1. What is the projected Compound Annual Growth Rate (CAGR) of the Personal Travel Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Personal Travel Insurance

Personal Travel InsurancePersonal Travel Insurance by Type (/> Single Trip Coverage, Annual Multi Trip Coverage, Other), by Application (/> Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

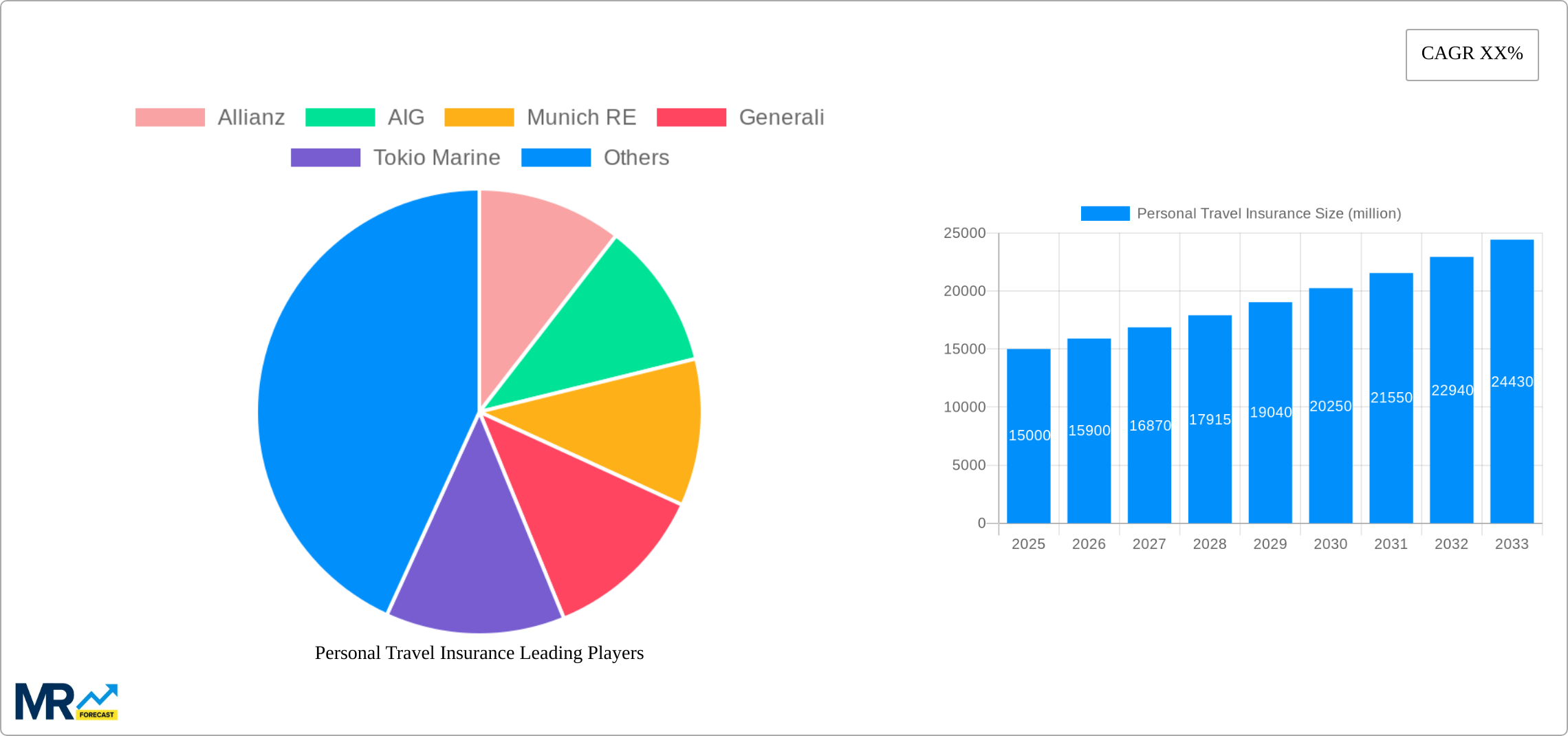

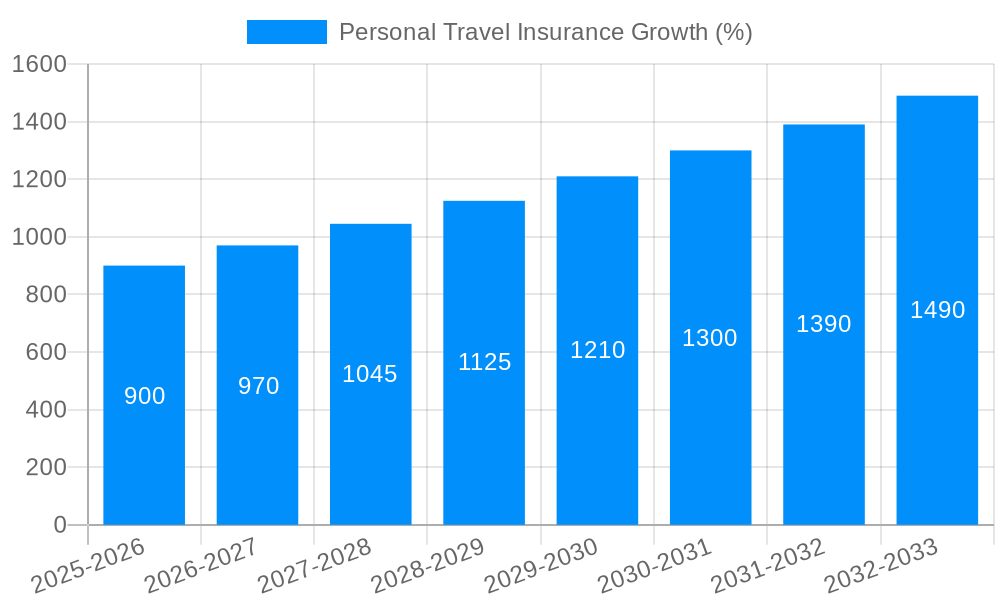

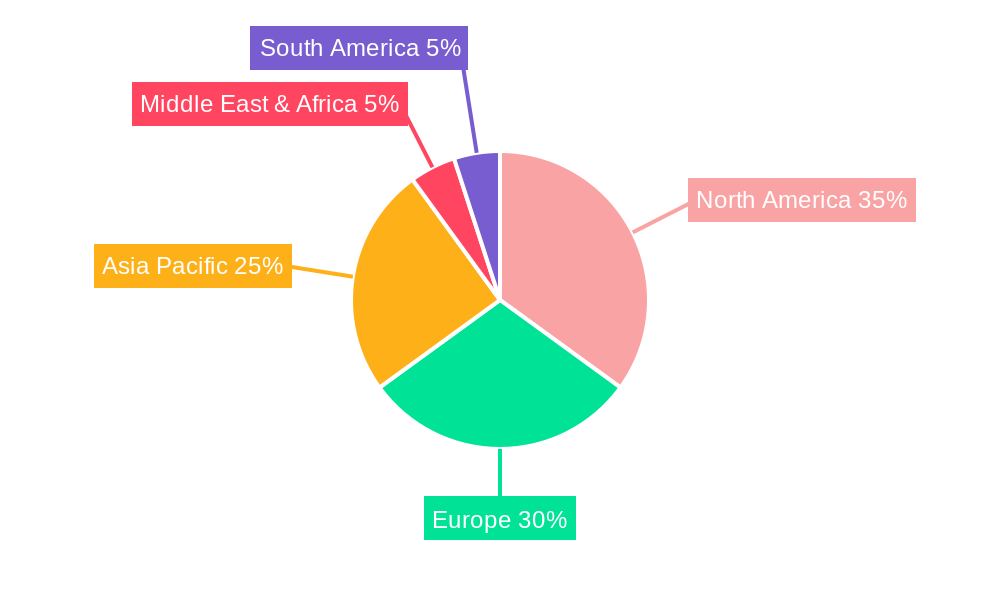

The global personal travel insurance market is experiencing robust growth, driven by increasing international travel, rising disposable incomes, and a growing awareness of unforeseen travel disruptions. The market, segmented by coverage type (single trip, annual multi-trip, other) and distribution channel (insurance intermediaries, insurance companies, banks, brokers, others), shows a clear preference for annual multi-trip policies, reflecting a shift towards more frequent travel amongst consumers. North America and Europe currently dominate the market share, benefiting from established insurance infrastructure and high travel volumes. However, the Asia-Pacific region demonstrates significant growth potential, fueled by a burgeoning middle class and increasing outbound tourism. Competition amongst major players like Allianz, AIG, and Tokio Marine is intense, with companies focusing on product innovation, digital distribution channels, and strategic partnerships to gain market share. While regulatory changes and economic fluctuations pose potential restraints, the overall market outlook remains positive, anticipating a steady compound annual growth rate (CAGR) over the forecast period (2025-2033).

The continued expansion of the personal travel insurance market is projected to be influenced by several factors. Technological advancements, particularly in digital insurance platforms and personalized risk assessment tools, are enhancing customer experience and streamlining the purchasing process. Furthermore, the rising prevalence of travel-related health emergencies and security concerns are increasing demand for comprehensive coverage. Market players are increasingly leveraging data analytics to better understand consumer preferences and tailor their offerings accordingly. The integration of travel insurance with other services, such as flight bookings and accommodation, further expands the market reach and accessibility. Sustained economic growth in emerging economies, coupled with advancements in global connectivity and affordability of air travel, will continue to bolster the market's growth trajectory in the coming years.

The global personal travel insurance market is experiencing robust growth, projected to reach tens of billions of USD by 2033. The period from 2019 to 2024 (historical period) witnessed significant expansion, driven primarily by increasing global travel and tourism. The base year of 2025 shows a market value in the tens of billions, illustrating continued market strength. The forecast period (2025-2033) anticipates continued expansion, fueled by several factors discussed later. This growth is not uniform across all segments, however. While annual multi-trip policies show consistent demand, the single-trip segment fluctuates depending on seasonal travel patterns and global events. Furthermore, the distribution channels are evolving, with online platforms and direct-to-consumer sales gaining traction, challenging traditional intermediaries. The market is also seeing a rise in demand for specialized travel insurance products catering to specific needs like adventure travel, medical emergencies, and business trips. This trend reflects a growing awareness of travel-related risks and a demand for comprehensive coverage. Geographic distribution also plays a crucial role, with developed markets exhibiting higher penetration rates compared to emerging economies, although these emerging markets are showcasing promising growth trajectories. The competitive landscape is dynamic, with established players like Allianz and AIG competing against specialized providers, leading to innovation in product offerings and pricing strategies. The impact of macroeconomic factors, such as fluctuating exchange rates and global economic uncertainty, are also influencing market trends. The overall market is characterized by a complex interplay of factors impacting both volume and value growth.

Several key factors are driving the phenomenal growth of the personal travel insurance market. The surging global tourism industry is a primary engine, with millions of people traveling internationally each year for leisure and business. This increased travel volume naturally leads to a heightened demand for protection against unforeseen events, such as medical emergencies, trip cancellations, and lost luggage. The rising middle class in emerging economies is also a significant contributor, as increased disposable incomes enable more people to afford international travel and, consequently, the insurance to protect their investment. Furthermore, a growing awareness of potential travel risks—ranging from health concerns to political instability—is prompting more travelers to seek comprehensive insurance coverage. Technological advancements have also played a role; online platforms offer streamlined purchasing experiences and greater accessibility, making it easier for individuals to compare policies and purchase insurance. The increasing popularity of adventure and extreme sports tourism further fuels demand for specialized travel insurance products that cater to higher-risk activities. Finally, government regulations and mandatory travel insurance requirements in certain countries also contribute to market growth.

Despite the positive growth trajectory, the personal travel insurance market faces several challenges. Economic downturns and recessions can significantly impact demand, as consumers may prioritize essential expenses over travel and associated insurance costs. Fluctuating currency exchange rates can also affect both the cost of travel and the pricing of insurance policies, leading to volatility in the market. Competition among established insurers and new entrants can create price pressure, affecting profitability. The complexity of insurance policies can lead to customer confusion and difficulty in choosing the right coverage. Fraudulent claims present a significant challenge for insurers, increasing operational costs and impacting profitability. Finally, accurately assessing and managing risks related to emerging threats such as pandemics or geopolitical instability remains a continuous challenge for insurers needing to constantly adapt their policies and pricing models. Successfully navigating these hurdles requires insurers to leverage data analytics, refine their risk assessment models, and provide clear and transparent policy information to customers.

The market is experiencing diverse growth across various segments and regions, but certain areas show particularly strong potential.

Segments:

Annual Multi-Trip Coverage: This segment consistently demonstrates strong growth due to its convenience and cost-effectiveness for frequent travelers. The predictable recurring revenue stream makes it attractive for insurers, allowing for better risk management and pricing strategies. Individuals who travel frequently for business or leisure find this type of coverage invaluable for comprehensive protection throughout the year. This segment is projected to be a major driver of market value, reaching tens of billions of USD in the forecast period.

Insurance Intermediaries: Traditional channels like insurance brokers and agents maintain a significant market share, leveraging their expertise and established networks. However, this segment is facing increasing competition from direct-to-consumer online platforms. The continued relevance of intermediaries hinges on their ability to adapt to the changing digital landscape, offer value-added services, and cater to specific customer segments. Their expertise in navigating complex insurance policies remains a key advantage in a market with a diverse range of products.

Regions:

While North America and Europe currently hold larger market shares, the Asia-Pacific region is experiencing rapid growth due to rising disposable incomes, increased travel amongst a burgeoning middle class, and government initiatives promoting tourism. This region's significant population base combined with its rapidly expanding travel sector positions it for substantial market share increases within the forecast period. The continued growth in the Asian and Pacific Rim areas means a large amount of growth potential in this section. This will require insurance companies to actively adapt their offerings to meet the specific needs and preferences of travelers in this region.

Several factors are catalyzing growth within the personal travel insurance industry. The increasing accessibility of travel, driven by affordable airfare and rising disposable incomes globally, creates a larger pool of potential customers. The growing awareness of travel risks, amplified by media coverage of unforeseen events, encourages more people to secure protection. Technological advancements, such as online comparison platforms and digital policy management tools, simplify the purchasing process and increase accessibility. Finally, the rise of specialized travel insurance products designed for specific activities or demographics taps into niche markets and further stimulates growth.

The personal travel insurance market is experiencing significant growth, driven by increased global travel, rising disposable incomes, and evolving customer needs. This market's dynamism is further enhanced by technological advancements and the emergence of new specialized products. The report provides a detailed analysis of this market, offering invaluable insights for businesses and investors looking to navigate this dynamic sector. The significant growth potential presented by emerging economies and the continued evolution of the digital landscape offer exciting prospects for future development in the sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allianz, AIG, Munich RE, Generali, Tokio Marine, Sompo Japan, CSA Travel Protection, AXA, Pingan Baoxian, Mapfre Asistencia, USI Affinity, Seven Corners, Hanse Merkur, MH Ross, STARR.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Personal Travel Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Personal Travel Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.