1. What is the projected Compound Annual Growth Rate (CAGR) of the Passenger Car Brake-by-wire System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Passenger Car Brake-by-wire System

Passenger Car Brake-by-wire SystemPassenger Car Brake-by-wire System by Application (New Energy Vehicles, Fuel Vehicles, World Passenger Car Brake-by-wire System Production ), by Type (EHB, EMB, HBBW, World Passenger Car Brake-by-wire System Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

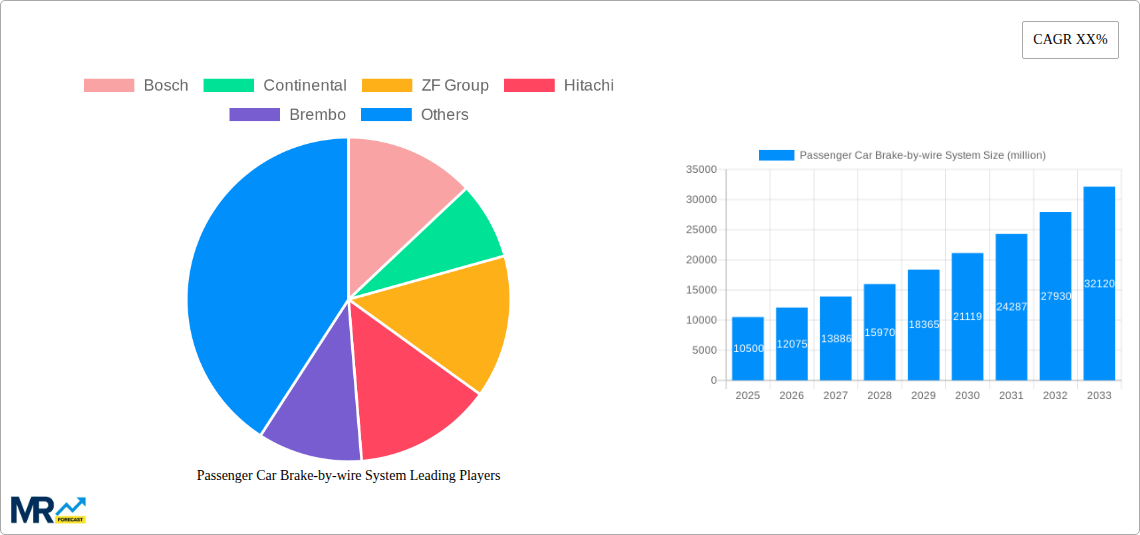

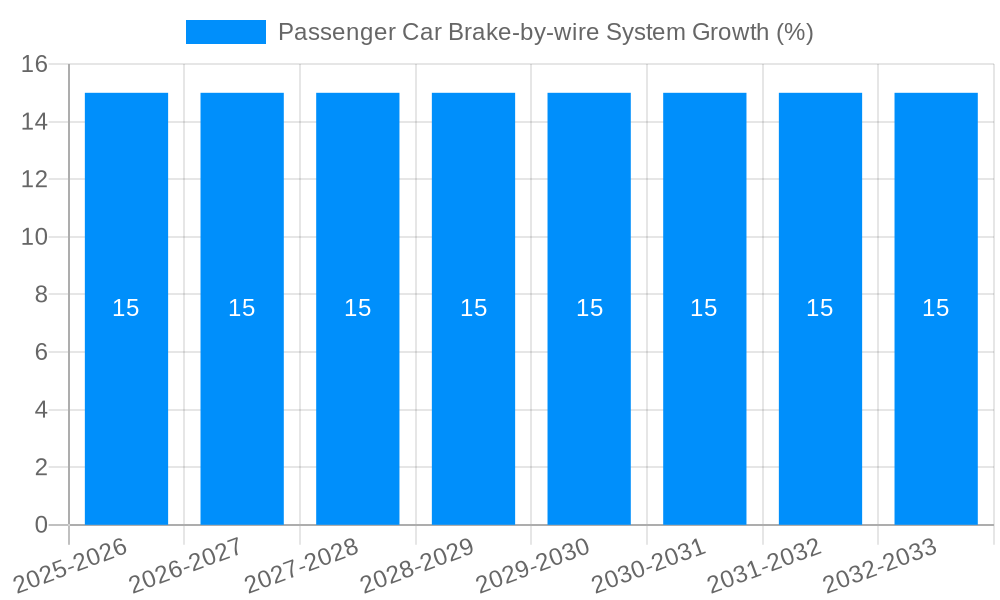

The global market for Passenger Car Brake-by-Wire (BBW) systems is poised for significant expansion, driven by increasing demand for advanced automotive safety features, fuel efficiency, and the accelerating adoption of electric and autonomous vehicles. Valued at an estimated $10,500 million in 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033, reaching a substantial value of over $30,000 million by the end of the forecast period. This robust growth is primarily fueled by the integration of BBW systems into New Energy Vehicles (NEVs), which inherently require advanced braking solutions for regenerative braking and optimized energy management. The shift towards sophisticated safety technologies, including Electronic Stability Control (ESC) and advanced driver-assistance systems (ADAS), further underpins the demand for BBW, offering faster response times and enhanced control compared to traditional hydraulic systems. The development of Electro-Mechanical Brakes (EMB) and Electro-Hydraulic Brakes (EHB) are key technological advancements contributing to this market surge.

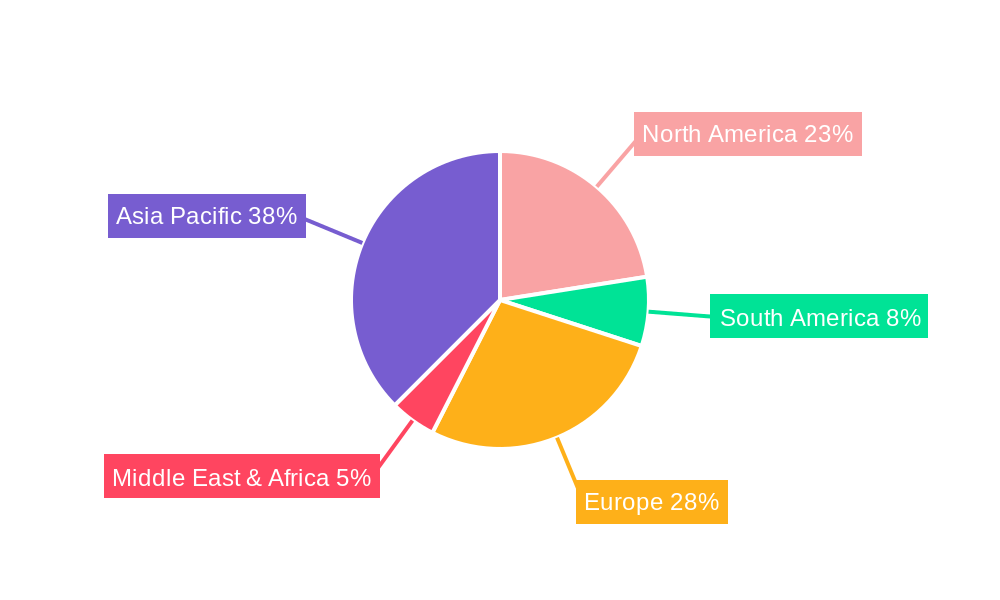

Despite the promising outlook, the market faces certain restraints. High development and integration costs associated with BBW systems can pose a challenge, particularly for smaller automakers or in cost-sensitive segments. Stringent regulatory approvals and the need for extensive testing to ensure fail-safe operation also contribute to the complexity and expense of market entry. However, these challenges are being mitigated by ongoing technological innovations and economies of scale as production volumes increase. The market is characterized by intense competition among major global players such as Bosch, Continental, and ZF Group, alongside emerging Chinese manufacturers like BYD and Beijing Trinova Technology. Geographically, the Asia Pacific region, led by China, is expected to dominate the market due to its leading position in EV production and a rapidly expanding automotive industry. North America and Europe are also significant markets, driven by stringent safety regulations and a strong consumer preference for advanced vehicle features. The market is segmented into EHB, EMB, and HBBW (Hybrid Brake-by-Wire) types, with EHB currently holding a larger share but EMB showing strong potential for future growth as technology matures and costs decrease.

The global passenger car brake-by-wire (BBW) system market is undergoing a significant transformation, driven by the relentless pursuit of enhanced vehicle safety, improved fuel efficiency, and the burgeoning adoption of autonomous driving technologies. XXX analysis reveals that the market, valued at an estimated 4.5 million units in the base year 2025, is poised for substantial growth, projected to reach 9.2 million units by 2033. This surge is largely attributable to the increasing sophistication of modern vehicles, where traditional hydraulic braking systems are gradually being superseded by electronic counterparts offering superior control and responsiveness. The integration of BBW systems is becoming a cornerstone for advanced driver-assistance systems (ADAS) and fully autonomous vehicles, enabling precise actuation and fail-safe mechanisms essential for self-driving functionalities. Furthermore, regulatory mandates and evolving consumer expectations for safer and more efficient mobility are acting as powerful tailwinds, accelerating the adoption of these advanced braking solutions. The historical period between 2019 and 2024 has witnessed a steady climb in BBW system integration, particularly in premium and electric vehicle segments. Looking ahead, the forecast period of 2025-2033 is expected to witness an even more pronounced acceleration, as economies of scale in production and technological advancements drive down costs and broaden accessibility across a wider spectrum of passenger cars. The shift from conventional braking to electromechanical and electro-hydraulic systems is not merely a technological upgrade; it represents a fundamental paradigm shift in vehicle control, promising a future of safer, more intelligent, and dynamically responsive automobiles.

The passenger car brake-by-wire system market is experiencing robust expansion, fueled by several compelling driving forces. Foremost among these is the accelerating global trend towards vehicle electrification. New Energy Vehicles (NEVs), including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), are inherently better suited for BBW integration due to their complex electronic architectures and the regenerative braking capabilities that BBW systems can seamlessly manage. As NEVs gain market share, so too does the demand for BBW solutions. Concurrently, the relentless advancement of autonomous driving technologies necessitates sophisticated control systems. BBW systems, with their precise electronic actuation and rapid response times, are critical enablers for ADAS features and fully autonomous driving, allowing for finer control of braking intensity and distribution than traditional hydraulic systems. Safety regulations are also playing a crucial role; as governments worldwide implement stricter safety standards, manufacturers are increasingly adopting BBW systems to meet these requirements and enhance overall vehicle safety. The promise of improved fuel efficiency, particularly in the context of hybridization and the drive to reduce emissions, further propels BBW adoption, as these systems can be optimized for energy recovery and reduced parasitic losses.

Despite the promising growth trajectory, the passenger car brake-by-wire system market faces several significant challenges and restraints that could temper its expansion. A primary concern remains the cost of these advanced systems. While production is scaling up, BBW systems, particularly the more advanced EMB (Electro-Mechanical Brake) types, are still considerably more expensive than their conventional hydraulic counterparts. This cost differential can be a significant barrier to widespread adoption in the mass-market passenger car segment. Regulatory hurdles and standardization efforts are also ongoing. The absence of globally unified standards for BBW system architecture, safety validation, and fail-safe mechanisms can lead to fragmentation and increased development costs for manufacturers and suppliers. Consumer perception and trust represent another hurdle. The shift from a direct, physical connection in hydraulic brakes to an electronically controlled system can induce apprehension among some consumers regarding safety and reliability, especially in critical braking situations. System complexity and reliability concerns also persist. Ensuring the absolute reliability and redundancy of these complex electronic systems, especially under extreme environmental conditions and over the long lifespan of a vehicle, requires rigorous testing and validation. Finally, the availability of skilled labor for development, manufacturing, and maintenance of BBW systems can be a limiting factor in certain regions.

The New Energy Vehicles (NEVs) segment is unequivocally poised to dominate the global passenger car brake-by-wire system market throughout the study period (2019-2033). This dominance is not only in terms of unit production but also in technological innovation and market adoption pace. NEVs, by their very nature, are designed with integrated electronic architectures that are inherently conducive to BBW systems. The need for precise control over regenerative braking, which is crucial for maximizing energy recovery and extending the range of electric vehicles, makes BBW systems a near necessity rather than an option. As governments worldwide implement stringent emission reduction targets and offer incentives for EV adoption, the production and sales of NEVs are experiencing exponential growth. For instance, China, as the world's largest NEV market, is expected to be a significant driver of BBW demand within this segment, with its established domestic manufacturers and supportive policies. North America and Europe are also witnessing a rapid surge in NEV adoption, further bolstering the dominance of this segment.

Furthermore, within the broader BBW system types, EHB (Electro-Hydraulic Brake) systems are currently the dominant technology, primarily due to their maturity, lower cost compared to EMB, and their compatibility with existing vehicle architectures, making them a more accessible upgrade for a wider range of vehicles, including traditional fuel-powered cars aiming for enhanced safety and efficiency features. However, the long-term forecast indicates a substantial rise in the adoption of EMB (Electro-Mechanical Brake) systems, particularly within the NEV segment. EMB offers the highest degree of precision and control, eliminating hydraulic fluid entirely and providing true "brake-by-wire" functionality. While currently more expensive, ongoing technological advancements and increasing production volumes are expected to make EMB systems more competitive, driving their adoption in higher-end NEVs and eventually trickling down to other segments. The market for HBBW (Hybrid Brake-by-Wire), which combines elements of both hydraulic and electronic control, will likely serve as a transitional technology, offering a balance of cost and performance for certain applications.

The dominance of the NEV segment is further amplified by the fact that these vehicles are often at the forefront of technological innovation. Manufacturers are more willing to invest in advanced braking solutions like BBW to differentiate their products and cater to the demands of environmentally conscious and tech-savvy consumers. The interplay between the growth of NEVs and the imperative for advanced braking systems creates a powerful synergy, ensuring that the NEV segment will be the primary engine of growth and innovation for the passenger car brake-by-wire system market for the foreseeable future. The sheer volume of NEV production, projected to steadily increase and surpass traditional fuel vehicles in many key markets, directly translates into a substantial demand for BBW systems.

The passenger car brake-by-wire system industry is experiencing significant growth catalysts. The escalating integration of Advanced Driver-Assistance Systems (ADAS) and the progression towards higher levels of vehicle autonomy are paramount. BBW systems provide the precise and rapid actuation required for features like adaptive cruise control, automatic emergency braking, and lane-keeping assist. Furthermore, the global push for enhanced vehicle safety, driven by regulatory bodies and consumer demand for accident prevention technologies, fuels the adoption of BBW as a superior safety solution. The electrification of the automotive sector, particularly the rapid expansion of New Energy Vehicles, also acts as a major catalyst, as BBW systems are inherently compatible with electric powertrains and optimize regenerative braking for improved efficiency.

This report offers a holistic view of the Passenger Car Brake-by-wire System market, encompassing a detailed analysis from the historical period of 2019-2024 through to the forecast period of 2025-2033, with 2025 serving as the base and estimated year. It delves into the intricate trends shaping the industry, highlights the potent driving forces behind market expansion, and critically examines the challenges and restraints that stakeholders must navigate. The report also pinpoints the key regions and segments expected to dominate market share, providing invaluable insights for strategic planning. Furthermore, it identifies the significant growth catalysts that are propelling the industry forward and profiles the leading players and their pivotal developments. This comprehensive coverage is designed to equip stakeholders with the critical intelligence needed to understand market dynamics, identify opportunities, and make informed business decisions within this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bosch, Continental, ZF Group, Hitachi, Brembo, ADVICS CO, Mando, BWI Group, Bethel Automotive Safety Systems Co, Beijing Trinova Technology Co, NASN Automotive, Tongyu Automotive, Global Technology, Nanjing JWD Automotive, BYD, Zhejiang Asia-Pacific Mechanical & Electronic Co, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Passenger Car Brake-by-wire System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Passenger Car Brake-by-wire System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.