1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Oral Liquid Glass Bottles?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pharmaceutical Oral Liquid Glass Bottles

Pharmaceutical Oral Liquid Glass BottlesPharmaceutical Oral Liquid Glass Bottles by Type (Low Borosilicate, Soda Lime Glass, Other), by Application (≤50ml Pharmaceuticals, 50-100ml Pharmaceuticals, 100-200ml Pharmaceuticals, >200ml Pharmaceuticals), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

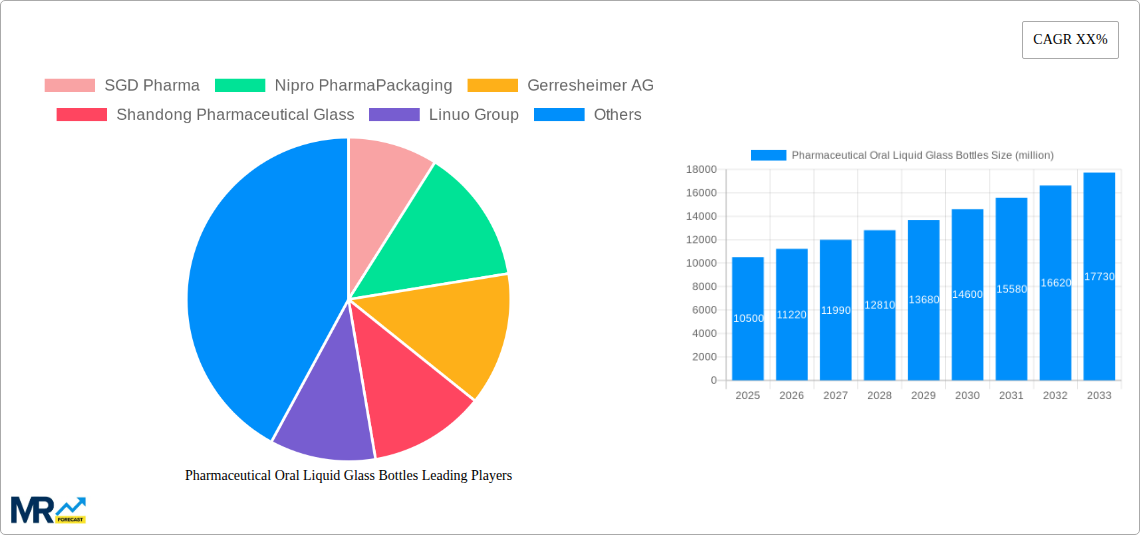

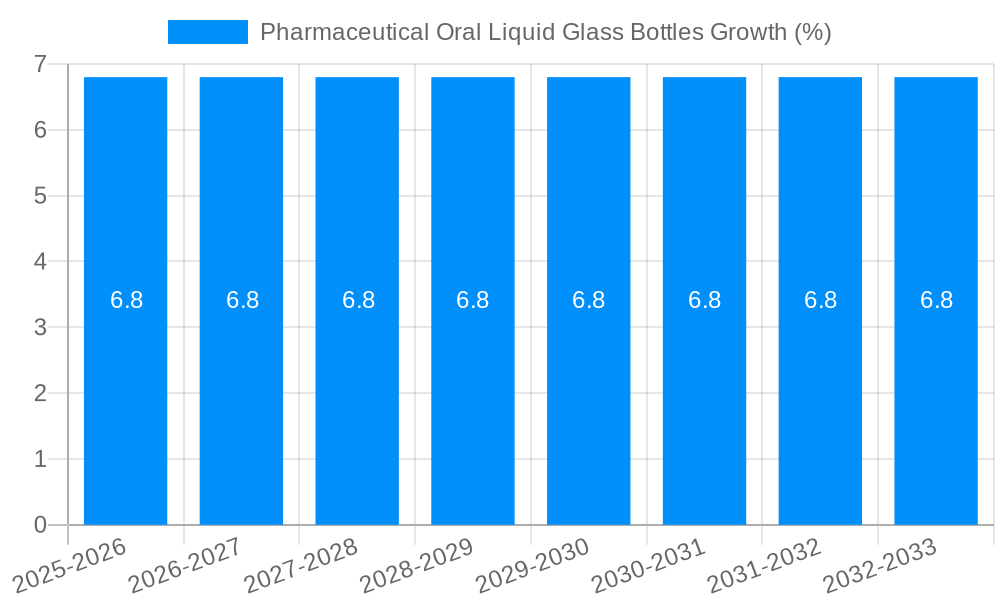

The global Pharmaceutical Oral Liquid Glass Bottles market is poised for significant expansion, projected to reach an estimated market size of $10,500 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 6.8%, indicating a sustained upward trajectory through the forecast period ending in 2033. The primary drivers for this surge are the increasing prevalence of chronic diseases and the growing demand for safe and effective pharmaceutical packaging solutions. Oral liquid medications, favored for their ease of administration, particularly among pediatric and geriatric populations, represent a substantial segment of the pharmaceutical industry. The inherent inertness and barrier properties of glass make it the preferred material for preserving the integrity and efficacy of these sensitive formulations, thereby driving consistent demand. Furthermore, advancements in glass manufacturing technologies are leading to more sustainable and cost-effective production, further bolstering market attractiveness.

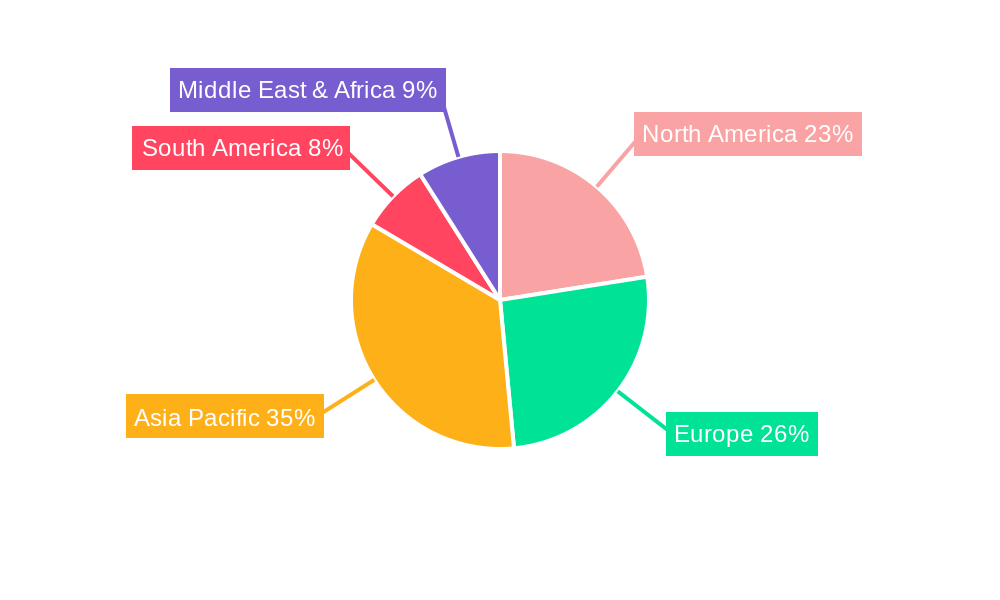

The market segmentation reveals a dynamic landscape influenced by both product type and application. Low borosilicate glass is expected to dominate due to its superior chemical resistance and thermal shock properties, making it ideal for a wide range of pharmaceutical applications. In terms of application, the <50ml and 50-100ml pharmaceutical segments are anticipated to exhibit the strongest growth, reflecting the increasing development of smaller dosage forms and single-use formulations. While the market enjoys strong growth drivers, potential restraints such as the fluctuating raw material costs and the emergence of alternative packaging materials like advanced polymers could pose challenges. Geographically, the Asia Pacific region, led by China and India, is expected to emerge as a dominant force, owing to its rapidly expanding pharmaceutical manufacturing base and a growing healthcare expenditure. North America and Europe will continue to be significant markets, driven by established pharmaceutical industries and stringent quality regulations. Key players like SGD Pharma, Nipro PharmaPackaging, and Gerresheimer AG are actively investing in innovation and capacity expansion to cater to this evolving market.

This report offers a comprehensive analysis of the global pharmaceutical oral liquid glass bottles market, providing in-depth insights into its current landscape, historical performance, and future trajectory. The study encompasses a detailed examination of key market drivers, prevailing challenges, regional dynamics, and technological advancements shaping the industry. With a robust methodology, the report delivers actionable intelligence for stakeholders, enabling informed strategic decision-making.

The pharmaceutical oral liquid glass bottles market is experiencing a dynamic evolution, driven by a confluence of factors that are reshaping its trajectory. XXX, representing the estimated market size of 250 million units in 2025, underscores the significant demand for these essential packaging solutions. The market's historical performance, from 2019-2024, has been characterized by steady growth, a trend anticipated to continue into the forecast period of 2025-2033. A pivotal insight is the increasing preference for glass bottles over plastic alternatives, largely attributed to glass's superior inertness, impermeability, and recyclability. This preference is further bolstered by the growing awareness of environmental sustainability and the demand for pharmaceutical packaging that minimizes the risk of chemical leaching into sensitive oral liquid formulations. The adoption of advanced manufacturing techniques and the development of specialized glass types are also contributing to market expansion. For instance, the demand for low borosilicate glass is on the rise due to its enhanced chemical resistance and thermal stability, crucial for preserving the integrity and efficacy of various pharmaceutical preparations. Furthermore, the continuous innovation in bottle design and closure systems is enhancing user convenience and product safety, thereby driving market penetration. The increasing prevalence of chronic diseases globally necessitates a robust supply of effective oral medications, directly translating into a sustained demand for high-quality pharmaceutical packaging solutions like glass bottles. The market is also witnessing a growing trend towards customized packaging solutions tailored to specific drug formulations and patient needs, further stimulating market diversification and growth. The estimated growth rate, projected to be around 5.5% annually during the forecast period, indicates a healthy and expanding market. The increasing focus on child-resistant packaging and tamper-evident features also adds to the value proposition of glass bottles. The market's capacity to adapt to evolving regulatory landscapes and maintain stringent quality standards remains a critical factor for sustained success.

Several key forces are synergistically propelling the growth of the pharmaceutical oral liquid glass bottles market. Foremost among these is the escalating global demand for pharmaceuticals, particularly oral liquid formulations, driven by an aging population, the rising incidence of chronic diseases, and increasing healthcare expenditure across emerging economies. As global populations expand and life expectancies increase, the need for effective and safe drug delivery systems intensifies. Oral liquids, often favored for their ease of administration, particularly for pediatric and geriatric populations, require packaging that ensures their stability, purity, and efficacy. Glass bottles, with their inherent inertness and impermeability, are the preferred choice for a wide array of pharmaceutical compounds, preventing degradation and contamination. Moreover, growing regulatory stringency worldwide, emphasizing product safety and the reduction of environmental impact, further favors glass packaging. Governments and health organizations are increasingly mandating stricter standards for pharmaceutical packaging, and glass consistently meets these requirements due to its non-reactive nature and recyclability. The increasing awareness among consumers about the potential health risks associated with plastic packaging, such as leaching of microplastics and endocrine disruptors, is also a significant driver. This heightened consumer consciousness is pushing pharmaceutical manufacturers to opt for safer and more sustainable alternatives. The ongoing technological advancements in glass manufacturing, leading to improved durability, lighter weight, and enhanced aesthetics of glass bottles, are also contributing to their appeal. The pharmaceutical industry's commitment to sustainability and corporate social responsibility is another crucial factor, as glass bottles are infinitely recyclable, aligning with global efforts to reduce waste and promote a circular economy.

Despite the robust growth trajectory, the pharmaceutical oral liquid glass bottles market is not without its challenges and restraints. A primary concern remains the fragility of glass, making it susceptible to breakage during transportation, handling, and storage. This inherent characteristic necessitates careful packaging, logistics, and handling protocols, which can add to the overall cost of the supply chain. The higher cost of glass compared to plastic alternatives can also be a restraint, particularly for manufacturers operating in cost-sensitive markets or producing high-volume, low-margin medications. While glass offers superior properties, the initial investment in glass bottles and the associated packaging and logistics can be a deterrent for some pharmaceutical companies. Weight considerations also play a role, as glass bottles are significantly heavier than their plastic counterparts, leading to increased transportation costs and a larger carbon footprint during shipping. This is particularly relevant in an era where environmental sustainability is a major focus. Furthermore, the complexity of certain manufacturing processes for specialized glass bottles, such as those requiring intricate designs or specific surface treatments, can lead to longer lead times and higher production costs. The risk of contamination during the manufacturing and filling processes, while a concern for all packaging types, requires stringent quality control measures and sterile environments for glass bottle production and utilization. Finally, while recycling rates for glass are generally high, variations in recycling infrastructure and efficiency across different regions can impact the overall environmental benefit and cost-effectiveness of using glass packaging in the long term.

The global pharmaceutical oral liquid glass bottles market exhibits significant regional variations and segment dominance. When considering the Application segment, the 100-200ml Pharmaceuticals category is poised to be a key growth driver and a substantial contributor to market volume, projected to account for an estimated 80 million units in 2025. This segment's dominance is rooted in the prevalent dosage forms for a wide range of essential medications, including antibiotics, cough and cold syrups, vitamins, and analgesics, which frequently fall within this volume range. These formulations are consumed by broad demographic groups, from children to adults, driving consistent demand. Furthermore, the packaging requirements for this volume often necessitate robust yet manageable bottle designs, for which glass offers an optimal balance of protection and usability. The Type segment of Low Borosilicate Glass is also expected to witness significant traction, driven by its superior chemical resistance and thermal stability compared to soda-lime glass. This makes it ideal for housing more sensitive or potent oral liquid formulations where maintaining product integrity is paramount. The increasing development of advanced pharmaceutical compounds with specific stability requirements will further fuel the demand for low borosilicate glass bottles.

In terms of regional dominance, North America and Europe are expected to continue their leadership in terms of market value, owing to the presence of a well-established pharmaceutical industry, high healthcare spending, stringent quality regulations, and a strong consumer preference for premium and safe packaging solutions. The robust research and development activities in these regions leading to the introduction of novel oral liquid medications contribute to sustained demand for high-quality glass bottles.

However, the Asia-Pacific region is projected to exhibit the highest growth rate in the forecast period. This surge is attributed to several factors:

Specific countries within Asia-Pacific, such as China, are particularly noteworthy. China, being a manufacturing powerhouse and a large consumer market, is a significant player in both the production and consumption of pharmaceutical oral liquid glass bottles. Its extensive network of pharmaceutical companies, coupled with a growing middle class, fuels a substantial demand for these packaging solutions.

The dominance of the 100-200ml Pharmaceuticals segment, coupled with the rising importance of Low Borosilicate Glass, within key regions like North America and Europe, and the accelerated growth in the Asia-Pacific, particularly China, paints a clear picture of the market's dynamics. The interplay of these segments and regions will define the competitive landscape and strategic opportunities for market players in the coming years.

The pharmaceutical oral liquid glass bottles industry is experiencing significant growth catalysts that are shaping its future. The escalating global demand for pharmaceuticals, fueled by an aging population and the rise of chronic diseases, directly translates into a sustained need for reliable drug packaging. Furthermore, increasing consumer awareness regarding the safety and inertness of glass compared to plastics is a powerful driver, pushing manufacturers towards glass for sensitive oral formulations. Stringent regulatory requirements that prioritize product integrity and patient safety also favor glass bottles, as they offer superior barrier properties and are less prone to chemical leaching.

This comprehensive report delves deep into the pharmaceutical oral liquid glass bottles market, providing an exhaustive analysis of its present and future. It examines market trends, from the growing preference for glass due to its inertness and recyclability to the specific demands of different drug volumes. The report meticulously outlines the driving forces, including escalating global pharmaceutical demand and increasing consumer awareness about packaging safety. It also addresses the challenges, such as the fragility and cost of glass, and offers insights into how these are being mitigated through technological advancements and operational efficiencies. The report highlights key regional and segment-specific market dynamics, identifying dominant application categories like 100-200ml pharmaceuticals and favored material types such as low borosilicate glass. Furthermore, it details the growth catalysts and provides an in-depth profile of leading industry players, alongside a timeline of significant market developments. This holistic approach ensures that stakeholders are equipped with the knowledge to navigate and capitalize on opportunities within this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SGD Pharma, Nipro PharmaPackaging, Gerresheimer AG, Shandong Pharmaceutical Glass, Linuo Group, Cangzhou Four Stars Glass, Zhengchuan Pharmaceutical Packaging, Trumph Junheng, Kibing Group, Taiwan Glass, Jiangsu Chaohua Glass Products, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pharmaceutical Oral Liquid Glass Bottles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmaceutical Oral Liquid Glass Bottles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.