1. What is the projected Compound Annual Growth Rate (CAGR) of the Remote Control Radiography and Fluoroscopy Devices?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Remote Control Radiography and Fluoroscopy Devices

Remote Control Radiography and Fluoroscopy DevicesRemote Control Radiography and Fluoroscopy Devices by Type (Bedside Control, Remote Control, World Remote Control Radiography and Fluoroscopy Devices Production ), by Application (Public Hospital, Private Hospital, World Remote Control Radiography and Fluoroscopy Devices Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

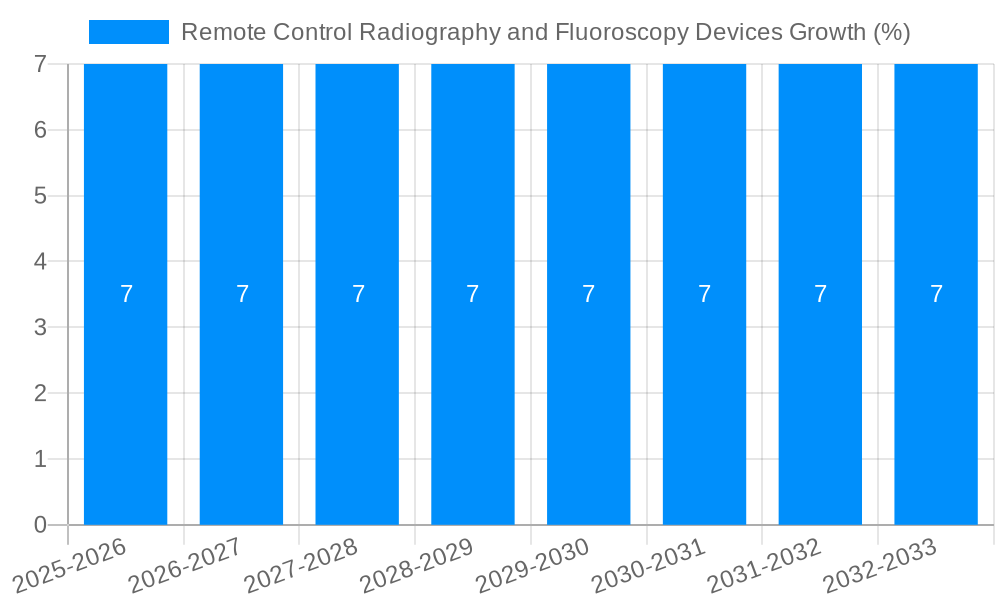

The global market for Remote Control Radiography and Fluoroscopy Devices is poised for significant expansion, projected to reach an estimated market size of approximately $1.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7%. This growth is primarily fueled by the increasing demand for advanced diagnostic imaging solutions in healthcare facilities worldwide, particularly in the wake of rising chronic disease prevalence and the need for minimally invasive procedures. Key drivers include technological advancements leading to enhanced image quality, reduced radiation exposure for both patients and medical professionals, and improved workflow efficiency in radiology departments. The growing emphasis on patient safety and operator comfort further propues the adoption of these remote-controlled systems, allowing for greater precision and reduced physical strain on radiographers. The market is witnessing a strong push towards integrated solutions that offer seamless data management and connectivity, catering to the evolving needs of modern healthcare.

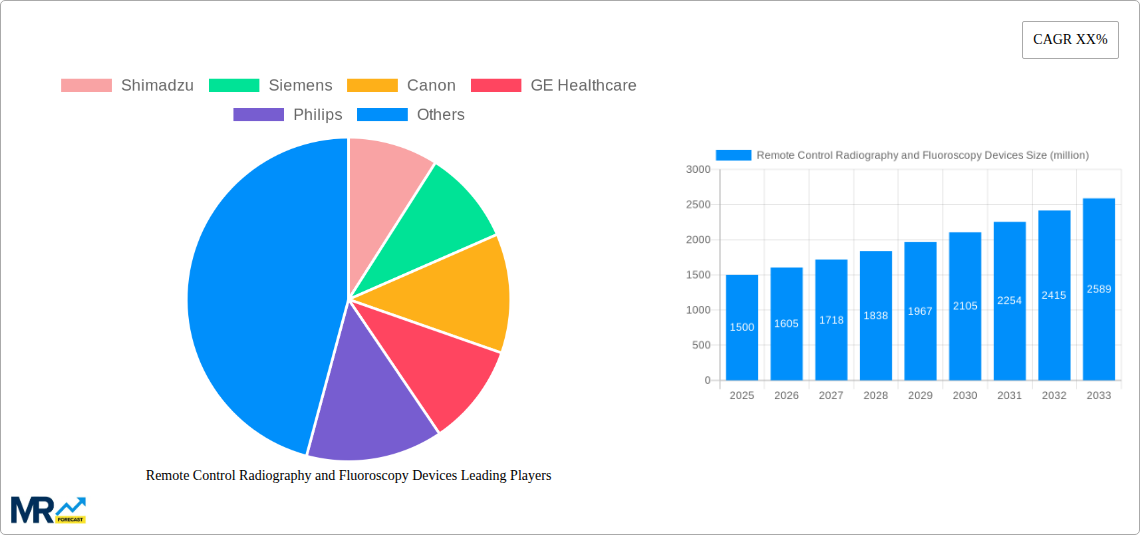

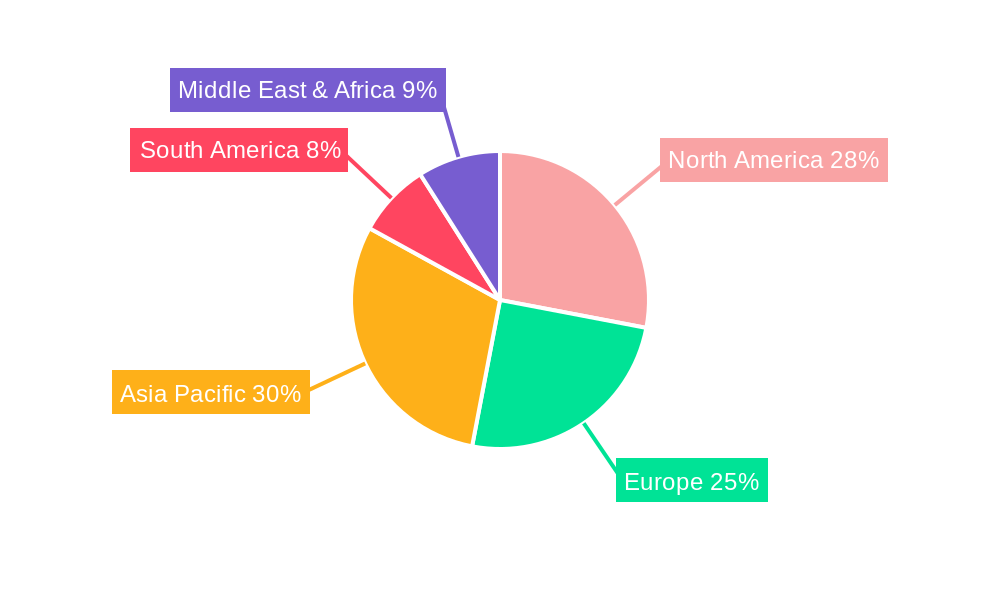

The market is segmented into Bedside Control, Remote Control, and World Remote Control Radiography and Fluoroscopy Devices, with the Remote Control segment anticipated to dominate due to its inherent benefits in reducing operator exposure and enabling complex imaging procedures. Public hospitals represent a major application segment, driven by government initiatives and the need for cost-effective, high-volume diagnostic services. However, private hospitals are also significant adopters, investing in cutting-edge technology to offer specialized services and attract a wider patient base. Geographically, Asia Pacific, led by China and India, is expected to emerge as a high-growth region, attributed to burgeoning healthcare infrastructure, increasing disposable incomes, and a growing awareness of advanced medical technologies. North America and Europe continue to be mature markets, characterized by high adoption rates of sophisticated imaging equipment and a strong regulatory framework. Major players like Siemens, GE Healthcare, and Philips are actively innovating, focusing on AI-powered features and hybrid imaging systems to maintain their competitive edge.

The global market for Remote Control Radiography and Fluoroscopy (RCRF) devices is poised for significant expansion, driven by an evolving healthcare landscape and advancements in imaging technology. The study period, spanning from 2019 to 2033, with a base year of 2025, reveals a dynamic market characterized by increasing adoption of digital imaging solutions and a growing emphasis on patient safety and workflow efficiency. During the historical period (2019-2024), the market witnessed steady growth, fueled by the initial integration of remote operation capabilities and the increasing prevalence of digital radiography. However, the estimated year of 2025 marks a pivotal point, with further acceleration anticipated as RCRF technology matures and becomes more accessible. The forecast period (2025-2033) is expected to witness a CAGR of approximately 7.5%, potentially reaching a valuation in the range of $12 billion to $15 billion units by the end of the projection. This growth is underpinned by several key trends. Firstly, the increasing demand for minimally invasive diagnostic procedures, which often benefit from fluoroscopic guidance, is a significant driver. Secondly, the growing need to optimize radiation dose for both patients and healthcare professionals is paramount, and RCRF systems offer enhanced control over exposure parameters and imaging sequences, contributing to reduced cumulative doses. Furthermore, the burgeoning trend of telemedicine and remote patient monitoring, accelerated by global health events, is creating fertile ground for RCRF devices, enabling specialists to provide expert imaging interpretation and guidance from distant locations. The integration of artificial intelligence (AI) and machine learning (ML) algorithms within RCRF systems is another transformative trend, promising to enhance image quality, automate routine tasks, and aid in diagnostic accuracy, further solidifying the market's upward trajectory. The shift from traditional film-based radiography to digital systems has already laid a strong foundation, and RCRF represents the next logical evolution, offering enhanced connectivity, data management capabilities, and improved operational flexibility within healthcare facilities. The potential for remote collaboration among radiologists and imaging technologists, even across geographical boundaries, is a game-changer, improving access to specialized expertise, particularly in underserved regions. The market is thus evolving towards more sophisticated, integrated, and remotely manageable imaging solutions.

The global market for Remote Control Radiography and Fluoroscopy (RCRF) devices is experiencing robust growth propelled by a confluence of powerful driving forces. A primary catalyst is the escalating global burden of chronic diseases and the increasing demand for advanced diagnostic imaging to manage them effectively. Conditions such as cardiovascular diseases, orthopedic ailments, and cancer require frequent and precise imaging for diagnosis, monitoring, and treatment planning, all of which can be facilitated by RCRF systems. Furthermore, the growing emphasis on patient safety and radiation dose reduction is a significant impetus. RCRF systems allow for precise control over imaging parameters and enable operators to maintain a safe distance from the radiation source, thereby minimizing occupational exposure for healthcare professionals. Simultaneously, sophisticated dose management software integrated into these devices ensures optimal radiation utilization for patients. The surge in the adoption of digital imaging technologies, including Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHRs), has created a synergistic environment for RCRF. These digital infrastructures facilitate seamless data transfer, storage, and remote access, making RCRF systems more integrated and efficient within the broader healthcare IT ecosystem. The increasing need for workflow optimization and operational efficiency within hospitals and diagnostic centers also plays a crucial role. RCRF devices enable radiologists and technicians to perform imaging procedures with greater flexibility and fewer physical constraints, potentially leading to higher patient throughput and reduced turnaround times for diagnostic reports.

Despite the promising growth trajectory, the Remote Control Radiography and Fluoroscopy (RCRF) devices market faces several challenges and restraints that could temper its expansion. A significant hurdle is the substantial initial investment required for advanced RCRF systems. The sophisticated hardware, software, and associated infrastructure can be prohibitively expensive for smaller healthcare facilities or those in resource-limited settings, thereby limiting widespread adoption. The steep learning curve associated with operating complex RCRF systems also presents a challenge. Comprehensive training programs are essential for radiologists and technicians to become proficient in utilizing the full capabilities of these devices, which can be time-consuming and resource-intensive. Cybersecurity concerns are another critical restraint. As RCRF devices become increasingly connected and rely on data transmission, the risk of cyberattacks, data breaches, and unauthorized access to sensitive patient information escalates. Robust cybersecurity measures and stringent regulatory compliance are imperative, adding to the overall cost and complexity of implementation. The regulatory landscape surrounding medical devices, particularly those involving radiation and remote operation, can also be complex and evolving. Obtaining necessary approvals and ensuring compliance with diverse national and international regulations can be a lengthy and arduous process, potentially delaying market entry for new products. Finally, resistance to change from established practices and potential skepticism regarding the reliability and efficacy of remote operation, especially in critical diagnostic scenarios, can slow down the adoption rate in certain regions or healthcare institutions.

The global Remote Control Radiography and Fluoroscopy (RCRF) devices market is projected to witness significant dominance from key regions and specific market segments, driven by a combination of technological adoption, healthcare infrastructure development, and market dynamics.

Dominant Regions/Countries:

Dominant Segments:

Several key factors are acting as significant growth catalysts for the Remote Control Radiography and Fluoroscopy (RCRF) devices industry. The persistent rise in the global prevalence of chronic diseases, including cardiovascular conditions, orthopedic disorders, and cancer, necessitates advanced and precise diagnostic imaging, which RCRF systems readily provide. Furthermore, the increasing global focus on patient safety and occupational health is driving the adoption of RCRF, as these devices significantly reduce radiation exposure for healthcare professionals. The technological advancements in digital imaging, coupled with the integration of AI and machine learning, are enhancing image quality, automating tasks, and improving diagnostic accuracy, making RCRF devices more attractive. The growing trend towards telemedicine and remote healthcare services, accelerated by recent global events, further fuels the demand for RCRF solutions that enable remote diagnostics and consultations.

This comprehensive report delves into the intricacies of the global Remote Control Radiography and Fluoroscopy (RCRF) devices market, providing a meticulous analysis of its trajectory from 2019 to 2033. The study meticulously examines key market insights, industry trends, and the driving forces that are shaping its expansion. It also addresses the inherent challenges and restraints that could impact market growth. Furthermore, the report identifies and analyzes the dominant regions, countries, and specific market segments, including the "Remote Control" and "World Remote Control Radiography and Fluoroscopy Devices Production" types and the "Public Hospital" application, that are expected to lead market growth. The report also highlights significant developments and technological advancements, offering a forward-looking perspective. By providing a detailed segmentation analysis, competitive landscape, and future outlook, this report offers an invaluable resource for stakeholders seeking to understand and capitalize on the evolving RCRF market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Shimadzu, Siemens, Canon, GE Healthcare, Philips, Wandong Medical, Fujifilm, Angell Technology, GMM, XGY, PRELOVE, Listem, Allengers Medical Systems, DMS Imaging, SternMed, Agfa-Gevaert, BMI Biomedical International, DEL Medical (UMG), Landwind Medical, IMAGO Radiology, PrimaX International, NP JSC Amico, Braun, Thales, Shenzhen Browiner Tech, Carestream Health, Samsung, Mindray, Italray.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Remote Control Radiography and Fluoroscopy Devices," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Remote Control Radiography and Fluoroscopy Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.