1. What is the projected Compound Annual Growth Rate (CAGR) of the PCSK9 Antagonists?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

PCSK9 Antagonists

PCSK9 AntagonistsPCSK9 Antagonists by Type (Monoclonal Antibody, siRNA, Other), by Application (Hypercholesterolemia, Atherosclerotic Cardiovascular Disease, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

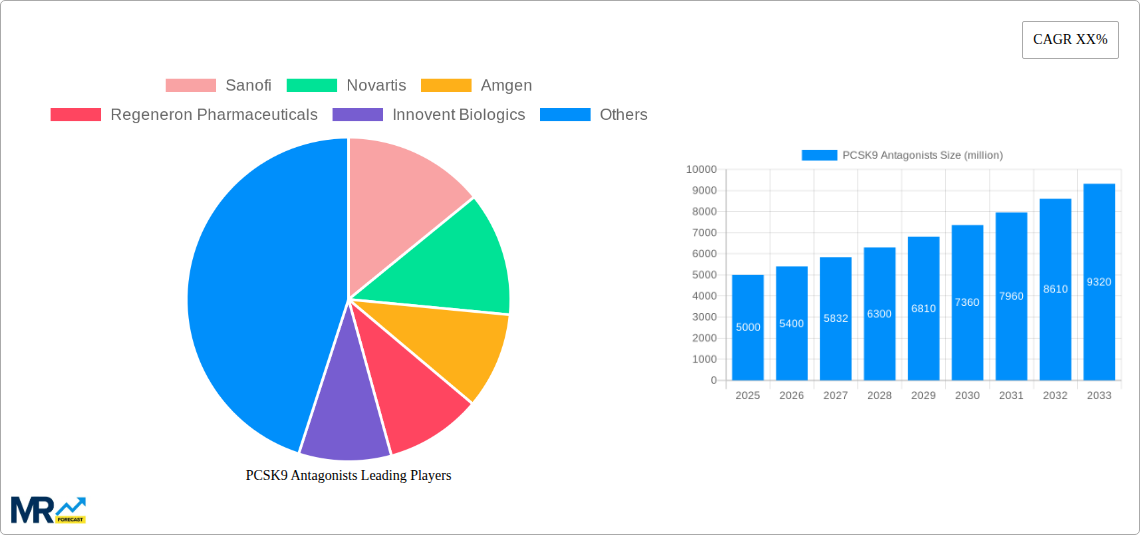

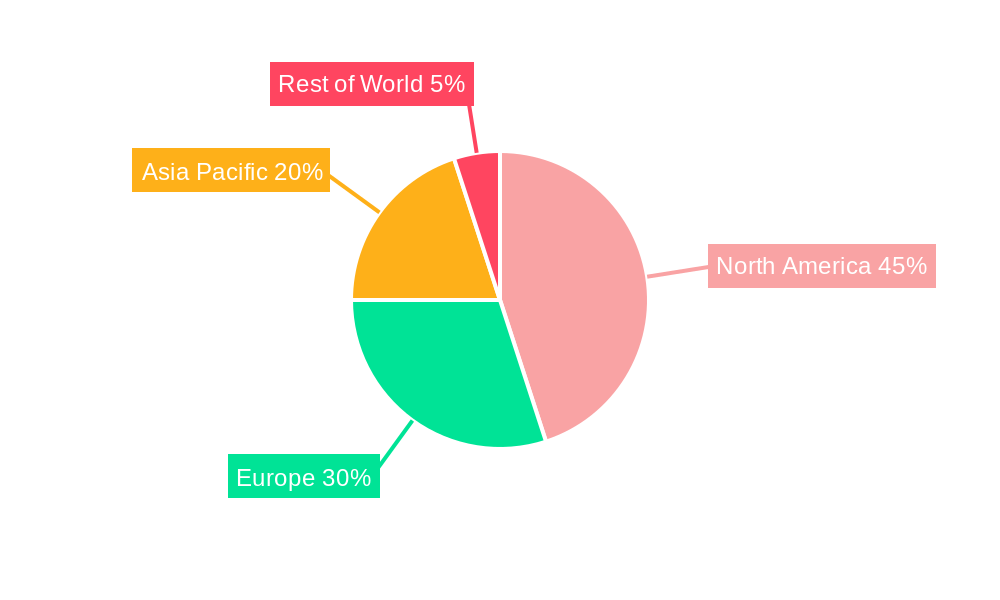

The PCSK9 inhibitor market, characterized by its high-value therapies targeting hypercholesterolemia and atherosclerotic cardiovascular disease (ASCVD), is poised for substantial growth. Driven by increasing prevalence of cardiovascular diseases globally, rising geriatric populations, and a growing awareness of lipid management, the market is projected to experience a robust Compound Annual Growth Rate (CAGR). While monoclonal antibodies currently dominate the market share, the emergence of innovative therapies like siRNA offers significant potential for future growth, presenting opportunities for diversification and enhanced efficacy. Major pharmaceutical players like Sanofi, Novartis, Amgen, and Regeneron are actively engaged in research and development, contributing to a highly competitive yet dynamic landscape. Despite the high cost of these therapies, favorable reimbursement policies in developed markets and the significant reduction in cardiovascular events contribute to the overall market expansion. Geographic variations exist; North America and Europe currently hold a larger market share owing to advanced healthcare infrastructure and greater awareness, but rapidly developing economies in Asia-Pacific present significant untapped potential for future expansion. Challenges remain in terms of potential side effects and access issues in low- and middle-income countries, factors that will need to be addressed for sustainable market growth.

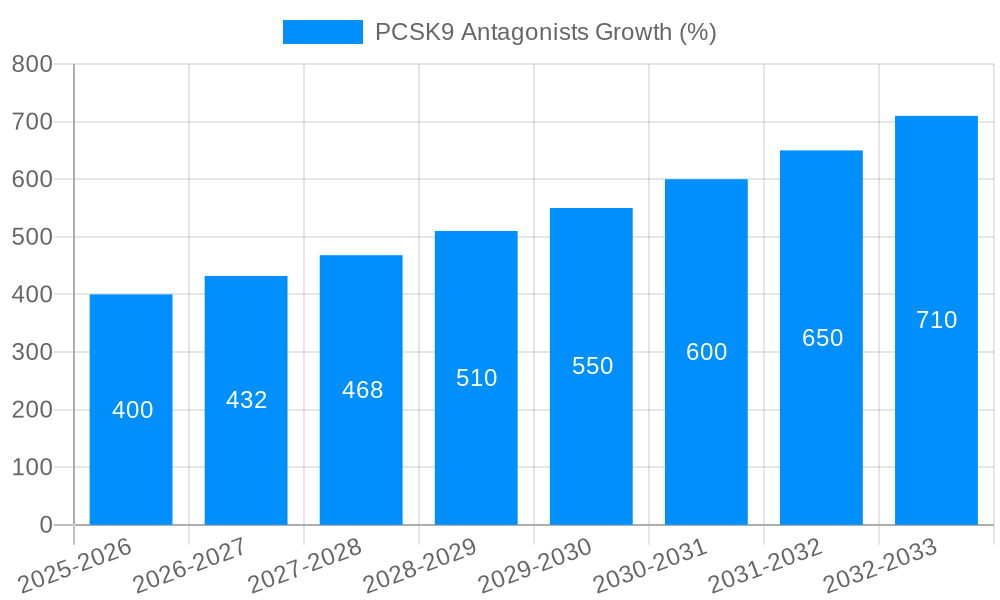

The market segmentation by application reveals a strong focus on hypercholesterolemia and ASCVD treatment, reflecting the significant unmet medical need in these areas. Future market growth will likely depend on the successful development of next-generation PCSK9 inhibitors with improved efficacy, safety profiles, and potentially more convenient administration methods. The competitive landscape, while intense, encourages innovation, driving the development of new formulations and delivery systems to improve patient compliance and treatment outcomes. Long-term market success will hinge on the ability of companies to navigate regulatory hurdles, manage pricing strategies effectively, and effectively address patient access issues, particularly in emerging markets. Ongoing research into the efficacy and safety of PCSK9 inhibitors across diverse populations will further refine treatment guidelines and drive future demand. Assuming a conservative CAGR of 8% and a 2025 market size of $5 billion, the market is expected to exceed $9 billion by 2033.

The PCSK9 antagonist market is experiencing robust growth, driven by the increasing prevalence of hypercholesterolemia and atherosclerotic cardiovascular diseases (ASCVD) globally. The market, valued at USD X billion in 2025, is projected to reach USD Y billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z%. This significant expansion is fueled by several factors, including the rising geriatric population, increased awareness of cardiovascular health risks, and the growing adoption of PCSK9 inhibitors as a second-line therapy for patients with high cholesterol who haven't responded adequately to statins. The market is predominantly dominated by monoclonal antibody-based therapies, although research into siRNA and other novel approaches continues. The competitive landscape is characterized by both established pharmaceutical giants and emerging biotech companies, leading to intense R&D activity and a pipeline of innovative products. Furthermore, the market is witnessing a shift towards personalized medicine, with ongoing efforts to identify patients who would most benefit from PCSK9 inhibition. This personalized approach, combined with advancements in drug delivery and combination therapies, will likely shape the market's future trajectory. The historical period (2019-2024) showcased substantial growth, setting the stage for the projected expansion during the forecast period (2025-2033). Key insights reveal a strong preference for monoclonal antibody-based treatments within the hypercholesterolemia application segment, primarily in developed economies. However, the growing prevalence of ASCVD in developing nations offers significant untapped potential for future market expansion. The rising cost of treatment remains a significant factor influencing market dynamics, creating challenges related to affordability and accessibility for patients in certain regions.

The surging prevalence of hypercholesterolemia and ASCVD is the primary driver of market growth. These conditions, major risk factors for heart attacks and strokes, are increasingly prevalent due to factors like aging populations, unhealthy lifestyles (including poor diet and lack of exercise), and rising obesity rates. The inadequacy of statin therapy alone in effectively managing high cholesterol in many patients is another crucial factor. PCSK9 inhibitors offer a significant advancement by providing a more effective approach for lowering LDL cholesterol levels, especially in high-risk individuals. Furthermore, increasing awareness among both healthcare professionals and patients regarding the benefits of PCSK9 inhibitors, coupled with supportive regulatory approvals and reimbursement policies, is accelerating market adoption. The ongoing research and development efforts focused on improving drug delivery mechanisms, formulating more patient-friendly formulations, and exploring novel drug combinations further stimulate market growth. The potential for combination therapies with other cardiovascular drugs is particularly attractive and likely to boost market value in the coming years. Finally, favorable clinical trial results consistently demonstrating the efficacy and safety of PCSK9 inhibitors are reinforcing confidence in these therapies, strengthening their position in the market.

Despite the significant market potential, several challenges hinder the widespread adoption of PCSK9 antagonists. The high cost of these therapies is a major barrier, limiting accessibility for many patients, particularly in low- and middle-income countries. Insurance coverage and reimbursement policies vary considerably across different regions, impacting market penetration. The need for frequent injections or subcutaneous administration can also be a deterrent for some patients, impacting adherence to treatment regimens. Moreover, the occurrence of potential side effects, though generally rare, poses a concern that needs careful management. Competition from other lipid-lowering therapies, including newer classes of drugs, could potentially impact the market share of PCSK9 inhibitors. Finally, the ongoing need for extensive clinical trials to establish long-term efficacy and safety profiles continues to be a factor influencing the market's development. Addressing these challenges through the development of more cost-effective formulations, improved delivery systems, and enhanced patient education is crucial for maximizing the market's potential.

Dominant Segment: Monoclonal Antibody Therapy for Hypercholesterolemia

Monoclonal antibodies represent the dominant segment in the PCSK9 antagonist market, holding the largest market share in terms of both revenue and volume due to their established efficacy and relative maturity compared to other therapeutic modalities. The majority of approved PCSK9 inhibitors currently available are monoclonal antibodies.

The application segment focused on hypercholesterolemia currently commands a significant portion of the market. The high prevalence of hypercholesterolemia globally, along with the increasing recognition of its association with cardiovascular diseases, drives this substantial demand. Treatment guidelines frequently recommend PCSK9 inhibitors for patients with very high LDL-C levels or those who haven't responded adequately to statin therapy, further bolstering this segment's growth.

North America and Europe are currently the leading geographical regions for PCSK9 antagonist consumption. These regions have established healthcare infrastructures, higher levels of awareness regarding cardiovascular disease, and greater access to advanced therapies. However, the rising prevalence of hypercholesterolemia and ASCVD in emerging markets like Asia-Pacific and Latin America presents significant opportunities for market expansion in the coming years. The increasing disposable incomes and improved healthcare access in these regions are creating favorable conditions for future growth.

The high cost of treatment, however, represents a considerable limitation to market penetration in less developed regions. Efforts to improve access, such as the development of more affordable generics and increased government support for treatment programs, will be essential for expanding market reach globally. Furthermore, increased focus on public health awareness campaigns to educate populations about the risks of hypercholesterolemia and the benefits of early intervention is vital in driving market growth in these emerging regions.

Several factors contribute to the expansion of the PCSK9 antagonists market. The growing prevalence of cardiovascular diseases, coupled with the limitations of statin therapy in many patients, necessitates effective alternative treatments like PCSK9 inhibitors. Advancements in drug delivery mechanisms and the development of more convenient and patient-friendly formulations are improving compliance and reducing the barriers to therapy. Moreover, the increasing awareness among both physicians and patients regarding the benefits of PCSK9 antagonists is driving their adoption. Favorable clinical trial data supporting their efficacy and safety further solidifies their market position.

This report provides a comprehensive analysis of the PCSK9 antagonists market, covering market trends, driving forces, challenges, key segments, and leading players. The report offers detailed insights into the market's historical performance (2019-2024), current status (2025), and future projections (2025-2033). It analyzes the market by type, application, and geography, providing a granular understanding of market dynamics. Furthermore, the report includes profiles of key market players and their strategic initiatives, offering a valuable resource for businesses and investors operating in this sector. The report’s projections are based on rigorous methodologies and incorporate data from various sources.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sanofi, Novartis, Amgen, Regeneron Pharmaceuticals, Innovent Biologics, Merck, Hasten Biopharmaceutical, Junshi Biosciences, Akeso, Jiangsu Hengrui Pharmaceuticals, Salubris Pharmaceuticals.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "PCSK9 Antagonists," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the PCSK9 Antagonists, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.