1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Portable Power Generators?

The projected CAGR is approximately 10.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Residential Portable Power Generators

Residential Portable Power GeneratorsResidential Portable Power Generators by Application (Less than 4 KW, 4- 8 KW, 8-17 KW, More than 17 KW), by Type (Gas and Propane Type, Diesel and Gasoline Type), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

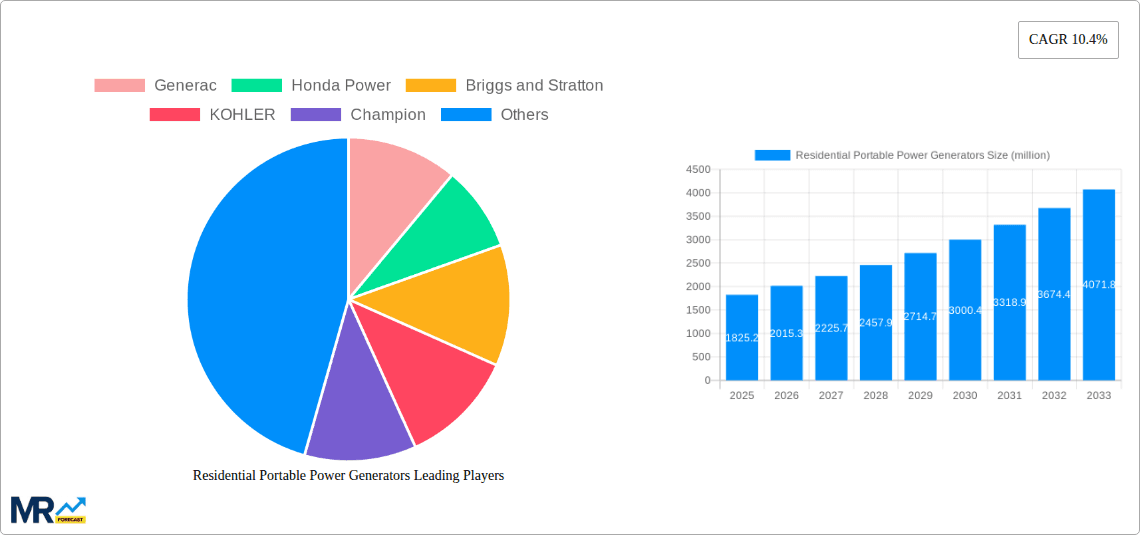

The residential portable power generator market, valued at $4,434 million in 2025, is projected to experience robust growth, driven by increasing frequency and severity of power outages, rising demand for backup power solutions in residential settings, and growing awareness of energy security concerns. This growth is further fueled by advancements in generator technology, leading to quieter, more fuel-efficient, and environmentally friendly models. The market segmentation reveals a significant demand across various power output ranges, with the 4-8 kW segment likely representing a substantial portion due to its suitability for most household needs. Gas and propane-fueled generators currently dominate the type segment, reflecting their readily available fuel sources and relatively lower cost compared to diesel or gasoline options. However, the increasing adoption of cleaner energy sources and stricter emission regulations may drive a shift towards more environmentally friendly alternatives in the coming years. Key players in this competitive landscape include Generac, Honda Power Equipment, Briggs & Stratton, Kohler, and others, constantly innovating and expanding their product lines to cater to evolving consumer demands and regional preferences. Geographic growth is anticipated across all regions, with North America and Asia Pacific likely to lead due to robust infrastructure development and increasing electrification in these regions.

The market's Compound Annual Growth Rate (CAGR) of 10.6% indicates a steady expansion over the forecast period (2025-2033). This growth trajectory is likely to be influenced by several factors, including rising disposable incomes in developing economies leading to increased demand for improved home amenities and energy security, and government initiatives promoting renewable energy integration and backup power systems in residential areas. The market's restraints may include fluctuating fuel prices, concerns about noise pollution, and the initial investment cost associated with purchasing and installing a generator. However, technological advancements aiming to reduce noise and improve fuel efficiency are likely to mitigate these concerns, fostering continued market growth. Competitive pressures from established and emerging players are also expected to shape the market landscape, driving innovation and enhancing product offerings to meet consumer demands for performance, reliability, and affordability.

The residential portable power generator market, valued at X million units in 2025, is experiencing robust growth, projected to reach Y million units by 2033. This expansion is driven by several interconnected factors. Increasing frequency and intensity of extreme weather events, such as hurricanes, wildfires, and ice storms, are creating a surge in demand for backup power solutions. Consumers are prioritizing energy independence and resilience, recognizing the vulnerability of grid-dependent systems. Technological advancements, including quieter operation, improved fuel efficiency, and smart features (remote monitoring, automatic start-up), are making these generators more appealing and user-friendly. Furthermore, the rising adoption of environmentally conscious propane and natural gas models is contributing to market expansion, catering to environmentally conscious consumers. The historical period (2019-2024) showed steady growth, laying the foundation for the impressive forecast period (2025-2033) projections. This growth isn't uniform across all segments. While the smaller (<4 kW) segment continues to hold a significant market share, driven by affordability and suitability for smaller homes, the demand for higher-capacity units (8-17 kW and above) is also expanding rapidly, reflecting an increasing preference for whole-home power protection. The market's competitive landscape includes both established players and newer entrants, fueling innovation and competition. Market segmentation by application (power output) and fuel type reveals diverse consumer needs and preferences, which manufacturers are actively addressing with tailored products and marketing strategies. The ongoing development of hybrid and inverter generator technology promises further market transformation.

The primary driver is the escalating frequency and severity of natural disasters globally. Power outages, often prolonged, caused by hurricanes, wildfires, and severe storms, are forcing homeowners to prioritize backup power. This shift in consumer mindset is significantly impacting purchasing decisions, prioritizing energy independence and resilience over cost considerations. Government incentives and subsidies for energy-efficient and renewable-energy-compatible generators are also encouraging adoption, particularly in regions prone to power disruptions. Moreover, technological advancements in generator design are making them quieter, more fuel-efficient, and easier to use. Smart features like remote monitoring and automatic start-up are enhancing their appeal to a broader consumer base. The ongoing expansion of the middle class, particularly in developing economies, is further boosting demand as more households can afford to invest in these essential safety and convenience items. The increasing awareness of potential grid failures, driven by aging infrastructure and cybersecurity concerns, also supports the upward trend. Finally, the rising adoption of propane and natural gas models addresses environmental concerns associated with conventional gasoline generators.

Despite the significant growth, several challenges hinder the market’s expansion. High initial purchase costs can be a barrier for budget-conscious consumers, particularly in regions with less frequent power outages. The complexity of installation and maintenance for larger generators can deter some homeowners, particularly those without technical expertise. Stricter emission regulations in some regions are driving up manufacturing costs and influencing the development of environmentally friendly but often more expensive fuel types. Concerns about noise pollution from generators, particularly in densely populated areas, remain a significant consideration for both users and their neighbors. Fluctuations in the price of fuel, a key operating cost, can impact the affordability and attractiveness of generators. Finally, a lack of awareness about generator maintenance and safety protocols could lead to accidents and improper usage, hindering overall market acceptance.

The North American market, particularly the United States, is anticipated to maintain its dominance throughout the forecast period (2025-2033), driven by higher incidences of extreme weather events and a strong emphasis on home safety and security. The 4-8 kW segment will likely experience the strongest growth, offering a balance between affordability and sufficient power for most household needs. This segment caters to a large portion of households who are looking to power essential appliances and systems during outages without the high cost of larger models. Simultaneously, demand for gas and propane-type generators is also set to rise, thanks to their wider availability, relative affordability, and cleaner-burning nature compared to diesel. While the <4kW segment maintains significant market share because of price sensitivity, the increasing adoption of energy storage solutions in conjunction with larger-capacity generators could reshape the power generation landscape. The growth of the 8-17kW segment reflects rising awareness and the willingness of consumers to protect their entire home in a power outage. These mid-range generators are ideal for households looking for a balance of capacity and cost. The larger capacity generators (>17 kW) will see growth too, but at a slower pace due to their higher cost and suitability primarily for larger homes with significant energy demands. In contrast, the diesel market segment faces comparatively slower growth due to higher running costs and stricter environmental norms.

Several factors are converging to propel the growth of the residential portable power generator market. Increased awareness of the vulnerability of power grids to extreme weather and other disruptions is driving demand. Technological innovations are making generators more user-friendly, efficient, and quieter. Government incentives are encouraging the adoption of cleaner energy solutions, such as propane-powered generators. The rising middle class in developing economies is increasing purchasing power, and improved distribution channels make generators accessible in various regions.

This report offers a comprehensive analysis of the residential portable power generator market, examining key trends, drivers, challenges, and regional dynamics. It provides detailed segmentation by application and fuel type, identifying the leading players and their market strategies. The report further explores the latest technological advancements and their impact on market growth, incorporating historical data (2019-2024) and projecting future trends (2025-2033) for a detailed understanding of the evolving market landscape. It will be an invaluable resource for businesses, investors, and policymakers interested in this critical sector. Note that the exact values (X and Y in million units) would be derived from extensive market research data analysis.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.6%.

Key companies in the market include Generac, Honda Power, Briggs and Stratton, KOHLER, Champion, Yamaha, TTI, United Power Technology, Eaton, Wacker Neuson, Honeywell, Hyundai Power, Sawafuji, Scott's, Pramac, HGI, Mi-T-M.

The market segments include Application, Type.

The market size is estimated to be USD 4434 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Residential Portable Power Generators," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Residential Portable Power Generators, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.