1. What is the projected Compound Annual Growth Rate (CAGR) of the Poultry and Livestock Anti-Infective Drugs?

The projected CAGR is approximately 6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Poultry and Livestock Anti-Infective Drugs

Poultry and Livestock Anti-Infective DrugsPoultry and Livestock Anti-Infective Drugs by Application (Cattle, Horse, Pig, Chicken, Duck, Others), by Type (External Use, Internal Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

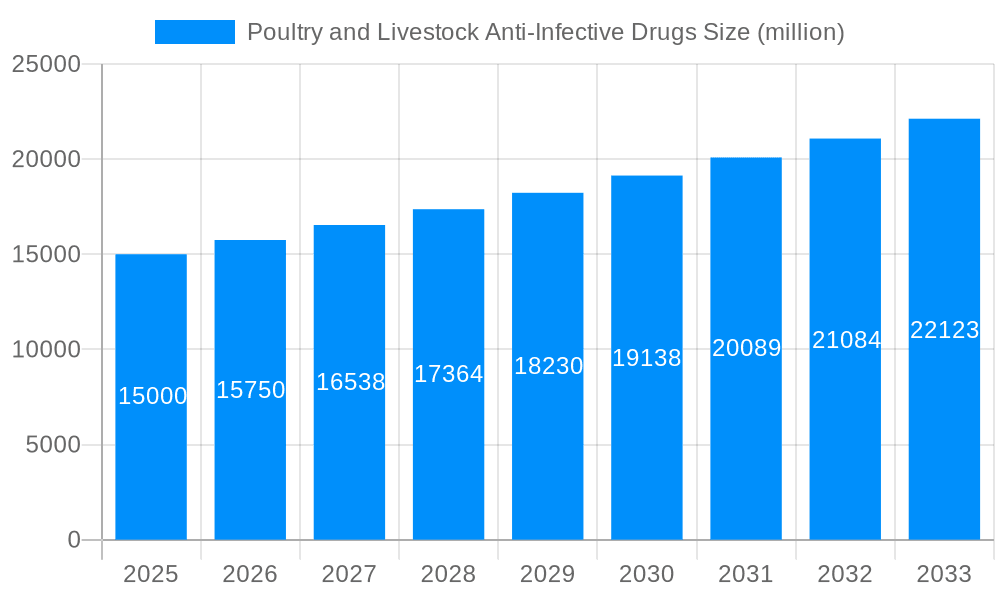

The global poultry and livestock anti-infective drugs market is poised for significant expansion, driven by escalating demand for animal protein and advancements in veterinary medicine. With a projected CAGR of 6%, the market is anticipated to grow from an estimated $2.25 billion in the base year of 2025 to a substantial figure by 2033. This growth trajectory is propelled by the increasing intensification of livestock and poultry farming to meet global protein needs, coupled with the persistent challenge of infectious diseases in animal populations. Innovations in drug development, leading to more efficacious and safer anti-infective agents, further bolster market expansion. However, regulatory pressures concerning antibiotic use, rising awareness of antimicrobial resistance, and the emergence of resistant pathogens present key market challenges. These necessitate the adoption of alternative disease management strategies and responsible therapeutic practices. Leading market participants, including Boehringer Ingelheim, Zoetis, Merck, Elanco, and Bayer, are actively pursuing R&D, strategic alliances, and global market penetration to maintain a competitive advantage.

Market segmentation is expected to encompass drug classes such as antibiotics, antivirals, antifungals, and antiparasitics, across various animal species including poultry, cattle, and swine, with varied routes of administration like oral and injectable. Regional market dynamics will be influenced by distinct livestock farming practices, regulatory landscapes, and disease prevalence. North America and Europe are anticipated to maintain dominant market positions due to established veterinary infrastructure. Emerging economies offer substantial growth potential, fueled by increasing animal production and the demand for cost-effective animal health solutions. The forecast period (2025-2033) indicates sustained market growth, potentially moderated by existing challenges. Strategic adaptation to these challenges will be crucial for sustaining the positive market outlook.

The global poultry and livestock anti-infective drugs market is experiencing significant growth, driven by factors such as the increasing demand for animal protein, rising prevalence of infectious diseases in livestock and poultry, and the growing awareness of animal health among farmers and consumers. The market size, estimated at XXX million units in 2025, is projected to witness substantial expansion during the forecast period (2025-2033). This growth is fueled by the increasing adoption of advanced veterinary practices and the development of novel anti-infective drugs with improved efficacy and safety profiles. The historical period (2019-2024) showcased steady growth, laying the foundation for the robust expansion anticipated in the coming years. However, challenges such as the emergence of antimicrobial resistance (AMR), stringent regulatory frameworks, and fluctuating raw material prices pose potential threats to market expansion. The market's future trajectory hinges on successful mitigation of these challenges, coupled with continuous innovation in drug development and improved disease prevention strategies. The increasing adoption of preventive measures, such as vaccination and improved biosecurity practices, is also shaping the market landscape. Furthermore, the growing focus on sustainable and responsible animal farming practices is influencing the demand for anti-infective drugs with minimal environmental impact. This intricate interplay of factors contributes to the dynamic and evolving nature of the poultry and livestock anti-infective drugs market. The competitive landscape is characterized by a mix of large multinational corporations and smaller specialized companies, each vying for market share through innovation, strategic partnerships, and product diversification.

Several key factors are driving the growth of the poultry and livestock anti-infective drugs market. Firstly, the ever-increasing global population necessitates a corresponding rise in animal protein production to meet dietary demands. This heightened demand puts immense pressure on livestock and poultry farms, increasing the risk of infectious diseases outbreaks. Secondly, the growing awareness regarding animal welfare and the need for disease prevention is prompting farmers to invest more in prophylactic measures and treatments, thereby boosting demand for anti-infective drugs. Thirdly, advancements in veterinary research and technology are leading to the development of newer, more effective, and safer anti-infective agents. These improved drugs are often accompanied by targeted delivery systems, enhancing efficacy while minimizing adverse effects. Furthermore, the growing adoption of sophisticated diagnostic techniques allows for earlier detection and treatment of infections, preventing widespread outbreaks and reducing economic losses. Finally, supportive government policies and initiatives aimed at promoting animal health and improving farming practices contribute significantly to the market's expansion. These factors collectively create a favorable environment for the sustained growth of the poultry and livestock anti-infective drugs market.

Despite the positive growth trajectory, the poultry and livestock anti-infective drugs market faces significant challenges. The most pressing concern is the escalating issue of antimicrobial resistance (AMR). The overuse and misuse of anti-infective drugs in livestock and poultry have contributed to the emergence of drug-resistant bacterial strains, rendering many existing treatments ineffective. This necessitates the development of new antimicrobials and alternative therapeutic strategies. Stringent regulatory approvals and increasing compliance costs for drug manufacturers also pose significant hurdles. Moreover, fluctuations in the prices of raw materials used in drug production can impact profitability and market stability. Finally, the rising demand for sustainable and environmentally friendly farming practices necessitates the development of anti-infective drugs with minimal environmental impact, adding another layer of complexity to the market. Overcoming these challenges requires a concerted effort from various stakeholders, including drug manufacturers, regulatory bodies, farmers, and veterinarians.

The poultry and livestock anti-infective drugs market is geographically diverse, with significant variations in demand and consumption patterns across different regions. Several factors contribute to regional variations, including livestock density, farming practices, prevalence of infectious diseases, and economic conditions.

Segment Domination:

In summary, the Asia-Pacific region is projected to lead market growth, driven by the sheer size of its livestock population and increasing agricultural activity. Within segments, antibacterial drugs currently maintain a strong position, although the rise of antimicrobial resistance compels an exploration of alternative therapeutic solutions, potentially driving growth in other segment areas. The interplay between region and segment highlights the complexity of this market and opportunities for innovation and tailored solutions.

The poultry and livestock anti-infective drugs industry's growth is significantly catalyzed by factors such as the increasing prevalence of infectious diseases in livestock and poultry populations globally, prompting a greater demand for effective treatments. The continuous development and introduction of innovative anti-infective drugs with enhanced efficacy and reduced side effects further contribute to market expansion. Furthermore, stricter regulations and heightened awareness regarding animal welfare are driving the adoption of preventive measures and responsible drug usage, further fueling market growth.

This report provides a comprehensive overview of the poultry and livestock anti-infective drugs market, encompassing market size estimations, historical data analysis, future projections, and a detailed examination of key industry players, significant developments, and prevailing market dynamics. It offers invaluable insights into growth drivers, challenges, and key market trends, providing a strategic roadmap for stakeholders navigating this complex and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6%.

Key companies in the market include Boehringer Ingelheim, Zoetis, Merck, Elanco, Bayer, Virbac, Ceva Sante Animale, Vetoquinol, Bimeda Animal Health.

The market segments include Application, Type.

The market size is estimated to be USD 2.25 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Poultry and Livestock Anti-Infective Drugs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Poultry and Livestock Anti-Infective Drugs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.