1. What is the projected Compound Annual Growth Rate (CAGR) of the Individual Travel Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Individual Travel Insurance

Individual Travel InsuranceIndividual Travel Insurance by Application (Aldult, Child), by Type (Domestic Travel, Foreign Travel), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

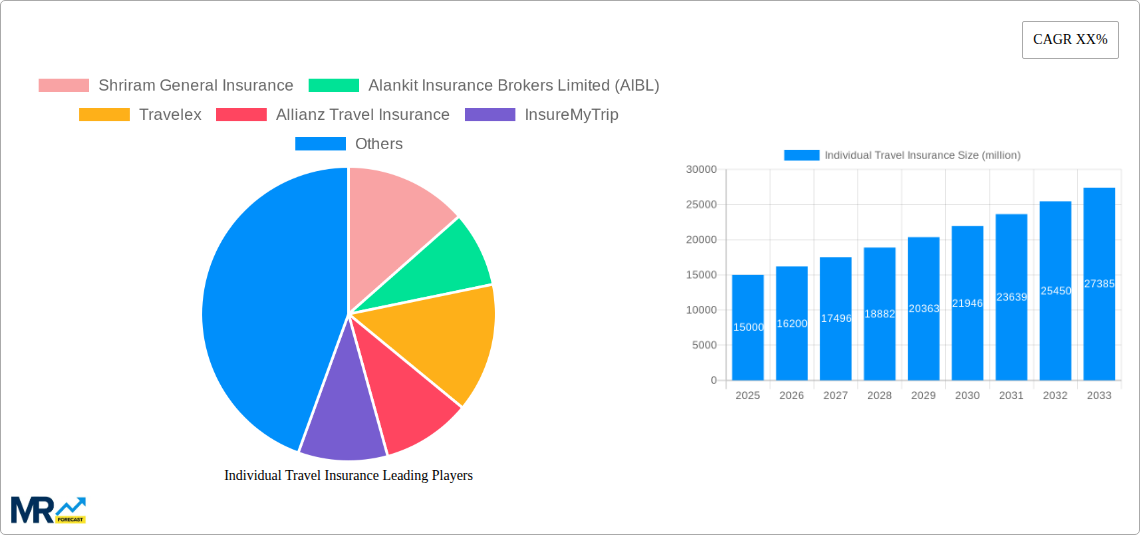

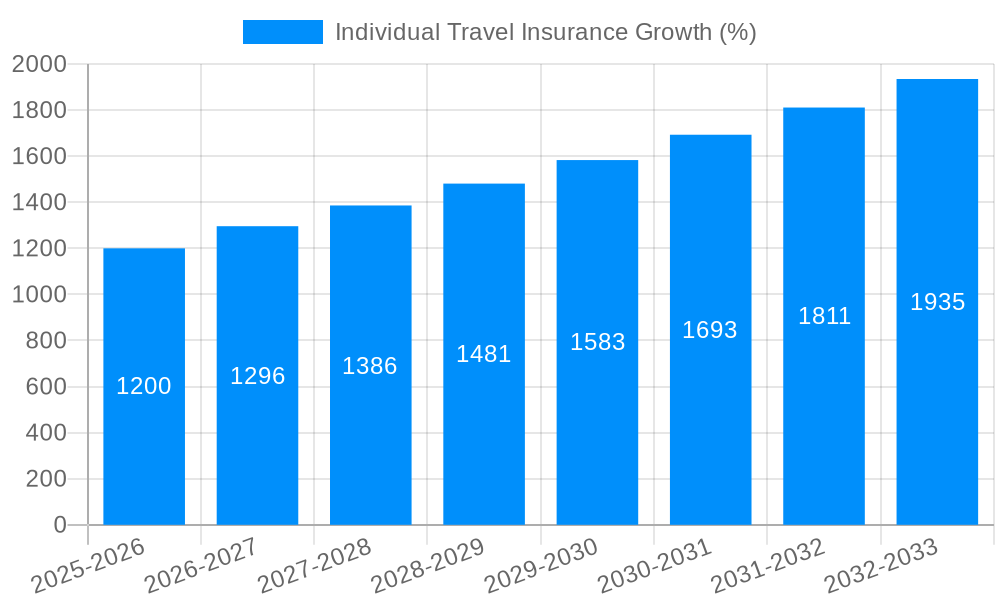

The individual travel insurance market is experiencing robust growth, driven by increasing international travel, heightened awareness of unforeseen travel disruptions (medical emergencies, trip cancellations, lost luggage), and the rising affordability of comprehensive coverage plans. The market, estimated at $15 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033. This growth is fueled by several key trends, including the proliferation of online travel agencies offering integrated insurance solutions, the expansion of coverage options tailored to specific traveler needs (e.g., adventure travel, backpacking), and a growing preference for digital distribution channels. Factors such as fluctuating currency exchange rates and economic uncertainty could potentially restrain market expansion, but the overall trajectory points towards significant market expansion.

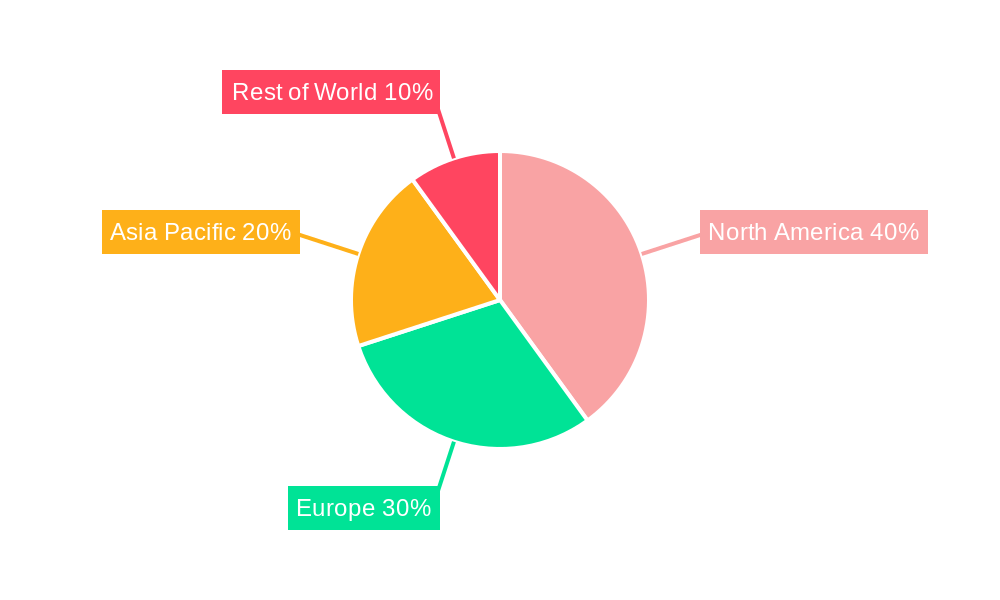

Several leading companies, including Shriram General Insurance, Allianz Travel Insurance, InsureMyTrip, and World Nomads, are actively competing within this dynamic landscape, leveraging technological advancements and strategic partnerships to enhance their offerings and expand their customer bases. The market is segmented geographically, with North America and Europe currently holding significant market shares, but emerging economies in Asia and South America are demonstrating considerable potential for future growth. This growth is further propelled by increasing disposable incomes, rising middle classes, and a growing appetite for experiential travel among younger demographics. The industry’s response to evolving customer expectations, including the provision of personalized coverage and seamless claim processes, will be critical to driving continued growth and capturing an expanding market share.

The individual travel insurance market, valued at USD X million in 2024, is poised for significant growth, reaching USD Y million by 2033, exhibiting a robust CAGR of Z% during the forecast period (2025-2033). This expansion is fueled by several converging factors. The increasing affordability of international travel, particularly among millennials and Gen Z, is a key driver. These demographics are more likely to prioritize experiences over material possessions and are increasingly embracing adventure travel, necessitating comprehensive travel insurance coverage. Furthermore, rising disposable incomes globally, coupled with a surge in the popularity of adventure tourism and exotic destinations, are contributing to higher demand for insurance products that cater to diverse travel needs. The historical period (2019-2024) witnessed a fluctuating market influenced by global events, such as the COVID-19 pandemic, which initially caused a dip in travel insurance purchases but subsequently spurred demand for policies with robust pandemic coverage. The market's recovery post-pandemic underscores the essential role of travel insurance in mitigating risks associated with unexpected events. The base year, 2025, represents a turning point, showcasing a resurgence in travel and a renewed focus on comprehensive insurance solutions tailored to the evolving needs of modern travelers. The estimated value for 2025 reflects this renewed confidence and the market's significant potential for future growth. This report analyzes data from 2019 to 2024 (Historical Period), uses 2025 as the base and estimated year, and projects the market until 2033 (Forecast Period). Data suggests a continuing upward trend, indicating a stable and expanding market for individual travel insurance throughout the study period (2019-2033).

Several powerful forces are driving the growth of the individual travel insurance market. The rise of online travel agencies (OTAs) and comparison websites has significantly simplified the process of purchasing travel insurance, making it more accessible to a wider consumer base. These platforms offer a variety of plans at competitive prices, increasing transparency and enabling consumers to make informed decisions. Moreover, increasing awareness regarding travel risks, including medical emergencies, trip cancellations, and lost luggage, is pushing individuals to prioritize insurance coverage. The media's frequent coverage of travel-related incidents, alongside targeted marketing campaigns by insurance providers, contributes to this heightened awareness. The growing popularity of adventure and experiential travel, often involving activities with inherent risks, necessitates comprehensive insurance plans that provide sufficient coverage. Finally, government regulations in some regions mandating or recommending travel insurance for international travel further boost market demand. These regulatory pushes, coupled with increasing consumer awareness and streamlined purchasing processes, are creating a favorable environment for continued expansion of the individual travel insurance market.

Despite the positive growth trajectory, the individual travel insurance market faces several challenges. One significant hurdle is the complexity of insurance policies, which often contain intricate terms and conditions that can be difficult for consumers to understand. This lack of clarity can lead to confusion and potentially inadequate coverage. Furthermore, the fluctuating cost of medical care across different countries poses a pricing challenge for insurers, influencing the affordability of policies and the overall market dynamics. The prevalence of fraud and claims disputes also presents a significant restraint. Insurers grapple with verifying the legitimacy of claims, resulting in higher operational costs and potentially impacting profitability. Additionally, economic downturns or global events, like pandemics, can significantly impact consumer purchasing behavior, leading to reduced demand for travel insurance. Effective marketing and communication strategies are crucial for insurers to overcome the challenges of policy complexity and successfully educate consumers about the importance of adequate coverage. Addressing fraud and claims disputes through robust verification processes is also essential for maintaining market stability and customer trust.

The individual travel insurance market displays diverse growth patterns across geographical regions and segments.

Dominant Segments:

In summary, while North America shows strength due to existing market maturity and consumer habits, the Asia-Pacific region represents the area with the most significant potential for rapid growth and expansion in the coming years. The comprehensive and adventure travel insurance segments are leading the way in terms of market share and projected revenue growth. The combined influence of these factors creates a dynamic and evolving market landscape.

The industry's growth is further catalyzed by technological advancements, offering insurers opportunities to improve efficiency and customer experience. Digital platforms and mobile apps simplify policy purchasing and claims processing, making travel insurance more accessible and convenient. Furthermore, the increasing integration of travel insurance with other travel services, such as flight and hotel bookings, enhances customer reach and facilitates seamless purchase experiences. This bundled approach offers added convenience and strengthens the appeal of travel insurance to potential customers.

This report provides a comprehensive analysis of the individual travel insurance market, offering detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. It is an invaluable resource for industry stakeholders, including insurers, brokers, and travel agencies, seeking to understand the dynamics of this rapidly evolving market and capitalize on emerging opportunities. The analysis covers a detailed study period from 2019 to 2033, providing a historical perspective and long-term forecast, thereby enabling informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Shriram General Insurance, Alankit Insurance Brokers Limited (AIBL), Travelex, Allianz Travel Insurance, InsureMyTrip, World Nomads, HTH Travel Insurance, IMG Travel Insurance, GeoBlue, Nationwide Insurance, AXA Assistance USA, AIG Travel, Seven Corners, Berkshire Hathaway Travel Protection, Generali Global Assistance.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Individual Travel Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Individual Travel Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.