1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical HDPE Bottle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pharmaceutical HDPE Bottle

Pharmaceutical HDPE BottlePharmaceutical HDPE Bottle by Type (0-50 ml, 50-100 ml, 100-150 ml, Others), by Application (Liquid Medicine, Solid Medicine), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

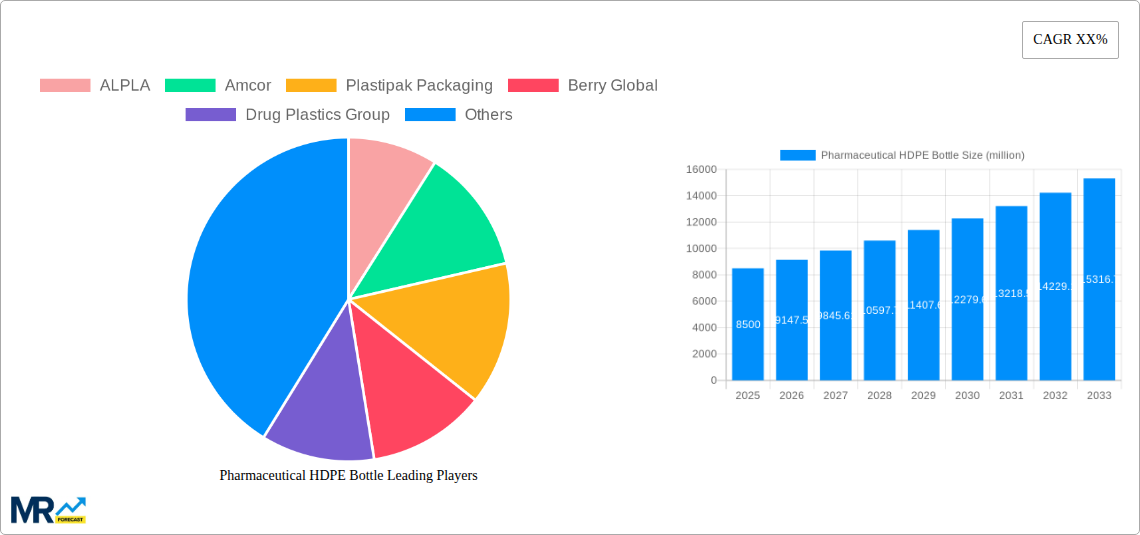

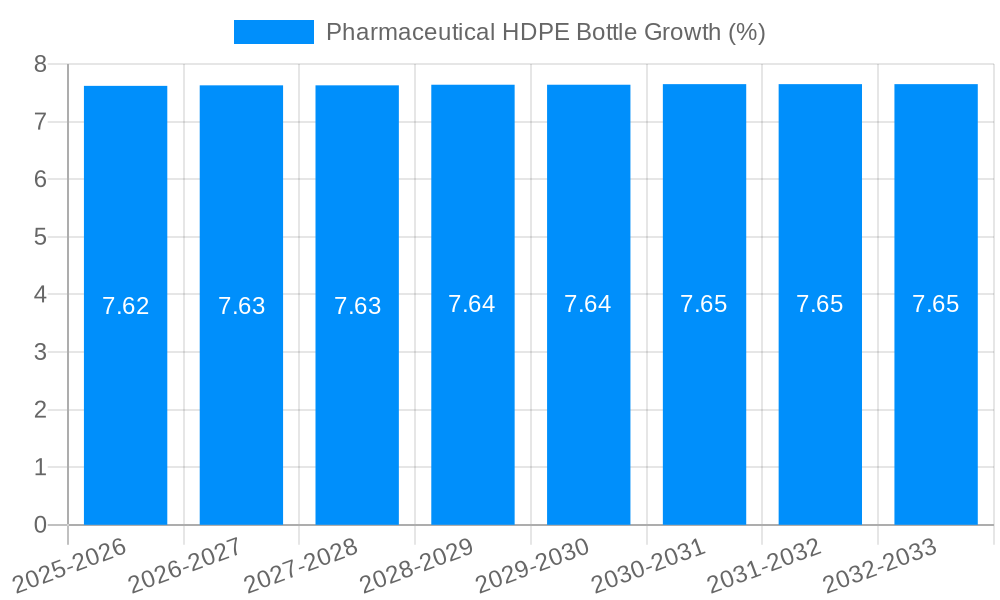

The global Pharmaceutical HDPE Bottle market is poised for robust growth, projected to reach an estimated market size of $8,500 million in 2025. Driven by the escalating demand for safe, reliable, and cost-effective packaging solutions in the pharmaceutical industry, the market is expected to witness a Compound Annual Growth Rate (CAGR) of 7.5% over the forecast period of 2025-2033. This substantial expansion is fueled by increasing healthcare expenditure worldwide, a growing geriatric population requiring more medication, and the continuous innovation in drug delivery systems. High-density polyethylene (HDPE) bottles have emerged as a preferred choice due to their excellent chemical resistance, durability, lightweight properties, and recyclability, aligning with the growing emphasis on sustainable packaging. The market is further propelled by the expanding pharmaceutical manufacturing base in emerging economies and the increasing adoption of advanced packaging technologies.

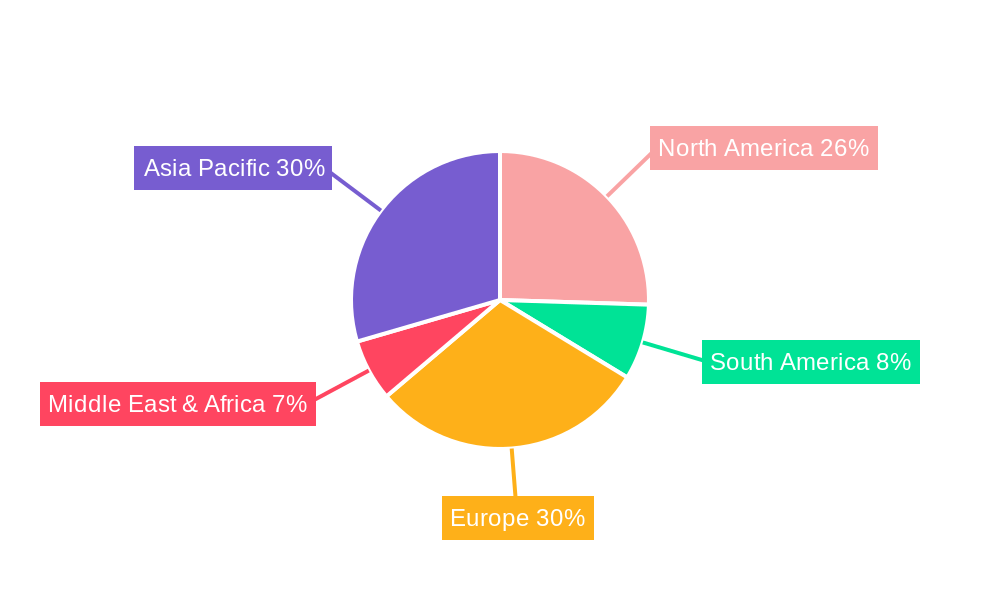

The market segmentation by type reveals a strong preference for bottles in the 50-100 ml and 100-150 ml capacities, catering to the packaging needs of various liquid and solid pharmaceutical formulations. The application segment is dominated by liquid medicine packaging, followed closely by solid medicine. Key market drivers include stringent regulatory requirements for pharmaceutical packaging, leading to the adoption of high-quality HDPE solutions, and the rising prevalence of chronic diseases, which necessitates consistent and secure medication delivery. However, challenges such as fluctuating raw material prices and intense competition among manufacturers could pose restraints. Geographically, Asia Pacific, particularly China and India, is anticipated to be the fastest-growing region, owing to its large population, expanding pharmaceutical sector, and favorable manufacturing landscape. North America and Europe are expected to maintain significant market shares due to their well-established pharmaceutical industries and high adoption rates of advanced packaging.

Here's a report description for Pharmaceutical HDPE Bottles, incorporating your specified values and structure:

The global Pharmaceutical HDPE (High-Density Polyethylene) Bottle market is poised for significant expansion, projected to reach an impressive XX million units by 2033. This robust growth trajectory is underpinned by a confluence of factors, including the ever-increasing demand for safe and reliable drug packaging solutions, coupled with advancements in material science and manufacturing technologies. The historical period (2019-2024) has witnessed steady growth, driven by the expanding pharmaceutical industry and a growing awareness of the benefits offered by HDPE bottles. These benefits include their excellent chemical resistance, durability, lightweight nature, and cost-effectiveness, making them a preferred choice for a wide array of pharmaceutical formulations. The base year (2025) serves as a crucial benchmark, with the market anticipated to further accelerate its upward trend throughout the forecast period (2025-2033). This acceleration will be fueled by emerging markets, a rising global population, and an increasing prevalence of chronic diseases that necessitate a consistent supply of medication. Innovations in bottle design, such as enhanced tamper-evident features, child-resistant closures, and specialized barrier properties to protect sensitive drugs from light and moisture, will also play a pivotal role. The market's evolution will be characterized by a sustained focus on sustainability, with manufacturers increasingly exploring recycled HDPE and bio-based alternatives to meet stringent environmental regulations and consumer preferences. The sheer volume of pharmaceutical products being manufactured globally ensures a consistent and growing demand for high-quality, compliant packaging like HDPE bottles. The versatility of HDPE allows for the packaging of both liquid and solid medications, catering to a broad spectrum of pharmaceutical needs.

The pharmaceutical HDPE bottle market is experiencing a sustained surge, propelled by an indispensable need for secure and effective drug containment. The ever-expanding global pharmaceutical sector, characterized by a continuous pipeline of new drug development and a growing emphasis on accessible healthcare, forms the bedrock of this demand. As the world population continues to grow and the prevalence of chronic diseases escalates, the need for safe and reliable medication delivery systems intensifies. HDPE bottles, with their inherent chemical inertness, provide an excellent barrier against degradation, ensuring the integrity and efficacy of a wide range of pharmaceutical products, from vital antibiotics to essential painkillers. Furthermore, their lightweight and shatterproof nature translates to reduced transportation costs and enhanced safety during handling and distribution, contributing significantly to their widespread adoption. The cost-effectiveness of HDPE, when compared to glass or other advanced packaging materials, makes it an attractive option for manufacturers looking to optimize production expenses without compromising on quality or regulatory compliance. This economic advantage is particularly crucial in price-sensitive markets and for large-scale production runs. The inherent durability of HDPE also minimizes product loss due to breakage, further solidifying its position as a preferred packaging solution in the pharmaceutical industry.

Despite the robust growth of the pharmaceutical HDPE bottle market, certain challenges and restraints warrant careful consideration. The increasing stringency of regulatory frameworks across different regions poses a significant hurdle. Pharmaceutical packaging must adhere to strict guidelines concerning material composition, leachables, extractables, and overall product safety. Meeting these evolving regulations requires continuous investment in research and development, quality control, and compliance testing, which can add to manufacturing costs. Furthermore, the growing global emphasis on sustainability and the drive towards a circular economy present both opportunities and challenges. While recycled HDPE is gaining traction, ensuring its consistent quality and purity for pharmaceutical applications can be complex. The perception among some consumers and manufacturers regarding the environmental impact of plastic packaging, even recyclable variants, can also influence material choices. Competition from alternative packaging materials, such as advanced polymers, glass, and specialized blister packs, remains a constant factor. These alternatives may offer specific advantages in terms of barrier properties or aesthetic appeal for certain drug formulations, necessitating continuous innovation and value proposition reinforcement from HDPE bottle manufacturers. Supply chain disruptions, raw material price volatility, and geopolitical uncertainties can also impact production costs and availability, presenting short-term restraints on market growth.

The 100-150 ml segment within the Pharmaceutical HDPE Bottle market is poised for dominant growth, driven by its widespread application in packaging a vast array of commonly prescribed liquid medications and solid dose forms. This volume range perfectly accommodates many standard dosages of syrups, suspensions, solutions, and even smaller solid dosage products, making it a cornerstone for everyday pharmaceutical needs. The versatility of the 100-150 ml bottles translates into broad demand across all therapeutic areas.

Key Region Dominance:

North America: The United States and Canada, with their highly developed pharmaceutical industries, advanced healthcare infrastructure, and significant per capita drug consumption, are expected to remain dominant markets. The region's stringent regulatory environment, which often sets global benchmarks, also drives demand for high-quality, compliant HDPE packaging.

Europe: Similar to North America, Europe boasts a mature pharmaceutical market with a high demand for quality packaging. Stringent EU regulations regarding pharmaceutical packaging materials and sustainability initiatives are driving innovation and the adoption of advanced HDPE solutions.

Key Segment Dominance (by Type):

The dominance of the 100-150 ml segment is a testament to its balanced utility for both liquid and solid pharmaceutical products, aligning with the everyday needs of patients and the production volumes of manufacturers. Combined with the established pharmaceutical ecosystems in North America and Europe, these factors create a powerful synergy driving significant market share.

Several key catalysts are fueling the expansion of the pharmaceutical HDPE bottle industry. The relentless growth of the global pharmaceutical sector, driven by an aging population, increasing prevalence of chronic diseases, and rising healthcare expenditure, forms the fundamental demand driver. Furthermore, ongoing innovation in drug delivery systems and the development of new pharmaceutical formulations often require specialized packaging, where HDPE's adaptability shines. The increasing focus on child-resistant closures and tamper-evident features in pharmaceutical packaging, mandated by regulations and consumer safety concerns, directly benefits HDPE bottles, which can be readily engineered to incorporate these features. The cost-effectiveness and durability of HDPE also make it a preferred choice for generic drug manufacturers and emerging markets, where price sensitivity is a key consideration.

This report offers an exhaustive analysis of the Pharmaceutical HDPE Bottle market, providing deep insights into its current landscape and future trajectory. It meticulously examines the market dynamics, including the driving forces behind its expansion and the challenges that manufacturers must navigate. The report details the market segmentation by type (0-50 ml, 50-100 ml, 100-150 ml, Others) and application (Liquid Medicine, Solid Medicine), highlighting the dominant segments and their growth potential. Comprehensive regional analysis identifies key markets with significant demand and opportunities. Furthermore, the report delves into industry developments, offering a forward-looking perspective on technological advancements, regulatory shifts, and sustainability trends that will shape the market in the coming years. This detailed coverage ensures stakeholders have a clear understanding of the market's intricacies and strategic imperatives for success.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ALPLA, Amcor, Plastipak Packaging, Berry Global, Drug Plastics Group, Hindustan Products, Alpha Packaging, Samir Brothers, Shanghai Haishun New Pharmaceutical Packaging, Rutvik Pharma, Gilpack, Zhejiang HUAHAI Pharmaceutical Packaging Products, Gerresheimer, Pack Plast Industries, Yantai Zhenhua Pharmaceutical Packaging, Jilin Dongyang Pharmaceutical Packaging, Neutroplast, Cangzhou Yikang Food and Drug Packaging, KW Plastics, Uma Krupa Plast, Inden Pharma, Multiplast Polymer, Maharashtra Metal Works, Dongguan Fukang Plastic Products, Peacock Industries, Xinfuda Group, Akhil Plast, Jiangsu Yongxing Pharmaceutical Packaging, Polycon Industries, Zhangjiagang Zhonghui Medical Plastic Technology, Special Biochem, Shanghai Haichang Medical Plastic, Reniplas Sdn. Bhd., He Shan Kun Yang Plastic, Techno Packaging Industries, Maheshwari Caps, Chengdu Weifu Shiye, San Plast, Rotex Polymers, Corning, Smart Packaging, Pharmapac, Pie Industries, RTCO-Packaging.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pharmaceutical HDPE Bottle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmaceutical HDPE Bottle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.