1. What is the projected Compound Annual Growth Rate (CAGR) of the Reusable Shipping Boxes?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Reusable Shipping Boxes

Reusable Shipping BoxesReusable Shipping Boxes by Type (Plastic, Cardboard, Others), by Application (Food Industry, Transportation Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

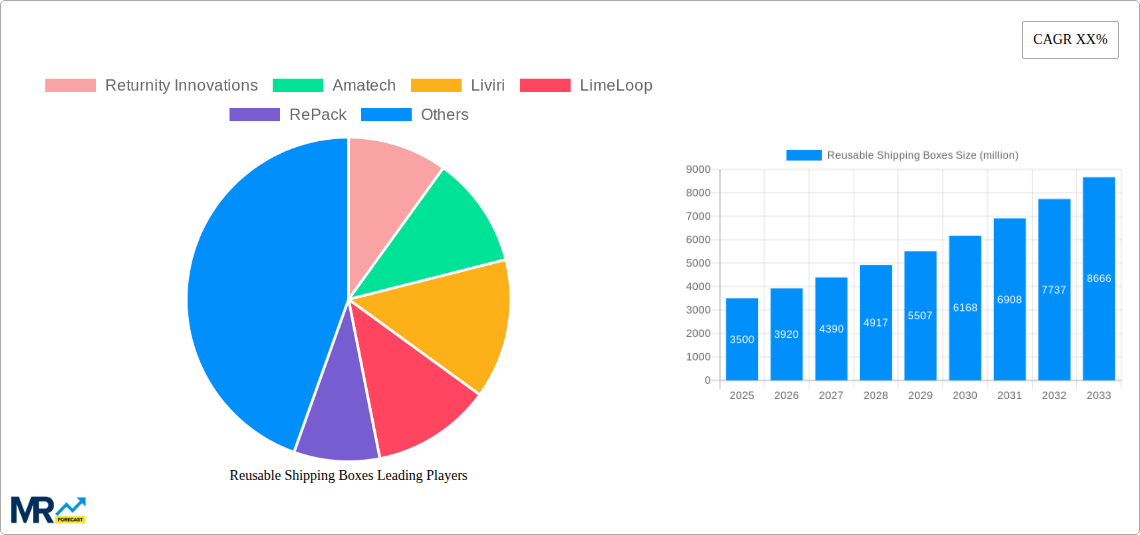

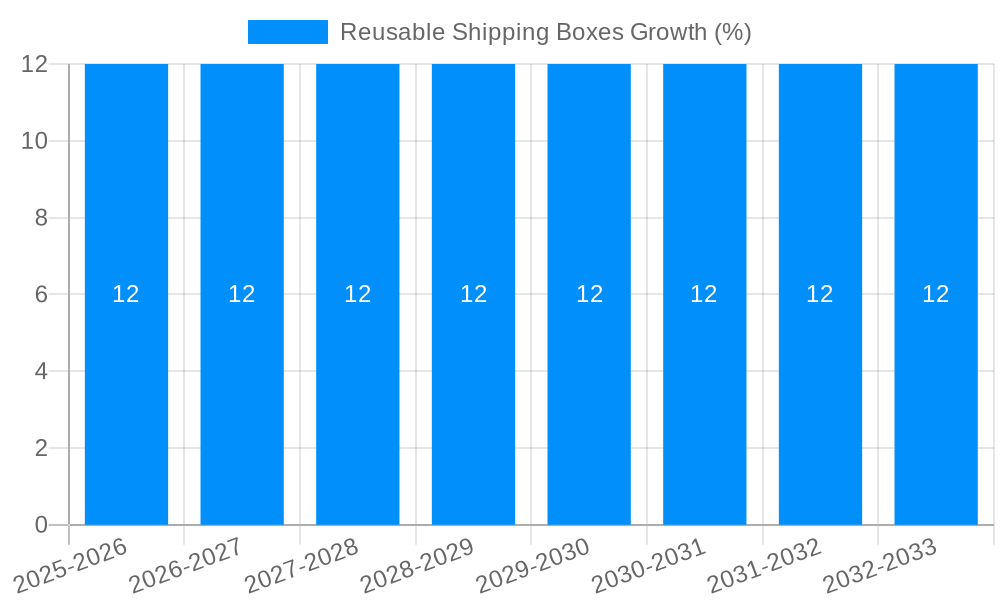

The global Reusable Shipping Boxes market is experiencing robust growth, estimated at approximately $3.5 billion in 2025, and is projected to expand at a Compound Annual Growth Rate (CAGR) of around 12% through 2033. This expansion is fueled by a growing environmental consciousness and increasing regulatory pressures to reduce single-use packaging waste. Key drivers include the escalating demand from the e-commerce sector, which necessitates frequent and efficient shipping solutions, and a broader industry shift towards sustainable supply chain practices. The convenience and cost-effectiveness offered by reusable packaging over its lifecycle, despite initial investment, are increasingly recognized by businesses across various sectors. Furthermore, advancements in material science are leading to more durable, lightweight, and cost-efficient reusable box designs, enhancing their appeal.

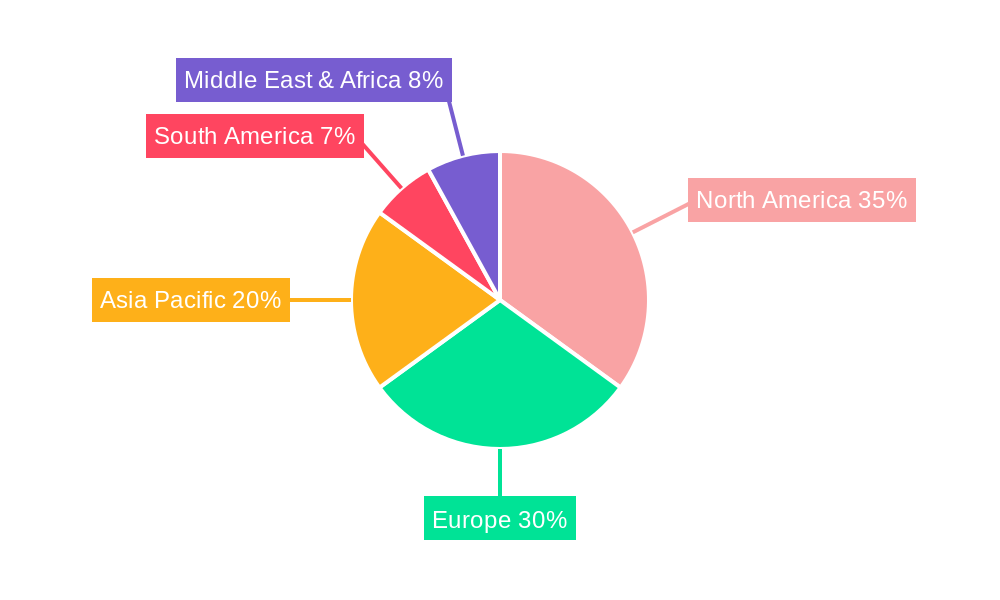

The market is segmented by type, with plastic dominating due to its durability and ease of cleaning, followed by cardboard and other innovative materials. The food industry and transportation industry are the primary application segments, leveraging reusable boxes for their ability to maintain product integrity and reduce logistical costs. However, the market faces some restraints, including the initial capital expenditure required for adoption, the need for robust reverse logistics infrastructure to facilitate returns, and consumer adoption challenges related to convenience. Despite these hurdles, the overarching trend towards a circular economy and the proactive efforts of key players like Returnity Innovations, Amatech, and RePack in developing innovative solutions are poised to overcome these limitations, driving sustained growth and market penetration across North America, Europe, and the rapidly expanding Asia Pacific region.

XXX, the global reusable shipping boxes market is poised for significant expansion, projected to reach XXX million units by the end of the forecast period in 2033. This surge is underpinned by a confluence of escalating environmental consciousness among consumers and businesses alike, coupled with increasingly stringent governmental regulations aimed at reducing single-use packaging waste. The study period, spanning from 2019 to 2033, with a base and estimated year of 2025, offers a detailed analysis of this dynamic sector. During the historical period of 2019-2024, early adoption and pilot programs laid the groundwork for the current growth trajectory. The market is witnessing a pronounced shift away from traditional cardboard and single-use plastic alternatives towards more durable, robust, and ergonomically designed reusable solutions. This evolution is driven by the inherent economic benefits of closed-loop systems, where the long-term cost savings from repeated usage outweigh the initial investment in reusable packaging. Companies like Returnity Innovations and Liviri are at the forefront, offering sophisticated, often plastic-based, reusable containers designed for efficient logistics and multiple return trips. The increasing integration of smart technologies, such as RFID tracking and IoT sensors, within these boxes is also a key trend, enhancing supply chain visibility, optimizing reverse logistics, and ensuring product integrity during transit. This technological integration not only improves operational efficiency but also provides valuable data for further refinement of reusable packaging systems. Furthermore, a growing emphasis on the "circular economy" principles is fueling innovation in material science and design, leading to the development of lighter, stronger, and more easily repairable reusable boxes. The market is also seeing a diversification of offerings, catering to specific industry needs. From insulated reusable boxes for the food industry to heavy-duty crates for the transportation sector, the market is adapting to a wide array of applications. This adaptability is crucial for widespread adoption, as it demonstrates the versatility and practical advantages of reusable shipping solutions across diverse industrial landscapes. The forecast period of 2025-2033 anticipates this momentum to accelerate, driven by further technological advancements and a deeper societal commitment to sustainability.

The burgeoning reusable shipping boxes market is experiencing a powerful impetus from a multifaceted array of driving forces. Foremost among these is the intensifying global focus on sustainability and environmental stewardship. Consumers are increasingly demanding eco-friendly packaging, and businesses are responding by actively seeking to reduce their carbon footprint and minimize waste generation. This ethical imperative is strongly supported by a growing body of government regulations and policies worldwide that penalize or restrict the use of single-use packaging materials. Initiatives promoting a circular economy, where materials are kept in use for as long as possible, further bolster the adoption of reusable shipping solutions. Beyond environmental concerns, the economic advantages of reusable shipping boxes are becoming increasingly apparent. While the initial investment may be higher, the long-term cost savings derived from the elimination of recurring single-use packaging purchases, reduced waste disposal fees, and optimized logistics are compelling. Companies like Rentacrate enterprises and BungoBox are demonstrating the profitability of well-managed reusable packaging systems. Furthermore, the increasing efficiency and reliability of reverse logistics networks are making the return and refurbishment of reusable boxes more seamless and cost-effective. Advances in material science have also led to the development of more durable, lightweight, and temperature-controlled reusable boxes, expanding their applicability across various industries, including the sensitive food industry where temperature integrity is paramount. The desire for enhanced brand image and corporate social responsibility is also a significant driver, as companies can leverage their commitment to sustainable packaging to differentiate themselves in the marketplace.

Despite the robust growth trajectory, the reusable shipping boxes market is not without its hurdles. A significant challenge lies in the initial capital investment required for acquiring a sufficient inventory of high-quality reusable containers. This upfront cost can be a substantial barrier for small and medium-sized enterprises (SMEs) or businesses with tighter budgets, even though the long-term benefits are evident. The establishment and efficient management of a robust reverse logistics network are also critical. The successful return, cleaning, and refurbishment of used boxes necessitate intricate planning, dedicated infrastructure, and effective partnerships, which can be complex and costly to set up, particularly for geographically dispersed operations. Consumer behavior and adoption rates can also present a restraint. Educating end-users about proper return procedures and ensuring their active participation in the closed-loop system are crucial for the overall effectiveness of reusable packaging. Resistance to change or a lack of awareness can hinder the widespread adoption of these systems. Furthermore, the standardization of reusable packaging across different industries and supply chains is still evolving. A lack of universal standards can lead to compatibility issues and complicate inter-company collaborations. Lastly, the potential for damage or loss of reusable boxes during transit or within the reverse logistics process, coupled with the associated costs of repair or replacement, can impact the overall economic viability of the system if not managed meticulously. Companies like Temple - Inland and International Paper, while established players, face the challenge of integrating reusable models into their existing infrastructure and customer expectations.

The Plastic segment within the reusable shipping boxes market is poised to exhibit dominant growth, driven by its inherent durability, versatility, and superior protection capabilities for a wide range of goods. This segment is particularly influential in the North America region, which is leading the market due to a confluence of factors including strong consumer demand for sustainable products, proactive government initiatives, and a well-developed logistics infrastructure. The United States, in particular, is a key market, with companies like Returnity Innovations, Liviri, and LimeLoop actively investing in and expanding their plastic reusable box offerings. The advanced material science and manufacturing capabilities in North America enable the production of high-performance plastic reusable boxes that can withstand numerous shipping cycles, offering significant cost savings over time and reducing environmental impact.

In terms of application, the Food Industry is a significant and rapidly growing segment that will contribute to the dominance of plastic reusable boxes. The stringent requirements for hygiene, temperature control, and product integrity in food transportation make durable and easily cleanable plastic containers an ideal solution. Companies like Amatech are instrumental in providing specialized reusable packaging solutions for the food sector, often leveraging high-grade plastics that meet food safety regulations. The ability of plastic boxes to maintain consistent temperatures, whether for fresh produce, chilled goods, or frozen items, is a critical advantage. Furthermore, the growing e-commerce penetration in the food sector, including meal kit delivery services and online grocery shopping, is creating a substantial demand for reliable and reusable packaging that can handle multiple deliveries and returns efficiently. The sustainability ethos that permeates the food industry, from farm to fork, further amplifies the appeal of reusable solutions, with plastic being a favored material for its longevity and ease of sanitization.

The Transportation Industry also plays a pivotal role in the market's dominance, as the need for robust and reliable packaging for the movement of goods, both within and across borders, is paramount. Plastic reusable boxes offer superior stackability, impact resistance, and security compared to traditional cardboard, which can degrade under adverse conditions. Companies like Salazar and Reuse – Rethinking Packaging are contributing to this dominance by offering tailored reusable solutions for logistics providers and manufacturers. The efficiency gains in warehouse management and shipping operations, achieved through the standardization and durability of plastic crates, are substantial. The trend towards faster delivery times and the increasing complexity of supply chains further necessitate packaging that can endure rough handling and repeated use without compromising the integrity of the cargo. The cost-effectiveness of these solutions, when factored over their extended lifespan, makes them an attractive proposition for large-scale logistics operations. While cardboard remains a viable option, especially for less sensitive goods or shorter transit times, the inherent advantages of plastic in terms of durability, hygiene, and long-term cost savings are positioning it as the segment to dominate the reusable shipping boxes market, particularly within the prominent North American region.

The reusable shipping boxes industry is experiencing accelerated growth fueled by several key catalysts. The escalating consumer demand for sustainable products is a major driver, pushing businesses towards eco-friendly packaging solutions. Governments worldwide are implementing stricter regulations on single-use plastics and waste reduction, making reusable alternatives more attractive and often mandated. Furthermore, the recognition of significant long-term cost savings for businesses through reduced packaging procurement and waste disposal fees is a powerful economic incentive. Technological advancements in material science are leading to the development of more durable, lightweight, and efficient reusable boxes, expanding their applicability. The growth of e-commerce also necessitates efficient and returnable packaging systems.

This report offers an in-depth and comprehensive analysis of the global reusable shipping boxes market, providing invaluable insights for stakeholders seeking to understand and capitalize on this evolving industry. Spanning a detailed study period from 2019 to 2033, with a specific focus on the base and estimated year of 2025, and a thorough historical analysis from 2019-2024, the report delves into market trends, growth drivers, and prevailing challenges. It meticulously examines the dominant role of plastic reusable boxes and the significant impact of the food and transportation industries within the North American region. Furthermore, the report identifies and profiles key players, including Returnity Innovations, Amatech, and Liviri, and details significant market developments from 2020 to 2023. The comprehensive coverage ensures that businesses can make informed strategic decisions, identify lucrative opportunities, and navigate the complexities of the reusable shipping boxes landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Returnity Innovations, Amatech, Liviri, LimeLoop, RePack, TerraCycle, Temple- Inland, Reuse- Rethinking Packaging, Salazar, International Paper, Crown Holdings, Amcor, Rentacrate enterprises, BungoBox.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Reusable Shipping Boxes," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Reusable Shipping Boxes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.