1. What is the projected Compound Annual Growth Rate (CAGR) of the Preclinical Oncology CRO?

The projected CAGR is approximately 7.78%.

Preclinical Oncology CRO

Preclinical Oncology CROPreclinical Oncology CRO by Type (Blood Cancer, Solid Tumors, Other), by Application (In Vitro, In Vivo), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

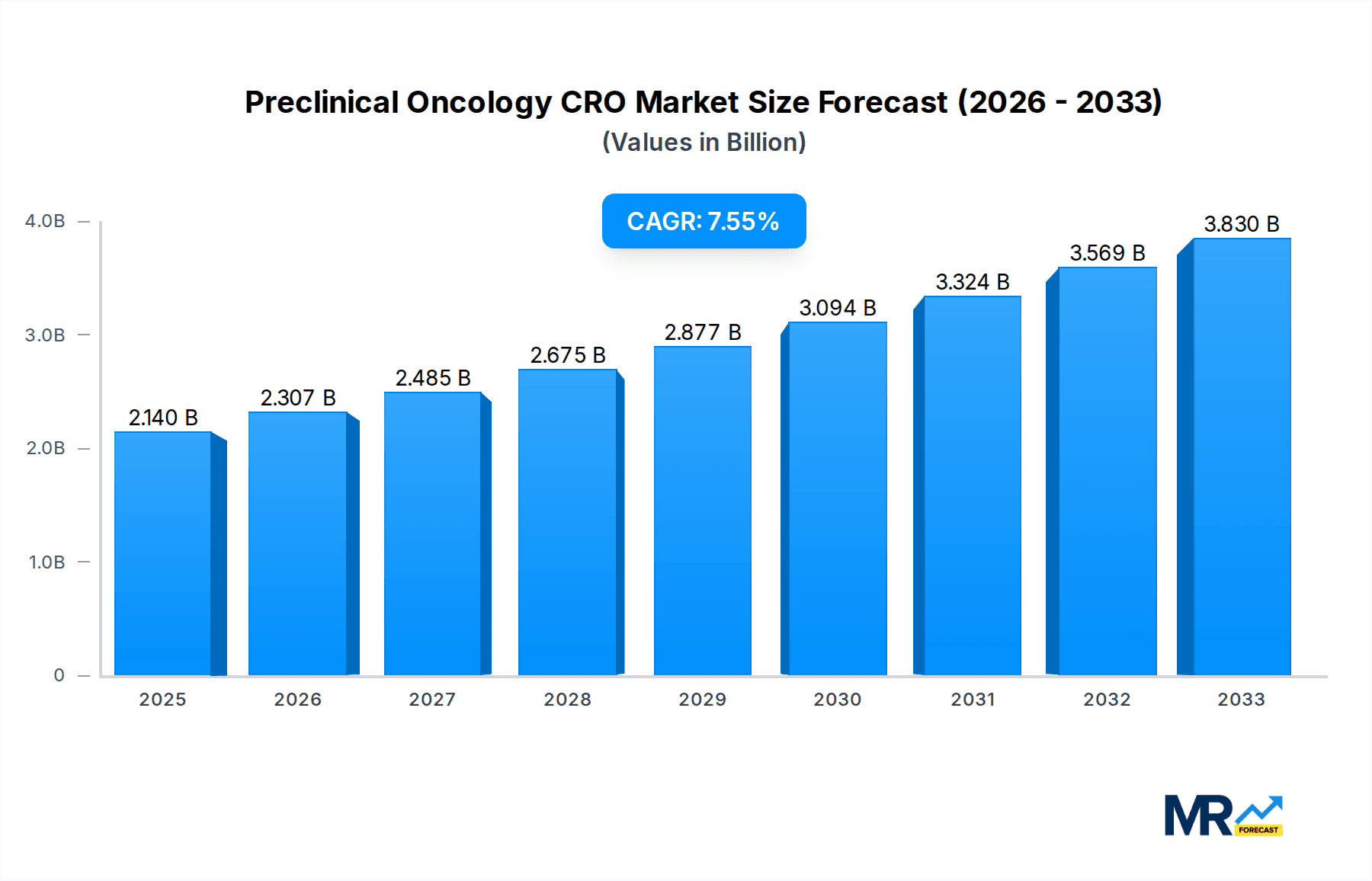

The Preclinical Oncology CRO market is experiencing robust growth, projected to reach an estimated USD 2.14 billion in 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 7.78% anticipated through 2033. This significant expansion is fueled by the escalating demand for novel cancer therapies and the increasing complexity of drug development pipelines. Pharmaceutical and biotechnology companies are heavily investing in outsourcing preclinical research to specialized Contract Research Organizations (CROs) to expedite drug discovery, reduce costs, and leverage specialized expertise. The market is segmented by type, with Blood Cancer and Solid Tumors representing the dominant segments due to the high prevalence and ongoing research into these disease areas. The application landscape is bifurcated into In Vitro and In Vivo studies, both of which are critical for evaluating drug efficacy and safety before clinical trials. The growing burden of cancer globally, coupled with advancements in precision medicine and immunotherapy, further propels the demand for sophisticated preclinical oncology services.

Key drivers behind this market surge include the continuous rise in cancer incidence and mortality worldwide, necessitating a perpetual flow of innovative treatment options. Technological advancements, such as next-generation sequencing, sophisticated imaging techniques, and the development of more predictive animal models, are enhancing the accuracy and efficiency of preclinical studies, thereby boosting market confidence. Emerging trends like the increasing focus on personalized medicine, the rise of biologics and antibody-drug conjugates (ADCs), and the growing emphasis on combination therapies are creating new avenues for CROs to offer specialized services. However, the market also faces certain restraints, including the stringent regulatory requirements for drug approval, the high cost associated with complex preclinical studies, and the potential for R&D failures. Despite these challenges, the strategic partnerships and collaborations between CROs and pharmaceutical giants, along with the expanding geographical reach of CRO services into emerging markets, are set to shape a dynamic and growth-oriented preclinical oncology CRO landscape.

The global preclinical oncology Contract Research Organization (CRO) market, a critical pillar in the advancement of cancer therapeutics, is projected for substantial growth, with an estimated market size reaching $7.5 billion in 2025 and poised to expand significantly throughout the forecast period of 2025-2033. This robust expansion is fueled by an escalating global cancer burden, a relentless pursuit of novel treatment modalities, and the increasing reliance of pharmaceutical and biotechnology companies on specialized CRO expertise. The historical period of 2019-2024 saw steady innovation and investment, laying the groundwork for the accelerated growth anticipated in the coming years. The study period of 2019-2033 encompasses both this foundational growth and the projected trajectory, offering a comprehensive view of the market's evolution. Key market insights reveal a pronounced shift towards more sophisticated and personalized approaches in preclinical oncology research. This includes a growing demand for specialized services focusing on immunotherapies, targeted therapies, and cell and gene therapies, reflecting their increasing prominence in the clinical pipeline. Furthermore, the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in drug discovery and development is becoming a standard expectation, enabling CROs to offer more efficient and predictive preclinical studies. The market is also witnessing an increased outsourcing trend, as companies, both large and small, recognize the cost-effectiveness and specialized capabilities that CROs bring to the table. This is particularly evident in the burgeoning biopharmaceutical sector, which often lacks the in-house infrastructure and expertise for complex preclinical oncology studies. The regulatory landscape, while presenting its own set of complexities, also acts as a driver, as CROs are adept at navigating these intricate pathways, ensuring that studies meet stringent global standards. The overall market dynamic is characterized by a competitive yet collaborative ecosystem, where innovation and strategic partnerships are key to success. The base year of 2025 serves as a pivotal point, marking the transition into a phase of intensified growth and technological adoption.

Several powerful forces are propelling the preclinical oncology CRO market forward, making it an indispensable component of the drug development lifecycle. The most significant driver is the sheer magnitude of the global cancer epidemic. With cancer incidence and mortality rates continuing to rise across various demographics, there is an urgent and persistent demand for innovative and effective treatments. This imperative translates directly into increased investment in preclinical research to identify and validate promising drug candidates. Furthermore, the rapidly evolving landscape of cancer biology, with a deeper understanding of tumor heterogeneity, the tumor microenvironment, and complex signaling pathways, necessitates sophisticated preclinical models and assays. CROs, equipped with specialized expertise and cutting-edge technologies, are uniquely positioned to address these complex scientific challenges. The increasing complexity and cost associated with in-house drug development also play a crucial role. Pharmaceutical and biotechnology companies are strategically outsourcing preclinical oncology services to CROs to leverage their specialized knowledge, access advanced platforms, and optimize resource allocation. This outsourcing trend allows companies to accelerate their drug development timelines, reduce R&D expenditures, and mitigate risks by engaging experts with proven track records. The burgeoning pipeline of targeted therapies and immunotherapies, which require highly specific and complex preclinical testing, further amplifies the demand for specialized CRO services. The study period of 2019-2033 showcases this increasing reliance on external expertise to navigate the intricacies of these advanced therapeutic modalities.

Despite the promising growth trajectory, the preclinical oncology CRO market faces several challenges and restraints that could temper its expansion. One of the primary concerns is the stringent and ever-evolving regulatory landscape. Adhering to diverse and often complex global regulatory requirements for preclinical studies demands significant expertise, meticulous documentation, and substantial investment in quality assurance. Navigating these regulatory hurdles can be time-consuming and costly, potentially delaying project timelines. Another significant challenge is the intense competition within the CRO market. The presence of numerous established players and emerging niche providers creates price pressures and necessitates continuous innovation to maintain a competitive edge. Companies must constantly invest in new technologies and services to differentiate themselves and attract clients, which can strain profit margins. The increasing complexity of cancer biology and the demand for highly specialized models and assays also pose a challenge. Developing and validating novel preclinical models, particularly those that accurately recapitulate human tumor heterogeneity and the tumor microenvironment, requires substantial scientific expertise and resources, which not all CROs may possess. Furthermore, ensuring the reproducibility and translatability of preclinical findings to clinical outcomes remains a persistent challenge in oncology drug development. Failures in late-stage clinical trials due to poor preclinical prediction can lead to significant financial losses and impact client confidence in CRO services. The forecast period of 2025-2033 will likely see these challenges continue to shape market dynamics.

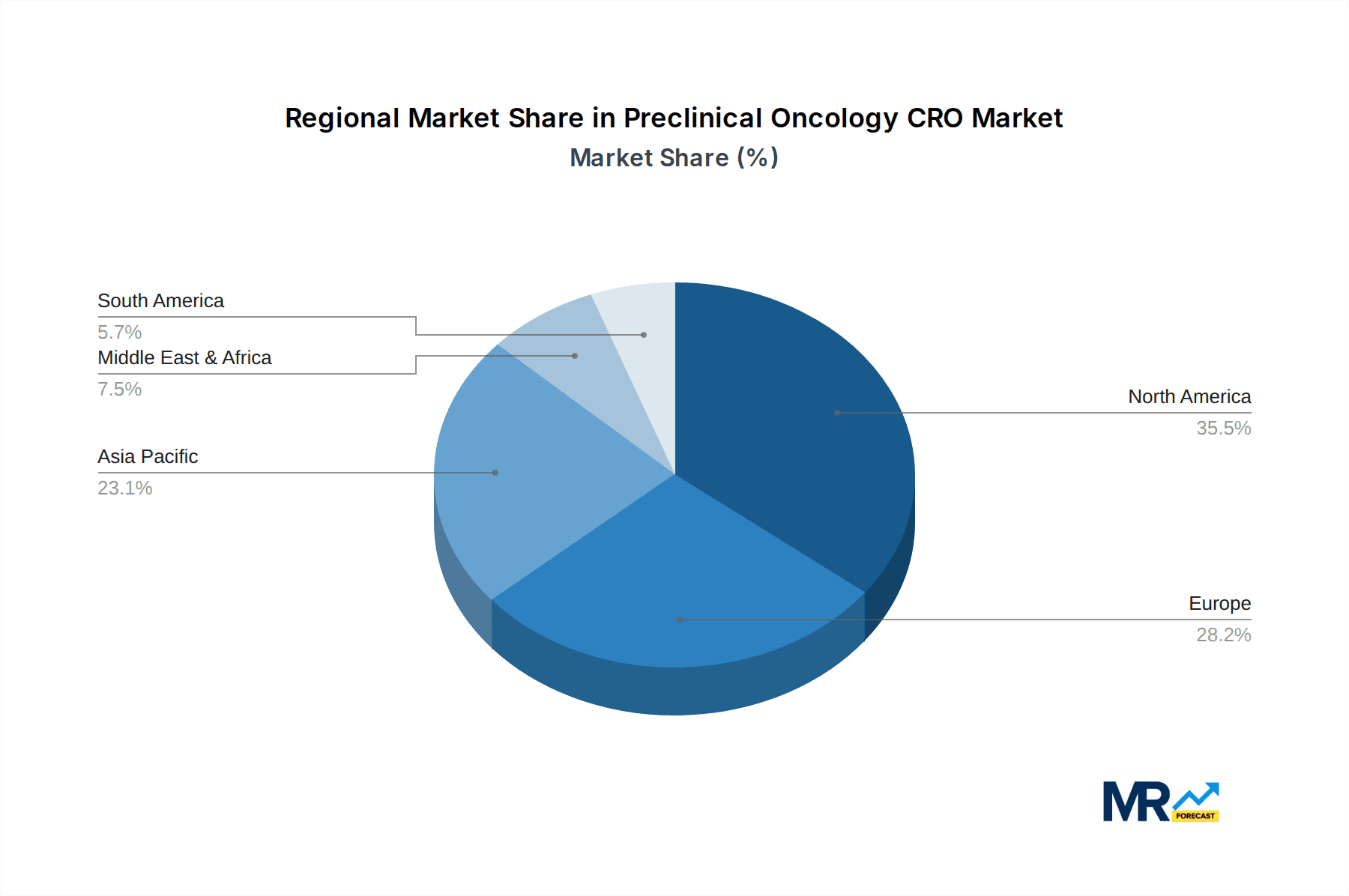

The preclinical oncology CRO market is characterized by significant regional variations and segment dominance, with both factors contributing to the overall market dynamics throughout the study period of 2019-2033.

Dominant Region/Country:

Dominant Segments:

Segment Type: Solid Tumors:

Segment Application: In Vivo:

The interplay between these dominant regions and segments creates a dynamic market where innovation, specialized expertise, and a deep understanding of cancer biology are paramount for success.

Several key growth catalysts are fueling the expansion of the preclinical oncology CRO industry. The relentless increase in cancer incidence worldwide necessitates a continuous pipeline of new and improved therapies, directly driving demand for preclinical research services. Furthermore, the emergence of groundbreaking therapeutic modalities such as immunotherapies, targeted agents, and cell and gene therapies requires highly specialized preclinical expertise and advanced models that CROs are uniquely positioned to provide. The strategic outsourcing trend by pharmaceutical and biotech companies, driven by cost efficiencies and access to specialized capabilities, is another significant catalyst. Finally, continuous technological advancements, including AI-driven drug discovery and the development of more predictive preclinical models, are enhancing the efficiency and effectiveness of preclinical studies, further stimulating market growth.

This report offers a comprehensive examination of the preclinical oncology CRO market, spanning the study period of 2019-2033. It delves into the intricate trends, driving forces, and challenges shaping the industry, with a detailed analysis of the market from the base year of 2025 through the forecast period of 2025-2033. The report provides crucial insights into key regional and country-specific market dynamics, alongside an in-depth segment analysis focusing on Solid Tumors and In Vivo applications, highlighting their dominance and growth drivers. Furthermore, it identifies critical growth catalysts and outlines the significant developments that have occurred and are expected in the sector. With a thorough understanding of the market's trajectory, this report serves as an indispensable resource for stakeholders seeking to navigate the evolving landscape of preclinical oncology research and drug development.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.78% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.78%.

Key companies in the market include Crown Bioscience, Charles River Laboratory, ICON Plc., Eurofins Scientific, Taconic Biosciences, Covance, EVOTEC, The Jackson Laboratory, Wuxi AppTec., MI Bioresearch, Inc., Champion Oncology, Inc., Xentech, .

The market segments include Type, Application.

The market size is estimated to be USD 2.14 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Preclinical Oncology CRO," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Preclinical Oncology CRO, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.