1. What is the projected Compound Annual Growth Rate (CAGR) of the Refrigerated Column Oven?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Refrigerated Column Oven

Refrigerated Column OvenRefrigerated Column Oven by Type (Manual Control Type, Automatic Control Type, Others, World Refrigerated Column Oven Production ), by Application (Food Industry, Chemical Industry, Pharmaceutical Industry, Others, World Refrigerated Column Oven Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

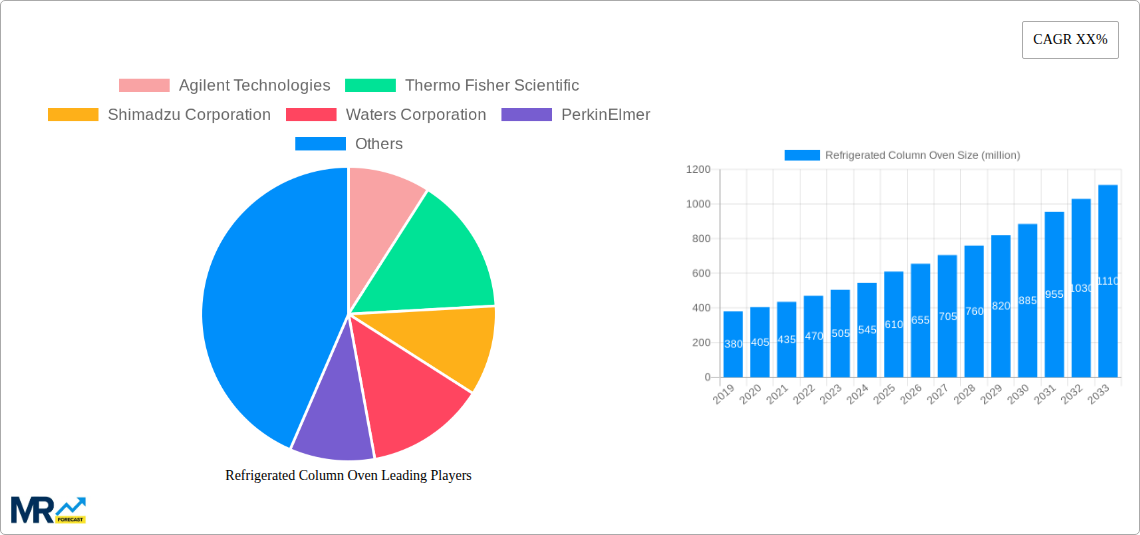

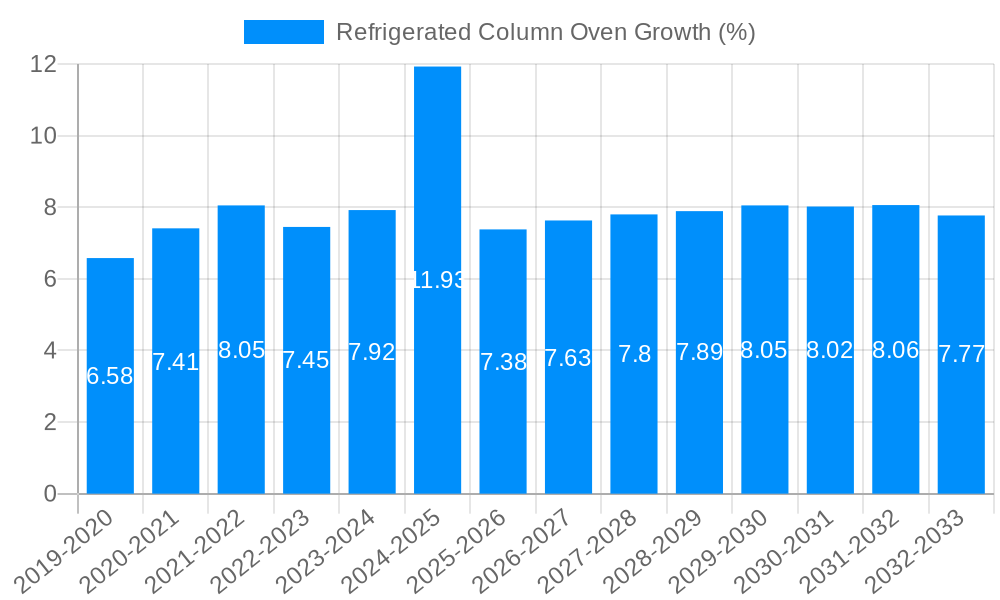

The global Refrigerated Column Oven market is poised for significant expansion, projected to reach an estimated market size of $610 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period of 2025-2033. The increasing demand for precise temperature control in analytical and preparatory processes across various industries is a primary driver. The food industry, with its stringent quality control measures and shelf-life testing requirements, is a key consumer of refrigerated column ovens. Similarly, the pharmaceutical sector relies heavily on these ovens for drug development, stability testing, and quality assurance, where accurate temperature maintenance is critical. The chemical industry also contributes to market growth through its use in synthesis, purification, and research applications. The advent of advanced automation and user-friendly interfaces in newer models is further stimulating adoption, making these sophisticated instruments more accessible and efficient.

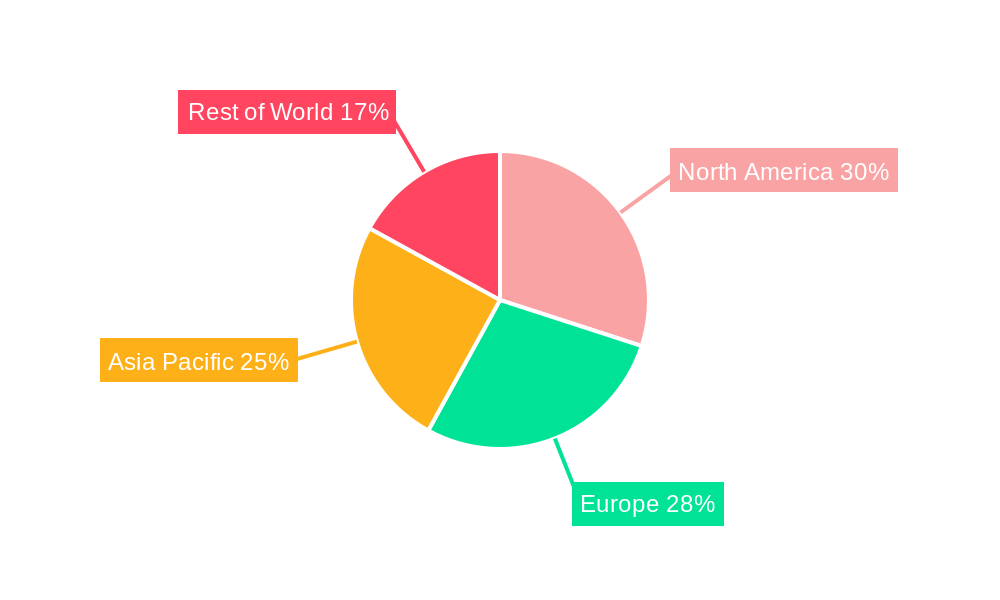

Further fueling market expansion are ongoing technological advancements, leading to the development of more energy-efficient and compact refrigerated column oven designs. The increasing prevalence of automatic control types, offering enhanced precision and reduced manual intervention, is a notable trend. While the market experiences strong tailwinds, certain restraints, such as the high initial investment cost for advanced models and the availability of alternative temperature control solutions in some niche applications, warrant consideration. However, the overarching trend towards greater precision, reliability, and regulatory compliance in scientific and industrial processes suggests a sustained upward trajectory for the refrigerated column oven market, with North America and Europe expected to maintain dominant market shares due to their established research infrastructure and stringent quality standards. The Asia Pacific region, driven by burgeoning pharmaceutical and chemical industries, is anticipated to be a significant growth engine.

This report delves into the intricate dynamics of the global Refrigerated Column Oven market, offering a comprehensive analysis spanning the Study Period: 2019-2033, with a Base Year and Estimated Year of 2025. The Forecast Period extends from 2025-2033, building upon the Historical Period of 2019-2024. We project a market valuation of several hundred million dollars by the end of the forecast period, demonstrating significant growth potential. The report meticulously examines market trends, driving forces, challenges, dominant segments, and the strategic moves of key industry players.

The global Refrigerated Column Oven market is poised for substantial expansion, driven by an escalating demand for precise and controlled chromatographic separations across a myriad of scientific disciplines. During the Historical Period (2019-2024), the market witnessed steady growth, fueled by the burgeoning pharmaceutical and chemical industries' need for advanced analytical instrumentation. As we enter the Base Year (2025) and look towards the Forecast Period (2025-2033), several key trends are emerging. A significant shift towards Automatic Control Type ovens is observed, reflecting the industry's pursuit of enhanced reproducibility, reduced manual intervention, and improved throughput in complex analytical workflows. This trend is intrinsically linked to the increasing automation in laboratories and the adoption of sophisticated software for method development and execution. Furthermore, the growing emphasis on quality control and regulatory compliance within sectors like pharmaceuticals and food safety necessitates highly reliable and stable temperature control, which refrigerated column ovens uniquely provide.

The integration of these ovens with advanced chromatography systems, such as High-Performance Liquid Chromatography (HPLC) and Ultra-High-Performance Liquid Chromatography (UHPLC), is becoming more prevalent. This seamless integration allows for optimized separation performance by maintaining column temperatures within a narrow, precise range, crucial for resolving challenging sample matrices and achieving high-resolution chromatograms. The market is also witnessing a growing demand for ovens with enhanced cooling capacities and broader temperature ranges, catering to the development of novel analytical methods that require sub-ambient temperatures for specific separations. Innovations in energy efficiency and compact design are also gaining traction, as laboratories increasingly seek to optimize space utilization and reduce operational costs. The report quantifies these trends, providing valuable insights into the evolving landscape of refrigerated column oven technology and its market penetration. The market is expected to reach several hundred million dollars by 2033.

The sustained growth of the Refrigerated Column Oven market is underpinned by a confluence of powerful driving forces. Foremost among these is the relentless expansion of the Pharmaceutical Industry. The discovery and development of new drugs, coupled with stringent quality control measures and the need for accurate impurity profiling, necessitate highly controlled analytical environments. Refrigerated column ovens play a critical role in ensuring reproducible and reliable chromatographic separations, essential for validating drug efficacy and safety. Similarly, the Chemical Industry, encompassing petrochemicals, specialty chemicals, and materials science, relies heavily on precise analytical techniques for product development, process optimization, and environmental monitoring. The ability of refrigerated column ovens to maintain stable column temperatures is paramount for achieving accurate and sensitive analyses in these diverse chemical applications.

Furthermore, the increasing global focus on Food Safety and Quality is another significant propellant. The detection of contaminants, pesticides, and allergens in food products requires sensitive and selective analytical methods, where precise temperature control of chromatographic columns is vital for obtaining accurate results. The rising global population and the expanding food processing industry further amplify this demand. Advancements in chromatography technology itself, leading to higher resolution and faster separation times, also indirectly drive the demand for refrigerated column ovens. As analytical scientists push the boundaries of what's possible with chromatography, the need for precise temperature management of columns becomes even more critical to fully leverage these technological advancements and achieve optimal performance. The market valuation, projected in the hundreds of millions of dollars, is a testament to the significant impact of these driving forces.

Despite the robust growth trajectory, the Refrigerated Column Oven market faces certain challenges and restraints that warrant careful consideration. One of the primary hurdles is the high initial cost of advanced refrigerated column ovens. These instruments, particularly those with sophisticated features and precise temperature control capabilities, represent a significant capital investment for many laboratories, especially smaller research institutions or those in emerging economies. This cost factor can limit widespread adoption, particularly for Manual Control Type ovens which, while more affordable, might not meet the stringent requirements of high-throughput or cutting-edge analytical applications.

Another restraint is the need for specialized technical expertise for operation and maintenance. While the trend towards automatic control simplifies routine operation, the installation, calibration, and troubleshooting of these complex systems often require trained personnel, which might not be readily available in all laboratory settings. Furthermore, the availability of alternative heating and cooling solutions, while generally less precise, can sometimes serve as a substitute in less demanding applications, potentially limiting the market share of dedicated refrigerated column ovens. The energy consumption of some high-performance refrigerated units can also be a concern, especially in laboratories aiming to reduce their environmental footprint and operational expenses. Finally, market saturation in certain developed regions and the economic slowdowns or geopolitical uncertainties can also pose temporary restraints on market expansion.

The global Refrigerated Column Oven market is characterized by significant regional disparities and a clear dominance of certain segments, driven by industry development and application needs. Within the Application segmentation, the Pharmaceutical Industry is projected to be the most dominant segment throughout the Study Period (2019-2033). This dominance is attributed to the industry's unwavering commitment to research and development, stringent regulatory frameworks (such as those governed by the FDA and EMA), and the continuous need for accurate and reproducible analytical data in drug discovery, quality control, and pharmacokinetic studies. The pharmaceutical sector's reliance on techniques like HPLC and UHPLC, where refrigerated column ovens are indispensable for optimal separation performance, solidifies its leading position. The market value within this segment is expected to reach several hundred million dollars.

Geographically, North America and Europe are anticipated to remain the leading regions in terms of market share and revenue during the forecast period. This leadership is a direct consequence of the well-established pharmaceutical and chemical industries in these regions, coupled with a strong emphasis on scientific research and technological innovation. These regions possess a high concentration of advanced analytical laboratories, research institutions, and a significant presence of major players in the instrument manufacturing sector, including companies like Agilent Technologies and Thermo Fisher Scientific. The robust regulatory environments in these areas also necessitate the use of highly reliable and precise analytical instrumentation, further boosting the demand for refrigerated column ovens.

In terms of Type, the Automatic Control Type segment is expected to witness the most significant growth and eventually dominate the market. This shift is driven by the global trend towards laboratory automation, the desire for increased efficiency, reduced human error, and enhanced data integrity. As the Base Year (2025) marks a pivotal point, the adoption of automatic systems will accelerate. While Manual Control Type ovens will continue to hold a market share, particularly in academic settings or for less demanding applications due to their lower cost, the long-term trajectory clearly favors automation. The World Refrigerated Column Oven Production itself is a measure of the overall market size and is influenced by the demand from these dominant application and regional segments. The value of World Refrigerated Column Oven Production is projected to reach several hundred million dollars.

The Refrigerated Column Oven industry is fueled by several powerful growth catalysts. The escalating demand for advanced analytical techniques in pharmaceutical research and development, particularly for small molecule drugs and biologics, is a primary driver. Furthermore, the increasing stringency of regulatory requirements globally for product quality and safety across various industries necessitates highly precise analytical instrumentation, directly benefiting refrigerated column oven manufacturers. Technological advancements leading to more sensitive and efficient chromatographic separations also compel laboratories to invest in sophisticated accessories like these ovens.

This comprehensive report provides an in-depth analysis of the global Refrigerated Column Oven market, meticulously covering all critical aspects from historical trends to future projections. It offers a detailed examination of market size and forecasts, expected to reach several hundred million dollars by 2033. The report scrutinizes the influence of key companies like Agilent Technologies, Thermo Fisher Scientific, and Shimadzu Corporation, detailing their market strategies and contributions. Segment-wise analysis, including Type (Manual, Automatic) and Application (Food, Chemical, Pharmaceutical), is thoroughly explored, highlighting the dominant segments and their growth drivers. Furthermore, industry developments, regional market dynamics, and potential challenges are all addressed, providing a holistic understanding of the market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Agilent Technologies, Thermo Fisher Scientific, Shimadzu Corporation, Waters Corporation, PerkinElmer, Phenomenex, Hitachi High-Tech.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Refrigerated Column Oven," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Refrigerated Column Oven, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.