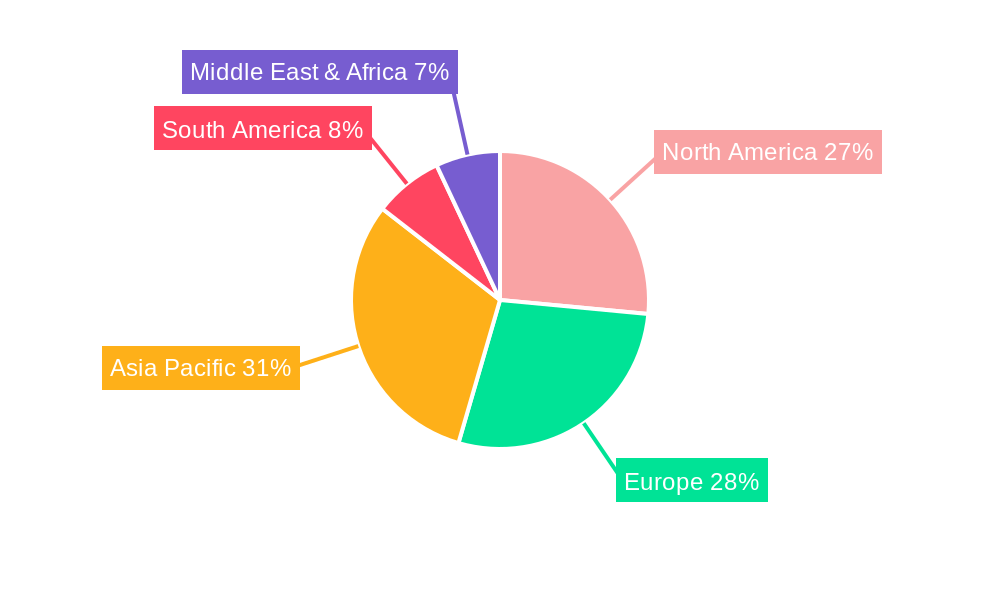

The World Rigid Sleeve Boxes Production market is poised for significant dominance by specific regions and product segments, driven by a complex interplay of economic development, consumer behavior, and industry-specific demands.

Dominant Regions/Countries:

Dominant Segments:

The interplay of these regions and segments, with their specific demands and consumption patterns, will dictate the overall growth trajectory and market share distribution within the World Rigid Sleeve Boxes Production landscape.

The World Rigid Sleeve Boxes Production industry is experiencing robust growth fueled by several key catalysts. The escalating demand for premium and luxury product experiences is a significant driver, as brands increasingly recognize packaging as a crucial element in brand perception and consumer engagement. The burgeoning e-commerce sector, demanding durable and protective packaging for transit, further amplifies this need. Furthermore, the rise of subscription box services across various consumer goods categories presents a consistent demand for visually appealing and sturdy packaging solutions. Innovations in sustainable materials and printing technologies are also opening new avenues, allowing for eco-conscious yet premium rigid sleeve box designs.

This report offers an exhaustive analysis of the World Rigid Sleeve Boxes Production market, providing in-depth insights into trends, market dynamics, and future projections. Spanning the period from 2019-2033, with 2025 as the base and estimated year, the study meticulously examines the market across various Types including Corrugated, Cardboard, Kraft, and Linen, and its diverse Applications such as Jewelry, Tobacco, Electronics, Personal Care and Cosmetics, Food and Beverages, and Others. The report delves into the driving forces propelling this industry forward, including the surge in e-commerce and the consumer’s growing desire for premium unboxing experiences. Simultaneously, it critically evaluates the challenges and restraints that may impact market growth, such as cost considerations and material sourcing complexities. The analysis also identifies key regions and dominant market segments, offering a comprehensive understanding of where and why growth is most pronounced. With detailed company profiles of leading players and a chronological overview of significant industry developments, this report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the opportunities within the dynamic rigid sleeve boxes market, where production is projected to reach millions of units.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PackMojo, FurongBox, Wibropack, PakFactory, Emenac Packaging, Half Price Packaging, PAX Solutions, Packaging Consultants, Inc., Lihua Group, International Paper, WestRock, Smurfit Kappa Group, Rengo, SCA, Georgia-Pacific, Mondi Group, Inland Paper, Oji, Cascades, Alliabox International (Alliance), DS Smith, Packaging Corporation of America, Europac Group.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Rigid Sleeve Boxes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rigid Sleeve Boxes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.