1. What is the projected Compound Annual Growth Rate (CAGR) of the Pipeline and Tank Inspection Robots?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pipeline and Tank Inspection Robots

Pipeline and Tank Inspection RobotsPipeline and Tank Inspection Robots by Type (Wall Climbing Robot, Internal Inspection Robot, Pipe Inspection Robot), by Application (Metal Oil Tank, Non-Metallic Oil Tanks), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

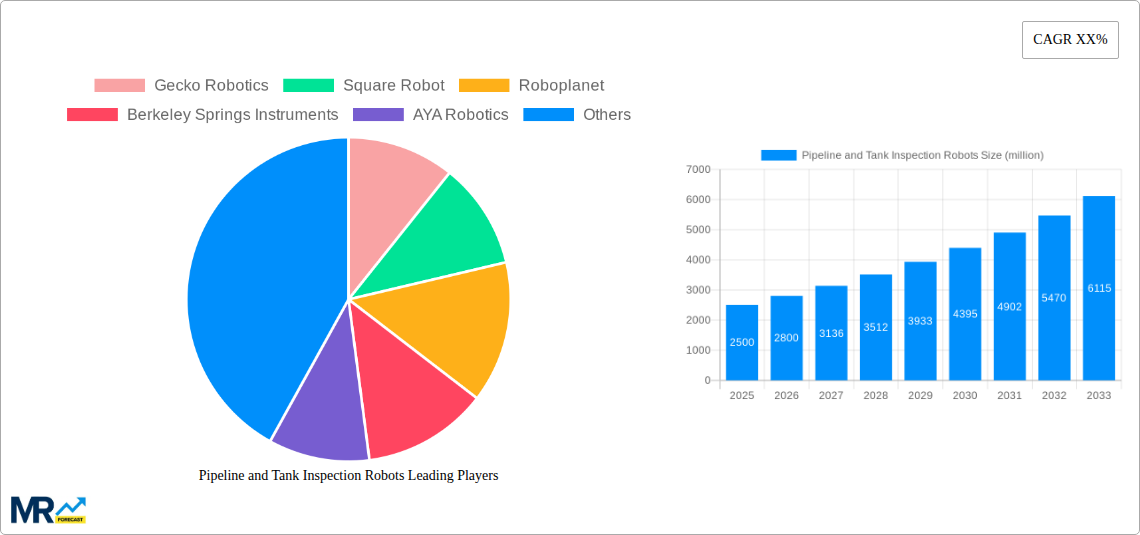

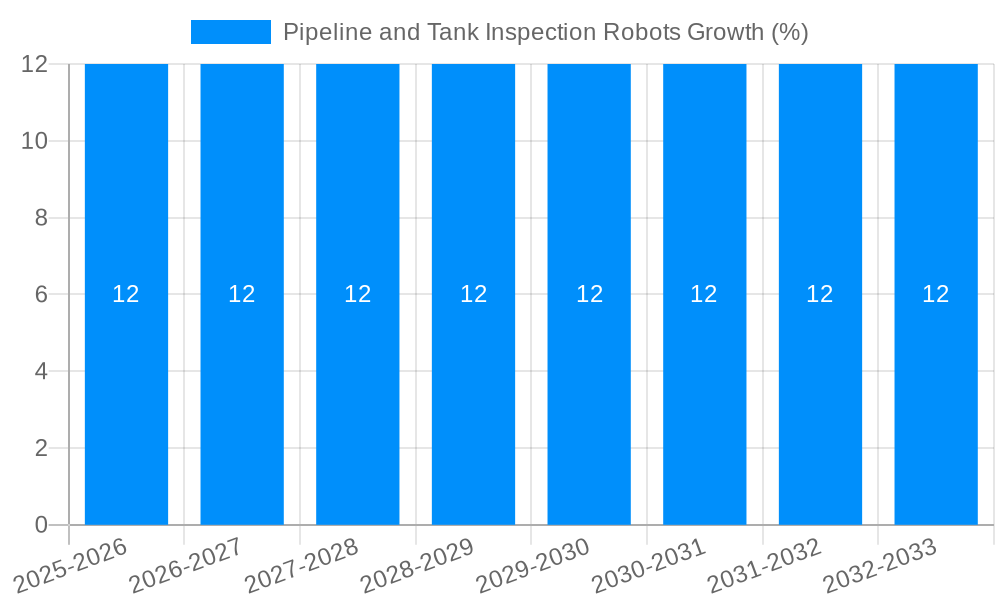

The global market for Pipeline and Tank Inspection Robots is poised for significant expansion, driven by an increasing emphasis on safety, regulatory compliance, and operational efficiency across various industries. Anticipated to reach a substantial market size of approximately $2.5 billion in 2025, the sector is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of around 12% through 2033. This upward trajectory is fueled by the growing need for advanced inspection solutions that can mitigate risks associated with aging infrastructure, prevent costly leaks, and ensure the integrity of critical assets like oil and gas pipelines, water distribution networks, and storage tanks. The inherent limitations of manual inspections, including human error, safety hazards, and time inefficiencies, are pushing industries towards automated and robotic alternatives.

Key market drivers include stringent environmental regulations demanding regular and thorough inspections, the rising adoption of IoT and AI technologies for predictive maintenance, and the demand for reduced downtime in industrial operations. The market is segmenting into distinct types, with Wall Climbing Robots, Internal Inspection Robots, and Pipe Inspection Robots catering to diverse inspection needs. Applications are primarily concentrated in Metal Oil Tanks and Non-Metallic Oil Tanks, reflecting the critical role these robots play in the energy sector. Emerging trends such as the development of smaller, more agile robots capable of navigating complex geometries, enhanced sensor integration for more comprehensive data collection, and the integration of AI for automated defect identification are shaping the competitive landscape. However, the high initial investment costs for sophisticated robotic systems and the need for skilled personnel to operate and maintain them represent potential restraints on market acceleration. The competitive environment is characterized by the presence of both established players and innovative startups, all striving to capture market share through technological advancements and strategic partnerships.

This comprehensive report delves into the burgeoning global market for Pipeline and Tank Inspection Robots. The study encompasses a detailed analysis of market trends, growth drivers, challenges, regional dynamics, and leading industry players, providing an invaluable resource for stakeholders seeking to understand and capitalize on this evolving sector. The Study Period for this report is from 2019 to 2033, with the Base Year for analysis set at 2025, and an Estimated Year also for 2025. The Forecast Period extends from 2025 to 2033, building upon a robust Historical Period of 2019-2024. The report quantifies the market size in millions of dollars, offering a clear financial perspective.

XXX reports a dynamic and upward trajectory for the Pipeline and Tank Inspection Robots market, projected to reach a substantial valuation in the coming years. The increasing demand for enhanced safety protocols, proactive infrastructure maintenance, and regulatory compliance is fundamentally reshaping the inspection landscape. Traditional manual inspection methods are proving increasingly inadequate for large-scale, complex, and potentially hazardous environments like oil and gas pipelines and storage tanks. This gap is being efficiently filled by robotic solutions that offer unparalleled precision, speed, and data acquisition capabilities. The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and sophisticated sensor suites (including ultrasonic, eddy current, and visual inspection technologies) is a defining trend. These advancements enable robots to not only detect anomalies but also to classify and predict potential failures, moving from reactive to predictive maintenance. The market is witnessing a significant shift towards autonomous and semi-autonomous systems, reducing human intervention in dangerous zones and optimizing operational efficiency. Furthermore, the development of robots capable of inspecting both internal and external surfaces, across diverse materials like metal and non-metallic tanks, is expanding the addressable market. The increasing investment in digital transformation within the oil and gas, water, and chemical industries is also a powerful tailwind, driving the adoption of these cutting-edge inspection technologies. The global market is expected to see steady growth, fueled by technological innovations and the escalating need for reliable and cost-effective infrastructure integrity management solutions. This trend is further underscored by the growing emphasis on environmental protection and the prevention of leaks and spills, which directly translate into a higher demand for sophisticated inspection robots. The competitive landscape is characterized by continuous innovation, with companies striving to develop more versatile, robust, and intelligent robotic platforms. The market is poised for significant expansion, driven by the inherent benefits of robotic inspection in terms of safety, efficiency, and data-driven decision-making.

The pipeline and tank inspection robots market is experiencing robust growth propelled by a confluence of critical factors. Foremost among these is the escalating imperative for enhanced safety in hazardous industrial environments. The oil and gas, chemical, and water treatment sectors, which heavily rely on extensive pipeline networks and large storage tanks, are under immense pressure to minimize risks associated with structural failures, leaks, and environmental contamination. Robotic inspection offers a safer alternative to manual inspections, significantly reducing the exposure of human personnel to dangerous substances, confined spaces, and extreme conditions. Furthermore, the rising global energy demand necessitates the expansion and maintenance of aging infrastructure. The sheer scale of these networks makes traditional inspection methods prohibitively time-consuming, expensive, and often incomplete. Robotic solutions provide a cost-effective and efficient means to conduct regular and thorough inspections, thereby extending the lifespan of critical assets and preventing costly unplanned downtime. Regulatory mandates and stringent compliance requirements across various industries also play a pivotal role. Governments and regulatory bodies are increasingly enforcing stricter standards for infrastructure integrity and environmental protection, compelling companies to adopt advanced inspection technologies to demonstrate adherence. The continuous advancements in robotics and sensor technology are making these inspection systems more capable, accurate, and affordable, further accelerating their adoption.

Despite the promising growth trajectory, the pipeline and tank inspection robots market faces several significant challenges and restraints that could temper its expansion. A primary hurdle is the substantial initial investment required for acquiring sophisticated robotic inspection systems. The cost of high-end robots, coupled with the necessary training and integration into existing workflows, can be a deterrent for smaller companies or those operating with tighter budgets. Another considerable challenge is the complex and often challenging operational environment. Pipelines and tanks can be located in remote, inaccessible, or extreme conditions, requiring robots to be highly robust, adaptable, and equipped with advanced navigation and communication capabilities. The development of AI and ML algorithms for truly autonomous decision-making and anomaly detection is still an ongoing process, and limitations in current capabilities can hinder the full potential of these robots. Moreover, the integration of robotic inspection data into existing asset management systems can be complex, requiring significant IT infrastructure upgrades and data standardization efforts. The cybersecurity of these connected robotic systems is also a growing concern, necessitating robust security protocols to prevent unauthorized access or manipulation. Lastly, the availability of skilled personnel to operate, maintain, and interpret data from these advanced robots can be a limiting factor. A shortage of trained technicians and data analysts might slow down the widespread adoption and effective utilization of these technologies.

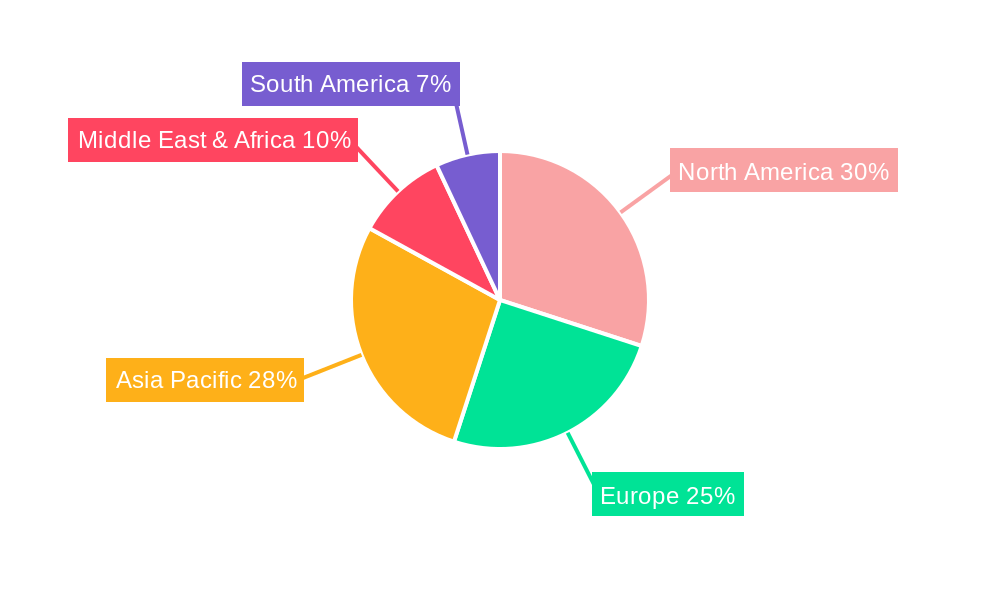

The global Pipeline and Tank Inspection Robots market is expected to witness significant dominance from specific regions and segments, driven by a combination of established infrastructure, stringent regulatory environments, and technological adoption rates.

Dominant Segments:

Type: Wall Climbing Robot: The Wall Climbing Robot segment is poised for exceptional growth and market leadership. These robots are indispensable for the inspection of vertical surfaces in large storage tanks, bridges, and industrial structures. Their ability to adhere to and traverse diverse materials, including steel, concrete, and composites, makes them highly versatile. The increasing focus on the integrity of large-scale metal oil tanks, particularly those with external coatings and complex geometries, will be a primary driver for wall climbing robots. Their capacity to carry various inspection payloads, such as cameras, ultrasonic sensors, and thermal imagers, allows for comprehensive data collection from challenging angles and heights that are difficult or dangerous for human inspectors. The ongoing development of more powerful suction or magnetic adhesion technologies will further enhance their applicability across different tank types and sizes.

Application: Metal Oil Tank: The inspection of Metal Oil Tanks represents another cornerstone segment driving market expansion. These tanks, critical for the storage of vast quantities of oil and gas, are subject to rigorous inspection requirements due to safety and environmental concerns. The sheer volume of existing metal oil tank infrastructure globally, coupled with the need for regular integrity assessments to prevent corrosion, structural fatigue, and leaks, ensures a sustained demand for inspection robots. The development of robots specifically designed to navigate the internal and external surfaces of these tanks, equipped with non-destructive testing (NDT) technologies like ultrasonic testing (UT) and magnetic particle testing (MPT), will be crucial. The increasing adoption of predictive maintenance strategies within the oil and gas industry further bolsters the demand for accurate and reliable data provided by these robots.

Dominant Region/Country:

The synergy between the critical need for infrastructure integrity, robust regulatory oversight, and a strong ecosystem of technological development positions North America as a leading force in the global pipeline and tank inspection robots market. The increasing adoption of wall climbing robots for tank inspections and the focus on metal oil tanks within this region will further solidify its dominant standing.

Several key factors are acting as powerful catalysts for the growth of the pipeline and tank inspection robots industry. The escalating need for enhanced safety in hazardous industrial environments, particularly in the oil and gas sector, is a primary driver. Furthermore, the increasing global demand for energy necessitates the expansion and diligent maintenance of aging infrastructure, where robots offer unparalleled efficiency. Stricter regulatory compliance mandates and the growing awareness of environmental protection are compelling organizations to invest in advanced inspection technologies. The continuous technological advancements in robotics, AI, and sensor technology are making these solutions more capable, affordable, and accessible. Finally, the shift towards predictive maintenance strategies within industries is fueling the demand for detailed and consistent data that only robotic inspections can reliably provide.

This comprehensive report offers an in-depth market analysis, providing invaluable insights into the global Pipeline and Tank Inspection Robots market. It meticulously examines market trends, size, and segmentation, with detailed forecasts from 2025 to 2033. The report elucidates the key driving forces, including the paramount need for enhanced safety and the optimization of aging infrastructure, while also addressing the challenges and restraints that shape market dynamics. It highlights dominant regions and key segments, such as Wall Climbing Robots and the inspection of Metal Oil Tanks, offering strategic perspectives. Furthermore, the report identifies critical growth catalysts and provides a detailed overview of leading industry players. The comprehensive coverage ensures stakeholders have a thorough understanding of the market's present state and future potential, enabling informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Gecko Robotics, Square Robot, Roboplanet, Berkeley Springs Instruments, AYA Robotics, Manta Robotics, Spectis Robotics, Arabian Robotics, Watertight Robotics, AETOS, Veritank, ANYbotics, Newton Labs, Guimu Robot, HeMan, Yipaikeji.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pipeline and Tank Inspection Robots," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pipeline and Tank Inspection Robots, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.