1. What is the projected Compound Annual Growth Rate (CAGR) of the Passenger Vehicle EPS?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Passenger Vehicle EPS

Passenger Vehicle EPSPassenger Vehicle EPS by Type (C-EPS, P-EPS, R-EPS, World Passenger Vehicle EPS Production ), by Application (Sedan & Hatchback, SUV, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

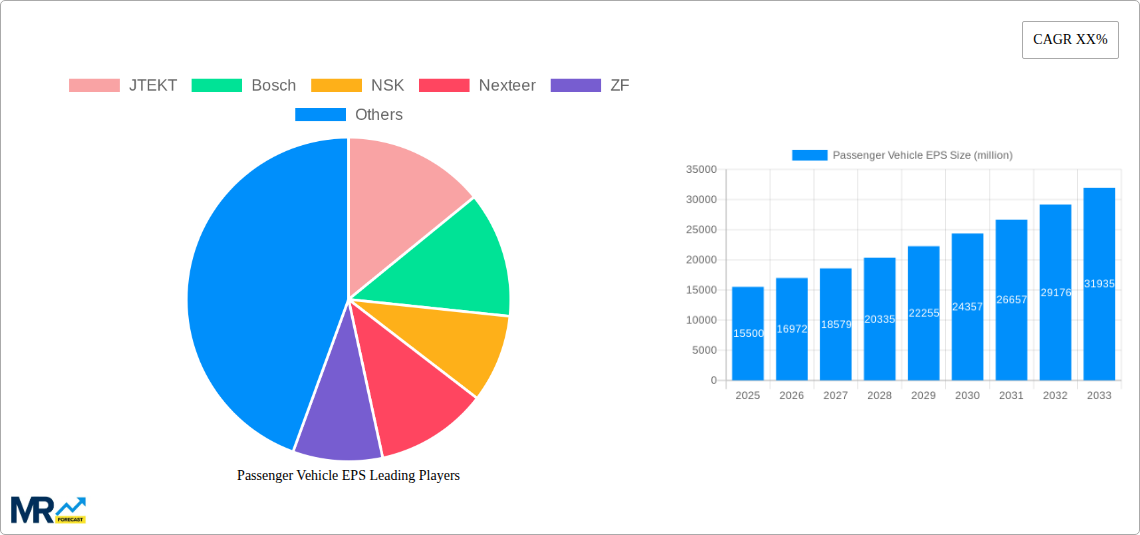

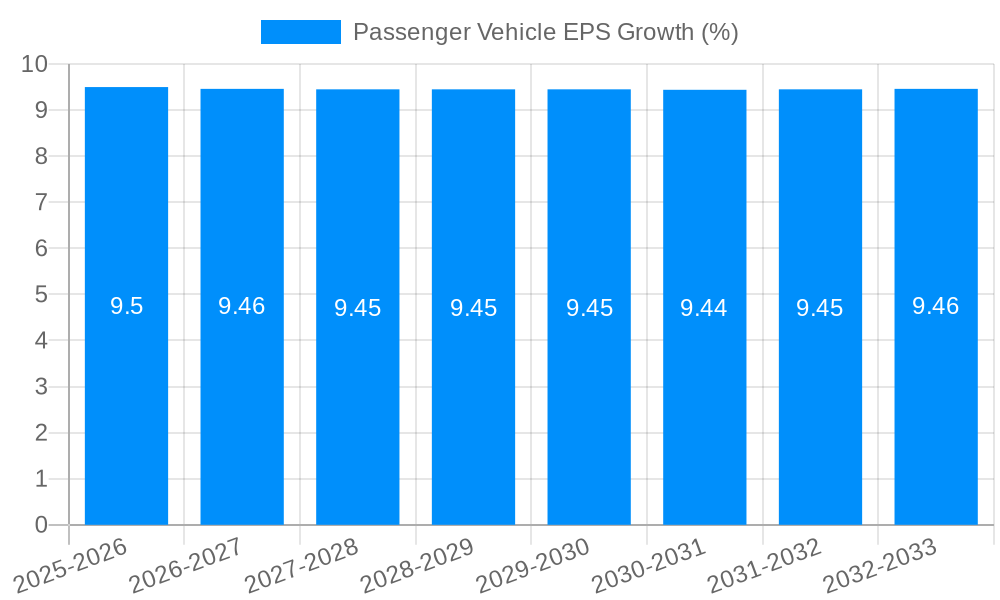

The global Passenger Vehicle Electric Power Steering (EPS) market is poised for substantial expansion, projected to reach approximately USD 15,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 9.5% anticipated throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by the increasing adoption of advanced driver-assistance systems (ADAS) and the growing demand for enhanced fuel efficiency and reduced emissions in vehicles. The shift towards electric vehicles (EVs), where EPS is a standard component, also significantly contributes to market growth. Furthermore, stringent government regulations mandating improved vehicle safety features and the inherent benefits of EPS, such as precise steering control and ease of integration with modern vehicle architectures, are key drivers propelling market demand. The market segmentation by type reveals a strong preference for Column EPS (C-EPS) due to its cost-effectiveness and widespread application, although Rack EPS (R-EPS) is gaining traction for its superior performance and suitability in higher-segment vehicles.

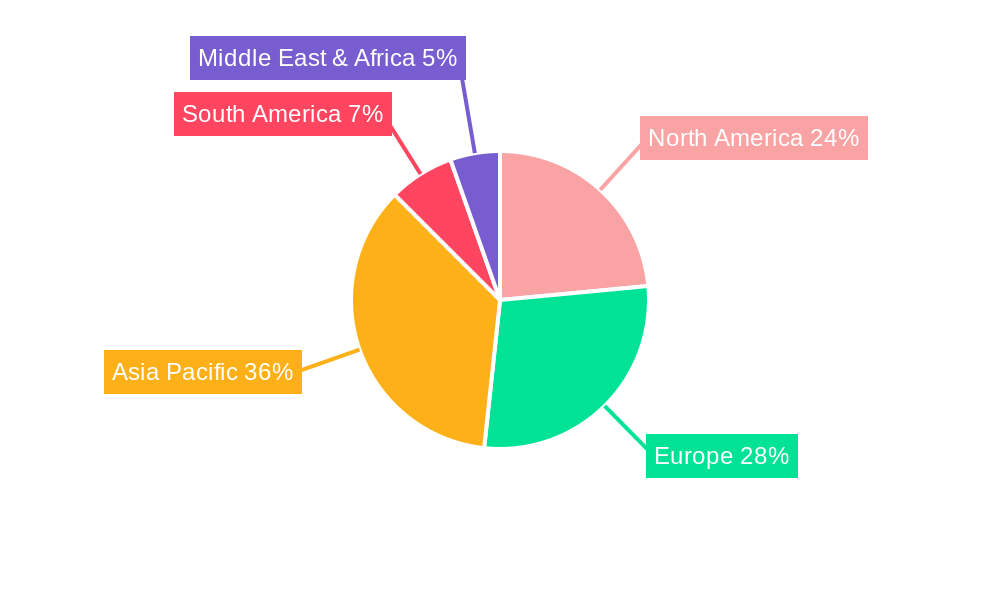

Geographically, the Asia Pacific region, particularly China, is expected to dominate the market, driven by its massive automotive production and increasing per capita income, leading to a higher penetration of passenger vehicles equipped with EPS. North America and Europe follow closely, influenced by the strong presence of leading automotive manufacturers and a high adoption rate of advanced technologies. The market, however, faces certain restraints, including the initial high cost of EPS systems compared to traditional hydraulic power steering in some emerging markets and the complexities associated with system integration and repair. Nevertheless, ongoing technological advancements aimed at reducing costs, improving performance, and enhancing the integration capabilities of EPS systems are expected to mitigate these challenges. Key players like JTEKT, Bosch, NSK, and Nexteer are actively investing in research and development to introduce innovative solutions and expand their global footprint, further shaping the competitive landscape of the Passenger Vehicle EPS market.

Here's a unique report description on Passenger Vehicle EPS, incorporating your specified elements:

The global passenger vehicle Electric Power Steering (EPS) market is poised for substantial growth and transformation throughout the study period of 2019-2033, with a projected output of 50 million units in the base year of 2025. This robust expansion is underpinned by a confluence of factors, including increasing vehicle electrification, stringent safety regulations, and the growing consumer demand for enhanced driving dynamics and fuel efficiency. The historical period (2019-2024) has witnessed a steady uptake of EPS systems, driven by early adopters and government mandates for improved emissions. As we move into the forecast period (2025-2033), the market is expected to accelerate, particularly from the estimated year of 2025 onwards, where innovation in EPS technology will play a pivotal role. The evolving landscape of automotive manufacturing, characterized by the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), will further solidify EPS as a standard component. Segment-wise, the C-EPS (Column EPS) segment is anticipated to continue its dominance, accounting for a significant portion of the 35 million unit production in 2025, owing to its cost-effectiveness and widespread application in compact and mid-size passenger vehicles. However, the R-EPS (Rack EPS) segment is set to experience a higher compound annual growth rate (CAGR) due to its superior performance characteristics, enabling more precise steering control, which is crucial for ADAS integration and performance-oriented vehicles. The P-EPS (Pinion EPS) segment, while smaller, will also see consistent growth, particularly in applications requiring a compact and lightweight steering solution. The SUV segment, a significant driver of the overall passenger vehicle market, will represent a substantial demand for EPS, with an estimated 15 million units in 2025. This is driven by the increasing popularity of SUVs globally and the integration of advanced steering technologies for improved handling and safety. The Sedan & Hatchback segment will remain a cornerstone, contributing a considerable 28 million units in 2025, largely due to the prevalence of C-EPS in these vehicle types. The "Other" application segment, encompassing niche vehicles and emerging mobility solutions, will show steady but less dominant growth. Global production figures are projected to surpass 75 million units by 2033, reflecting a dynamic and expanding market.

The surge in passenger vehicle Electric Power Steering (EPS) adoption is primarily propelled by an intensifying global push towards vehicle electrification. As automakers pivot their production lines to accommodate a growing fleet of electric and hybrid vehicles, EPS systems become an almost indispensable component. Their lower energy consumption compared to traditional hydraulic systems aligns perfectly with the efficiency demands of EVs, contributing directly to extended range and improved battery performance. Furthermore, stringent safety regulations across major automotive markets are a significant catalyst. Mandates for features like electronic stability control (ESC), lane-keeping assist, and automatic emergency braking (AEB) necessitate the precise and responsive steering control that EPS offers. The integration of ADAS is becoming a key differentiator for vehicle manufacturers, and EPS is fundamental to achieving these advanced functionalities. Consumer demand for a more engaging and comfortable driving experience also plays a crucial role. EPS systems offer a lighter steering feel at low speeds, enhancing maneuverability in urban environments, and progressively firm up at higher speeds for greater stability and confidence. This adaptability caters to a broader range of driver preferences and driving conditions, making it a desirable feature. Lastly, the continuous technological advancements in EPS, leading to lighter, more compact, and cost-effective solutions, are further accelerating their market penetration, making them increasingly accessible across various vehicle segments.

Despite the robust growth trajectory, the passenger vehicle EPS market faces certain inherent challenges and restraints. One significant hurdle is the initial cost of implementation, particularly for smaller automakers or those operating in price-sensitive markets. While EPS technology is becoming more affordable, the upfront investment in R&D and manufacturing can still be a barrier. Another concern revolves around the complexity of integration with existing vehicle architectures and advanced electronic systems. Ensuring seamless communication and functionality between the EPS module, other ECUs, and sensors requires sophisticated engineering and rigorous testing, which can be resource-intensive. The reliance on electronic components and software also introduces potential vulnerabilities. Issues such as electromagnetic interference (EMI), software glitches, or sensor failures can lead to steering malfunctions, raising concerns about reliability and safety, which in turn can impact consumer confidence. Furthermore, the increasing demand for advanced functionalities like steer-by-wire, while an opportunity, also presents a significant technological and regulatory hurdle. The transition to fully steer-by-wire systems requires overcoming safety validation challenges and establishing new industry standards, a process that is likely to be lengthy and complex. Finally, supply chain disruptions for critical electronic components, exacerbated by geopolitical factors and global demand fluctuations, can impact production volumes and lead times, posing a significant restraint on market expansion.

The global passenger vehicle EPS market is characterized by regional dominance and segment leadership, with certain areas and categories poised to outpace others in the coming years. Asia-Pacific, particularly China, is anticipated to emerge as the dominant region in terms of both production and consumption of passenger vehicle EPS. By 2025, China is expected to account for over 30 million units of the global production, driven by its massive automotive manufacturing base, supportive government policies promoting EVs and intelligent vehicles, and a rapidly growing domestic consumer market. The sheer volume of vehicle production in China, coupled with the increasing adoption of advanced automotive technologies, positions it as the undisputed leader.

Within the segments, the C-EPS (Column EPS) will continue to hold a dominant share of the market through 2033. In 2025 alone, C-EPS is projected to constitute approximately 60% of the total EPS production, translating to around 30 million units. This dominance stems from its cost-effectiveness, ease of integration into a wide array of vehicle platforms, and its suitability for the high-volume production of compact cars, sedans, and hatchbacks. The C-EPS system is particularly prevalent in entry-level and mid-range passenger vehicles, which constitute a significant portion of the global automotive sales. Its ability to provide adequate steering assistance for everyday driving conditions and its relatively lower manufacturing cost make it the go-to choice for many manufacturers targeting affordability and efficiency.

However, the R-EPS (Rack EPS) segment is expected to exhibit the highest growth rate during the forecast period. By 2033, its market share is projected to increase significantly, driven by the increasing demand for more sophisticated steering capabilities. R-EPS systems offer superior steering precision, better feedback, and a more robust performance, making them ideal for performance-oriented vehicles, SUVs, and vehicles equipped with advanced driver-assistance systems (ADAS). The growing popularity of SUVs, which are increasingly being equipped with advanced safety and handling features, is a major driver for R-EPS adoption. In 2025, R-EPS is estimated to contribute around 15 million units to the global production. The growing sophistication of vehicles and the emphasis on driving dynamics and safety will continue to propel the R-EPS market forward, gradually chipping away at the C-EPS dominance in higher-tier vehicle segments.

The Sedan & Hatchback application segment will remain the largest contributor to EPS demand, with an estimated 28 million units in 2025. This segment's enduring popularity, particularly in developing economies, ensures a consistent and substantial demand for EPS systems, primarily C-EPS. Conversely, the SUV segment, representing an estimated 15 million units in 2025, is poised for a higher growth rate due to its rising global appeal and the increasing integration of advanced EPS technologies to enhance handling and safety in these larger vehicles. The "Other" application segment will contribute a smaller, but growing, share, reflecting innovation in niche vehicle categories.

Several key factors are acting as growth catalysts for the passenger vehicle EPS industry. The relentless pursuit of enhanced fuel efficiency and reduced emissions by automakers worldwide directly favors EPS, as it consumes significantly less energy than hydraulic systems. The accelerating integration of ADAS features, such as lane-keeping assist and adaptive cruise control, mandates the precise control and responsiveness that EPS provides, acting as a critical enabler for these technologies. Furthermore, the growing consumer preference for intuitive and comfortable driving experiences, characterized by lighter steering at low speeds and firmer steering at high speeds, is driving demand for EPS systems. Finally, ongoing technological advancements leading to more compact, lightweight, and cost-effective EPS solutions are making them accessible to a broader range of vehicle models.

This comprehensive report offers an in-depth analysis of the global passenger vehicle Electric Power Steering (EPS) market, meticulously covering the study period from 2019 to 2033, with a specific focus on the base and estimated year of 2025. It delves into the intricate dynamics shaping the industry, including technological advancements, regulatory landscapes, and evolving consumer preferences. The report provides granular insights into production volumes and market shares across key segments such as C-EPS, P-EPS, and R-EPS, alongside an examination of their application in Sedan & Hatchback, SUV, and other vehicle types. Furthermore, it highlights the strategic initiatives and innovations undertaken by leading global players like JTEKT, Bosch, NSK, Nexteer, ZF, Mobis, Showa, Thyssenkrupp, and Mando. The analysis extends to identifying significant industry developments and outlining the growth catalysts that will drive the market forward, offering a complete picture for stakeholders seeking to understand and capitalize on the opportunities within the dynamic passenger vehicle EPS sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include JTEKT, Bosch, NSK, Nexteer, ZF, Mobis, Showa, Thyssenkrupp, Mando, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Passenger Vehicle EPS," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Passenger Vehicle EPS, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.