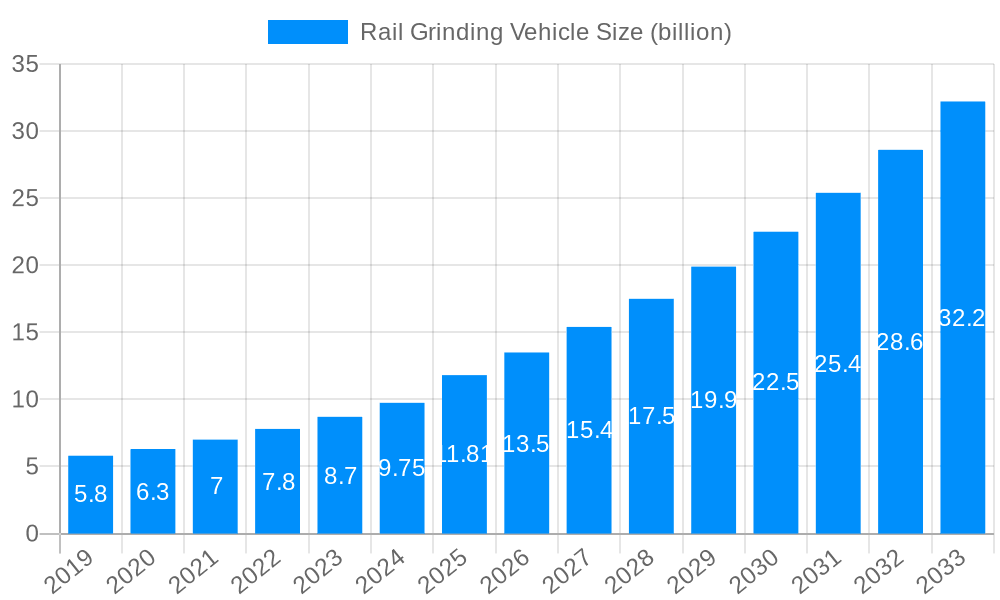

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rail Grinding Vehicle?

The projected CAGR is approximately 14.22%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rail Grinding Vehicle

Rail Grinding VehicleRail Grinding Vehicle by Type (Switch, Main Line), by Application (Ballastless Track, Ballast Track), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global rail grinding vehicle market is poised for substantial expansion, projected to reach an estimated $11.81 billion in market size. This impressive growth is driven by a robust Compound Annual Growth Rate (CAGR) of 14.22%, indicating a dynamic and rapidly evolving industry. The increasing demand for efficient and cost-effective railway maintenance, coupled with the ongoing expansion of rail networks worldwide, forms the bedrock of this market's ascent. Key drivers include the imperative to enhance track safety and performance, reduce operational disruptions, and extend the lifespan of rail infrastructure. The shift towards ballastless tracks in high-speed rail projects and the continuous need for maintenance of traditional ballast tracks both contribute significantly to market demand, segmenting the market by application and highlighting the dual focus of the industry. The development and adoption of advanced grinding technologies, such as automated systems and more efficient grinding heads, are also playing a crucial role in shaping the market's trajectory.

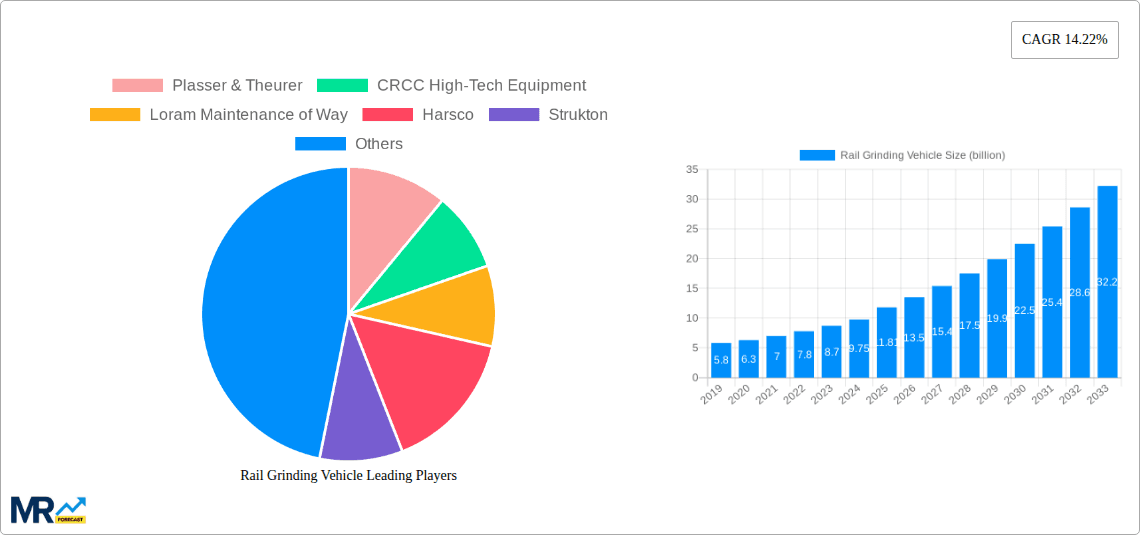

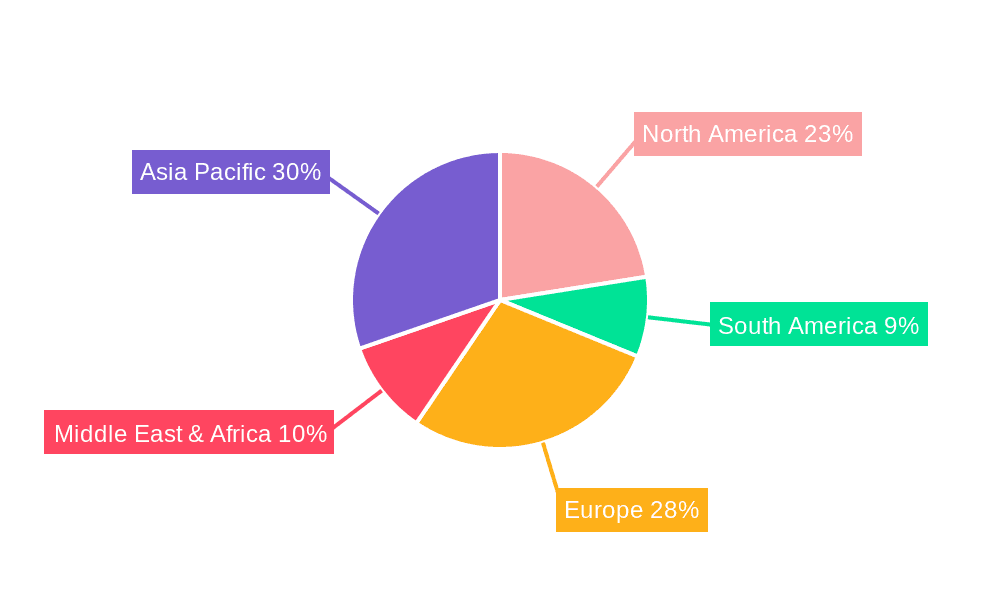

The rail grinding vehicle market encompasses a variety of segments, including switch grinding and main line grinding, catering to diverse maintenance needs. Major industry players like Plasser & Theurer, CRCC High-Tech Equipment, and Loram Maintenance of Way are at the forefront of innovation, introducing sophisticated solutions to meet the evolving demands of railway operators. Geographically, the market exhibits strong potential across all regions, with Asia Pacific, particularly China and India, expected to be a significant growth engine due to substantial investments in railway infrastructure development and modernization. North America and Europe also represent mature yet growing markets, driven by stringent safety regulations and the need to maintain extensive existing rail networks. Emerging economies in South America and the Middle East & Africa are presenting new opportunities as they expand their railway systems. Challenges, such as high initial investment costs for advanced grinding equipment and the need for skilled personnel, are present but are being addressed through technological advancements and increasing awareness of the long-term economic benefits of proactive rail maintenance.

This report provides an in-depth analysis of the global rail grinding vehicle market, forecasting significant growth and identifying key trends shaping the industry from the historical period of 2019-2024 through to the projected 2033. The base year for our estimations is 2025, with a comprehensive forecast period extending to 2033. We delve into market dynamics, exploring the driving forces behind its expansion, the challenges that stakeholders must navigate, and the geographical and segment-specific opportunities that promise substantial returns. With an estimated market value in the billions of USD, this report offers crucial insights for manufacturers, service providers, and investors alike.

The global rail grinding vehicle market is poised for robust expansion, driven by an increasing emphasis on rail infrastructure maintenance and the pursuit of enhanced operational efficiency within the railway sector. Over the study period from 2019 to 2033, with a base year estimation in 2025, the market is expected to witness a compound annual growth rate that will solidify its position as a multi-billion dollar industry. A significant trend emerging is the increasing adoption of advanced grinding technologies that offer higher precision, reduced environmental impact, and greater automation. This includes the integration of sophisticated sensor technologies for real-time rail profiling, the development of dynamic grinding systems that adapt to varying rail conditions, and the implementation of GPS and data analytics for optimized grinding path planning. The increasing demand for high-speed rail networks and the continuous expansion of freight transportation networks worldwide necessitates well-maintained tracks to ensure safety, reduce wear and tear on rolling stock, and minimize operational disruptions. Furthermore, the growing awareness of the economic benefits of proactive rail maintenance, which prevents costly emergency repairs and extends the lifespan of rail infrastructure, is a key driver. The shift towards sustainable railway operations is also influencing the market, with manufacturers focusing on developing energy-efficient grinding vehicles and implementing environmentally friendly grinding materials. The report will explore these trends in detail, including their impact on market segmentation by application (Ballast Track and Ballastless Track) and by type (Main Line and Switch), offering a nuanced understanding of the evolving landscape. The market is expected to witness a surge in the adoption of both traditional and novel grinding techniques, with a particular focus on those that can deliver superior surface quality and extended rail life. The economic implications of prolonged rail service life and the reduction of derailment risks are substantial, contributing to a positive market outlook. The increasing investment in railway modernization projects across developed and developing economies further fuels the demand for advanced rail grinding solutions.

Several potent forces are propelling the growth of the rail grinding vehicle market, with an estimated market value projected to reach billions of USD by 2025 and beyond. Foremost among these is the relentless global expansion of railway networks, both for passenger and freight transport. As more track kilometers are laid and existing lines are upgraded to accommodate higher speeds and heavier loads, the imperative for effective rail maintenance intensifies. This directly translates to a heightened demand for sophisticated rail grinding vehicles capable of ensuring the integrity and longevity of these critical assets. Another significant driver is the increasing focus on operational efficiency and cost reduction within the rail industry. Proactive rail grinding, as opposed to reactive repairs, significantly mitigates the risk of costly derailments, unplanned service disruptions, and premature wear on both the track infrastructure and the rolling stock. The economic benefits of extending rail life and minimizing maintenance-related downtime are substantial and are increasingly recognized by railway operators worldwide. Furthermore, the growing emphasis on passenger safety and the stringent regulatory standards governing rail transportation are compelling operators to invest in state-of-the-art maintenance equipment. The pursuit of higher operational speeds, particularly in high-speed rail corridors, demands exceptionally smooth and precisely profiled rails, making advanced grinding techniques indispensable. The report will further elaborate on how these factors are creating a fertile ground for innovation and market expansion.

Despite the promising growth trajectory, the rail grinding vehicle market faces several significant challenges and restraints that could temper its expansion, even as the market value continues to climb into the billions of USD. A primary constraint is the substantial capital investment required to procure and maintain advanced rail grinding vehicles. The sophisticated technology and specialized nature of these machines mean that their initial cost can be a significant barrier for smaller railway operators or those in developing economies with limited budgets. This high upfront cost can lead to a preference for older, less advanced, or outsourced maintenance solutions. Another hurdle is the availability of skilled labor. Operating and maintaining these complex grinding vehicles requires a highly trained and specialized workforce, and a shortage of such expertise can impede the efficient deployment and utilization of this equipment. Furthermore, the operational disruptions associated with grinding activities themselves, even when minimized by advanced techniques, can still pose a challenge for busy rail corridors where minimizing downtime is paramount. The environmental impact of some grinding processes, such as dust generation, while being addressed by technological advancements, can still be a point of concern and subject to stricter regulations. The cyclical nature of infrastructure spending in some regions can also lead to intermittent demand for grinding services and equipment, creating market volatility. The report will delve into these aspects, assessing their potential impact on market growth.

The global rail grinding vehicle market, projected to be valued in the billions of USD in 2025 and beyond, is expected to witness significant regional and segmental dominance.

Key Regions and Countries:

Key Segments:

The interplay between these dominant regions and segments creates a dynamic market, with significant investments flowing into regions undertaking large-scale infrastructure projects and segments that represent the backbone of global rail operations. The continuous evolution of grinding technology, however, is also paving the way for increased adoption in other segments and regions.

The rail grinding vehicle industry is experiencing robust growth, driven by several key catalysts that are significantly expanding its market value into the billions of USD. The increasing global investment in railway infrastructure, encompassing both new track construction and the modernization of existing networks, directly fuels the demand for effective track maintenance. Furthermore, the growing emphasis on operational efficiency and cost reduction within the rail sector compels operators to adopt proactive maintenance strategies, such as rail grinding, to prevent costly failures and extend asset lifespan. The continuous pursuit of higher speeds and increased safety standards in passenger and freight transport also necessitates precisely maintained rails, making advanced grinding technologies indispensable.

The global rail grinding vehicle market is characterized by the presence of several key players, each contributing significantly to market development and technological advancement. These companies operate across various regions and segments, offering a diverse range of grinding solutions. The estimated market value is in the billions of USD.

The rail grinding vehicle sector has witnessed several key developments, enhancing efficiency, sustainability, and technological sophistication. These advancements are critical as the market continues to grow into the billions of USD.

This report offers a comprehensive examination of the rail grinding vehicle market, valued in the billions of USD, covering the period from 2019 to 2033. We provide detailed analysis of market dynamics, including growth drivers, challenges, and regional and segment-specific opportunities. The report includes an in-depth look at the leading players and their contributions, as well as significant technological developments that are shaping the industry. Our insights are crucial for stakeholders seeking to navigate this evolving and increasingly important sector of railway infrastructure maintenance.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.22% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.22%.

Key companies in the market include Plasser & Theurer, CRCC High-Tech Equipment, Loram Maintenance of Way, Harsco, Strukton, Speno, Remputmash Group, GEATECH Group, Gemac Engineering, CRRC, MATISA France, Vortok International, Teräspyörä-Steelwheel Oy, Alstom, Bombardier, General Electric, Hitachi, Transmashholding, Voestalpine, Toshiba, Kawasaki, Hyundai Rotem, Wabtec, Herzog, .

The market segments include Type, Application.

The market size is estimated to be USD 11.81 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Rail Grinding Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rail Grinding Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.