1. What is the projected Compound Annual Growth Rate (CAGR) of the Penem APIs?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Penem APIs

Penem APIsPenem APIs by Type (Injection Grade API, Crude Penem, World Penem APIs Production ), by Application (Meropenem, Imipenem, Biapenem, Ertapenem, Others, World Penem APIs Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

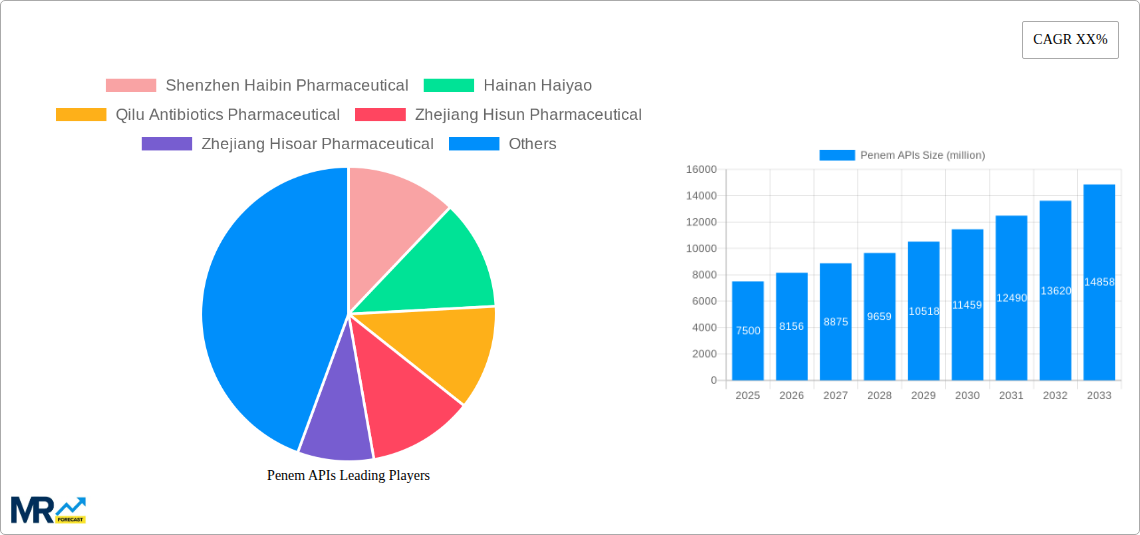

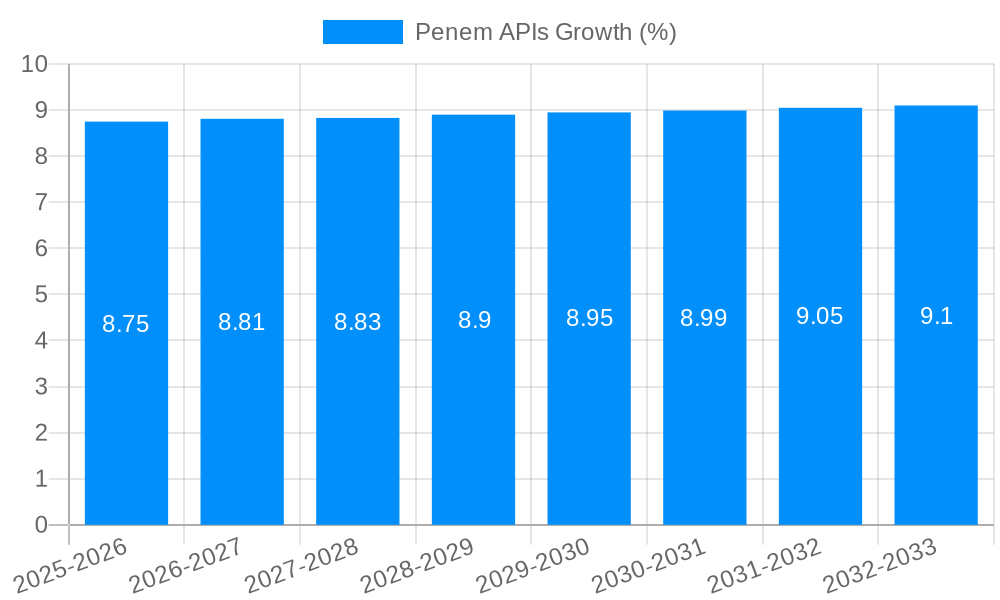

The global Penem APIs market is projected to reach approximately USD 7,500 million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This expansion is primarily fueled by the increasing incidence of severe bacterial infections and the growing demand for broad-spectrum antibiotics, particularly in the wake of rising antibiotic resistance concerns. The market's growth is further propelled by the continuous research and development efforts aimed at discovering novel penem derivatives with enhanced efficacy and reduced side effects. Key drivers include the rising healthcare expenditures globally, an aging population susceptible to infections, and the expanding access to advanced medical treatments in emerging economies. The production of World Penem APIs is a significant segment, indicating a concentrated global supply chain for these critical pharmaceutical ingredients.

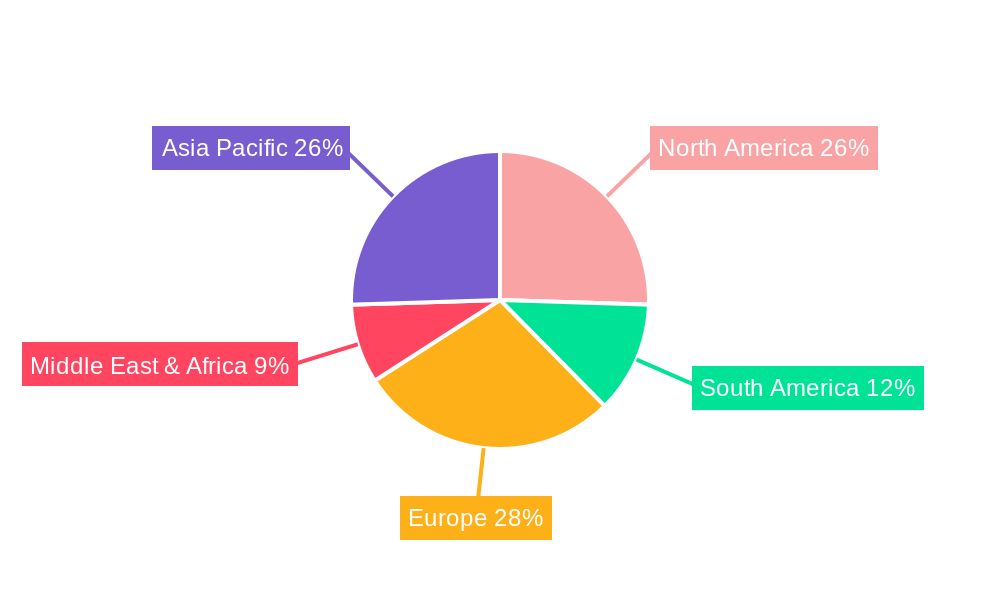

The market is characterized by a dynamic competitive landscape with prominent players like Shenzhen Haibin Pharmaceutical, Hainan Haiyao, Qilu Antibiotics Pharmaceutical, and Zhejiang Hisun Pharmaceutical leading the charge. These companies are investing heavily in expanding their manufacturing capacities and strengthening their R&D pipelines to meet the escalating demand. While the market benefits from strong drivers, certain restraints, such as stringent regulatory approvals for new drug formulations and the potential for the development of alternative antibiotic classes, could pose challenges. However, the inherent effectiveness and established therapeutic profile of penem antibiotics are expected to sustain their market dominance. Segmentation by application reveals Meropenem and Imipenem as leading formulations, underscoring their critical role in treating serious infections like pneumonia and meningitis. Regional analysis indicates Asia Pacific, particularly China and India, as a significant hub for both production and consumption, driven by a large patient pool and expanding pharmaceutical manufacturing capabilities, while North America and Europe remain mature markets with consistent demand.

Here's a comprehensive report description on Penem APIs, incorporating your specified values, companies, segments, and structure:

The Penem APIs market is poised for robust expansion, driven by an escalating global demand for advanced antibacterial agents. During the Historical Period (2019-2024), the market witnessed steady growth, largely fueled by an increasing prevalence of serious bacterial infections and the recognized efficacy of penem antibiotics in treating multidrug-resistant organisms. The Base Year (2025) serves as a pivotal point, with projections indicating a compound annual growth rate (CAGR) of over 5% extending into the Forecast Period (2025-2033). This sustained upward trajectory is underpinned by several key trends. The rising incidence of hospital-acquired infections (HAIs) and the continuous emergence of new bacterial resistance mechanisms necessitate the development and widespread availability of potent antibiotics like penems. Furthermore, advancements in manufacturing technologies and process optimization are contributing to increased production efficiency and cost-effectiveness, thereby enhancing market accessibility. The market's dynamic nature is also shaped by evolving regulatory landscapes and the increasing focus on quality and purity of Active Pharmaceutical Ingredients (APIs). The Estimated Year (2025) data suggests a global Penem APIs production exceeding 250 million USD, with a significant portion dedicated to critical applications such as Meropenem and Imipenem. The Study Period (2019-2033) encompasses both past market dynamics and future outlooks, providing a holistic view of the penem API landscape. Innovations in drug delivery systems and the ongoing research into novel penem derivatives with broader spectrums of activity are also expected to shape market trends in the coming years, pushing the market value towards 400 million USD by the end of the forecast period. The injection-grade API segment, being the most utilized form for potent antibiotics, is anticipated to maintain its dominance within the overall market structure.

The Penem APIs market's growth is being propelled by a confluence of critical factors that underscore the indispensable role of these antibiotics in modern healthcare. A primary driver is the escalating global burden of infectious diseases, particularly those caused by Gram-negative bacteria that exhibit resistance to a wide array of conventional antibiotics. The increasing prevalence of hospital-acquired infections (HAIs), often involving complex pathogens, directly translates to a higher demand for broad-spectrum antibiotics like penems, which are crucial for empirical therapy and treating life-threatening infections. The rising aging global population also contributes significantly, as older individuals are generally more susceptible to infections and often have underlying health conditions that complicate treatment, necessitating more potent antibacterial agents. Furthermore, advancements in pharmaceutical research and development, leading to the discovery and refinement of penem derivatives with improved pharmacokinetic profiles and enhanced efficacy against emerging resistant strains, are continuously expanding the therapeutic arsenal and market opportunities. The continuous investment by key players in research and manufacturing capabilities, coupled with strategic collaborations and mergers, further fuels market expansion by ensuring a consistent and high-quality supply of Penem APIs. The recognition of penems as first-line treatments for specific severe infections by international health organizations also solidifies their market position.

Despite the promising growth trajectory, the Penem APIs market is not without its inherent challenges and restraints that could impede its full potential. One of the most significant hurdles is the continuous emergence of antibiotic resistance. While penems are potent, bacteria can develop resistance mechanisms over time, necessitating ongoing research and development of new formulations or entirely new classes of antibiotics. This arms race against evolving pathogens requires substantial and sustained investment in R&D. Another considerable challenge lies in the stringent regulatory requirements for API manufacturing and approval. Ensuring compliance with global quality standards, such as Good Manufacturing Practices (GMP), and navigating the complex approval processes in different countries can be time-consuming and resource-intensive, potentially delaying market entry for new products and increasing production costs. The high cost of manufacturing Penem APIs, stemming from intricate synthesis processes and the need for specialized equipment and expertise, can also act as a restraint, particularly in price-sensitive markets. Furthermore, the global supply chain vulnerabilities, exacerbated by geopolitical events or natural disasters, can disrupt the availability of raw materials and finished APIs, leading to price volatility and potential shortages. The increasing focus on antibiotic stewardship programs aimed at judicious use of potent antibiotics to combat resistance could also lead to a more controlled prescription pattern, impacting overall demand.

The Injection Grade API segment within the Penem APIs market is poised for significant dominance, driven by its direct application in critical care settings. This segment is characterized by its high purity requirements and is essential for parenteral administration of penem antibiotics, which is the preferred route for treating severe systemic infections where rapid and effective drug delivery is paramount. The production of Injection Grade API, valued at over 150 million USD in the Base Year (2025), is expected to witness substantial growth throughout the Forecast Period (2025-2033), accounting for a major share of the World Penem APIs Production.

Among the various applications, Meropenem is anticipated to be a key driver of this segment's dominance. Meropenem's broad-spectrum activity against a wide range of Gram-positive and Gram-negative bacteria, including many multidrug-resistant pathogens, makes it an indispensable antibiotic in hospitals worldwide. Its use in treating conditions like pneumonia, meningitis, sepsis, and intra-abdominal infections ensures a consistent and substantial demand for Meropenem API. Similarly, Imipenem, often used in combination with cilastatin, remains a critical antibiotic for severe infections and will continue to contribute significantly to the market's growth.

Geographically, Asia Pacific, with a strong manufacturing base and increasing healthcare expenditure, is projected to emerge as a dominant region in both production and consumption of Penem APIs. Countries like China and India are major hubs for API manufacturing, benefiting from lower production costs and a skilled workforce. Companies such as Shenzhen Haibin Pharmaceutical, Hainan Haiyao, Qilu Antibiotics Pharmaceutical, Zhejiang Hisun Pharmaceutical, and Zhejiang Hisoar Pharmaceutical from China, along with Indian giants like Sun Pharmaceutical, are key contributors to this regional dominance. The region's expanding pharmaceutical industry, coupled with a growing focus on domestic production of essential medicines, positions it to capture a significant market share.

Dominant Segment: Injection Grade API

Key Applications Driving Dominance:

Dominant Region: Asia Pacific

The consistent demand for effective treatments for severe bacterial infections, coupled with the strategic importance of regions like Asia Pacific in global API production, solidifies the outlook for the Injection Grade API segment and specifically the applications of Meropenem and Imipenem. The World Penem APIs Production is largely concentrated in these areas, reflecting the global demand for these life-saving medications.

The Penem APIs industry is experiencing several key growth catalysts that are accelerating its market expansion. The escalating global prevalence of antimicrobial resistance (AMR) is the most significant driver, compelling healthcare systems to rely on potent antibiotics like penems for treating infections caused by multidrug-resistant organisms. Furthermore, advancements in biotechnology and chemical synthesis are leading to more efficient and cost-effective production methods for Penem APIs, making them more accessible. Increased government initiatives and funding aimed at combating infectious diseases and strengthening pharmaceutical manufacturing capabilities also play a crucial role. The growing demand from emerging economies, with their expanding healthcare infrastructure and increasing access to advanced medical treatments, further fuels this growth.

This report offers an exhaustive analysis of the Penem APIs market, providing detailed insights into its trends, drivers, and challenges across the Study Period (2019-2033). It meticulously examines market segmentation by type (Injection Grade API, Crude Penem) and application (Meropenem, Imipenem, Biapenem, Ertapenem, Others), offering in-depth data on World Penem APIs Production. The report leverages data from the Base Year (2025) and Estimated Year (2025) to project future market dynamics during the Forecast Period (2025-2033), building upon the Historical Period (2019-2024). It highlights the strategic importance of regions and key players, providing a comprehensive understanding of the competitive landscape and future opportunities within this vital segment of the pharmaceutical industry. The report also delves into significant industry developments and regulatory considerations, equipping stakeholders with the knowledge to navigate this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Shenzhen Haibin Pharmaceutical, Hainan Haiyao, Qilu Antibiotics Pharmaceutical, Zhejiang Hisun Pharmaceutical, Zhejiang Hisoar Pharmaceutical, Sun Pharmaceutical, Savior Lifetec, ACS Dobfar, Kopran, High Tech Pharm, Zhuhai United Laboratories, Cspc Holdings, Jiangxi Fushine Pharmaceutical, Jeil pharma.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Penem APIs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Penem APIs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.