1. What is the projected Compound Annual Growth Rate (CAGR) of the Paromomycin?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Paromomycin

ParomomycinParomomycin by Type (95% Purity Type, 96% Purity Type, Others, World Paromomycin Production ), by Application (Paromomycin Sulfate, Paromomycin Injection, World Paromomycin Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

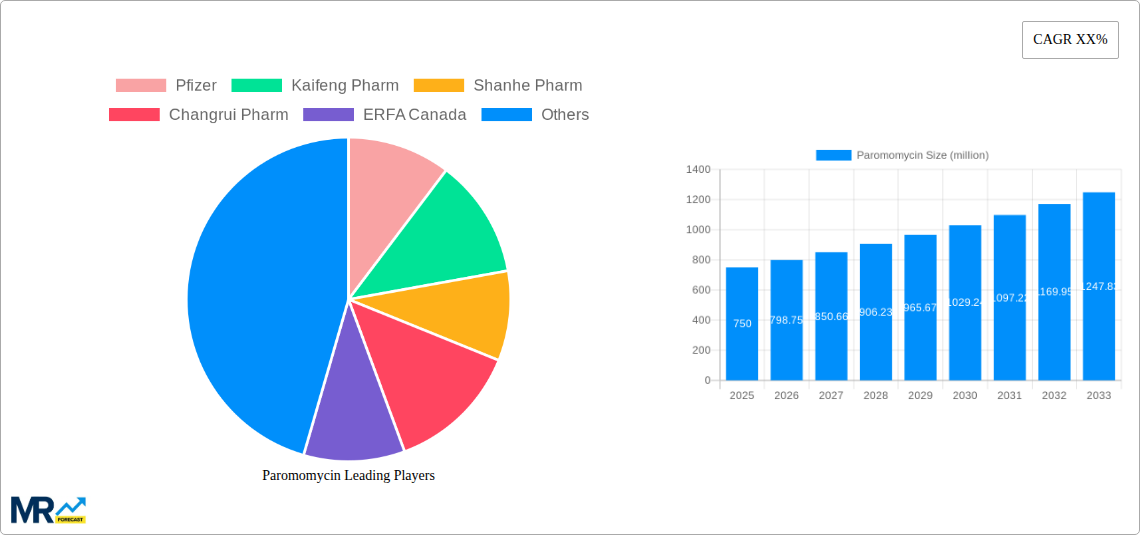

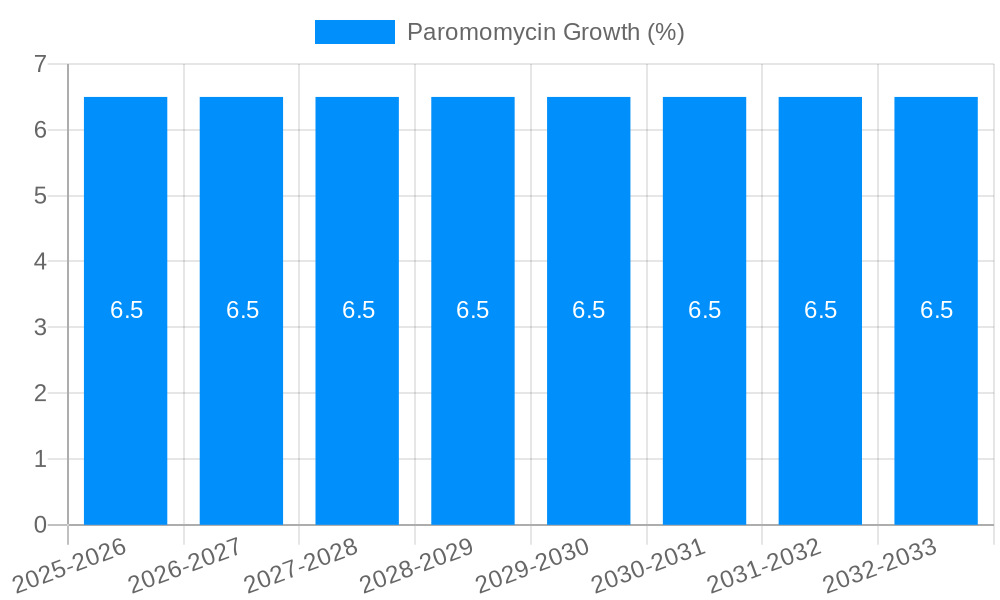

The global Paromomycin market is poised for significant expansion, projected to reach an estimated $750 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.5% anticipated through 2033. This growth is primarily propelled by the increasing prevalence of parasitic infections globally, particularly in developing regions, and the crucial role of Paromomycin as a first-line treatment for conditions like intestinal amoebiasis and giardiasis. Furthermore, its application in managing hepatic encephalopathy and as an antibiotic for specific bacterial infections contributes to its sustained demand. The market is segmenting distinctly based on purity levels, with 95% Purity Type dominating due to its widespread use in pharmaceutical formulations, followed by 96% Purity Type for more specialized applications. The Paromomycin Sulfate application segment is expected to lead, reflecting its oral dosage form's convenience and efficacy, while Paromomycin Injection caters to more severe or specific clinical needs. The market's trajectory is further bolstered by ongoing research and development efforts aimed at optimizing drug delivery and exploring new therapeutic avenues for Paromomycin.

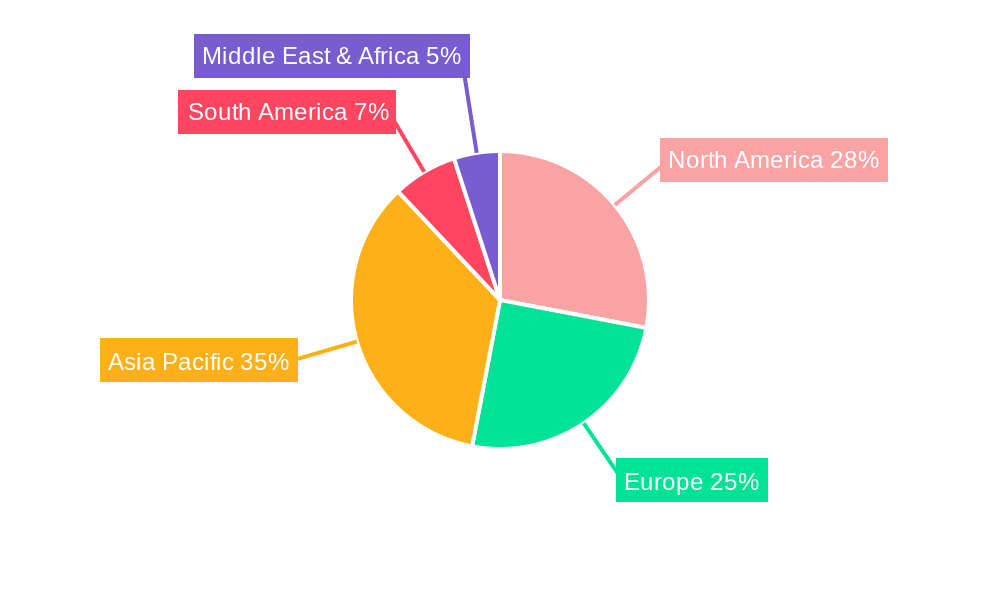

While the market exhibits strong growth potential, certain factors could influence its pace. The emergence of alternative treatments and the potential development of parasitic resistance to Paromomycin represent key restraints. However, the cost-effectiveness and established efficacy of Paromomycin, especially in resource-limited settings, continue to solidify its market position. Geographically, the Asia Pacific region is emerging as a significant growth engine, driven by a large population base, a rising incidence of infectious diseases, and improving healthcare infrastructure. North America and Europe, with their established healthcare systems and significant research investments, will continue to be major contributors. Key players like Pfizer, Kaifeng Pharm, and Shanhe Pharm are actively engaged in expanding production capacities and geographical reach, further fueling market competition and innovation. The dynamic interplay between therapeutic needs, R&D advancements, and competitive landscape will shape the future trajectory of the global Paromomycin market.

Here is a unique report description on Paromomycin, incorporating your specified elements:

The global Paromomycin market is experiencing a dynamic evolutionary path, marked by shifting production landscapes, evolving purity standards, and targeted application growth. Our comprehensive analysis, covering the historical period of 2019-2024 and extending to a robust forecast through 2033, with 2025 serving as the pivotal base and estimated year, reveals a market driven by increasing demand for its critical therapeutic applications, particularly in the management of parasitic infections and as a component in certain complex antibiotic regimens. The production volume, currently measured in the hundreds of millions of units, is projected to see a steady upward trajectory. This growth is underpinned by significant investments in R&D aimed at optimizing production efficiency and exploring novel therapeutic avenues for Paromomycin. The market’s segmentation by purity type, with 95% and 96% purity grades leading the charge, reflects the stringent quality control demanded by the pharmaceutical industry. Emerging economies are increasingly contributing to both production and consumption, driven by a greater focus on public health initiatives and the accessibility of essential medicines. Furthermore, the application segment, particularly Paromomycin Sulfate, is anticipated to maintain its dominance, although Paromomycin Injection is showing promising growth potential, suggesting a diversification in its clinical utility. The interplay between manufacturing capabilities, regulatory frameworks, and the persistent global burden of neglected tropical diseases will continue to shape the overall market dynamics, presenting both opportunities and challenges for stakeholders involved in the Paromomycin value chain. Understanding these intricate trends is paramount for strategic planning and resource allocation within this vital segment of the pharmaceutical industry, ensuring the continued availability of this crucial antibiotic. The projected market evolution indicates a sustained demand, emphasizing the need for innovation in both production and application development.

The global Paromomycin market is propelled by a confluence of critical factors that are fundamentally shaping its growth trajectory. Foremost among these is the persistent and, in some regions, resurgent prevalence of parasitic infections, including amebiasis and leishmaniasis. Paromomycin remains a cornerstone therapy for these conditions, particularly in resource-limited settings where access to newer, more expensive treatments is restricted. This enduring clinical utility translates directly into sustained demand. Furthermore, the increasing recognition of antibiotic resistance and the need for effective salvage therapies in multidrug-resistant infections are subtly contributing to Paromomycin's relevance. While not a first-line agent for common bacterial infections, its unique spectrum of activity and parenteral formulation offer crucial options in specific, challenging clinical scenarios. The global health agenda's growing emphasis on neglected tropical diseases (NTDs) also plays a significant role. Organizations and governments are increasingly investing in programs aimed at eradicating or controlling diseases where Paromomycin is a key treatment, thereby stimulating market demand. The ongoing efforts by major pharmaceutical players and emerging manufacturers to enhance production efficiency and ensure a stable global supply chain are also critical driving forces, making the drug more accessible and affordable.

Despite the positive growth drivers, the Paromomycin market is not without its significant challenges and restraints. One of the primary hurdles is the emergence of alternative therapeutic options for some of the diseases it treats, particularly in developed markets where newer, potentially more efficacious or better-tolerated drugs are available. This can lead to a gradual erosion of market share in certain applications. The inherent toxicities associated with Paromomycin, including ototoxicity and nephrotoxicity, necessitate careful patient monitoring and limit its use in vulnerable populations or for extended treatment durations. This can also increase the complexity and cost of treatment regimens. Furthermore, regulatory hurdles and the stringent approval processes for pharmaceutical products can impede the introduction of new formulations or expanded indications, slowing down market penetration. The cost of production, while being addressed through efficiency improvements, can still be a barrier in certain regions, impacting affordability and accessibility. Moreover, the market is susceptible to fluctuations in global health funding and policy changes related to infectious disease control. The development of resistance, though less pronounced than with some other antibiotics, remains a long-term concern that requires ongoing surveillance and responsible stewardship to mitigate.

The global Paromomycin market is poised for significant regional and segment dominance, driven by a complex interplay of disease burden, healthcare infrastructure, regulatory environments, and manufacturing capabilities.

Dominant Segments:

Application: Paromomycin Sulfate

Type: 95% Purity Type

Dominant Region/Country:

The synergy between a high prevalence of target diseases, strong manufacturing capabilities, and supportive public health policies makes the Asia Pacific region the epicenter of Paromomycin production and consumption. This dominance is further reinforced by the leading role of its constituent companies in the global supply chain.

The Paromomycin industry is propelled by several key growth catalysts. The persistent global burden of protozoal infections, particularly in developing regions, ensures sustained demand. Increased investment in global health initiatives and the focus on eradicating neglected tropical diseases also provide significant impetus. Furthermore, the exploration of Paromomycin in novel therapeutic combinations and its potential role in managing certain antibiotic-resistant bacterial infections are emerging growth avenues. Advancements in manufacturing technologies leading to improved yields and cost-effectiveness further support market expansion.

This report offers a comprehensive examination of the global Paromomycin market, spanning the study period of 2019-2033, with 2025 as the base and estimated year. It delves deep into market trends, identifying key drivers such as the persistent prevalence of parasitic infections and the drug's role in essential medicine lists. The report also addresses significant challenges, including potential toxicities and the emergence of alternative therapies. A detailed analysis of regional dominance, with a focus on the Asia Pacific region, and segment leadership, particularly for Paromomycin Sulfate, is provided. Growth catalysts, leading market players, and significant historical and projected developments are meticulously documented, offering stakeholders valuable insights for strategic decision-making and market navigation.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Pfizer, Kaifeng Pharm, Shanhe Pharm, Changrui Pharm, ERFA Canada, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Paromomycin," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Paromomycin, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.