1. What is the projected Compound Annual Growth Rate (CAGR) of the Portable Car GPS Systems?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Portable Car GPS Systems

Portable Car GPS SystemsPortable Car GPS Systems by Type (Positioning System, Navigation System), by Application (Passenger Vehicle, Commercial Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

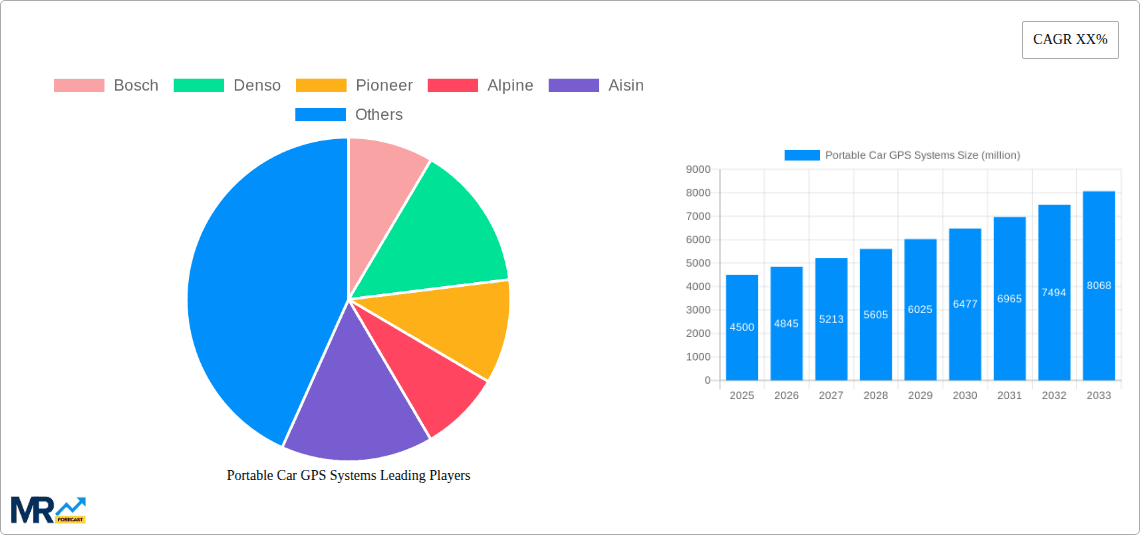

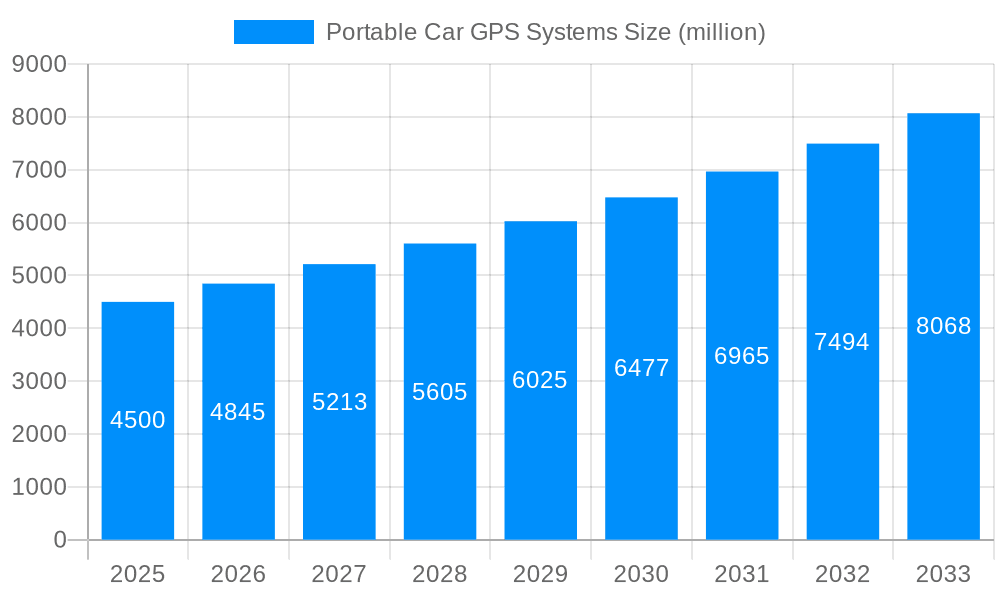

The portable car GPS systems market, while facing challenges from smartphone integration and in-car navigation systems, continues to demonstrate resilience, driven by specific consumer needs and market segments. The market, estimated at $1.5 billion in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 5%, reaching approximately $2 billion by 2033. This growth is fueled by the enduring demand for dedicated, user-friendly devices, particularly among older drivers who may find smartphone interfaces less intuitive, and in regions with limited or unreliable mobile data coverage. The market segmentation highlights the diverse applications of portable GPS devices, ranging from basic navigation units to more advanced systems offering features such as speed cameras alerts, traffic updates, and offline maps. The presence of established players like Bosch, Denso, and Garmin alongside emerging brands indicates a dynamic competitive landscape characterized by innovation in features, pricing strategies, and geographic expansion.

Key restraints include the increasing sophistication of integrated navigation systems offered by car manufacturers, along with the ubiquitous use of smartphone navigation apps. However, the enduring appeal of dedicated GPS devices, with their simplicity, durability, and dedicated functionality, offsets these pressures. Growth is likely to be concentrated in developing economies where smartphone penetration is lower and the demand for reliable and affordable navigation solutions is strong. Further growth drivers include advancements in GPS technology, such as improved accuracy and enhanced map data, alongside specialized devices tailored for specific activities like trucking or off-road navigation. The market is expected to evolve towards more sophisticated, feature-rich portable GPS systems designed to complement rather than compete with existing in-car and smartphone navigation options.

The global portable car GPS systems market, valued at approximately 15 million units in 2025, is projected to experience significant growth throughout the forecast period (2025-2033). This growth is fueled by a confluence of factors, including increasing vehicle ownership, particularly in developing economies, and the rising demand for convenient and affordable navigation solutions. While the integration of GPS functionality into factory-installed infotainment systems is increasing, the portable GPS market retains a strong niche, primarily catering to budget-conscious consumers and those who want a dedicated device for navigation, unencumbered by the complexities of integrated systems. This segment offers flexibility—users can easily move their GPS device between vehicles. The historical period (2019-2024) witnessed a period of moderate growth, largely driven by improvements in map data accuracy, user-friendly interfaces, and the decreasing cost of hardware. However, the entry of low-cost, feature-rich smartphones with integrated mapping capabilities presented a challenge. The market has adapted by focusing on features differentiating it from smartphone navigation, like enhanced offline map capabilities, ruggedized designs for demanding environments, larger displays for improved visibility, and superior voice guidance for hands-free operation. The market is also seeing increased demand for devices with advanced features such as real-time traffic updates, speed camera alerts, and points of interest (POI) databases specific to local regions, catering to the needs of diverse user preferences. Moreover, the continued development of sophisticated map data and algorithms promises to improve navigation accuracy and efficiency, bolstering market growth further.

Several factors are propelling the growth of the portable car GPS systems market. The burgeoning middle class in developing nations, coupled with rising vehicle ownership, represents a significant untapped market. These consumers are increasingly seeking reliable and affordable navigation solutions, making portable GPS systems an attractive option compared to more expensive integrated systems. Furthermore, advancements in technology have led to more user-friendly interfaces, improved map accuracy, and the inclusion of additional features like lane guidance, speed camera warnings, and offline map capabilities. These enhancements significantly improve the user experience and provide a compelling reason for consumers to choose portable GPS systems over smartphone alternatives. The relative affordability of portable GPS devices compared to built-in navigation systems makes them particularly appealing to budget-conscious drivers. Finally, the portability of these devices allows users to easily transfer them between vehicles, providing further convenience and value. This flexibility is a key differentiator for portable GPS systems in a market increasingly dominated by integrated in-car systems.

Despite the positive growth outlook, the portable car GPS systems market faces several challenges. The most significant hurdle is the widespread adoption of smartphones equipped with GPS capabilities. These devices provide a convenient and readily available navigation solution, often at little to no extra cost, and have made inroads into the portable GPS market. Another challenge is the ongoing development of advanced driver-assistance systems (ADAS) and integrated navigation systems that are becoming standard features in new vehicles. This trend reduces the demand for standalone portable units. Additionally, maintaining accurate and up-to-date map data can be expensive and logistically demanding, potentially impacting profitability. Competition from numerous manufacturers, some offering low-cost alternatives with limited features, intensifies the pressure on profit margins. Finally, the increasing reliance on cloud-based services for real-time traffic and other data can make these systems susceptible to connectivity issues, which compromises their functionality.

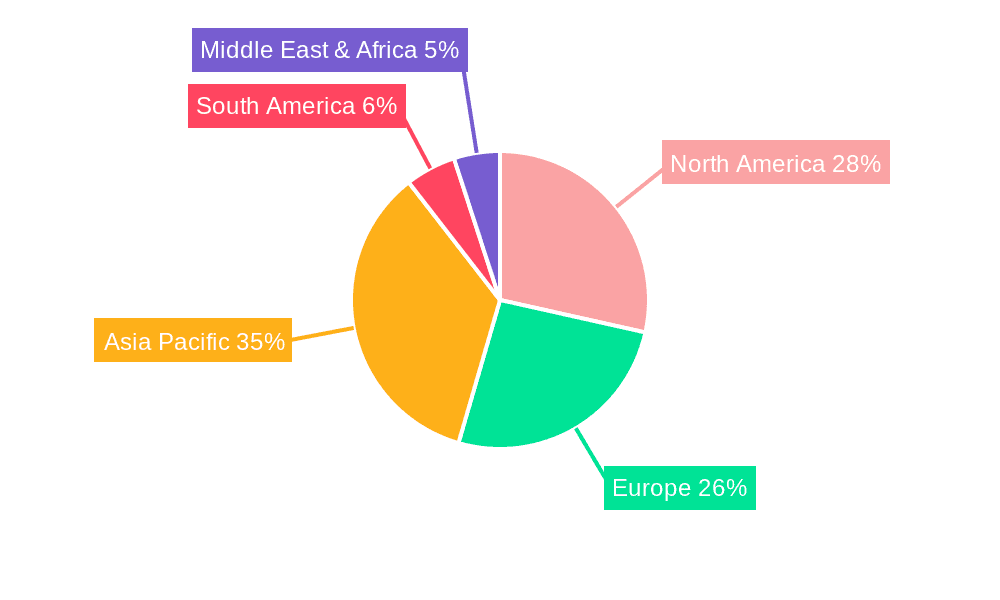

Asia-Pacific: This region is anticipated to dominate the portable car GPS systems market due to the rapid growth in vehicle sales and a large and expanding middle class, particularly in countries like India and China. The increasing affordability of portable GPS devices makes them particularly appealing to this market segment.

North America: While not as rapidly growing as Asia-Pacific, North America still represents a substantial market for portable car GPS systems, with a strong focus on premium features and advanced functionalities.

Europe: The European market is expected to show steady growth, driven by the demand for robust and reliable navigation systems, particularly for long-distance travel and in areas with less developed road infrastructure.

Segment Domination: The segment of portable GPS devices featuring advanced features such as real-time traffic updates, lane guidance, and offline maps will likely see greater growth compared to basic models. These advanced features offer a competitive edge against smartphone navigation apps, justifying the higher price point. Consumers are willing to pay a premium for improved accuracy, safety features, and enhanced user experience. The increasing preference for voice-activated navigation further boosts the market for advanced devices. The need for offline maps in regions with poor cellular coverage is also a significant factor driving demand in this segment.

The paragraph above highlights the key regional and segmental drivers, focusing on the synergies between technological advancement and market demand. The combination of rising vehicle ownership in emerging economies and a preference for advanced features in developed markets points towards a complex but robust future for this sector.

Several factors are fueling growth within the portable car GPS systems industry. Firstly, the continuous improvement of map data accuracy and the integration of advanced features like real-time traffic updates are vital in enhancing the user experience and attracting new consumers. Secondly, the affordability of portable GPS devices compared to integrated navigation systems remains a key driver, making them accessible to a broader customer base. The increasing adoption of voice-activated navigation and the development of ruggedized designs for off-road usage are also adding to the market’s expansion.

This report provides a comprehensive analysis of the portable car GPS systems market, covering historical data (2019-2024), the estimated year (2025), and a detailed forecast for the period 2025-2033. It includes market sizing in millions of units, identifies key trends and growth drivers, analyzes competitive landscapes and significant developments, and delves into regional and segmental performances. The report offers valuable insights for manufacturers, investors, and other stakeholders seeking to understand and navigate this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bosch, Denso, Pioneer, Alpine, Aisin, TomTom, Kenwood, Sony, Clarion, Garmin, Panasonic, Hangsheng, Coagent, Kaiyue Group, Skypine, Roadrover, FlyAudio, Freeway, Evervictory, ADAYO, Soling, Desay, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Portable Car GPS Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Portable Car GPS Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.