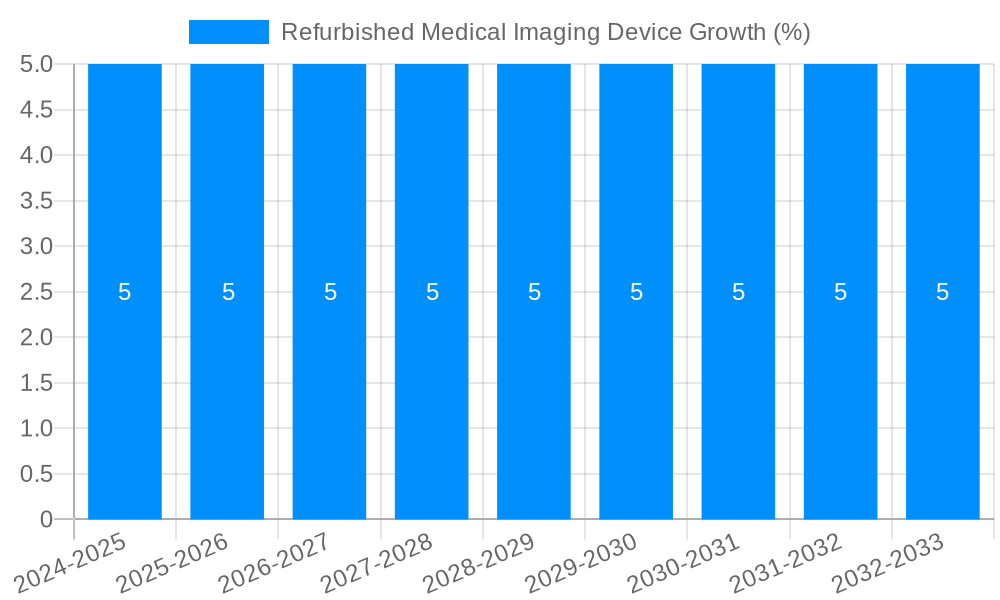

1. What is the projected Compound Annual Growth Rate (CAGR) of the Refurbished Medical Imaging Device?

The projected CAGR is approximately 4.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Refurbished Medical Imaging Device

Refurbished Medical Imaging DeviceRefurbished Medical Imaging Device by Type (X-Ray Device, Magnetic Resonance Imaging (MRI) Equipment, Nuclear Imaging Equipment, Others), by Application (Hospital, Clinic, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

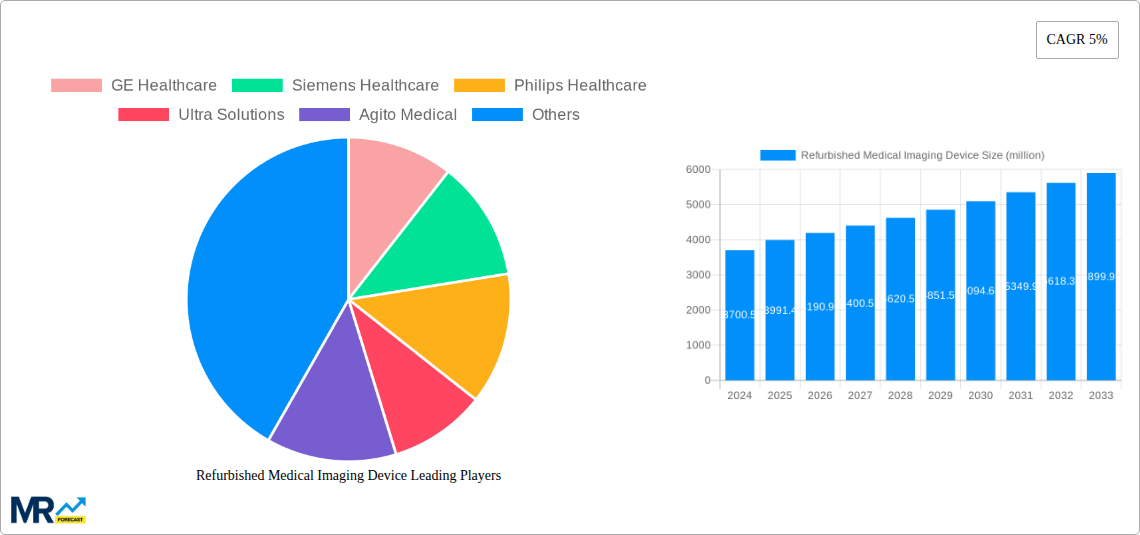

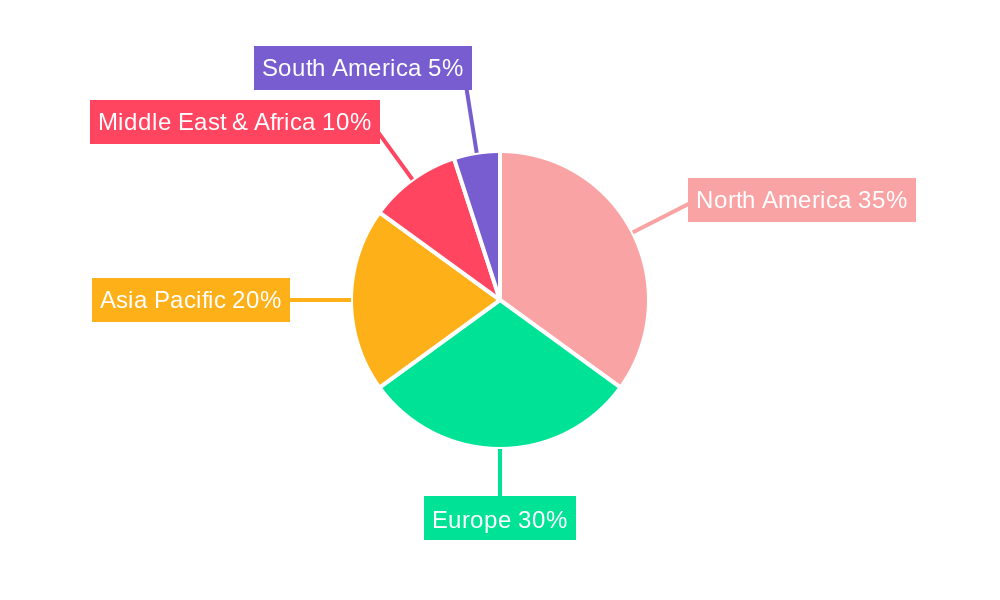

The refurbished medical imaging device market, valued at $2971.3 million in 2025, is projected to experience robust growth, driven by increasing demand for cost-effective healthcare solutions and the rising prevalence of chronic diseases necessitating frequent imaging procedures. A Compound Annual Growth Rate (CAGR) of 4.3% from 2025 to 2033 indicates a steady expansion, with the market expected to surpass $4000 million by 2030. This growth is fueled by several factors. Firstly, the substantial cost savings associated with refurbished equipment compared to new systems make it an attractive option for hospitals, clinics, and smaller healthcare providers, particularly in developing economies. Secondly, advancements in refurbishment technologies ensure that these devices meet stringent quality and safety standards, allaying concerns about performance and reliability. Finally, the rising adoption of telemedicine and remote healthcare increases the need for cost-effective imaging solutions across wider geographical areas. The market segmentation shows strong demand across various device types (X-Ray, MRI, Nuclear Imaging) and applications (hospitals and clinics), with North America and Europe currently dominating market share due to established healthcare infrastructure and high adoption rates. However, emerging markets in Asia-Pacific are expected to witness significant growth driven by increasing healthcare investments and a burgeoning middle class with improved access to healthcare.

The competitive landscape is characterized by a mix of established players like GE Healthcare, Siemens Healthcare, and Philips Healthcare, along with smaller specialized companies focusing on refurbishment and servicing. The increasing focus on sustainability and reduced environmental impact of medical equipment also contributes to the market's expansion, as refurbishing extends the lifespan of devices, minimizing electronic waste. However, challenges remain, including potential concerns about warranty periods and the need for robust quality control mechanisms to ensure the reliability and safety of refurbished equipment. The continued development of advanced imaging technologies could lead to faster obsolescence of certain devices and potential impact on the refurbished market. Despite these challenges, the long-term outlook remains positive, driven by the persistent need for affordable and high-quality medical imaging across a global healthcare landscape.

The refurbished medical imaging device market is experiencing robust growth, driven by a confluence of factors. The global market, valued at approximately $XX billion in 2025, is projected to reach $YY billion by 2033, exhibiting a CAGR of Z% during the forecast period (2025-2033). This expansion is fueled by several key market insights. Firstly, the escalating demand for high-quality medical imaging services, coupled with budget constraints faced by healthcare providers, particularly in developing economies, is creating a significant opportunity for the refurbished market. Refurbished equipment offers a cost-effective alternative to new devices, allowing facilities to upgrade their technology without substantial capital investment. This is particularly relevant for smaller clinics and hospitals with limited budgets. Secondly, the increasing prevalence of chronic diseases globally is driving the need for advanced diagnostic imaging, further boosting the demand for both new and refurbished equipment. However, the refurbished market specifically benefits from the availability of high-quality pre-owned machines from major manufacturers, many of which undergo rigorous refurbishment processes to meet stringent quality standards. This assures hospitals and clinics of reliable performance at a lower cost. Finally, the growing emphasis on sustainability and reducing electronic waste contributes to the market's appeal. Choosing refurbished equipment minimizes environmental impact compared to manufacturing new devices, aligning with the increasing global focus on sustainable healthcare practices. The historical period (2019-2024) has shown consistent growth, laying a strong foundation for the significant expansion anticipated during the forecast period. The market is witnessing innovation in refurbishment technologies and increased transparency in the supply chain, further fostering trust and enhancing the quality of refurbished medical imaging devices. Competitive pricing strategies employed by refurbished equipment providers are further driving market expansion and increasing the adoption of these cost-effective solutions. The base year for this analysis is 2025, providing a solid benchmark for future projections and a clearer understanding of market dynamics.

Several key factors are driving the growth of the refurbished medical imaging device market. Cost savings are paramount; refurbished equipment offers significant price advantages compared to new devices, making it an attractive option for healthcare providers facing budget limitations. This is particularly true for smaller clinics and hospitals in emerging markets where the initial investment in new equipment can be prohibitive. The availability of high-quality refurbished equipment from reputable manufacturers like GE Healthcare, Siemens Healthineers, and Philips Healthcare, who often provide refurbishment services themselves, ensures reliability and performance. This significantly reduces the risk associated with purchasing pre-owned equipment, making it a viable alternative to new purchases. Furthermore, the increasing demand for advanced imaging technology, particularly in areas with growing populations and higher incidences of chronic diseases, necessitates increased access to imaging services. Refurbished equipment helps address this need by making advanced imaging technology more accessible and affordable. Technological advancements in refurbishment techniques ensure that refurbished devices meet stringent quality standards, often comparable to new equipment. This heightened quality and reliability further contribute to the growing acceptance and adoption of refurbished medical imaging devices. Finally, a growing awareness of environmental sustainability is encouraging the adoption of refurbished equipment as a way to reduce electronic waste and promote environmentally responsible healthcare practices.

Despite the significant growth potential, the refurbished medical imaging device market faces certain challenges and restraints. One major concern is the potential for variability in quality among different refurbished equipment providers. Maintaining consistent quality and reliability across the market requires robust quality control measures and standardization practices. The lack of consistent regulatory frameworks across different regions can also create difficulties in ensuring the safety and performance of refurbished devices. The market may also face concerns regarding the availability of spare parts and after-sales service for older models of equipment. Securing reliable sources for parts and establishing efficient service networks are crucial for ensuring long-term functionality and customer satisfaction. In addition, the perception of lower quality compared to new equipment, despite technological advancements in refurbishment, can hinder the market's expansion. Addressing this requires effective communication strategies highlighting the quality and reliability of refurbished devices through case studies and transparent certification processes. Finally, potential warranty and liability issues may pose challenges to both buyers and sellers in the refurbished equipment market. Clear and comprehensive warranty policies are essential to address these concerns and build trust in the market.

The North American and European markets are currently leading the refurbished medical imaging device market, driven by the presence of a large number of healthcare facilities, well-established regulatory frameworks, and a greater awareness of cost-effective healthcare solutions. However, the Asia-Pacific region is expected to witness significant growth in the coming years, fueled by increasing healthcare spending and a growing demand for advanced medical imaging services.

By Type: The X-Ray device segment is currently dominating the market due to its relatively lower cost and widespread usage compared to other imaging modalities, especially in smaller clinics and hospitals. The large installed base of older X-ray systems creates a substantial pool of potential refurbished units. The MRI equipment segment, although currently smaller, is expected to show strong growth, as the technology advances and refurbishment techniques become more sophisticated, offering greater cost-effectiveness for this high-value equipment. While Nuclear Imaging Equipment is used less extensively it still commands a significant value.

By Application: Hospitals constitute the largest segment of the market. Their higher patient volumes and diverse range of imaging needs make them major purchasers of both new and refurbished equipment. Clinics, while individually purchasing less equipment, together represent a large collective market. However, the "Others" application category, which may include mobile imaging units or specialized facilities, also exhibits promising growth potential as these facilities often prioritize cost-efficiency.

The significant market size and diverse application of X-Ray devices across hospitals and clinics make it the primary segment driving market revenue, contributing to millions of dollars in annual sales. This segment's affordability and extensive utilization across various healthcare settings position it for continued growth in the years to come. The relative ease of refurbishment for X-Ray devices also contributes to this segment's market dominance.

Several factors are catalyzing the growth of the refurbished medical imaging device industry. The increasing affordability of refurbished equipment makes advanced medical imaging technology accessible to a broader range of healthcare providers, improving access to healthcare in underserved communities. This increased accessibility, coupled with the rising prevalence of chronic diseases, is driving demand. Furthermore, the growing awareness of environmental sustainability is motivating healthcare facilities to adopt more eco-friendly practices, with refurbished equipment playing a significant role in reducing electronic waste. Finally, technological advancements in refurbishment techniques are ensuring that refurbished devices meet stringent quality and performance standards, boosting customer confidence and trust in the market.

This report offers a comprehensive overview of the refurbished medical imaging device market, providing detailed insights into market trends, drivers, challenges, and key players. It includes valuable data on market segmentation by type, application, and geography, along with forecasts for future market growth. The report also identifies key growth catalysts and examines the role of sustainability in shaping the market's trajectory. This analysis helps healthcare providers, investors, and industry stakeholders make informed decisions related to the acquisition, refurbishment, and deployment of medical imaging equipment. The comprehensive nature of the report makes it a valuable resource for understanding the current state and future potential of this dynamic and rapidly evolving market segment.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.3%.

Key companies in the market include GE Healthcare, Siemens Healthcare, Philips Healthcare, Ultra Solutions, Agito Medical, Soma Technology, Block Imaging, Whittemore Enterprises, Integrity Medical Systems, TRACO, .

The market segments include Type, Application.

The market size is estimated to be USD 2971.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Refurbished Medical Imaging Device," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Refurbished Medical Imaging Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.