1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Whole-house Ventilation System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Residential Whole-house Ventilation System

Residential Whole-house Ventilation SystemResidential Whole-house Ventilation System by Type (Exhaust-only, Supply-only, Balanced, World Residential Whole-house Ventilation System Production ), by Application (Single-family, Multi-family, World Residential Whole-house Ventilation System Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

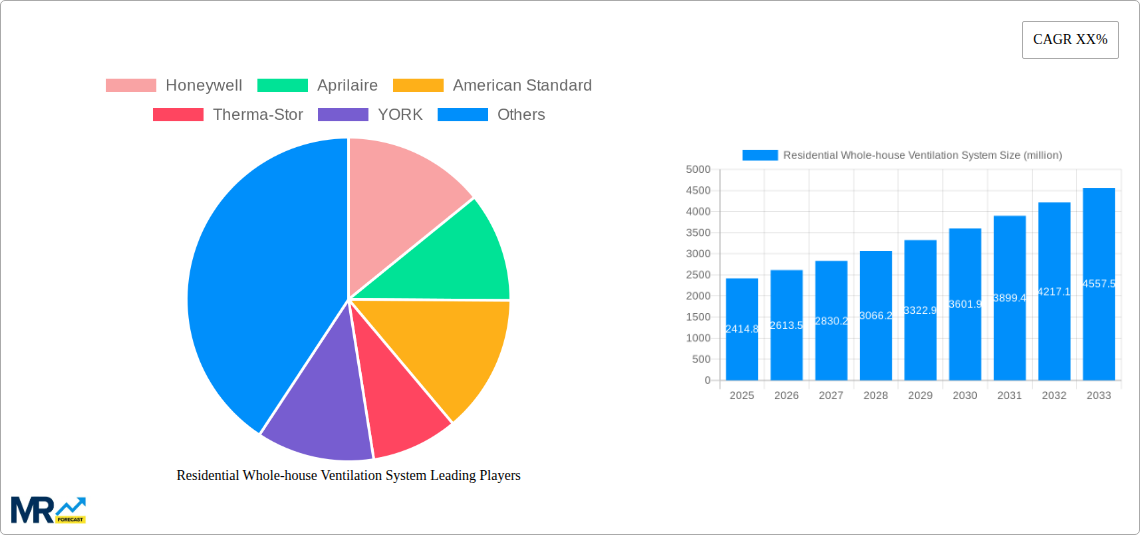

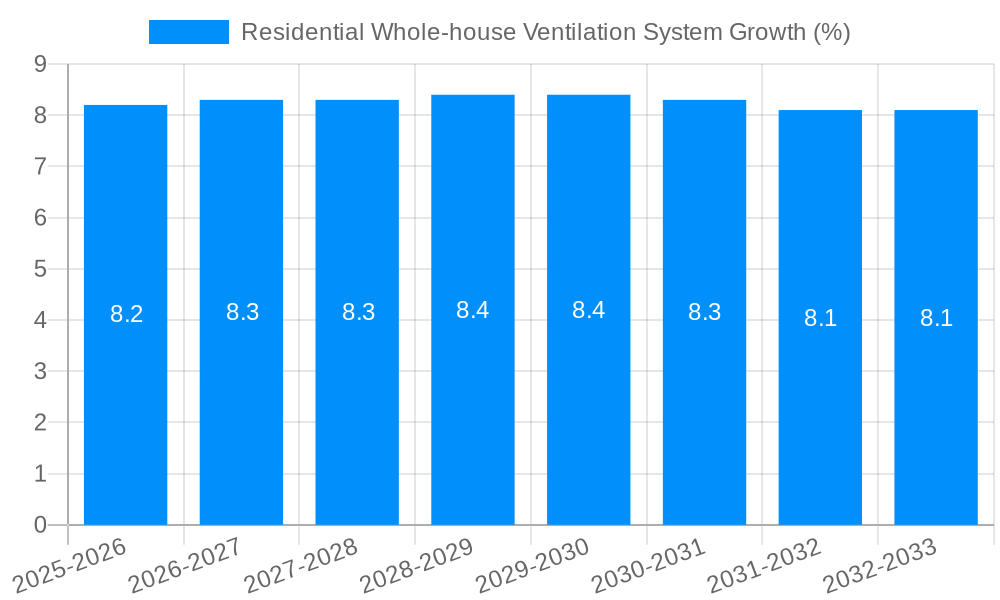

The global Residential Whole-house Ventilation System market is poised for robust growth, projected to reach USD 2414.8 million by 2025. This expansion is fueled by an increasing awareness among homeowners and builders regarding indoor air quality (IAQ) and its direct impact on health and well-being. Stringent building codes and a growing demand for energy-efficient homes, where airtight construction is paramount, necessitate effective ventilation solutions to prevent moisture buildup, mold, and the accumulation of indoor pollutants. The market is experiencing a significant Compound Annual Growth Rate (CAGR) of approximately 8.5%, indicating sustained upward momentum. Key drivers include rising disposable incomes, a heightened focus on sustainable building practices, and technological advancements leading to more sophisticated and user-friendly ventilation systems. The “Exhaust-only” segment is expected to lead due to its cost-effectiveness and widespread adoption, while the “Balanced” ventilation systems, offering superior IAQ control, are gaining traction. This market’s trajectory is strongly influenced by evolving consumer preferences towards healthier living environments.

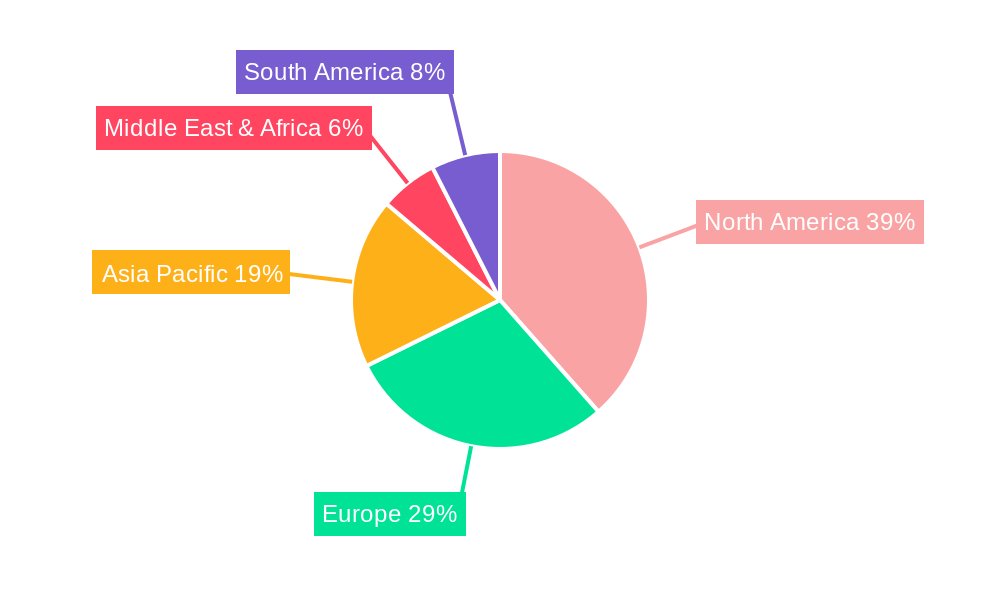

The competitive landscape features established players like Honeywell, Aprilaire, and Carrier, alongside emerging innovators. These companies are driving market evolution through the introduction of smart ventilation technologies, heat recovery ventilators (HRVs), and energy recovery ventilators (ERVs) that offer both improved air quality and significant energy savings. North America currently dominates the market, driven by early adoption and stringent regulations in countries like the United States and Canada. However, the Asia Pacific region, particularly China and India, is anticipated to witness the fastest growth due to rapid urbanization, increasing new housing constructions, and a burgeoning middle class prioritizing healthier homes. Restraints such as the initial cost of installation and a lack of widespread consumer education in certain developing markets are being addressed through increased product availability, innovative financing options, and targeted marketing campaigns highlighting the long-term health and economic benefits of whole-house ventilation. The forecast period (2025-2033) indicates continued strong demand, solidifying the importance of these systems in modern residential construction.

This report delves into the dynamic global market for Residential Whole-house Ventilation Systems, forecasting significant growth and evolution from 2019 through 2033. Our analysis, with the Base Year set at 2025, provides granular insights into market drivers, challenges, key regional and segmental performances, and the strategic landscape of leading manufacturers. We aim to equip stakeholders with the critical intelligence needed to navigate this burgeoning sector.

The global Residential Whole-house Ventilation System market is experiencing a substantial upward trajectory, projected to reach over $15 million by the end of the forecast period in 2033. This growth is underpinned by a confluence of factors, including increasing awareness of indoor air quality (IAQ) and its impact on health and well-being, coupled with the accelerating trend of energy-efficient home construction. As building envelopes become more airtight to conserve energy, the necessity for controlled ventilation to maintain healthy IAQ becomes paramount. Consumers are increasingly recognizing that while sealing homes is beneficial for energy savings, it can trap pollutants like volatile organic compounds (VOCs), allergens, and moisture, leading to issues such as mold growth and respiratory problems. This heightened awareness is driving demand for integrated ventilation solutions that go beyond simple exhaust fans. Furthermore, advancements in smart home technology are playing a pivotal role. Modern ventilation systems are becoming more sophisticated, offering features like demand-controlled ventilation, integrated air purification, and seamless integration with other smart home devices. This allows for automated adjustments based on occupancy, humidity levels, and detected pollutant levels, optimizing both air quality and energy efficiency. The market is also witnessing a rise in the adoption of heat recovery ventilators (HRVs) and energy recovery ventilators (ERVs), particularly in colder and hotter climates respectively. These systems pre-condition incoming fresh air using the energy from outgoing stale air, significantly reducing heating and cooling loads. The emphasis on sustainable building practices and government regulations promoting healthier indoor environments are further bolstering market expansion. From a segmentation perspective, the Balanced ventilation systems, which supply and exhaust air in equal measure, are expected to witness the most robust growth due to their superior IAQ control and energy recovery capabilities. Similarly, the Single-family application segment is anticipated to dominate, driven by higher disposable incomes and a greater emphasis on personalized comfort and health within individual homes. The overall market sentiment is optimistic, with innovation and consumer demand setting a strong pace for future development.

Several potent forces are actively propelling the expansion of the Residential Whole-house Ventilation System market. Foremost among these is the escalating global concern for indoor air quality (IAQ). With increasing urbanization and a greater proportion of life spent indoors, consumers are becoming acutely aware of the potential health risks associated with poor ventilation, including respiratory ailments, allergies, and the exacerbation of existing health conditions. This growing consciousness directly translates into a demand for sophisticated ventilation solutions that actively manage and improve the air within homes. Secondly, stringent building energy efficiency codes and standards worldwide are a significant catalyst. As new homes are built with enhanced insulation and airtightness to minimize energy consumption, mechanical ventilation systems become essential to prevent the buildup of moisture, pollutants, and CO2, thereby ensuring a healthy living environment without compromising energy savings. This regulatory push is compelling builders and developers to integrate these systems as standard features. The advancement of smart home technology is another key driver. The integration of intelligent sensors and automation allows for demand-controlled ventilation, where systems adjust based on real-time IAQ readings and occupancy, optimizing performance and energy use. This convenience and customization appeal to modern homeowners. Finally, a growing emphasis on occupant health and well-being, particularly post-pandemic, has elevated the importance of IAQ as a critical component of healthy living. This holistic approach to home design and functionality is solidifying the position of whole-house ventilation systems.

Despite the robust growth trajectory, the Residential Whole-house Ventilation System market faces several challenges and restraints that could impede its full potential. A primary hurdle is the initial cost of installation. Whole-house systems, especially advanced balanced systems with heat or energy recovery, can represent a significant upfront investment for homeowners, making them a less accessible option for budget-conscious consumers or in price-sensitive housing markets. This can lead to a preference for less comprehensive and cheaper alternatives like window fans or exhaust-only systems. Another significant challenge is the lack of widespread consumer awareness and understanding. While IAQ is gaining prominence, many homeowners still do not fully grasp the benefits of whole-house ventilation compared to simpler ventilation methods or may not be aware of the long-term health and cost implications of poor indoor air. Educating the market effectively remains a crucial task. Installation complexity and the need for skilled labor also present a restraint. Proper installation and commissioning of these systems require specialized knowledge and training, which can be a bottleneck for widespread adoption, especially in regions with a shortage of qualified HVAC technicians. Furthermore, the perceived complexity of maintenance can deter some consumers. While modern systems are designed for ease of use, the need for regular filter replacements and occasional servicing can be seen as an ongoing burden. Finally, competition from alternative solutions such as standalone air purifiers or dehumidifiers, while not direct replacements, can divert consumer spending and attention away from integrated whole-house ventilation solutions.

The global Residential Whole-house Ventilation System market is characterized by distinct regional dynamics and segment performances that are set to shape its future landscape.

Dominating Regions/Countries:

Dominating Segments:

While multi-family dwellings also present a growing opportunity, the individual control and investment capacity within the single-family segment, coupled with the superior performance of balanced systems, will solidify their dominance in the global Residential Whole-house Ventilation System market during the study period.

The growth of the Residential Whole-house Ventilation System industry is being significantly accelerated by several key catalysts. A paramount driver is the escalating global consumer awareness regarding the detrimental effects of poor indoor air quality on health, leading to a direct demand for cleaner living environments. Furthermore, the ongoing tightening of building energy efficiency regulations worldwide necessitates controlled ventilation to maintain healthy IAQ in increasingly airtight structures, effectively making these systems indispensable. The integration of smart home technology, enabling demand-controlled ventilation and personalized comfort, is also a major growth catalyst, appealing to tech-savvy homeowners. Finally, a growing global emphasis on sustainable building practices and a desire for healthier lifestyles further propels the adoption of these advanced ventilation solutions.

This comprehensive report provides an exhaustive analysis of the global Residential Whole-house Ventilation System market, meticulously covering the historical period of 2019-2024 and extending through an extensive forecast period of 2025-2033, with 2025 serving as the base and estimated year. Our research delves into the intricate interplay of market trends, identifying key drivers such as escalating IAQ awareness and stringent energy efficiency regulations, which are collectively expected to propel the market to over $15 million in value. We meticulously examine the challenges, including initial costs and consumer education, that influence market penetration. The report further offers a detailed breakdown of dominant regions and crucial market segments, highlighting the ascendancy of North America and Europe, and the leading roles of balanced ventilation systems and single-family applications. Leading industry players are identified, alongside a timeline of significant technological advancements and market developments, providing a complete strategic overview for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Honeywell, Aprilaire, American Standard, Therma-Stor, YORK, Carrier, Panasonic, Daikin, Aldes, Zehnder, UltimateAir, AirScape, Broan, Siegenia, .

The market segments include Type, Application.

The market size is estimated to be USD 2414.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Residential Whole-house Ventilation System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Residential Whole-house Ventilation System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.