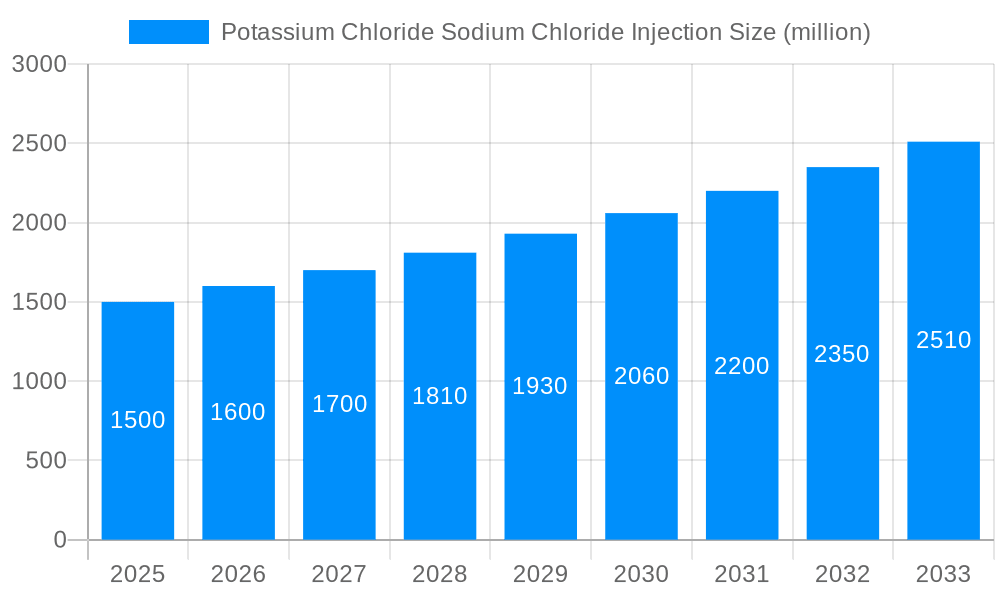

1. What is the projected Compound Annual Growth Rate (CAGR) of the Potassium Chloride Sodium Chloride Injection?

The projected CAGR is approximately 3.85%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Potassium Chloride Sodium Chloride Injection

Potassium Chloride Sodium Chloride InjectionPotassium Chloride Sodium Chloride Injection by Type (100ml: Potassium Chloride 0.15g and Sodium Chloride 0.9g, 100ml: Potassium Chloride 0.3g and Sodium Chloride 0.9g), by Application (Hospital, Clinic, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Potassium Chloride Sodium Chloride Injection market is poised for substantial expansion, driven by the escalating incidence of electrolyte imbalances necessitating intravenous fluid therapy, a rising prevalence of chronic conditions such as heart failure and renal disorders, and the enhancement of healthcare infrastructure, particularly in emerging economies. The market is segmented by concentration (0.15g/0.9g and 0.3g/0.9g Potassium Chloride/Sodium Chloride per 100ml) and application (hospitals, clinics, and other healthcare settings). Hospitals currently dominate the market share, attributed to a higher patient volume requiring intravenous treatments. Nevertheless, the 'other' segment, comprising outpatient clinics and home healthcare, is projected to witness the most rapid growth, propelled by a growing preference for cost-effective and convenient treatment modalities. Key industry players, including Pfizer, B. Braun Medical, and Baxter Healthcare, are actively pursuing product portfolio diversification and geographic expansion, thereby intensifying market competition. Despite potential challenges from pricing pressures and regulatory complexities, advancements in delivery system technology and heightened awareness regarding electrolyte balance management are anticipated to stimulate market growth throughout the forecast period.

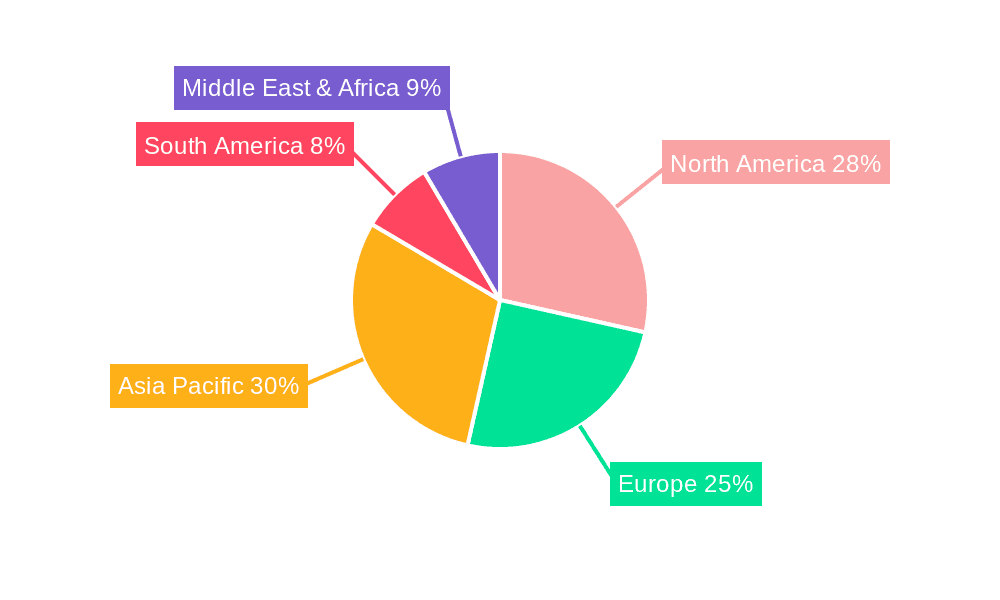

The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.85% from 2025 to 2033. Regional analysis indicates that North America and Europe currently command significant market positions due to their sophisticated healthcare systems and high per capita healthcare expenditure. However, the Asia-Pacific region, with a particular focus on China and India, is expected to exhibit considerable growth potential in the forthcoming years, fueled by escalating healthcare investments, expanding populations, and a rising incidence of chronic diseases. This growth will be further supported by improved healthcare accessibility and increasing disposable incomes in these areas. Strategic collaborations, mergers, and acquisitions are anticipated to be pivotal in shaping the competitive dynamics of the market during the forecast period. The total market size is estimated at 72.89 million units in the base year.

The global Potassium Chloride Sodium Chloride Injection market is projected to experience robust growth throughout the forecast period (2025-2033), reaching a valuation in the millions of units by 2033. Driven by increasing prevalence of electrolyte imbalances requiring intravenous fluid replacement, the market witnessed significant expansion during the historical period (2019-2024). This growth is further fueled by advancements in healthcare infrastructure, particularly in developing economies, leading to increased accessibility to this essential medication. The estimated market value for 2025 sits at a substantial figure (insert million unit figure here) reflecting the current demand and projected future growth. Analysis indicates that the 100ml: Potassium Chloride 0.3g and Sodium Chloride 0.9g segment currently holds a larger market share compared to the 0.15g Potassium Chloride variant, attributable to the higher concentration addressing more severe electrolyte deficiencies. However, both segments are expected to demonstrate significant growth throughout the forecast period, driven by the growing prevalence of conditions requiring intravenous electrolyte replenishment. Furthermore, the hospital segment dominates application-based market share, due to the nature of the injection and the need for medical supervision. However, expanding access to outpatient clinics and increased home healthcare initiatives are expected to positively impact the clinic and other application segments in the coming years. Competitive landscape analysis reveals a mix of established multinational pharmaceutical companies and regional players, each contributing to market dynamics. The market is expected to be shaped by factors such as pricing strategies, technological innovations in injection delivery systems, and regulatory approvals. Overall, the future trajectory indicates a promising outlook for the Potassium Chloride Sodium Chloride Injection market, with potential for significant expansion in both volume and value terms.

Several key factors are driving the expansion of the Potassium Chloride Sodium Chloride Injection market. The rising incidence of chronic diseases like heart failure, kidney disease, and diabetes significantly increases the demand for electrolyte replacement therapies. These conditions often lead to electrolyte imbalances, making Potassium Chloride Sodium Chloride Injection a crucial component of treatment. Furthermore, the aging global population contributes significantly to this market growth, as older adults are more prone to electrolyte imbalances due to age-related physiological changes. The expanding healthcare infrastructure, particularly in emerging economies, ensures increased access to essential medications, including Potassium Chloride Sodium Chloride Injection, furthering market growth. Advancements in medical technology, including improved intravenous delivery systems and monitoring devices, enhance the efficiency and safety of treatment, boosting market adoption. Stringent regulatory approvals and guidelines ensure the quality and safety of the injections, inspiring confidence among healthcare professionals and patients. Finally, the increasing awareness among healthcare providers and patients about the importance of electrolyte balance drives the demand for effective and readily available therapies such as Potassium Chloride Sodium Chloride Injections.

Despite the positive growth trajectory, the Potassium Chloride Sodium Chloride Injection market faces several challenges. The potential for adverse reactions, such as cardiac arrhythmias if administered incorrectly, necessitates stringent monitoring and careful dosage control, potentially hindering market expansion in certain settings. Pricing pressures from generic competitors and the increasing cost of raw materials can affect profitability for manufacturers. Stringent regulatory approvals and guidelines, while essential for patient safety, can also create hurdles for new market entrants and increase the time-to-market for innovative products. Furthermore, variations in healthcare reimbursement policies across different regions can impact market accessibility and growth. The potential for counterfeiting and the need for robust supply chain management to maintain product integrity pose additional challenges. Finally, fluctuations in the global economy and healthcare spending can influence market demand and overall growth.

Type: The 100ml: Potassium Chloride 0.3g and Sodium Chloride 0.9g segment is projected to dominate the market due to its higher concentration, making it suitable for patients with more severe electrolyte imbalances requiring faster and more effective replenishment. This segment's larger market share reflects a greater clinical need for higher potassium concentrations. The 0.15g Potassium Chloride variant still maintains a substantial presence, catering to patients requiring less concentrated solutions. Both segments are anticipated to experience consistent growth driven by the overall increase in demand for electrolyte replacement therapy.

Application: The hospital segment currently holds the dominant market share, given the critical nature of intravenous electrolyte replacement and the need for medical supervision during administration. Hospitals possess the necessary infrastructure and trained personnel to safely administer these injections. However, the clinic segment is showing promising growth as outpatient facilities enhance their capabilities to provide such services. The "Other" segment, encompassing home healthcare and other settings, is anticipated to experience a rise in demand as healthcare practices evolve, but will lag behind hospitals and clinics in market share throughout the forecast period.

Geographic Regions: Developed regions with well-established healthcare infrastructure and high prevalence of chronic diseases will continue to dominate the market, but the growth of developing economies with expanding access to healthcare and increasing disposable income will witness significant expansion in demand for Potassium Chloride Sodium Chloride Injections. This will lead to a notable contribution from these emerging markets in the coming years.

The Potassium Chloride Sodium Chloride Injection market is poised for continued growth, spurred by the increasing prevalence of chronic diseases, expansion of healthcare infrastructure, particularly in emerging markets, advancements in intravenous delivery systems, and growing awareness among healthcare professionals about the importance of electrolyte balance. These factors collectively contribute to a robust and promising outlook for the industry.

The comprehensive report provides a detailed analysis of the Potassium Chloride Sodium Chloride Injection market, covering historical data, current market trends, and future projections. The report includes insights into market drivers, restraints, competitive landscape, and key regional markets. It offers valuable information for stakeholders, including manufacturers, distributors, and healthcare professionals involved in this vital segment of the healthcare industry. The study provides a robust understanding of market dynamics enabling informed business decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.85% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.85%.

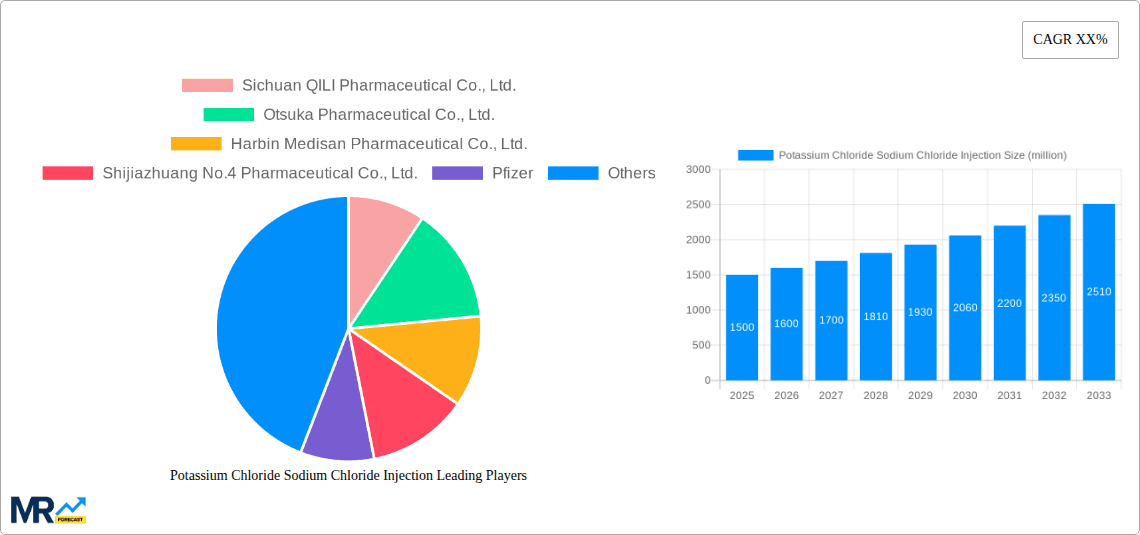

Key companies in the market include Sichuan QILI Pharmaceutical Co., Ltd., Otsuka Pharmaceutical Co., Ltd., Harbin Medisan Pharmaceutical Co., Ltd., Shijiazhuang No.4 Pharmaceutical Co., Ltd., Pfizer, B. Braun Medical Inc., Baxter Healthcare, AdvaCare, Fresenius Kabi, .

The market segments include Type, Application.

The market size is estimated to be USD 72.89 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Potassium Chloride Sodium Chloride Injection," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Potassium Chloride Sodium Chloride Injection, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.