1. What is the projected Compound Annual Growth Rate (CAGR) of the Plug-In Hybrid Electric Passenger Vehicle?

The projected CAGR is approximately 10.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Plug-In Hybrid Electric Passenger Vehicle

Plug-In Hybrid Electric Passenger VehiclePlug-In Hybrid Electric Passenger Vehicle by Type (Range, 100 km, 200km ), by Application (Commercial, Household, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

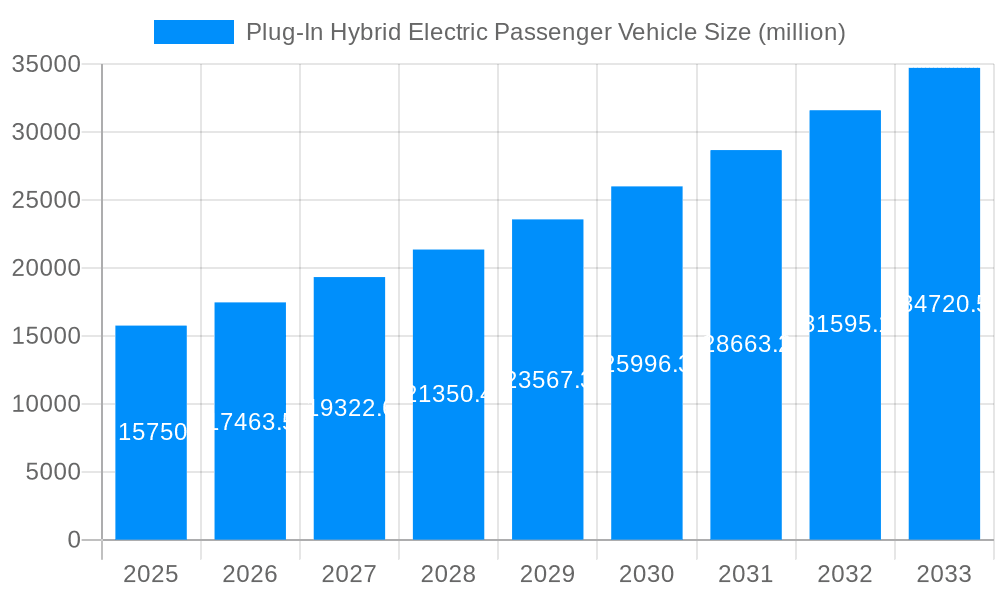

The Plug-In Hybrid Electric Passenger Vehicle (PHEV) market is experiencing robust growth, projected to reach a market size of $15,750 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 10.7% from 2019 to 2033. This expansion is fueled by several key drivers. Increasing concerns about environmental sustainability and stricter government regulations promoting cleaner transportation are significantly impacting consumer preferences. Furthermore, advancements in battery technology, leading to increased electric range and reduced charging times, are enhancing the appeal of PHEVs. Government incentives like tax credits and subsidies are also playing a pivotal role in accelerating market adoption. Competitive pricing strategies by major automotive manufacturers, including General Motors, Toyota, Ford, and others, are making PHEVs more accessible to a wider range of consumers. However, factors such as high initial purchase price compared to conventional vehicles, limited charging infrastructure in certain regions, and concerns about battery lifespan and replacement costs continue to pose challenges to wider market penetration. The market is segmented by various factors including vehicle type, battery capacity, and geographical region, with North America and Europe currently representing significant market shares. The forecast period of 2025-2033 anticipates continued strong growth, driven by ongoing technological advancements and supportive government policies.

The competitive landscape is characterized by intense rivalry among established automotive giants and emerging players. Established manufacturers are leveraging their brand recognition and extensive distribution networks to gain market share, while new entrants are focusing on innovation and niche market segments. The future of the PHEV market will likely see increased integration of smart technologies, including connectivity features and autonomous driving capabilities. The development of more efficient and affordable battery technologies will be crucial in overcoming existing limitations and further driving market expansion. Strategic partnerships and collaborations between automotive manufacturers and battery technology providers are also expected to play a vital role in shaping the market's future trajectory. Overall, the PHEV market presents significant opportunities for growth and innovation, promising a substantial shift towards sustainable transportation in the coming years.

The global plug-in hybrid electric passenger vehicle (PHEV) market is experiencing robust growth, driven by stringent emission regulations, increasing fuel prices, and growing consumer awareness of environmental concerns. Between 2019 and 2024 (historical period), the market witnessed a significant surge, laying the groundwork for even more substantial expansion during the forecast period (2025-2033). Our analysis, using data from the base year (2025) and estimating market size in the millions of units, projects continued upward momentum. Key market insights reveal a shift towards higher-range PHEVs, driven by improved battery technology and consumer demand for extended electric-only driving capabilities. The market is also witnessing diversification in vehicle segments, with PHEV options becoming increasingly available across various body styles, from compact cars to SUVs. Furthermore, government incentives and subsidies are playing a crucial role in boosting adoption rates, particularly in regions with ambitious emission reduction targets. Competition among manufacturers is intensifying, leading to innovations in technology, design, and affordability, which further fuels market growth. The estimated year (2025) showcases a considerable market size, signaling a significant turning point in the global automotive landscape. This trend is expected to continue, potentially reaching [Insert projected market size in millions of units for 2033] by the end of the forecast period. The market is not without its challenges, however, including infrastructure limitations, range anxiety, and the relatively higher initial purchase price compared to conventional vehicles. Nonetheless, the overall trajectory strongly suggests a continuously expanding market share for PHEVs in the coming decade. The study period (2019-2033) encapsulates the transformative period of PHEV adoption, highlighting the market's evolution from niche technology to a mainstream automotive offering. Major players are heavily investing in research and development, resulting in technological advancements that are addressing consumer concerns and expanding market accessibility. This is particularly evident in the increased range and improved charging infrastructure.

Several key factors are propelling the growth of the plug-in hybrid electric passenger vehicle market. Firstly, stringent government regulations aimed at reducing carbon emissions are incentivizing both manufacturers and consumers to adopt cleaner vehicle technologies. Many countries are implementing stricter emission standards and offering substantial tax breaks and subsidies for PHEV purchases. Secondly, the fluctuating and often high cost of gasoline is pushing consumers to explore more fuel-efficient alternatives. PHEVs offer a compelling proposition by combining the benefits of electric driving with the flexibility of a gasoline engine, reducing reliance on fossil fuels and mitigating fuel cost volatility. Thirdly, growing environmental awareness among consumers is driving demand for eco-friendly vehicles. PHEVs contribute to a smaller carbon footprint compared to traditional gasoline-powered cars, appealing to environmentally conscious individuals and families. Furthermore, technological advancements in battery technology are resulting in increased driving range on electric power, reduced charging times, and improved overall performance of PHEVs, addressing earlier consumer concerns and enhancing the overall user experience. The ongoing development of charging infrastructure also plays a vital role, making it easier and more convenient for PHEV owners to recharge their vehicles. The combination of these factors creates a powerful synergy that is driving significant and sustained growth in the PHEV market.

Despite the promising growth trajectory, the PHEV market faces several challenges. The higher initial purchase price of PHEVs compared to conventional internal combustion engine (ICE) vehicles remains a significant barrier for many consumers. Government subsidies can mitigate this to some extent, but the price disparity still poses a hurdle for widespread adoption, particularly in developing economies. Range anxiety, the fear of running out of battery charge before reaching a charging station, continues to be a concern for potential buyers, despite improvements in battery technology. The availability and accessibility of charging infrastructure is also a critical factor. A lack of sufficient charging points, particularly in rural areas and less developed regions, can significantly hinder PHEV adoption. Furthermore, the relatively longer charging times compared to refuelling a gasoline car can be a deterrent for some consumers. The complexity of the PHEV technology and the need for specialized maintenance can also add to the overall cost of ownership. Finally, the dependence on the availability of electricity, especially in regions with unreliable power grids, presents another challenge to overcome for wider market penetration. Addressing these challenges requires a multi-faceted approach involving technological innovations, policy support, and infrastructure development.

The PHEV market is geographically diverse, with several key regions and segments showing strong growth potential.

China: China is projected to be the largest market for PHEVs globally, due to its massive automotive market, strong government support for electric vehicles, and growing consumer demand for greener transportation options. The country's ambitious emission reduction targets are driving significant investments in PHEV technology and infrastructure. Extensive government subsidies and incentives are also contributing to increased adoption rates. Specific policy initiatives aimed at promoting new energy vehicles, including PHEVs, are propelling growth. Furthermore, a growing middle class with increased disposable income is fueling demand for higher-end PHEV models.

Europe: European countries have implemented stringent emission regulations, pushing automakers to increase their PHEV offerings. Strong government support in several European nations in the form of subsidies and tax incentives is driving market expansion. Furthermore, a well-developed charging infrastructure network and consumer awareness of environmental issues contribute significantly to higher PHEV adoption rates. Various government programs are prioritizing electric mobility, fostering a conducive market environment.

North America: While the North American market is growing, it lags behind China and Europe in terms of PHEV adoption. However, increasing awareness of environmental issues and the introduction of more affordable PHEV models are gradually driving market growth. Government incentives, though less substantial than in some other regions, are playing a role. The increasing popularity of SUVs and crossovers is also influencing the design and availability of PHEV models in the segment. The market's expansion will depend on the continued enhancement of charging infrastructure and affordability.

SUV Segment: The SUV segment is dominating the PHEV market due to consumer preference for larger vehicles and the increasing availability of PHEV options in this category. SUVs' practicality and versatility make them attractive choices for families and outdoor enthusiasts. Manufacturers are responding by offering a wider range of PHEV SUVs with competitive features and performance. The higher price point of SUVs compared to smaller vehicles does not seem to be significantly hindering the growth of this segment.

Premium Segment: PHEVs in the premium segment are also experiencing significant growth as consumers are willing to invest in advanced technologies and premium features. Luxury automakers are actively developing and marketing high-performance PHEV models with extensive features and advanced driver-assistance systems. The focus on luxury and technological innovation enhances the appeal of PHEVs in this segment.

Several factors are catalyzing growth in the PHEV industry. These include technological advancements leading to increased battery range and faster charging times, supportive government policies offering incentives and subsidies, the rising cost of gasoline and associated environmental concerns, and the intensified competition among manufacturers leading to innovation and affordability. The expansion of charging infrastructure and the growing awareness of environmental sustainability are further fueling market expansion.

This report provides a comprehensive overview of the plug-in hybrid electric passenger vehicle market, analyzing historical trends, current market dynamics, and future growth prospects. It offers detailed insights into key market drivers, challenges, and opportunities, enabling stakeholders to make informed strategic decisions. The report covers major regions, segments, and key players, providing a holistic view of this rapidly evolving sector. Furthermore, it incorporates qualitative and quantitative data, including market size estimations and forecasts, to offer a robust and reliable analysis of the PHEV market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.7%.

Key companies in the market include General Motors, Toyota, Ford, Geely, Honda, Mitsubishi Group, BMW, Volkswagen Group, BYD, SAIC MOTOR, Mercedes-Benz, Hyundai Motor Group, Fiat Chrysler Automobiles, .

The market segments include Type, Application.

The market size is estimated to be USD 15750 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Plug-In Hybrid Electric Passenger Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Plug-In Hybrid Electric Passenger Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.