1. What is the projected Compound Annual Growth Rate (CAGR) of the Photo Scanner?

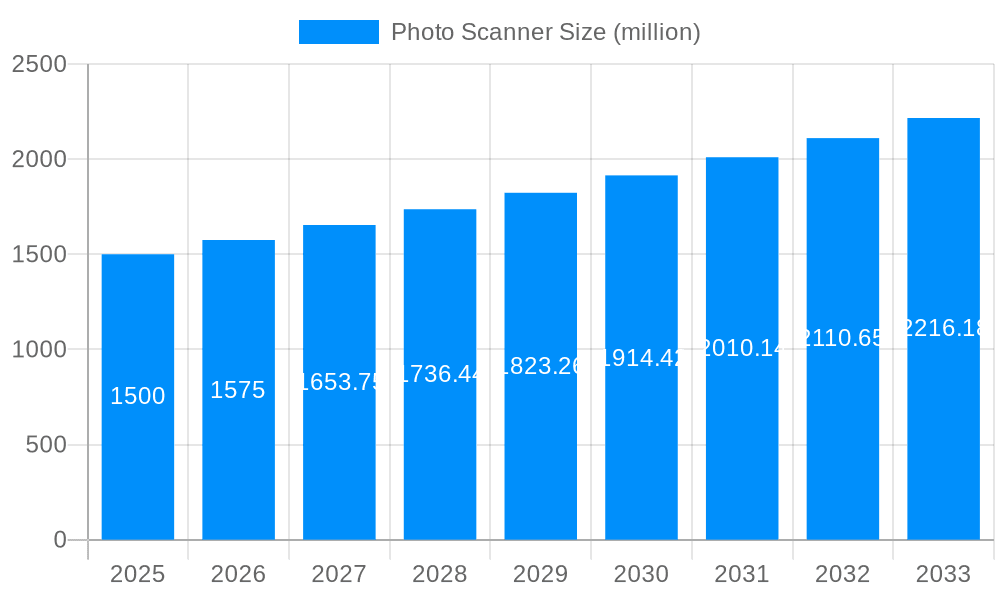

The projected CAGR is approximately 4.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Photo Scanner

Photo ScannerPhoto Scanner by Type (Benchtop Type, Portable Type), by Application (Office Use, Household Use, Commercial Use, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

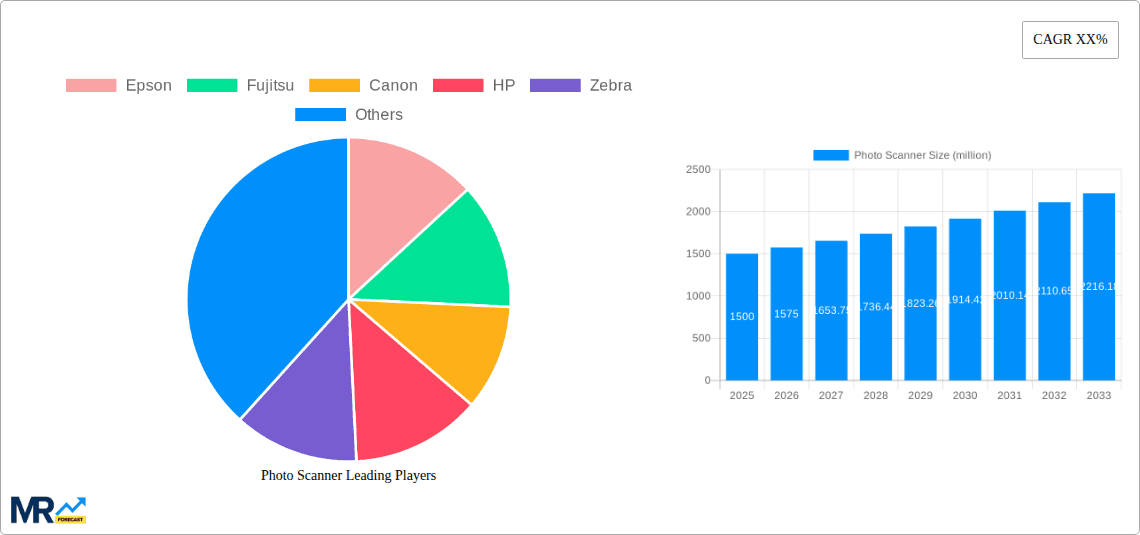

The global photo scanner market is poised for robust expansion, driven by the escalating need for digitizing both personal and professional photo collections. The market, valued at $8.91 billion in the base year of 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.1% from 2025 to 2033. This growth trajectory is underpinned by several key catalysts: the rising adoption of digital photo storage and sharing services, the imperative to archive and preserve valuable visual assets, and the increasing integration of cloud-based storage solutions. Concurrently, technological advancements in scanner capabilities, including enhanced resolution, accelerated scanning speeds, and superior image fidelity, are significant contributors to market proliferation. The market is segmented by scanner type (flatbed, film, portable), resolution, and application (home, professional, archival). Leading manufacturers such as Epson, Fujitsu, Canon, HP, Zebra, Plustek, and Visioneer are engaged in strategic competition, emphasizing innovation and product differentiation to secure market dominance.

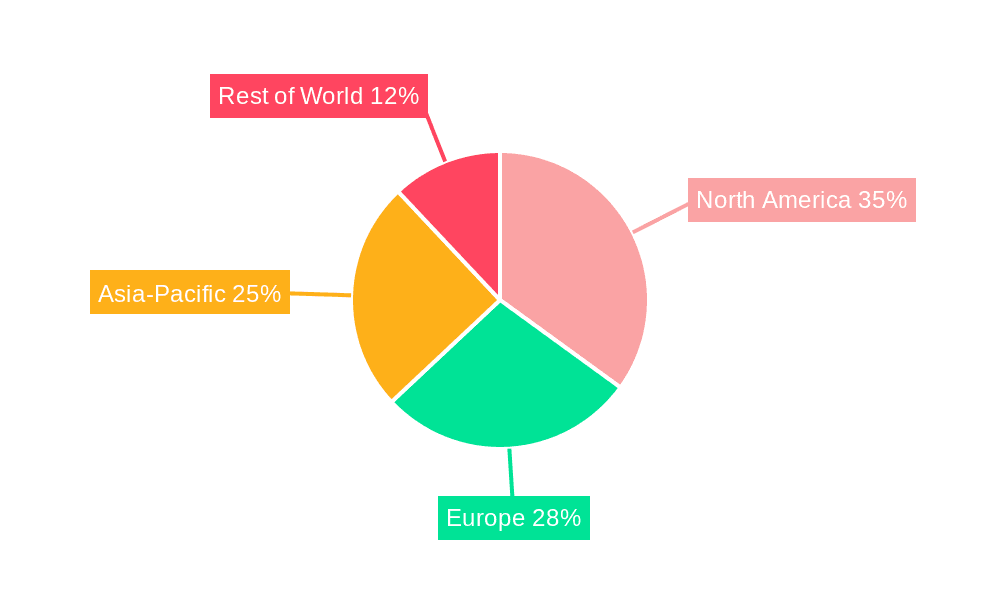

Despite a favorable outlook, several growth restraints are present. The initial investment for high-resolution photo scanners can be a deterrent, particularly in cost-sensitive economies. Furthermore, the burgeoning quality of smartphone camera technology poses a competitive challenge to dedicated photo scanning devices. Nevertheless, the demand for uncompromising image quality and the capacity to digitize legacy media like photos, negatives, and slides remain powerful market drivers. The ongoing transition from physical to digital media, especially within professional archival and photographic industries, will sustain market growth, notwithstanding these constraints. Expansion is anticipated to be most pronounced in regions characterized by elevated disposable incomes and advanced digital infrastructure.

The global photo scanner market, valued at several million units in 2024, is experiencing a dynamic shift driven by evolving consumer needs and technological advancements. While the historical period (2019-2024) saw a steady, if not explosive, growth fueled primarily by the digitization of personal photo archives, the forecast period (2025-2033) projects a more nuanced trajectory. The estimated market size in 2025 serves as a crucial benchmark, highlighting a period of market stabilization before anticipated renewed growth. This stabilization is partly attributable to the increasing prevalence of smartphones with high-resolution cameras, offering a readily accessible alternative for photo digitization. However, several factors are poised to reignite market expansion. The demand for high-quality scans for professional purposes, such as archiving historical photographs or preserving family heirlooms, remains robust. Furthermore, the development of more sophisticated scanner technologies, including AI-powered image enhancement and cloud integration, is attracting a new wave of users. This suggests a future where photo scanners aren't just about basic digitization but also about preserving and enhancing photo quality, leading to a premium segment within the market. The continued decline in the cost of high-resolution scanning technologies will also influence market growth. This trend, coupled with the increasing awareness of the long-term benefits of digital preservation, positions the photo scanner market for sustained, albeit measured, expansion in the coming years. The competitive landscape, dominated by established players like Epson, Canon, and Fujitsu, alongside emerging players focusing on niche technologies, further underscores the market's dynamic nature. The market’s evolution is less about raw unit sales and more about the value proposition offered—high-quality scans, ease of use, and integrated solutions for archival and sharing. This shift towards value-added services is a key trend shaping the industry's future.

Several factors are fueling the growth of the photo scanner market. Firstly, the increasing need for digital preservation of precious memories is a primary driver. Physical photographs are susceptible to damage, fading, and loss, prompting individuals and institutions to actively seek digital alternatives. This desire to safeguard family history and irreplaceable memories is a powerful force pushing market expansion. Secondly, the rising demand for high-resolution scans for professional uses, such as archival purposes in museums or historical societies, and for use in professional photo restoration services, fuels the market for higher-end models. Technological advancements, particularly in AI-powered image enhancement and cloud integration, significantly improve the user experience. The ability to automatically enhance scans, correct imperfections, and easily store digitized photos in the cloud is highly appealing and adds value to the overall offering. Moreover, the declining cost of production for advanced photo scanners makes them more accessible to a broader consumer base. This affordability factor, coupled with increasing awareness of digital preservation benefits through marketing campaigns and educational initiatives, further propels market growth. Finally, the increasing integration of photo scanners into other digital workflows, allowing seamless integration with photo editing software and cloud storage platforms, expands their appeal beyond just simple digitization.

Despite the positive growth outlook, the photo scanner market faces several challenges. The most significant is the competition from smartphone cameras, which offer a convenient and readily accessible alternative for quick photo digitization. This presents a considerable challenge, especially to lower-end photo scanners. The market is also susceptible to economic fluctuations. During periods of economic downturn, discretionary spending on consumer electronics, including photo scanners, tends to decrease. This can lead to temporary dips in market growth. Another challenge is educating consumers on the superior quality and longevity of scans produced by dedicated photo scanners compared to smartphone images. Many consumers remain unaware of the differences in resolution, color accuracy, and preservation capabilities. Furthermore, the relatively high cost of high-resolution, professional-grade photo scanners can limit their accessibility to a niche market. Finally, the potential for technological obsolescence is a constant concern. Rapid advancements in imaging technology could render existing scanners outdated, requiring companies to invest heavily in research and development to stay competitive.

The North American and European markets are expected to be key drivers of the photo scanner market, due to higher disposable incomes and a greater emphasis on preserving family heritage. Within these regions, the professional segment – including museums, archives, and photo restoration services – demonstrates substantial growth potential.

Segment Dominance: The professional segment— encompassing high-resolution scanners used for archival purposes and in specialized settings — is projected to command a significant portion of the market share due to the increasing need for high-quality digital copies of invaluable photographic materials. This segment is less susceptible to competition from smartphone cameras, as it prioritizes superior image quality and advanced features, justifying the higher cost. The consumer segment, while larger in terms of units sold, will likely exhibit slower growth compared to the professional segment, driven by the continued popularity of smartphone photography.

The overall market growth will be driven by a combination of factors including increased demand from both consumer and professional users, advancements in technology, and the growing awareness of the need for digital preservation of photographic materials.

Several factors are poised to accelerate growth. The increasing demand for high-resolution scans for professional archiving and restoration is a major catalyst. Technological advancements in areas such as AI-powered image enhancement and cloud integration are enhancing the user experience and creating new market opportunities. Furthermore, strategic partnerships between scanner manufacturers and cloud storage providers are streamlining the workflow, contributing to increased user adoption.

This report provides a comprehensive analysis of the photo scanner market, covering market trends, driving forces, challenges, key regions and segments, growth catalysts, leading players, and significant developments. It offers valuable insights into the current market dynamics and provides projections for the forecast period (2025-2033), enabling stakeholders to make informed strategic decisions. The report's historical data (2019-2024) provides context for the current market situation, and the estimated year (2025) serves as a critical point for assessing future projections. The report includes detailed profiles of key players, highlighting their market strategies and competitive landscapes. This comprehensive analysis helps stakeholders understand the growth potential and challenges within the photo scanner market and develop suitable strategies for the future.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.1%.

Key companies in the market include Epson, Fujitsu, Canon, HP, Zebra, Plustek, Visioneer, .

The market segments include Type, Application.

The market size is estimated to be USD 8.91 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Photo Scanner," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Photo Scanner, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.