1. What is the projected Compound Annual Growth Rate (CAGR) of the Power Semiconductor Device and Module?

The projected CAGR is approximately 5.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Power Semiconductor Device and Module

Power Semiconductor Device and ModulePower Semiconductor Device and Module by Type (/> MOSFET, Diodes, IGBT, BJT, Thyristor, SiC Power Device, GaN Power Device), by Application (/> Automotive & EV/HEV, EV Charging, Industrial Motor/Drive, PV, Energy Storage, Wind Power, UPS, Data Center & Server, Rail Transport, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

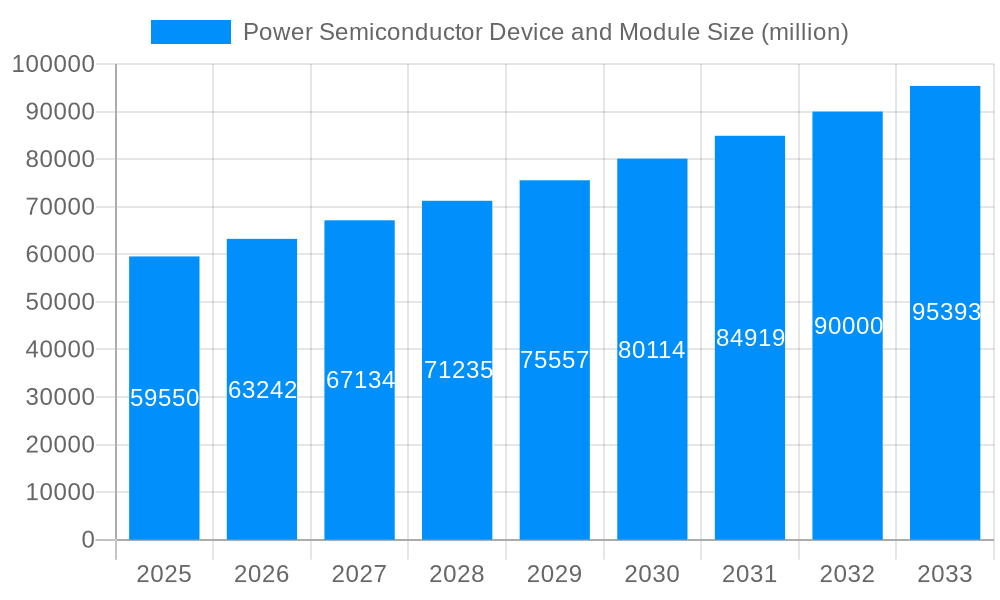

The power semiconductor device and module market, currently valued at $59.55 billion (2025), is poised for substantial growth. While the exact CAGR isn't provided, considering the strong drivers in electric vehicles (EVs), renewable energy infrastructure, and industrial automation, a conservative estimate would place the Compound Annual Growth Rate (CAGR) between 7% and 10% for the forecast period (2025-2033). This growth is fueled by the increasing demand for energy-efficient solutions across various sectors. The shift towards electric mobility is a major catalyst, driving significant demand for power semiconductors in inverters, on-board chargers, and other EV components. Furthermore, the expanding renewable energy sector, particularly solar and wind power, requires advanced power semiconductors for efficient energy conversion and grid integration. Industrial automation, with its reliance on high-performance motors and drives, also contributes significantly to market expansion. Key restraints include supply chain complexities and the fluctuating prices of raw materials, particularly silicon. However, ongoing technological advancements, such as the development of wide bandgap semiconductors (SiC and GaN), are mitigating these challenges and further propelling market growth.

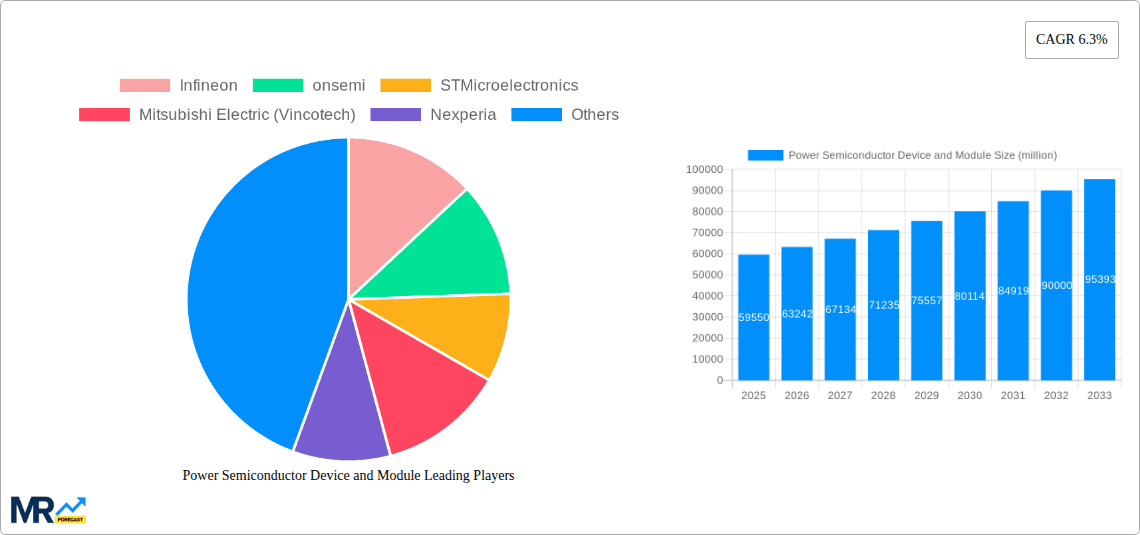

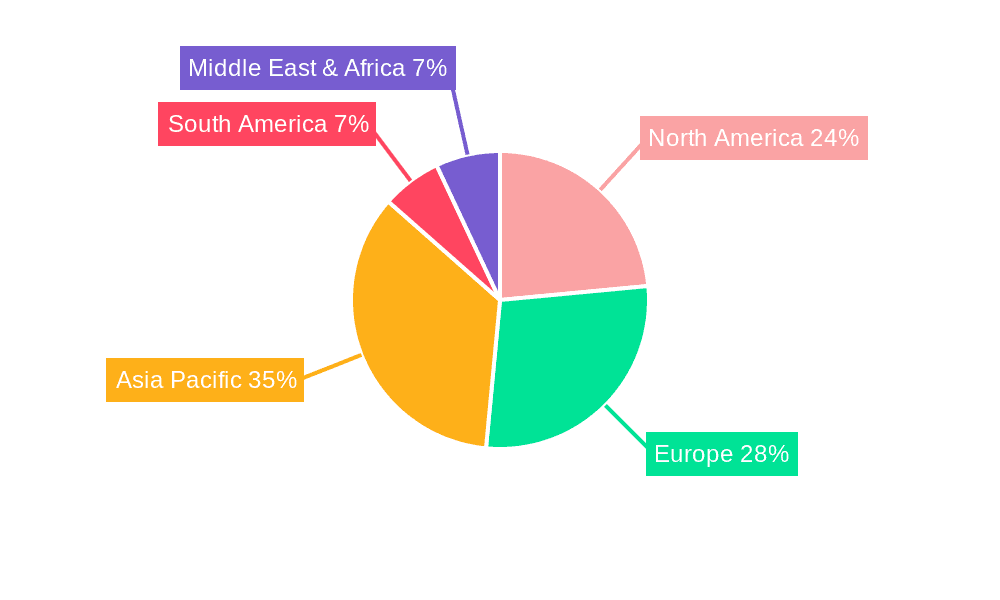

The competitive landscape is highly fragmented, with numerous prominent players including Infineon, onsemi, STMicroelectronics, and others vying for market share. These companies are actively investing in research and development to enhance product performance, efficiency, and reliability. Regional variations in growth rates are expected, with regions experiencing rapid industrialization and electrification likely witnessing higher growth rates. North America and Europe are currently dominant, but the Asia-Pacific region is expected to witness the fastest growth due to increasing investments in renewable energy and electric vehicle manufacturing. The market segmentation (unspecified in the provided data) likely includes various power semiconductor types (IGBTs, MOSFETs, diodes, etc.) and applications (automotive, industrial, consumer electronics, etc.), each with its own growth trajectory. Long-term forecasts suggest a steady increase in market value, exceeding $100 billion by 2033, driven by continued technological advancements and the global push towards sustainable and efficient energy solutions.

The global power semiconductor device and module market is experiencing robust growth, projected to reach tens of billions of units by 2033. Driven by the burgeoning demand for electric vehicles (EVs), renewable energy systems, and industrial automation, the market witnessed significant expansion during the historical period (2019-2024), exceeding several million units annually. The estimated market size for 2025 suggests continued momentum, with Infineon, onsemi, and STMicroelectronics leading the charge, capturing significant market share. However, the landscape is increasingly competitive, with a rise of Chinese manufacturers like Hangzhou Silan Microelectronics and Yangzhou Yangjie Electronic Technology making inroads. This increased competition fosters innovation, driving down costs and expanding market accessibility. The forecast period (2025-2033) anticipates sustained growth, fueled by technological advancements in wide bandgap semiconductors (SiC and GaN), which offer superior efficiency and power density compared to traditional silicon-based devices. This trend is particularly pronounced in high-power applications such as EV charging infrastructure and data centers. Moreover, the increasing adoption of smart grids and energy-efficient appliances is further boosting demand for power semiconductor devices and modules across various sectors. The market is witnessing a shift towards higher voltage and higher current devices, driven by the increasing power demands in various applications. This necessitates advanced packaging technologies and innovative thermal management solutions to ensure efficient and reliable operation. Furthermore, the ongoing trend of miniaturization in electronic devices requires compact and high-performance power semiconductor modules.

The power semiconductor device and module market's impressive trajectory is fueled by several key factors. The rapid electrification of transportation, spearheaded by the global shift towards electric vehicles, represents a major driving force. EVs require significant numbers of power semiconductor devices for motor control, battery management, and charging infrastructure. The renewable energy sector, with its emphasis on solar and wind power, also contributes significantly to market growth. Power semiconductors are crucial components in inverters and converters used to convert DC power to AC power and vice-versa, making them essential for efficient energy generation and distribution. Furthermore, the growing adoption of industrial automation and robotics necessitates robust and efficient power management solutions, creating substantial demand for power semiconductor devices. Data centers, which are experiencing explosive growth, rely heavily on power semiconductor-based power supplies to manage the enormous energy requirements of computing infrastructure. Finally, the increasing focus on energy efficiency and reduction of carbon emissions across various industries is further boosting demand for advanced power semiconductor technologies that offer higher efficiency and lower energy consumption. These interconnected factors have created a synergistic effect, propelling the market towards sustained and impressive growth.

Despite the promising outlook, the power semiconductor device and module market faces several challenges. The high upfront costs associated with the development and manufacturing of advanced power semiconductors, especially wide bandgap devices like SiC and GaN, can limit market penetration, particularly in price-sensitive applications. The complex supply chains involved in the manufacturing of these components create vulnerability to geopolitical factors and disruptions. Ensuring consistent supply and managing costs effectively remain ongoing hurdles. Moreover, the need for sophisticated testing and qualification procedures to guarantee the reliability and performance of these high-power devices adds to the overall cost and time-to-market. Additionally, the stringent regulatory requirements and safety standards related to power electronics in various applications add to the complexities faced by manufacturers. This also includes compliance with environmental regulations concerning the use and disposal of these materials. Finally, technological advancements necessitate ongoing research and development to maintain a competitive edge in an ever-evolving market.

Asia-Pacific: This region is projected to dominate the market due to the rapid growth of the electronics manufacturing industry, particularly in China, Japan, South Korea, and India. The massive investments in renewable energy infrastructure and the burgeoning automotive sector, particularly EVs, are key drivers of growth within this region. The presence of major manufacturers and a large consumer base contributes to the dominance of this area.

North America: North America is also expected to witness significant growth, primarily driven by the increasing demand for electric vehicles and the expansion of renewable energy sources. Technological advancements and strong government support for clean energy initiatives further fuel market expansion in this region. A well-established technological base and high consumer spending power also contribute to the growth of this market segment.

Europe: Europe’s commitment to sustainable energy and electric mobility is creating considerable demand for power semiconductors. Stringent environmental regulations also incentivize adoption of energy-efficient technologies. The established automotive industry and presence of key manufacturers in the region propel its market share.

High-Power Applications: Segments involving high-power applications, including electric vehicle charging stations, renewable energy systems (solar and wind power inverters), and industrial motor drives, are expected to show exceptionally high growth rates due to increasing demand and technological advancements.

Wide Bandgap Semiconductors (SiC & GaN): These technologies offer significantly improved efficiency and power density compared to traditional silicon-based devices, leading to considerable growth within the segment. Their higher cost is gradually offset by their long-term benefits, driving adoption in higher-end applications.

In summary, the combined effect of rapid technological advancement, strong governmental support in key regions, and the escalating demand across numerous sectors makes the power semiconductor device and module market a highly dynamic and promising sector. The aforementioned segments and regions are set to experience robust growth during the forecast period, shaping the future of power electronics.

The power semiconductor industry's growth is strongly catalyzed by several key factors, including the increasing adoption of electric vehicles (EVs) globally, the push towards renewable energy sources and efficient energy management systems, and the expansion of data centers requiring high-performance power solutions. These factors, along with ongoing technological advancements in wide-bandgap semiconductors and improved packaging techniques, are driving innovation and market expansion at an unprecedented rate.

(Note: Further specific developments would need to be researched based on industry news and company announcements.)

This report offers a comprehensive analysis of the power semiconductor device and module market, covering historical data (2019-2024), an estimated market size for 2025, and a detailed forecast for 2025-2033. The report identifies key market trends, driving forces, challenges, and growth catalysts, providing valuable insights into market dynamics. It profiles major players, examining their market share and competitive strategies, and highlights significant recent developments. The regional and segmental analysis offers granular detail to aid strategic decision-making. This information is essential for investors, manufacturers, and industry professionals seeking to understand and navigate this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.4%.

Key companies in the market include Infineon, onsemi, STMicroelectronics, Mitsubishi Electric (Vincotech), Nexperia, Vishay Intertechnology, Toshiba, Fuji Electric, Rohm, Renesas Electronics, Diodes Incorporated, Littelfuse (IXYS), Alpha & Omega Semiconductor, Semikron Danfoss, Hitachi Power Semiconductor Device, Microchip, Sanken Electric, Semtech, MagnaChip, Bosch, Texas Instruments, KEC Corporation, Wolfspeed, PANJIT Group, Unisonic Technologies (UTC), Niko Semiconductor, Hangzhou Silan Microelectronics, Yangzhou Yangjie Electronic Technology, China Resources Microelectronics Limited, Jilin Sino-Microelectronics, StarPower, NCEPOWER, Prisemi, Jiangsu Jiejie Microelectronics, OmniVision Technologies, Suzhou Good-Ark Electronics, Zhuzhou CRRC Times Electric, WeEn Semiconductors, Changzhou Galaxy Century Microelectronics, MacMic Science & Technolog, BYD, Hubei TECH Semiconductors, BASiC Semiconductor, Shandong Jingdao Microelectronics, CETC 55, Guangdong AccoPower Semiconductor, InventChip Technology, United Nova Technology, ANHI Semiconductor, Grecon Semiconductor (Shanghai), Denso.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Power Semiconductor Device and Module," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Power Semiconductor Device and Module, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.