1. What is the projected Compound Annual Growth Rate (CAGR) of the Personnel Screening Inspection Systems?

The projected CAGR is approximately 17.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Personnel Screening Inspection Systems

Personnel Screening Inspection SystemsPersonnel Screening Inspection Systems by Type (X-Ray Backscatter Imaging Technology, Millimeter Wave Imaging Technology, Terahertz Imaging Technology, World Personnel Screening Inspection Systems Production ), by Application (Commercial, Government, World Personnel Screening Inspection Systems Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Personnel Screening Inspection Systems market is poised for substantial growth, projected to reach a significant valuation by 2033. This expansion is driven by a confluence of factors, primarily the escalating need for enhanced security across various sectors, including commercial aviation, government facilities, and critical infrastructure. The increasing threat of terrorism and the imperative to prevent illicit material smuggling have spurred investments in advanced screening technologies. Furthermore, the evolving regulatory landscape, demanding more stringent passenger and cargo screening protocols, directly fuels market demand. Technological advancements, particularly in X-ray backscatter imaging, millimeter wave, and Terahertz technologies, are offering superior detection capabilities, leading to greater adoption and replacing older, less effective methods. This innovation pipeline is crucial for maintaining the projected robust growth trajectory.

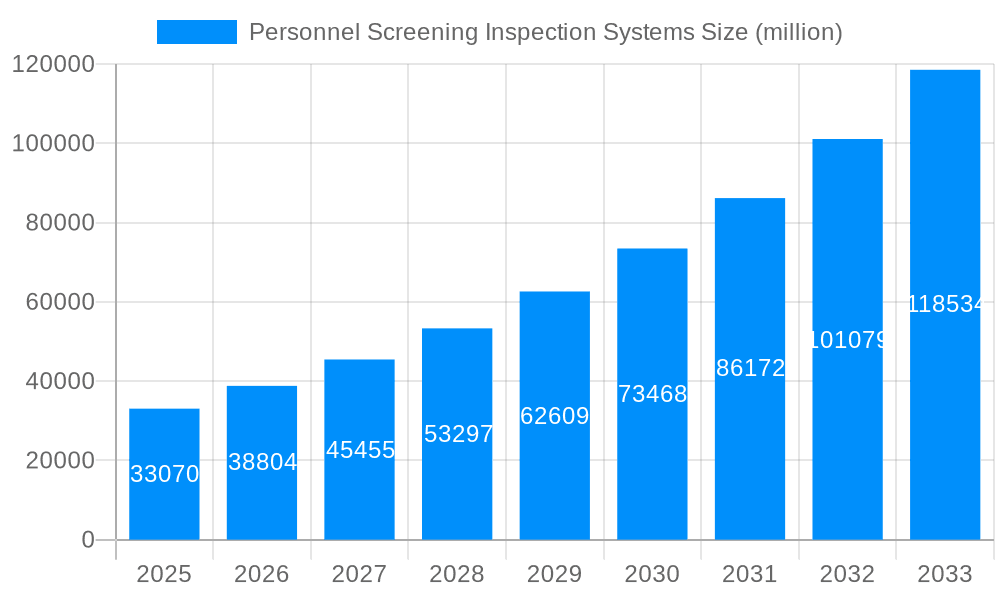

The market's impressive Compound Annual Growth Rate (CAGR) of 17.5% underscores the dynamism and increasing importance of personnel screening. Key drivers include the continuous need for sophisticated threat detection, the deployment of these systems in high-traffic areas like airports and public venues, and the rising global defense budgets which often encompass advanced security solutions. Emerging trends like the integration of Artificial Intelligence (AI) and Machine Learning (ML) for faster and more accurate threat identification, along with the development of non-intrusive and faster screening processes, are shaping the market. While the substantial initial investment in advanced systems and the need for continuous upgrades might present some challenges, the overwhelming emphasis on public safety and security is expected to outweigh these restraints, ensuring sustained demand and market expansion across all major regions.

This report offers a comprehensive analysis of the global Personnel Screening Inspection Systems market, forecasting its trajectory from 2019 to 2033, with a specific focus on the base and estimated year of 2025 and a detailed forecast period from 2025-2033, building upon historical data from 2019-2024. The market is projected to witness substantial growth, driven by escalating security concerns and advancements in imaging technologies. The estimated market size for 2025 is projected to reach $5.2 billion, with a robust expansion expected to propel it to approximately $12.8 billion by 2033. This growth is underpinned by a dynamic interplay of technological innovation, evolving regulatory landscapes, and an increasing demand for sophisticated threat detection solutions across various sectors. The report delves into the intricate details of market segmentation, regional dominance, and the strategic initiatives undertaken by key industry players.

The global Personnel Screening Inspection Systems market is currently in a phase of significant technological evolution and expanding application. A key market insight is the escalating adoption of non-ionizing radiation technologies, such as millimeter-wave and terahertz imaging, which are gradually replacing or augmenting traditional X-ray systems. This shift is primarily driven by growing concerns regarding the health implications of prolonged exposure to ionizing radiation and the demand for more sophisticated, less intrusive screening methods. The market is also witnessing a trend towards integrated systems that combine multiple imaging modalities, artificial intelligence (AI) for automated threat detection and analysis, and data fusion capabilities to enhance accuracy and reduce false positives. The increasing sophistication of threats, ranging from concealed weapons and explosives to contraband and biological agents, necessitates the development and deployment of advanced screening technologies. Furthermore, the push for faster throughput in high-traffic areas like airports, border crossings, and public venues is fostering innovation in automated and rapid screening solutions. The market is also experiencing a notable trend towards miniaturization and portability of screening devices, enabling their deployment in diverse and dynamic environments. This includes the development of handheld scanners and portable full-body scanners, which offer greater flexibility for law enforcement, emergency responders, and private security firms. The ongoing digitalization of security infrastructure, coupled with the proliferation of smart city initiatives and the need for robust border security, further contributes to the upward trend in demand for advanced personnel screening systems. The evolving geopolitical landscape and the persistent threat of terrorism continue to be significant drivers, compelling governments and organizations worldwide to invest heavily in sophisticated security measures. The market is also witnessing a growing demand for integrated security solutions that go beyond simple threat detection to include biometric identification and behavior analysis. This holistic approach to security is expected to shape the future of personnel screening. The report highlights that by 2025, the market is expected to see a substantial increase in the integration of AI algorithms for real-time threat identification and classification, significantly enhancing the efficiency and effectiveness of screening processes. This technological advancement is not only aimed at improving detection rates but also at reducing the workload on human operators.

The robust growth of the Personnel Screening Inspection Systems market is propelled by a confluence of critical factors, predominantly centered around an escalating global security imperative. The persistent and evolving nature of terrorism, coupled with the increasing threat of organized crime and the illicit trafficking of contraband, has placed a significant onus on governments and security agencies to implement more effective and comprehensive screening protocols. This necessitates continuous investment in advanced technologies that can reliably detect a wider array of threats with greater accuracy. Furthermore, the increasing globalization and the resultant surge in international travel and trade have amplified the need for sophisticated screening solutions at ports of entry, airports, and border crossings. The demand for enhanced passenger safety and security in public spaces, including transportation hubs, critical infrastructure, and large public gatherings, also acts as a powerful catalyst. The report underscores that the proactive stance taken by various governments to bolster national security frameworks, often driven by international agreements and the need to protect critical assets, is a fundamental driver. Moreover, advancements in imaging technologies, such as the development of higher resolution sensors, improved signal processing, and the integration of AI for automated threat detection, are making screening systems more efficient, accurate, and less intrusive, thereby driving their adoption. The emphasis on non-ionizing radiation technologies, driven by health concerns, is also opening new avenues for market growth. The continuous innovation within the industry, fueled by R&D investments from leading companies, is creating a pipeline of cutting-edge solutions that address emerging security challenges. The market size for 2025 is projected to be around $5.2 billion, reflecting the substantial current investment in these technologies.

Despite the promising growth trajectory, the Personnel Screening Inspection Systems market is not without its challenges and restraints. A primary hurdle is the significant cost associated with the procurement, deployment, and maintenance of advanced screening systems. High-end technologies, particularly those incorporating millimeter-wave and terahertz imaging, can represent a substantial capital investment, which can be a deterrent for smaller organizations or those in developing economies. The complexity of these systems also necessitates highly trained personnel for operation and maintenance, adding to the overall operational expenditure. Furthermore, the rapid pace of technological evolution presents a challenge in itself, as older systems can quickly become obsolete, requiring continuous upgrades and reinvestment. Privacy concerns associated with intrusive scanning technologies, especially in commercial applications and public spaces, can lead to public resistance and regulatory scrutiny, potentially slowing down adoption. The stringent regulatory environments and the lengthy approval processes for new security technologies in certain regions can also act as a restraint on market growth. The threat landscape is also continuously evolving, with adversaries developing new methods to circumvent existing screening technologies. This necessitates a constant arms race in technological development, which can be resource-intensive. Interoperability issues between different systems and the lack of standardized protocols across various security agencies can also hinder seamless integration and data sharing. The report highlights that the market size for 2025 is estimated at $5.2 billion, but these challenges could temper the expected growth to $12.8 billion by 2033 if not adequately addressed.

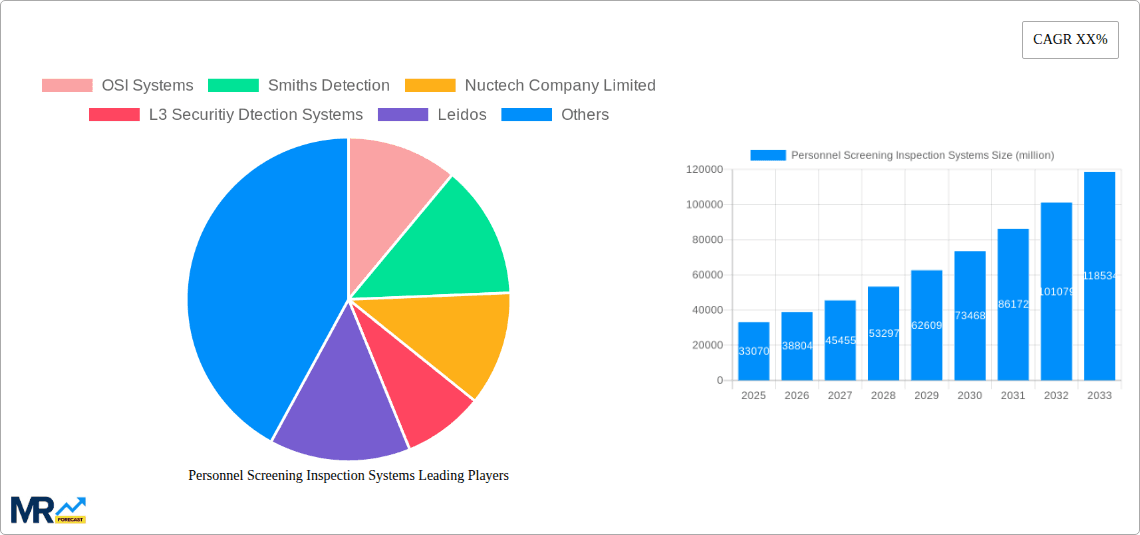

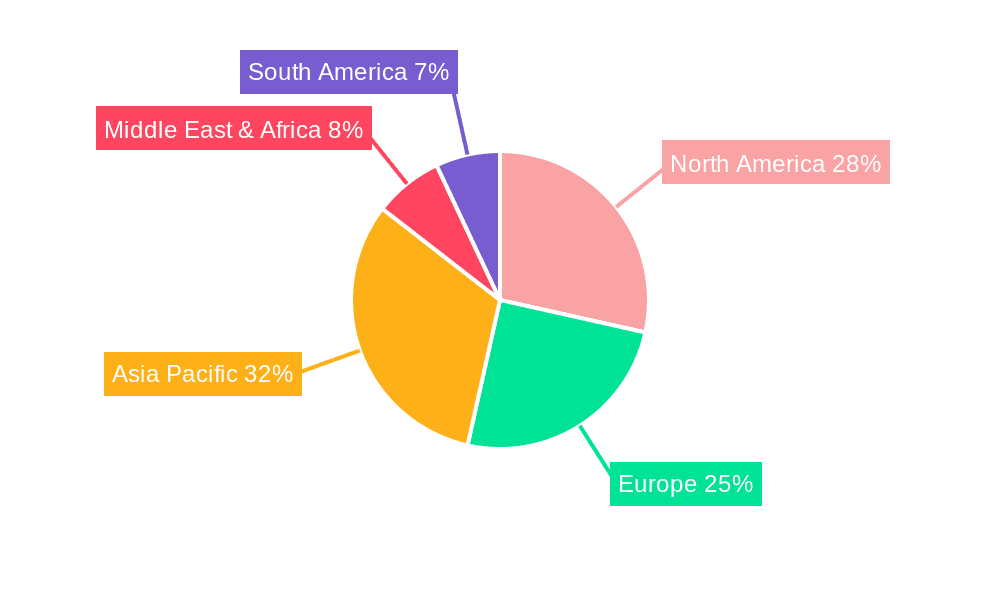

The global Personnel Screening Inspection Systems market is characterized by regional variations in adoption rates and segment dominance, driven by a combination of economic factors, security priorities, and technological readiness. Currently, North America, particularly the United States, along with Europe, represent dominant regions in terms of market value. This is attributed to significant government spending on homeland security, advanced airport security infrastructure, and a proactive approach to counter-terrorism. The presence of leading market players like Smiths Detection, L3 Security Detection Systems, and Leidos, headquartered in these regions, further bolsters their market share. Asia Pacific, however, is emerging as a high-growth region, propelled by increasing investments in security infrastructure from countries like China and India. The rapid expansion of air travel, growing concerns about internal security, and the development of smart cities are key drivers in this region.

Within the segmentation by Type, X-Ray Backscatter Imaging Technology currently holds a significant market share due to its established presence and widespread application in aviation security. Its cost-effectiveness and proven track record in detecting metallic objects and explosives make it a staple in many screening checkpoints. However, the report projects a substantial growth for Millimeter Wave Imaging Technology and Terahertz Imaging Technology segments over the forecast period (2025-2033). Millimeter wave technology offers superior detection of non-metallic threats, including plastics and liquids, and is increasingly being adopted for its non-ionizing nature and ability to screen individuals at greater distances and speeds. Terahertz imaging, while still in its nascent stages of widespread commercial adoption, promises even greater potential for detecting a wider range of concealed items, including drugs and chemical agents, with exceptional clarity and without any health risks. The market size for Millimeter Wave Imaging Technology is projected to see a compound annual growth rate (CAGR) of over 9% from 2025 to 2033, reaching an estimated $3.5 billion by 2033. Terahertz Imaging Technology, though starting from a smaller base, is expected to exhibit an even higher CAGR of approximately 12% during the same period, driven by ongoing research and development and its potential for advanced threat detection.

In terms of Application, the Government sector currently dominates the market, driven by defense budgets, border security initiatives, and law enforcement needs. This segment is expected to continue its dominance throughout the forecast period, with governments worldwide prioritizing the acquisition of advanced screening systems to safeguard national interests and public safety. The estimated market size for the Government segment in 2025 is $3.8 billion. The Commercial sector, encompassing airports, public transportation, critical infrastructure, and large event venues, is also a significant and growing segment. The increasing focus on passenger safety, retail security, and the prevention of unauthorized access is fueling the demand for sophisticated screening solutions in commercial settings. The commercial segment is projected to grow at a CAGR of approximately 7.5% from 2025 to 2033, reaching an estimated $9.0 billion by 2033. The confluence of technological advancements in imaging, increased security awareness, and substantial government and commercial investments indicates a strong and sustained growth trajectory for the Personnel Screening Inspection Systems market.

The Personnel Screening Inspection Systems industry is experiencing significant growth catalysts that are shaping its future. Escalating global security threats, including terrorism and organized crime, necessitate continuous investment in advanced detection technologies. The rapid expansion of international travel and trade further amplifies the demand for efficient and reliable screening at borders and transport hubs. Technological advancements, particularly in AI-driven analytics, millimeter-wave, and terahertz imaging, are creating more sophisticated, non-intrusive, and faster screening solutions, driving adoption. Growing awareness and regulatory emphasis on passenger safety and public venue security are also contributing factors.

This report provides an exhaustive analysis of the Personnel Screening Inspection Systems market, offering deep insights into its present landscape and future trajectory. It meticulously examines market trends, identifies key growth drivers, and dissects the challenges and restraints that impact industry expansion. The report includes detailed projections for market size and growth rates from the historical period of 2019-2024 through to a forecast period extending to 2033, with a specific focus on the base and estimated year of 2025. Furthermore, it delves into regional market dynamics, pinpointing key regions and countries poised for dominance. The segmentation analysis covers various technologies, including X-ray backscatter, millimeter wave, and terahertz imaging, as well as application segments like commercial and government. The report also highlights significant industry developments and profiles the leading companies shaping the market. The estimated market size for 2025 is $5.2 billion, with a projected reach of $12.8 billion by 2033.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 17.5%.

Key companies in the market include OSI Systems, Smiths Detection, Nuctech Company Limited, L3 Securitiy Dtection Systems, Leidos, Analogic, CEIA, Astrophysics, Autoclear, Adani Systems, Gilardoni S.p.A., Brainware Terahertz Information Technology, Asqella, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Personnel Screening Inspection Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Personnel Screening Inspection Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.