1. What is the projected Compound Annual Growth Rate (CAGR) of the Petroleum Moisture Analyzer?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Petroleum Moisture Analyzer

Petroleum Moisture AnalyzerPetroleum Moisture Analyzer by Application (Petroleum, Lubricating Oil, Liquid Fuel), by Type (Desktop Petroleum Moisture Analyzer, Portable Petroleum Moisture Analyzer), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

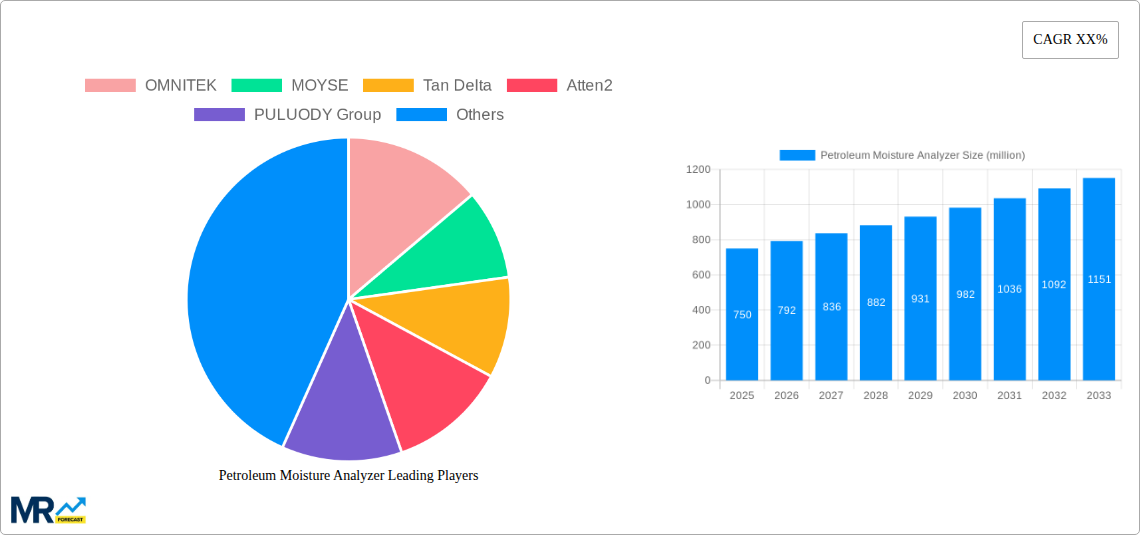

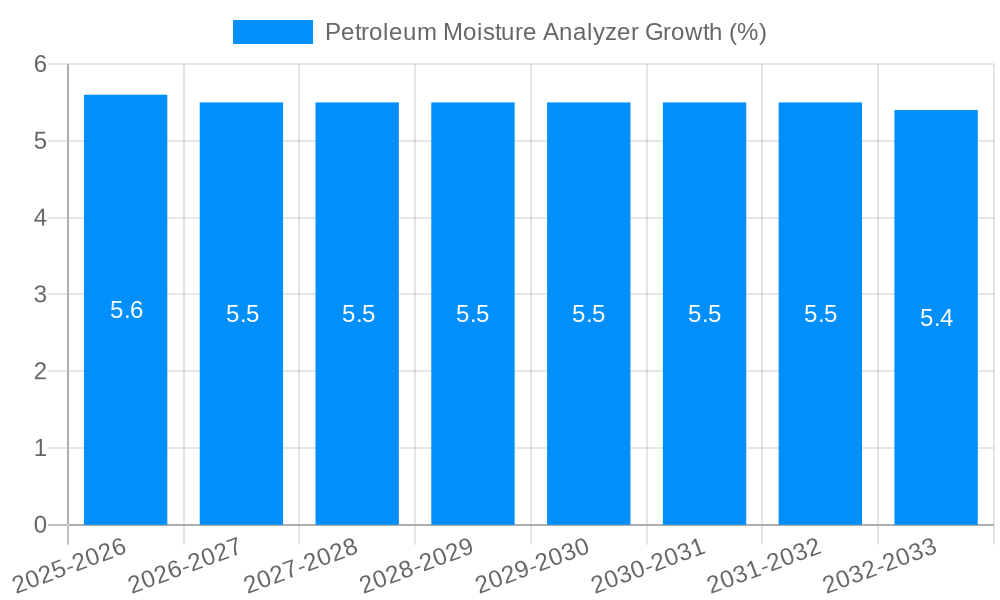

The global Petroleum Moisture Analyzer market is experiencing robust expansion, projected to reach an estimated market size of approximately $750 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 5.5% anticipated over the forecast period of 2025-2033. This growth is primarily fueled by the increasing demand for accurate moisture detection in various petroleum applications, including lubricants and liquid fuels, to ensure product quality, operational efficiency, and prevent equipment damage. Stringent regulations regarding fuel purity and environmental standards are also acting as significant drivers, compelling industries to invest in advanced moisture analysis technologies. The lubricant sector, in particular, is witnessing heightened adoption of these analyzers to maintain the performance and longevity of machinery in critical industries like automotive, aerospace, and manufacturing.

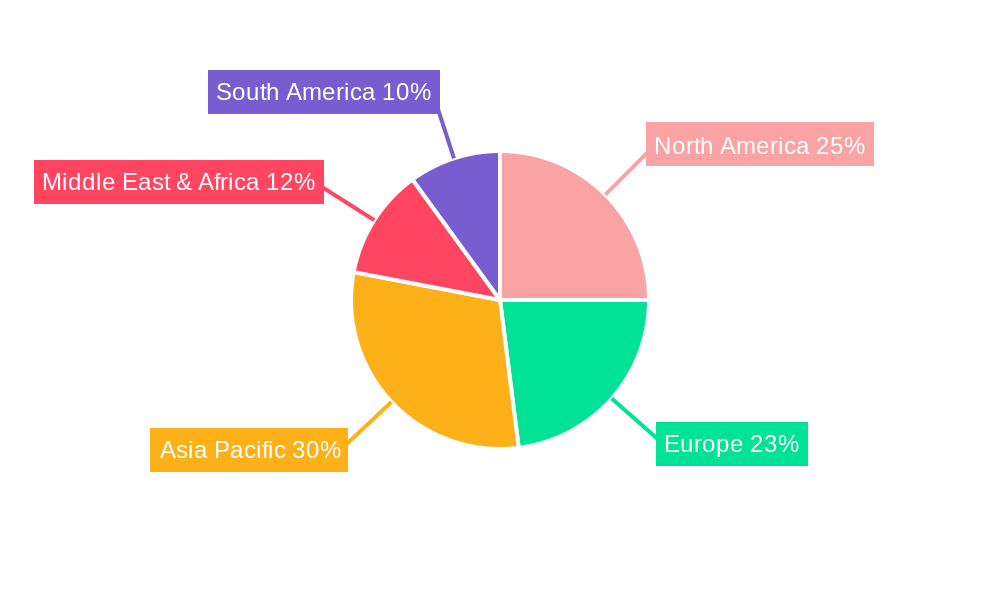

The market is characterized by a dynamic landscape with both desktop and portable petroleum moisture analyzers catering to diverse needs. Portable analyzers are gaining traction due to their flexibility and on-site testing capabilities, essential for field operations and remote locations. Key market restraints include the high initial cost of sophisticated analytical instruments and the availability of alternative, albeit less precise, testing methods. However, ongoing technological advancements leading to improved accuracy, faster testing times, and enhanced data management are expected to mitigate these challenges. Geographically, Asia Pacific, led by China and India, is poised to be a significant growth region, driven by rapid industrialization and a burgeoning automotive sector. North America and Europe remain mature yet vital markets, driven by stringent quality control mandates and a strong emphasis on equipment maintenance and operational safety. Key players like OMNITEK, MOYSE, and Tan Delta are actively involved in product innovation and strategic partnerships to capture market share.

This report offers a comprehensive analysis of the global Petroleum Moisture Analyzer market, providing in-depth insights and future projections. Spanning a Study Period: 2019-2033, with a Base Year: 2025 and Estimated Year: 2025, the report meticulously examines the Historical Period: 2019-2024 and projects trends through the Forecast Period: 2025-2033. Our research delves into critical market dynamics, including technological advancements, emerging applications, and the competitive landscape, all quantified with values often expressed in the millions.

The global Petroleum Moisture Analyzer market is on an upward trajectory, fueled by an increasing demand for precise and reliable moisture detection across various petroleum-related industries. Over the Study Period: 2019-2033, this market is expected to witness significant growth, with the Base Year: 2025 serving as a pivotal point for current estimations. The emphasis on maintaining product quality and operational efficiency within the petroleum sector, encompassing refined products, lubricants, and fuels, is a primary driver. As the industry grapples with stricter environmental regulations and the need for optimized resource utilization, the accurate measurement of moisture content becomes paramount. For instance, elevated moisture levels in petroleum products can lead to corrosion, reduced efficiency in refining processes, and compromised performance of lubricants and fuels, potentially resulting in multi-million dollar losses due to equipment damage or product rejection. The development and adoption of advanced analytical techniques, moving beyond traditional Karl Fischer titration methods, are shaping the market. These innovations include spectroscopic and sensor-based technologies that offer faster, more accurate, and in-line moisture analysis capabilities.

Furthermore, the market is segmented by type, with both Desktop Petroleum Moisture Analyzers and Portable Petroleum Moisture Analyzers playing crucial roles. Desktop units are integral to laboratory settings and quality control departments, offering high precision for batch testing. Portable analyzers, on the other hand, are gaining traction due to their ability to provide real-time data in field operations, such as at remote extraction sites or during transportation. This portability is essential for immediate decision-making, preventing potential issues that could cost millions in remediation. The Estimated Year: 2025 is anticipated to see a consolidated market value in the hundreds of millions, reflecting the robust demand. During the Forecast Period: 2025-2033, continued innovation in sensor technology, miniaturization of devices, and integration with digital platforms for data management and analysis will likely further accelerate market expansion. The increasing complexity of crude oil processing and the growing use of synthetic lubricants also contribute to the demand for sophisticated moisture analysis solutions. Considering the Historical Period: 2019-2024, we observed a steady adoption of these analyzers, laying the groundwork for the projected substantial growth in the coming years, where market values are expected to reach into the billions in the longer term.

The petroleum moisture analyzer market is experiencing a significant uplift driven by a confluence of powerful factors that underscore the critical need for precise moisture detection. Foremost among these is the escalating global demand for refined petroleum products, lubricants, and liquid fuels. As economies grow and energy consumption rises, the sheer volume of these commodities necessitates stringent quality control measures to ensure optimal performance and prevent downstream issues. Moisture contamination, even at trace levels, can lead to detrimental effects such as accelerated corrosion in storage tanks and pipelines, degradation of lubricant properties impacting machinery lifespan, and reduced combustion efficiency in fuels. These consequences can translate into substantial economic losses, easily running into the millions of dollars annually, due to equipment failure, product recalls, and increased maintenance costs. Consequently, the adoption of advanced petroleum moisture analyzers, capable of providing rapid and accurate measurements, is becoming indispensable for proactive risk mitigation.

Another potent driver is the relentless pursuit of operational efficiency and cost reduction within the petroleum industry. By accurately monitoring moisture levels, companies can optimize refining processes, prevent premature equipment wear, and ensure that products meet stringent specifications, thereby avoiding costly rejections. The growing emphasis on sustainability and environmental compliance also plays a crucial role. Moisture in fuels can contribute to incomplete combustion and increased emissions, and in lubricants, it can lead to premature disposal. Therefore, accurate moisture analysis helps in enhancing product longevity and reducing environmental impact, aligning with global sustainability goals and potentially avoiding millions in environmental penalty fines. The market is further propelled by continuous technological advancements in analyzer design, leading to more sensitive, reliable, and user-friendly devices. Innovations in sensor technology, data processing, and connectivity are making these instruments more accessible and integrated into broader industrial automation systems, further solidifying their importance and driving market growth into the hundreds of millions.

Despite the robust growth prospects, the Petroleum Moisture Analyzer market is not without its inherent challenges and restraints that can temper its expansion. One significant hurdle is the initial capital investment required for sophisticated analytical equipment. While the long-term benefits in terms of cost savings and quality assurance are substantial, the upfront expenditure can be a deterrent, particularly for smaller enterprises or those in regions with less developed economies. The cost of high-end analyzers, capable of detecting extremely low moisture levels with high accuracy, can easily run into tens of thousands of dollars, making a fleet of such devices represent a significant outlay in the millions. Furthermore, the ongoing operational costs associated with calibration, maintenance, and consumables (such as reagents for Karl Fischer titration methods) can add to the overall burden, impacting the total cost of ownership for users.

Another restraining factor is the technical expertise required for the proper operation and interpretation of results from advanced petroleum moisture analyzers. While manufacturers strive to create user-friendly interfaces, some analytical techniques demand a skilled workforce capable of understanding complex principles, performing precise sample preparation, and analyzing the data generated. A shortage of adequately trained personnel in certain regions can limit the widespread adoption of these instruments. Moreover, the diverse nature of petroleum products and their potential contaminants can present analytical challenges. Different matrices and the presence of other interfering substances might require specialized methods or adjustments to standard procedures, potentially increasing the complexity and cost of analysis. Standardization efforts across different regions and product types are still evolving, and the lack of universally accepted protocols for certain analyses can create inconsistencies and hinder market penetration. Finally, the cyclical nature of the oil and gas industry, with its inherent price volatility and investment fluctuations, can indirectly impact the demand for capital equipment like moisture analyzers, potentially leading to periods of slowed growth or decreased sales, impacting market values that are in the millions.

The global Petroleum Moisture Analyzer market is poised for dominance by specific regions and product segments, driven by unique industrial characteristics and technological adoption rates. In terms of geographical dominance, North America, particularly the United States, is expected to lead the market. This is attributed to its mature and highly sophisticated petroleum industry, encompassing extensive upstream exploration and production activities, refining operations, and a vast network of fuel distribution. The presence of major oil and gas companies, coupled with a strong emphasis on research and development, fosters the adoption of cutting-edge analytical technologies. Stringent regulatory frameworks concerning fuel quality and environmental protection further necessitate the use of highly accurate moisture analyzers, driving consistent demand that contributes significantly to market values often reaching hundreds of millions within this region alone. Furthermore, the substantial investments in upgrading aging infrastructure in refineries and storage facilities across North America will continue to fuel the demand for advanced diagnostic tools, including moisture analyzers.

In terms of product segments, the Application: Petroleum is projected to be the largest and most dominant segment within the market. This broad category encompasses crude oil, refined fuels like gasoline and diesel, and various intermediate petroleum products. The sheer volume of petroleum processed and transported globally, coupled with the critical need to monitor moisture content at every stage to prevent corrosion, maintain product integrity, and ensure efficient refining operations, underpins its dominance. Moisture contamination in crude oil, for instance, can significantly impact the refining process, leading to increased energy consumption and reduced yield, with potential financial repercussions easily reaching millions of dollars per incident. The Type: Desktop Petroleum Moisture Analyzer segment is expected to maintain a significant market share, particularly in quality control laboratories within refineries and research institutions, where high precision and repeatability are paramount. However, the Type: Portable Petroleum Moisture Analyzer segment is witnessing rapid growth and is projected to gain substantial market traction. The increasing decentralization of operations, the need for real-time on-site testing in remote exploration sites, and during transportation of petroleum products are driving this growth. For example, portable analyzers allow for immediate assessment of moisture levels in tankers or pipelines, preventing costly delays or product downgrades in the field, which could otherwise amount to millions in lost revenue.

The Application: Lubricating Oil segment also represents a significant and growing market. Lubricants are critical components in a wide array of industrial machinery and automotive applications. Moisture ingress into lubricants can lead to hydrolysis, emulsification, and a significant reduction in their lubricating properties, resulting in increased wear and tear on machinery. The economic impact of lubricant failure can be substantial, with equipment damage costs easily running into the millions. Therefore, manufacturers and users of lubricating oils are increasingly relying on petroleum moisture analyzers to ensure the quality and performance of their products, particularly in demanding industrial environments. The growing automotive sector and the increasing demand for high-performance synthetic lubricants further bolster this segment. The Application: Liquid Fuel segment, encompassing fuels beyond traditional gasoline and diesel, such as jet fuel and biofuels, is also a key contributor. Each of these fuels has specific moisture content requirements to ensure optimal performance and prevent issues like fuel system corrosion. The global aviation industry's reliance on precise fuel specifications, for example, makes moisture analysis in jet fuel a critical aspect, with potential losses from contaminated fuel easily reaching millions. The continuous innovation in analyzer technology, offering faster, more accurate, and field-deployable solutions, will continue to drive the adoption across these applications and regions, solidifying their dominance in the market, with the overall market value expected to ascend into the billions over the forecast period.

Several key factors are acting as significant growth catalysts for the Petroleum Moisture Analyzer industry. The increasing stringency of quality control standards across the petroleum, lubricating oil, and liquid fuel sectors necessitates more precise and reliable moisture detection methods. Furthermore, the growing awareness of the economic impact of moisture contamination, ranging from equipment damage to product rejection, is driving greater investment in advanced analytical instrumentation. Technological advancements leading to more portable, faster, and accurate analyzers, coupled with the integration of digital data management and IoT capabilities, are also accelerating adoption. The global expansion of refining capacity and increased exploration activities in emerging markets further create new avenues for growth.

The global Petroleum Moisture Analyzer market is characterized by the presence of several key players who are at the forefront of innovation and market penetration. These companies are instrumental in driving technological advancements and meeting the diverse needs of the petroleum industry.

The Petroleum Moisture Analyzer sector has witnessed several significant developments that have shaped its evolution and market dynamics. These advancements highlight the continuous drive for improved performance, accuracy, and usability.

This report provides an all-encompassing examination of the Petroleum Moisture Analyzer market, delving deep into its intricacies from 2019 to 2033. With a Base Year: 2025 and projections extending through 2033, we offer a robust understanding of market dynamics, technological advancements, and competitive landscapes. Our analysis quantifies key market insights, often in the millions, to provide tangible economic context. We explore the driving forces, including the escalating demand for quality control and operational efficiency, and the challenges, such as initial investment costs and the need for skilled personnel. The report meticulously identifies dominant regions and segments, such as North America and the petroleum application segment, detailing why they hold significant market sway. Furthermore, we highlight the pivotal growth catalysts and significant developments that are continuously shaping the future of this vital industry. This comprehensive coverage ensures that stakeholders are equipped with the knowledge to navigate and capitalize on opportunities within the Petroleum Moisture Analyzer market, reaching values into the hundreds of millions annually.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include OMNITEK, MOYSE, Tan Delta, Atten2, PULUODY Group, AZI, Vinci Technologies, Shanghai Shenkai Petrochemical Equipment, Shenzhen Aris Instrument, Dalian Wuzhou Petroleum Equipment, Qingyang Dairuite Oil Instrument, Jilin Ruigu Scientific Instrument, Hunan BASF Testing Technology, Guangdong Wanmu Instrument, Qingdao Xinruide Petroleum Instrument, Yangzhou Accord Instrument, Beijing Osai Zhongtai Technology, Beijing Bigdipper Technology, Friend Instrument Experimental Analysis Instrument, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Petroleum Moisture Analyzer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Petroleum Moisture Analyzer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.